Beauty and wellness businesses have come roaring back to life with the decline of COVID-19 restrictions, and a startup that’s built a platform that caters to the many needs of small enterprises in the industry today is announcing a big round of funding to grow with them.

Fresha — a multipurpose commerce tool for independent wellness and beauty businesses such as hair, nail and skin salons, yoga instructors and more, based first and foremost around a completely free subscription platform for those businesses to schedule bookings from customers — has picked up $100 million.

Fresha plans to use the funds to expand the list of countries where it operates, to grow the categories of companies that use its services (mental health practitioners is one example; fitness is another) and to build more services complementing what it already provides, helping customers do their work by providing them with more insights and data about what they do already. It will also be making acquisitions to expand its customer base.

General Atlantic is leading this Series C, with Huda Kattan, Michael Zeisser of FMZ Ventures and Jonathan Green of Lugard Road Capital also participating, along with past investors Partech, Target Global and FJ Labs.

Fresha has raised $132 million to date, and it’s not disclosing its valuation. But as a point of reference, when it closed its Series B (as Shedul; the company rebranded in February 2020), it was valued at $105 million.

Chances are that figure is significantly higher now.

Fresha’s current range of services include a free-to-use platform for booking appointments; free software for managing accounts; a payments service that includes both a physical point of sale and digital interface; and a wider marketplace both to provide goods to the businesses (B2B); and for the businesses to sell goods to customers (B2C).

The London-based company has 50,000 business customers and 150,000 stylists and professionals in 120+ countries (mostly in the U.K., the U.S., Canada, Australia, New Zealand and Europe), with some 250 million appointments booked to date.

And while many businesses did have to curtail how they operated (and in some countries had to stop operating altogether), Fresha found that it was attracting a lot of new business in part because of its “free” model that meant customers didn’t have to pay to maintain a booking platform at a time when they weren’t taking bookings, but could use Fresha to generate revenues in other ways (such as through the sale of goods, vouchers for future services and more.)

So in a year when you might have thought that a company based around providing services to industries that were hard hit by COVID would have also been hard-hit, in fact Fresha saw a 30x increase in card payment transactions versus the year before, and more than $12 billion worth of booking appointments made on its platform.

