Peyton Carr is a financial advisor to founders, entrepreneurs and their families, helping them with planning and investing. He is a managing director of

Keystone Global Partners.

More posts by this contributor

As an entrepreneur, you started your business to create value, both in what you deliver to your customers and what you build for yourself. You have a lot going on, but if building personal wealth matters to you, the assets you’re creating deserve your attention.

You can implement numerous advanced planning strategies to minimize capital gains tax, reduce future estate tax and increase asset protection from creditors and lawsuits. Capital gains tax can reduce your gains by up to 35%, and estate taxes can cost up to 50% on assets you leave to your heirs. Careful planning can minimize your exposure and actually save you millions.

Smart founders and early employees should closely examine their equity ownership, even in the early stages of their company’s life cycle. Different strategies should be used at different times and for different reasons. The following are a few key considerations when determining what, if any, advanced strategies you might consider:

- Your company’s life cycle — early, mid or late stage.

- The value of your shares — what they are worth now, what you expect them to be worth in the future and when.

- Your own circumstances and goals — what you need now, and what you may need in the future.

Some additional items to consider include issues related to qualified small business stock (QSBS), gift and estate taxes, state and local income taxes, liquidity, asset protection, and whether you and your family will retain control and manage the assets over time.

Smart founders and early employees should closely examine their equity ownership, even in the early stages of their company’s life cycle.

Here are some advanced equity planning strategies that you can implement at different stages of your company life cycle to reduce tax and optimize wealth for you and your family.

Irrevocable nongrantor trust

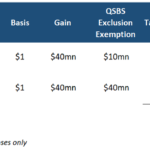

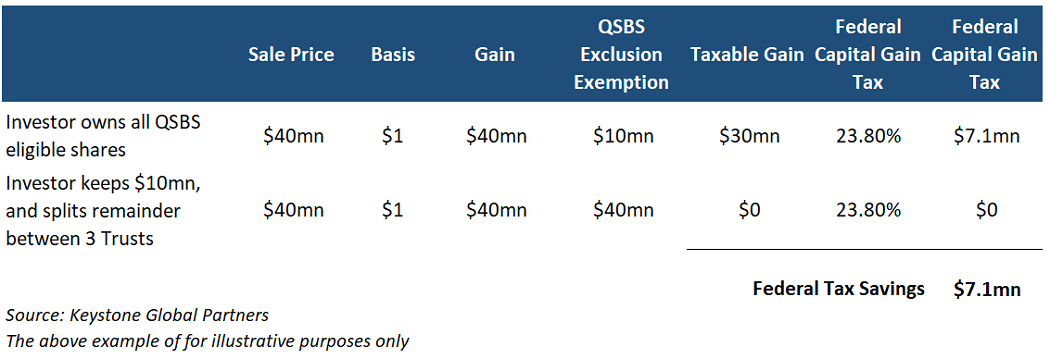

QSBS allows you to exclude tax on $10 million of capital gains (tax of up to 35%) upon an exit/sale. This is a benefit every individual and some trusts have. There is significant opportunity to multiply the QSBS tax exclusion well beyond $10 million.

The founder can gift QSBS eligible stock to an irrevocable nongrantor trust, let’s say for the benefit of a child, so that the trust will qualify for its own $10 million exclusion. The founder owning the shares would be the grantor in this case. Typically, these trusts are set up for children or unborn children. It is important to note that the founder/grantor will have to gift the shares to accomplish this, because gifted shares will retain the QSBS eligibility. If the shares are sold into the trust, the shares lose QSBS status.

Image Credits: Peyton Carr

In addition to the savings on federal taxes, founders may also save on state taxes. State tax can be avoided if the trust is structured properly and set up in a tax-exempt state like Delaware or Nevada. Otherwise, even if the trust is subject to state tax, some states, like New York, conform and follow the federal tax treatment of the QSBS rules, while others, like California, do not. For example, if you are a New York state resident, you will also avoid the 8.82% state tax, which amounts to another $2.6 million in tax savings if applied to the example above.

This brings the total tax savings to almost $10 million, which is material in the context of a $40 million gain. Notably, California does not conform, but California residents can still capture the state tax savings if their trust is structured properly and in a state like Delaware or Nevada.

