In March, Spotify announced it was acquiring the company behind the sports-focused audio app Locker Room to help speed its entry into the live audio market. Today, the company is making good on that deal with the launch of Spotify Greenroom, a new mobile app that allows Spotify users worldwide to join or host live audio rooms, and optionally turn those conversations into podcasts. It’s also announcing a Creator Fund that will help fuel the new app with more content in the future.

The Spotify Greenroom app itself is based on Locker Room’s existing code. In fact, Spotify tells us, current Locker Room users will see their app update to become the rebranded and redesigned Greenroom experience, starting today.

Where Locker Room had used a white-and-reddish orange color scheme, the new Greenroom app looks very much like an offshoot from Spotify, having adopted the same color palette, font and iconography.

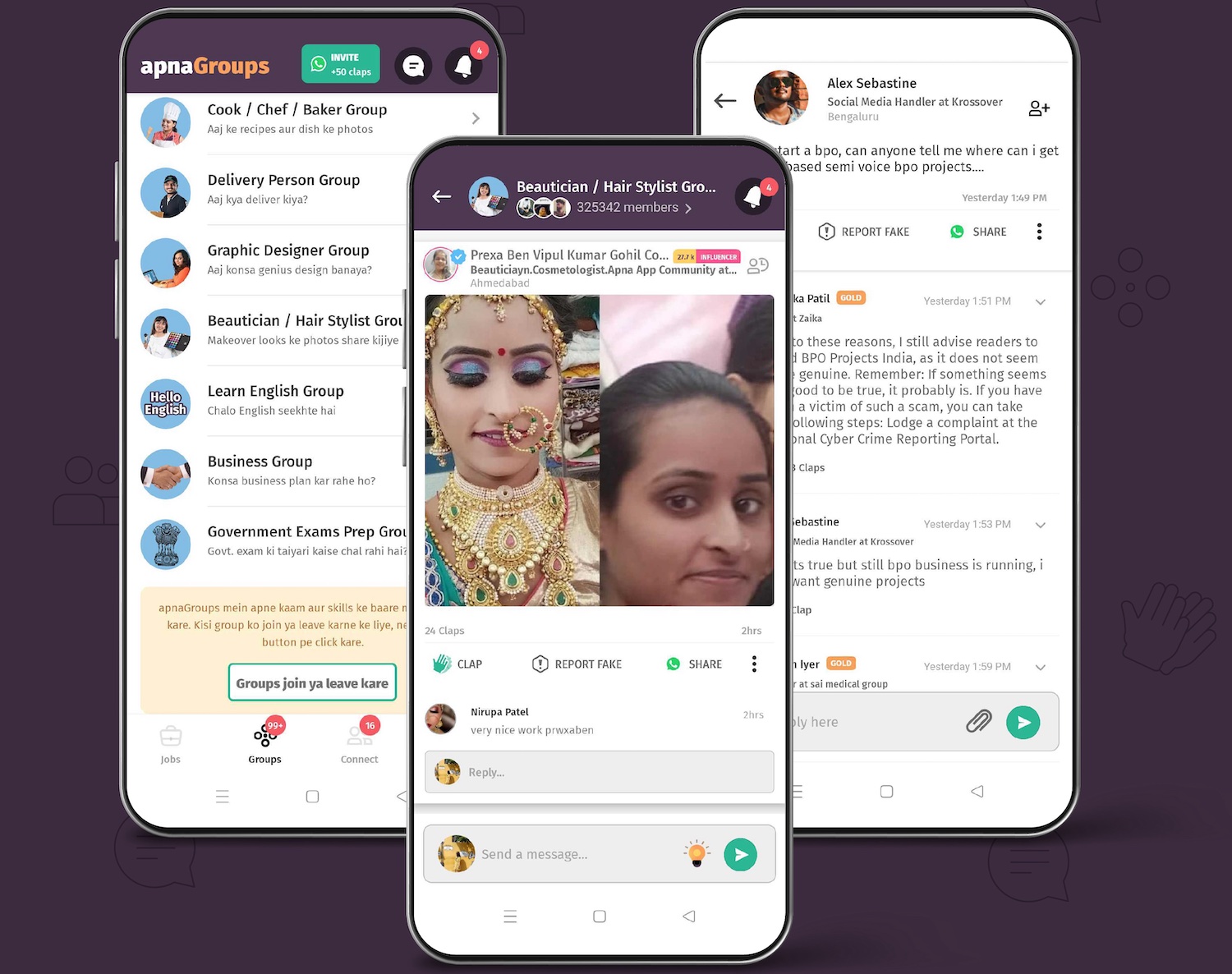

To join the new app, Spotify users will sign in with their current Spotify account information. They’ll then be walked through an onboarding experience designed to connect them with their interests.

Image Credits: Spotify

For the time being, the process of finding audio programs to listen to relies primarily on users joining groups inside the app. That’s much like how Locker Room had operated, where its users would find and follow favorite sports teams. However, Greenroom’s groups are more general interest now, as it’s no longer only tied to sports.

