Lordstown Motors released its Q1 earnings yesterday, and the electric vehicle manufacturer is facing a few challenges.

Expenses were higher than expected, it plans to slash production by about 50%, and the company reported zero revenue and a net loss of $125 million. Oh, it also needs more capital.

“But there’s more to the Lordstown mess than merely a single bad quarter,” writes Alex Wilhelm. “Lordstown’s earnings mess and the resulting dissonance with its own predictions are notable on their own, but they also point to what could be shifting sentiment regarding SPAC combinations.”

In light of the company’s lackluster earnings report (and a pending SEC investigation), Alex unpacks the company’s Q1, “but don’t think that we’re only singling out one company; others fit the bill, and more will in time.”

May 27 Clubhouse chat: How to ensure data quality in the era of Big Data

Image Credits: TechCrunch

Join TechCrunch reporter Ron Miller and Patrik Liu Tran, co-founder and CEO of automated real-time data validation and quality monitoring platform Validio, on Thursday, May 27 at 9 a.m. PDT/noon EDT for a Clubhouse chat about ensuring data quality in the era of Big Data.

The world produces 2.5 quintillion bytes of data daily, but modern data infrastructure still lacks solutions for monitoring data quality and data validation.

Among other topics, they’ll discuss the build versus buy debate, how to better understand data failures, and why traditional methods for identifying data failures are no longer operational.

Click here to join the conversation.

Thanks very much for reading Extra Crunch; have a great week!

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Full Extra Crunch articles are only available to members.

Use discount code ECFriday to save 20% off a one- or two-year subscription.

How Expensify shed Silicon Valley arrogance to realize its global ambitions

Image Credits: Nigel Sussman

Expensify may be the most ambitious software company ever to mostly abandon the Bay Area as the center of its operations.

The startup’s history is tied to places representative of San Francisco: The founding team worked out of Peet’s Coffee on Mission Street for a few months, then crashed at a penthouse lounge near the 4th and King Caltrain station, followed by a tiny office and then a slightly bigger one in the Flatiron building near Market Street.

Thirteen years later, Expensify still has an office a few blocks away on Kearny Street, but it’s no longer a San Francisco company or even a Silicon Valley firm. The company is truly global with employees across the world — and it did that before COVID-19 made remote working cool.

It makes sense that a company founded by internet pirates would let its workforce live anywhere they please and however they want to. Yet, how does it manage to make it all work well enough to reach $100 million in annual revenue with just a tad more than 100 employees?

As I described in Part 2 of this EC-1, that staffing efficiency is partly due to its culture and who it hires. It’s also because it has attracted top talent from across the world by giving them benefits like the option to work remotely all year as well as paying SF-level salaries even to those not based in the tech hub. It’s also got annual fully paid month-long “workcations” for every employee, their partner and kids.

Brian Chesky describes a faster, nimbler post-pandemic Airbnb

Image Credits: TechCrunch

Managing Editor Jordan Crook interviewed Airbnb co-founder and CEO Brian Chesky to discuss the future of travel and what it was like leading the world’s biggest hospitality startup during a global pandemic.

“Our business initially dropped 80% in eight weeks. I say it’s like driving a car. You can’t go 80 miles an hour, slam on the brakes, and expect nothing really bad to happen.

Now imagine you’re going 80 miles an hour, slam on the brakes, then rebuild the car kind of while still moving, and then try to accelerate into an IPO, all on Zoom.”

Embedded finance will help fill the life insurance coverage gap

There’s latent demand for life insurance currently unaddressed by much of the financial services industry, and embedded finance can be the solution.

It’s imperative for companies to consider product lines and partnerships to expand markets, create new revenue streams and provide added value to their customers.

Connecting consumers with products they need through channels they already know and trust is both a massive revenue opportunity and a social good, providing financial resilience to families at a time when they need it most.

Zeta Global’s IPO filing uncovers modest growth, strong adjusted profitability

Zeta Global raised north of $600 million in private capital in the form of both equity financing and debt, making it a unicorn worth understanding.

The gist is that Zeta ingests and crunches lots of data, helping its users market to their customers on a targeted basis throughout their individual buying lifecycles. In simpler terms, Zeta helps companies pitch customers in varied manners depending on their own characteristics.

You can imagine that, as the digital economy has grown, the sort of work Zeta Global supports has only expanded. So, has Zeta itself grown quickly? And does it have an attractive business profile? We want to know.