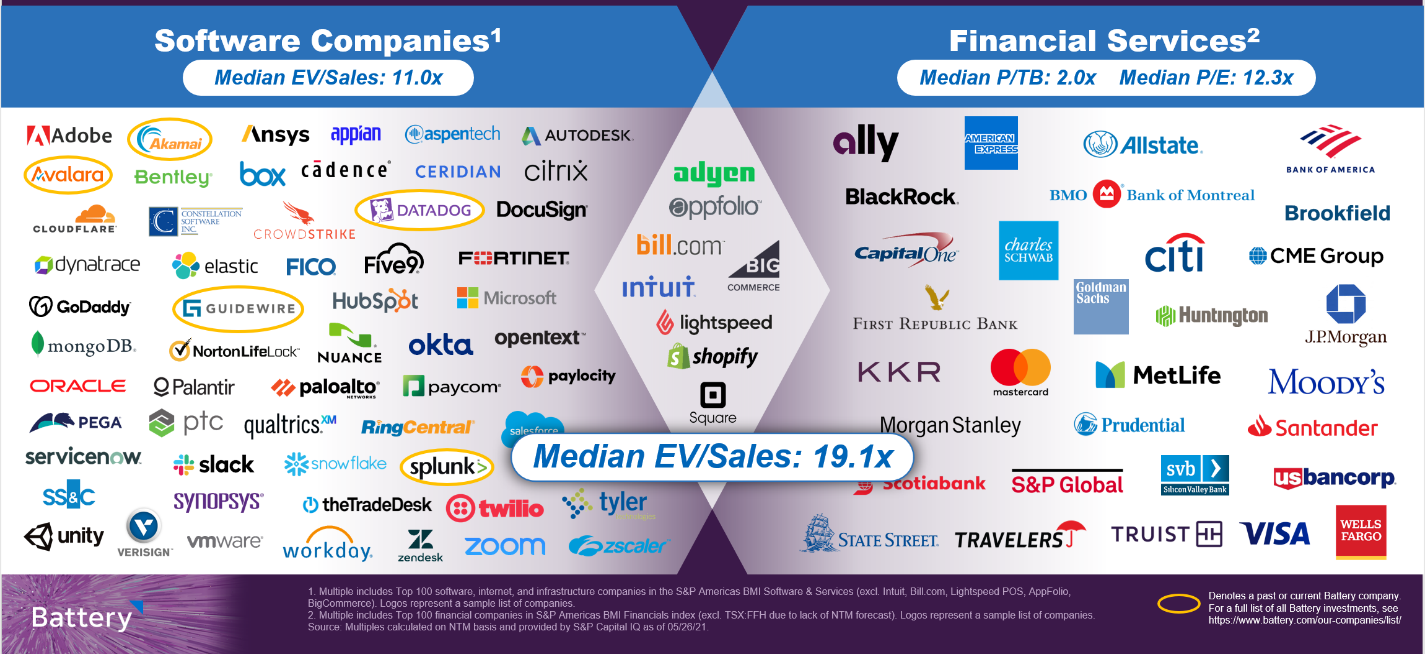

In a market that is very crowded with tech companies building platforms to book beauty (and other) services and to manage the business of independent retailers — they include giants like Lightspeed POS, as well as smaller players like Booksy (which also recently raised) and StyleSeat, but also players like Square and PayPal, and many others — the core of Fresha’s offering is a booking platform built as a totally free product.

Why free? To attract more users to its other services (such as payments, which do come at a price), and because co-founders William Zeqiri (CEO) and Nick Miller (product chief) — pictured above, respectively left and right — think this the only way to build a business like this in a crowded market.

“We believe that software is a commodity,” said Zeqiri in an interview. “A lot of our competitors are beating each other on price to the bottom. We wanted to consolidate the supply side of the software, gather data about the businesses, how they use what they use.”

That data led, first, to identifying the need for and building out software and launching its B2B and B2C marketplaces, and the idea is that it will likely lead to more products as it continues to mature, whether it’s better analytics for its current customers so that they can better price or develop their services accordingly, or entirely new tools for new categories of users.

Meanwhile, the services that it already provides, like payments, have taken off like a shot, not least because they’ve served a need for any virtual transactions, like selling vouchers or items.

Miller noted that while a lot of its customers actually interface with tech with a lot of reluctance — they are the essence of “physical” retailers when you think about it — they also found themselves having to use more digital services simply because of circumstances. “Looking back at what happened, tech adoption accelerated for our customers,” said Miller. He said that current customers usage for the point-of-sale systems and online payments is roughly equal.

Looking ahead, Fresha’s investor list is notable for its strategic mix and might shed some light on how it grows. Kattan, a “beauty influencer” and the founder of Huda Beauty, is investing by way of HB Investments, a strategic venture arm; while Zeisser’s FMZ focuses on “experience economy” investments today, but he himself has a long history working at tech companies building marketplaces, including years with Alibaba as head of its U.S. investment practice. These speak to areas where Fresha is likely interested in expanding its reach — more marketplace activity; and perhaps more social media angles and exposure for its customers at a time when social media really has become a key way for beauty and wellness businesses to market themselves.

“Fresha has emerged as a leader powering the beauty and wellness industry,” said Aaron Goldman, Global co-head of financial services and managing director at General Atlantic, in a statement. “William, Nick and the Fresha team have built a product that is resonating with the market and creating long-term value through the intersection of its payments, software and marketplace offerings. We are thrilled to be partnering with the company and believe Fresha has significant opportunity to further scale its innovative platform.”

“I’ve witnessed firsthand the positive impact Fresha has for beauty entrepreneurs,” added Kattan. “The company is a force for good in the growing community of beauty professionals around the globe, who are increasingly adopting a self-employed approach. By making top business software accessible without any subscription fees, Fresha lets professionals focus on what they do best — offering great experiences for their customers.”

Powered by WPeMatico