As dating app Tinder and its parent company Match explore the future of personal connection through apps, it’s interesting to see what sort of ideas it tested but later discarded. One such experiment was something called “Tinder Mixer,” which had briefly offered Tinder users a way to join group video chats, and “play games” with others nearby.

The feature was tested for a short period of time last year in New Zealand, we understand, but will not be launching.

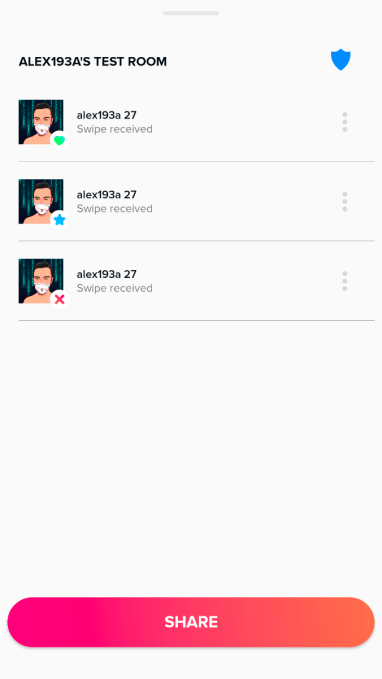

The Tinder Mixer experience was uncovered by app researcher Alessandro Paluzzi, who found references the product in the Tinder Android app’s code. He had not yet publicized the finding, as we worked to learn more about the origins of the product.

The resources he found in the dating app had given the appearance of a product in the midst of development, Paluzzi noted, but as it turns out it was one that had already been tested and quickly shut down as Tinder continued its other, ongoing experiments in the dating market.

According to Tinder, the Tinder Mixer test has no impact on its product roadmap this year, and the Tinder Mixer experience described here will likely never come into existence.

That said, what made the product particularly intriguing was that it saw Tinder venturing, however briefly and experimentally, into more of a social discovery space, compared with the usual Tinder experience. Typically, Tinder users swipe on daters’ profiles, match, chat and sometimes even video call each other on a one-on-one basis. But live video chatting with a group is not something Tinder today offers.

That said, the idea of going live on video is not new to Match.

This is an area where the company has experimented before, including with its apps Plenty of Fish, which offers a one-to-many video broadcasting feature, and Ablo, which offers one-on-one video chats with people around the world. These experiments constitute what the company considers “dating-adjacent” experiences. In other words, you could meet someone through these video interactions, but that’s not necessarily their main goal.

These video experiences have continued even as Match announced its $1.73 billion acquisition of Seoul-based Hyperconnect — its biggest acquisition ever, and one that puts the company more on the path towards a future that involves the “social discovery” and live streaming market.

The company believes social discovery an area with vast potential, and a market it estimates that could be twice the size of dating, in fact.

Match Group CEO Shar Dubey spoke to this point recently at the JP Morgan Technology, Media and Communications Conference, noting that on some of its bigger platforms, Match has seen that a number of its users were looking for more of “a shared experience and a sense of community among other like-minded single people on the platform,” she said.

She noted that technology has reached a point where people could now interact with others through richer experiences than the traditional dating flow of swipe-match-chat allowed for, including few-to-few, many-to-many, and one-to-many type of experiences.

Hyperconnect brings to Match much of the technology that would allow the company to expand in these areas.

Today, it offers two apps, Azar and Hakuna Live, which let users to connect with one another online. The former, launched in 2014, is focused on one-on-one live video and voice chats while the latter, launched in 2019 is in the online broadcast space. Not coincidentally, these apps mirror the live stream experiences that Match has been running on Plenty of Fish and Ablo.

Because these live streaming services are often more heavily adopted by younger demographics, it makes sense that Match may have wanted to also test out such a live stream experience on Tinder, which also skews younger, even if the test ultimately only served as a way to collect data as opposed to informing a specific future product’s development.

With the Hyperconnect deal soon to be finalized, the incoming apps will initially give Match an expanded footprint in the live streaming and social discovery market in Asia — 75% of Hyperconnect’s usage and revenue comes from markets in Asia. Match then plans to leverage its international experience and knowledge to accelerate their growth in other markets where they haven’t yet broken through.

But another major reason for the acquisition is that Match sees the potential in deploying Hyperconnect’s technology across its existing portfolio of dating apps to not only create richer experiences but also to cater to users in markets where the “Western” way of online dating hasn’t yet been fully embraced, but social discovery has.

“We think there is real synergy of bringing some of these experiences that are popular in social discovery platforms onto our dating platforms, as well as sort of enhance the social discovery platforms and help people get to their dating intent, should they choose to,” Dubey explained, at the JP Morgan conference.

What any of that may mean for Tinder, more specifically, is not yet known.

Powered by WPeMatico

In reverse, tech companies — even those with strong gross margins — with slipping growth can see their multiples compress rapidly. Then, the vultures circle.

In reverse, tech companies — even those with strong gross margins — with slipping growth can see their multiples compress rapidly. Then, the vultures circle.