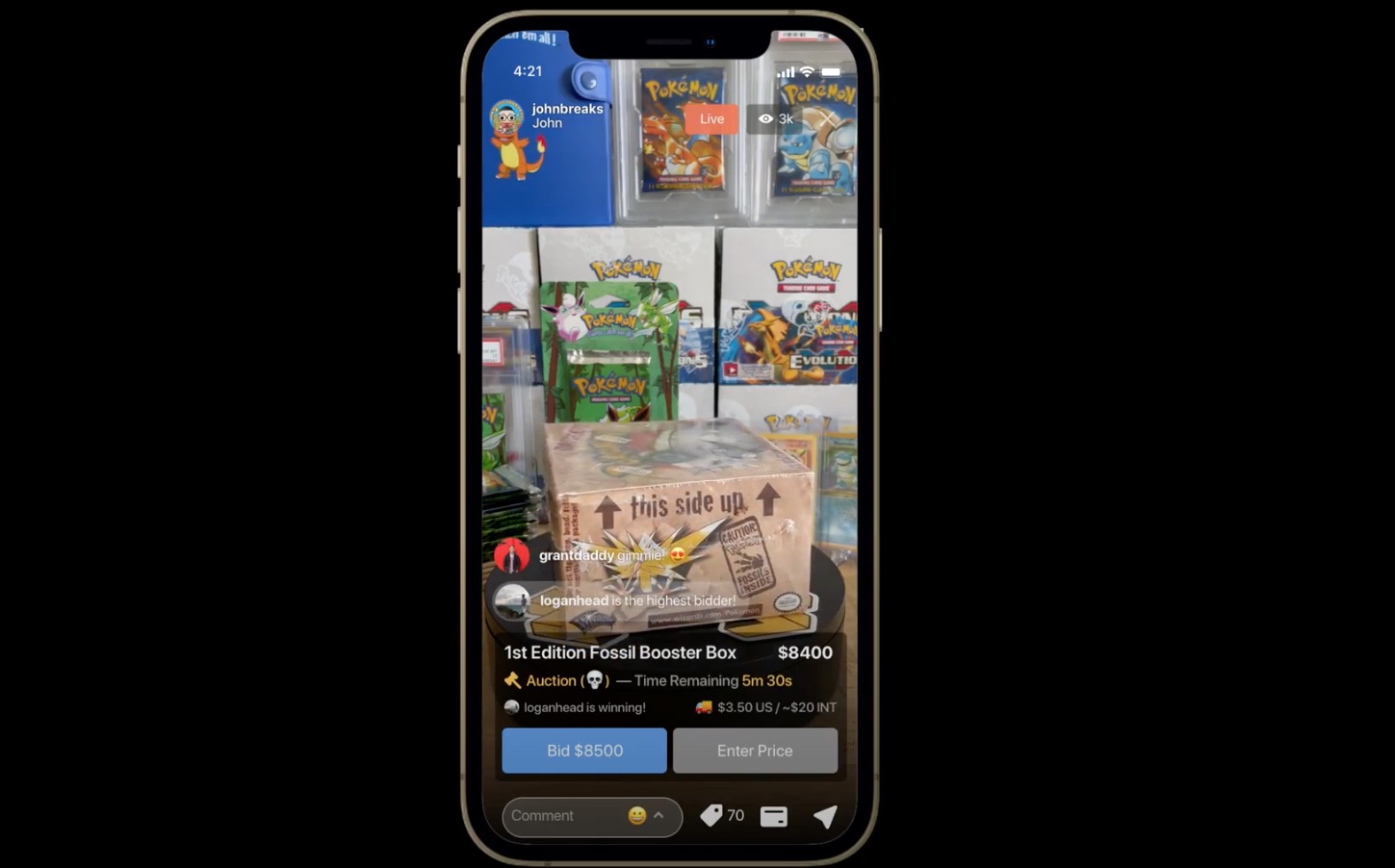

5 predictions for the future of e-commerce

In 2016, more than 20 years after Amazon’s founding and 10 years since Shopify launched, it would have been easy to assume e-commerce penetration (the percentage of total retail spend where the goods were bought and sold online) would be over 50%.

But what we found was shocking: The U.S. was only approximately 8% penetrated — only 8% for arguably the most advanced economy in the world!

Despite e-commerce growth skyrocketing over the past year, the reality is the U.S. has still only reached an e-commerce penetration rate of around 17%. During the last 18 months, we’ve closed the gap to South Korea and China’s e-commerce penetration of more than 25%, but there is still much progress to be made.

Here are five key predictions for what this road to further penetration will hold.

Develop a buyer’s guide to educate your startup’s sales team and customers

Every company wants to be innovative, but innovation comes with its share of difficulties. One key challenge for early-stage companies that are disrupting a particular space or creating a new category is figuring out how to sell a unique product to customers who have never bought such a solution.

This is especially the case when a solution doesn’t have many reference points and its significance may not be obvious.

Some buyers could use a walkthrough of the buying process. If you are building a singular product in a nascent market that necessitates forward-looking customers and want to drastically shorten sales cycles, create a buyer’s guide.

When to walk away from a VC who wants to invest in your startup

Pay attention to red flags when meeting with VCs: If they cancel late or leave you waiting, it’s a sign, just like being asked generic questions that demonstrate little or no understanding of the proposition. If they critique you or your business, that’s fine (obviously), but make sure you find out what’s behind their assertions to judge how well informed they are.

If you’re going to face these people each month and debate the direction of your business, the least you can expect is a robust argument outlining precisely why you may not have all the right answers.

If you fail to spot the warning signs, you’ll live to regret it. But do your due diligence and work constructively with them and, together, you might actually build a sustainable future.