In time, Spotify tells us the plan is for Greenroom to leverage Spotify’s personalization technology to better connect users to content they would want to hear. For example, it could send out notifications to users if a podcaster you already followed on Spotify went live on Spotify Greenroom. Or it could leverage its understanding of what sort of podcasts and music you listen to in order to make targeted recommendations. These are longer-term plans, however.

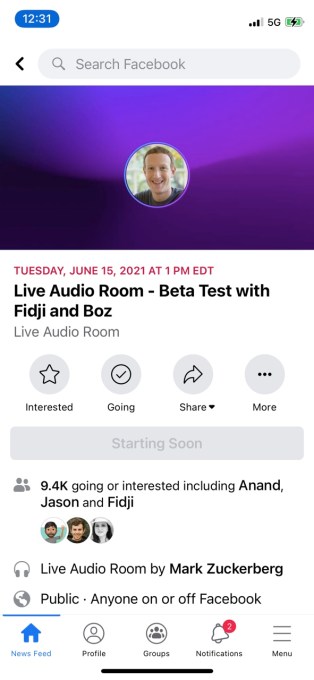

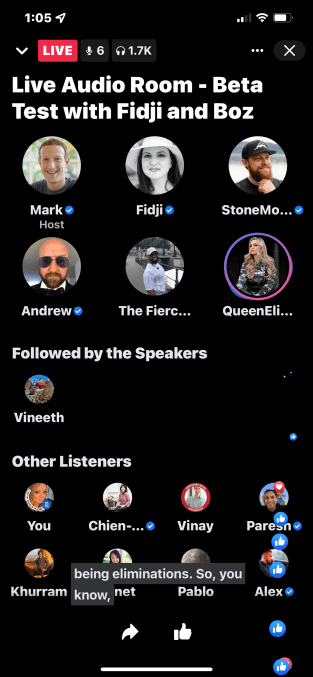

As for Spotify Greenroom’s feature set, it’s largely on par with other live audio offerings — including those from Clubhouse, Twitter (Spaces) and Facebook (Live Audio Rooms). Speakers in the room appear at the top of the screen as rounded profile icons, while listeners appear below as smaller icons. There are mute options, moderation controls and the ability to bring listeners onstage during the live audio session. Rooms can host up to 1,000 people, and Spotify expects to scale up that number later on.

Image Credits: Spotify

Listeners can also virtually applaud speakers by giving them “gems” in the app — a feature that came over from Locker Room, too. The number of gems a speaker earned displays next to their profile image during a session. For now, there’s no monetary value associated with the gems, but that seems an obvious next step as Greenroom today offers no form of monetization.

It’s worth noting there are a few key differentiators between Spotify Greenroom and similar live audio apps. For starters, it offers a live text chat feature that the host can turn on or off whenever they choose. Hosts can also request the audio file of their live audio session after it wraps, which they can then edit to turn into a podcast episode.

Perhaps most importantly is that the live audio sessions are being recorded by Spotify itself. The company says this is for moderation purposes, which is a challenge for live audio platforms. If a user reports something in a Greenroom audio room, Spotify can go back to look into the matter, to determine what sort of actions may need to be taken. Moderation is an area Clubhouse has struggled with, as its users have sometimes encountered toxicity and abuse in the app in real time, including in troubling areas like racism and misogyny. Recently, Clubhouse said it had to shut down a number of rooms for antisemitism and hate speech, as well. (Clubhouse says it now records a temporary encrypted buffer of the audio in a room while the room is live for the purpose of supporting incident investigations — a system that has been in place for months.)

Spotify says the moderation of Spotify Greenroom will be handled by its existing content moderation team. Of course, how quickly Spotify will be able react to boot users or shut down live audio rooms that are in violation of its Code of Conduct remains to be seen.

While the app launching today is focused on user-generated live audio content, Spotify has larger plans for Greenroom. Later this summer, the company plans to make announcements around programmed content — something it says is a huge priority — alongside the launch of other new features. This will include programming related to music, culture and entertainment, in addition to the sports content for which Locker Room was known.

Image Credits: Spotify

The company also says it will be marketing Spotify Greenroom to artists through its Spotify for Artists channels, in hopes of seeding the app with more music-focused content. And it confirmed that monetization options for creators will come further down the road, too, but isn’t talking about what those may look like in specific detail for the moment.

In addition, Spotify is today announcing the Spotify Creator Fund, which will help audio creators in the U.S. generate revenue for their work. The company, however, declined to share any details on this front, either — like the size of the fund, how much creators would receive, time frame for distributions, selection criteria or other factors. Instead, it’s only offering a sign-up form for those who may be interested in hearing more about this opportunity in the future. That may make it difficult for creators to weigh their options, when there are now so many.

Spotify Greenroom is live today on both iOS and Android across 135 markets around the world. That’s not quite the global footprint of Spotify itself, though, which is available in 178 markets. It’s also only available in the English language for the time being, with plans to expand as it grows.

Powered by WPeMatico