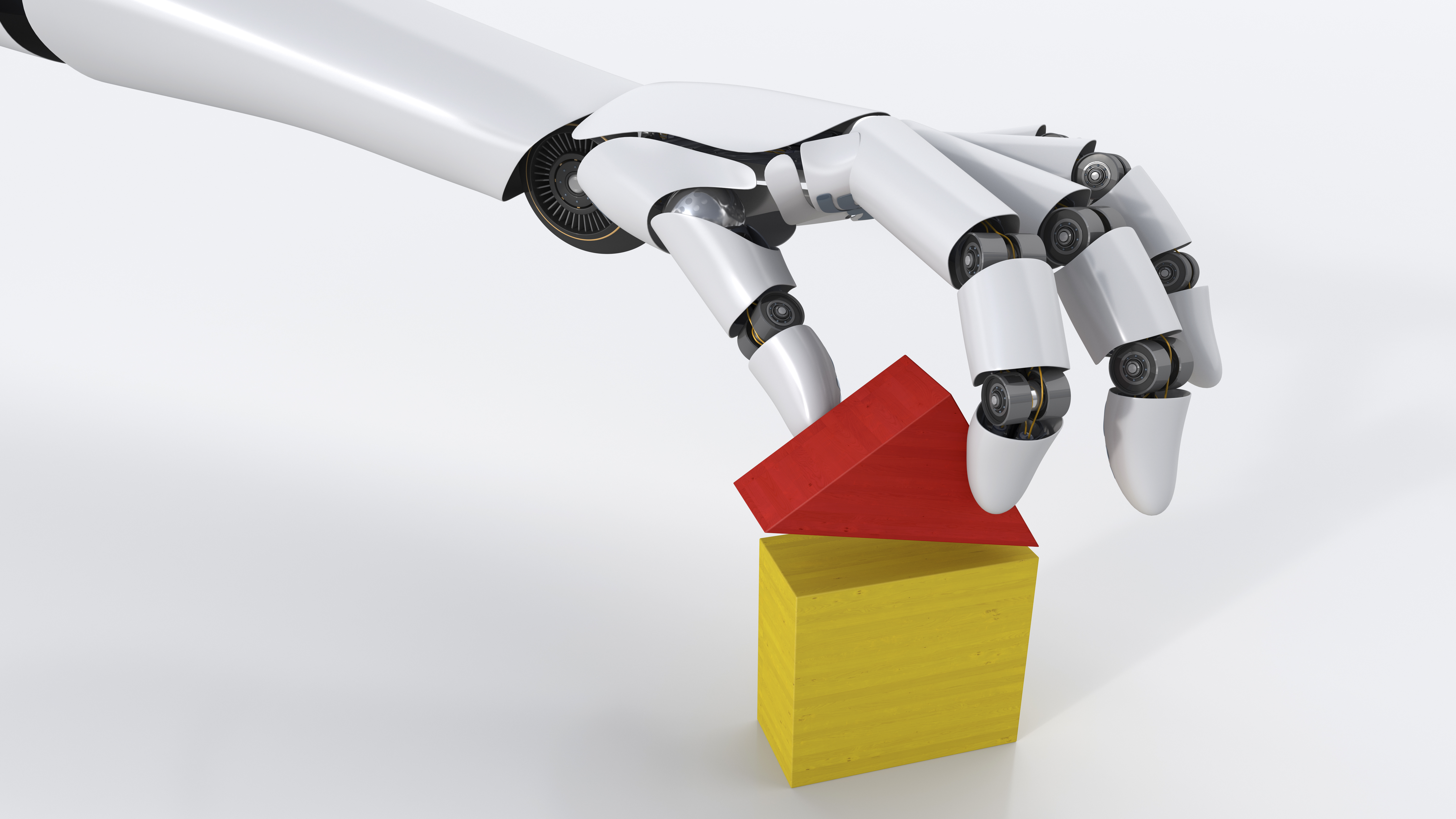

Deep Science: Robots, meet world

Image via Getty Images / Westend61

This column aims to collect some of the most relevant recent discoveries and papers — particularly in, but not limited to, artificial intelligence — and explain why they matter.

In this edition, we have a lot of items concerned with the interface between AI or robotics and the real world. Of course, most applications of this type of technology have real-world applications, but specifically, this research is about the inevitable difficulties that occur due to limitations on either side of the real-virtual divide.

2 CEOs are better than 1

Netflix has two CEOs: Co-founder Reed Hastings oversees the streaming side of the company, while Ted Sarandos guides Netflix’s content.

Warby Parker has co-CEOs as well — its co-founders went to college together. Other companies like the tech giant Oracle and luggage maker Away have shifted from having co-CEOs in recent years, sparking a wave of headlines suggesting that the model is broken.

While there isn’t a lot of research on companies with multiple CEOs, the data is more promising than the headlines would suggest. One study on public companies with co-CEOs revealed that the average tenure for co-CEOs, about 4.5 years, was comparable to solitary CEOs, “suggesting that this arrangement is more stable than previously believed.”

Furthermore, it’s impossible to be in two places at once or clone yourself. With co-CEOs, you can effectively do just that.

Powered by WPeMatico