Currently, each person has a limited lifetime gift tax exemption, and any gifted amount beyond this will generate up to a 40% gift tax that has to be paid. Because of this, there is a trade-off between gifting the shares early while the company valuation is low and using less of your gift tax exemption versus gifting the shares later and using more of the lifetime gift exemption.

The reason to wait is that it takes time, energy and money to set up these trusts, so ideally, you are using your lifetime gift exemption and trust creation costs to capture a benefit that will be realized. However, not every company has a successful exit, so it is sometimes better to wait until there is a certain degree of confidence that the benefit will be realized.

Parent-seeded trust

One way for the founder to plan for future generations while minimizing estate taxes and high state taxes is through a parent-seeded trust. This trust is created by the founder’s parents, with the founder as the beneficiary. Then the founder can sell the shares to this trust — it doesn’t involve the use of any lifetime gift exemption and eliminates any gift tax, but it also disqualifies the ability to claim QSBS.

The benefit is that all the future appreciation of the asset is transferred out of the founder’s and the parent’s estate and is not subject to potential estate taxes in the future. The trust can be located in a tax-exempt state such as Delaware or Nevada to also eliminate home state-level taxes. This can translate up to 10% in state-level tax savings. The trustee, an individual selected by the founder, can make distributions to the founder as a beneficiary if desired.

Further, this trust can be used for the benefit of multiple generations. Distributions can be made at the discretion of the trustee, and this skips the estate tax liability as assets are passed from generation to generation.

Grantor retained annuity trust (GRAT)

This strategy enables the founder to minimize their estate tax exposure by transferring wealth outside of their estate, specifically without using any lifetime gift exemption or being subject to gift tax. It’s particularly helpful when an individual has used up all their lifetime gift tax exemption. This is a powerful strategy for very large “unicorn” positions to reduce a founder’s future gift/estate tax exposure.

For the GRAT, the founder (grantor) transfers assets into the GRAT and gets back a stream of annuity payments. The IRS 7520 rate, currently very low, is a factor in calculating these annuity payments. If the assets transferred into the trust grow faster than the IRS 7520 rate, there will be an excess remainder amount in GRAT after all the annuity payments are paid back to the founder (grantor).

This remainder amount will be excluded from the founder’s estate and can transfer to beneficiaries or remain in the trust estate tax-free. Over time, this remainder amount can be multiples of the initial contributed value. If you have company stock that you expect will pop in value, it can be very beneficial to transfer those shares into a GRAT and have the pop occur inside the trust.

This way, you can transfer all the upside gift and estate tax-free out of your estate and to your beneficiaries. Additionally, because this trust is structured as a grantor trust, the founder can pay the taxes incurred by the trust, making the strategy even more powerful.

One thing to note is that the grantor must survive the GRAT’s term for the strategy to work. If the grantor dies before the end of the term, the strategy unravels and some or all the assets remain in his estate as if the strategy never existed.

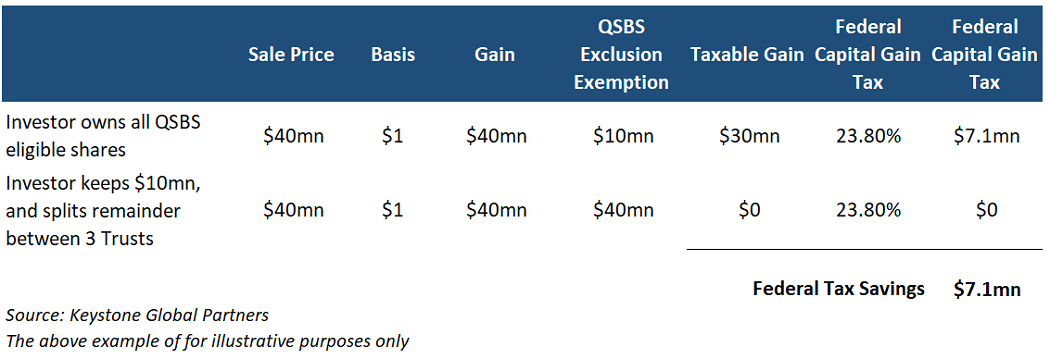

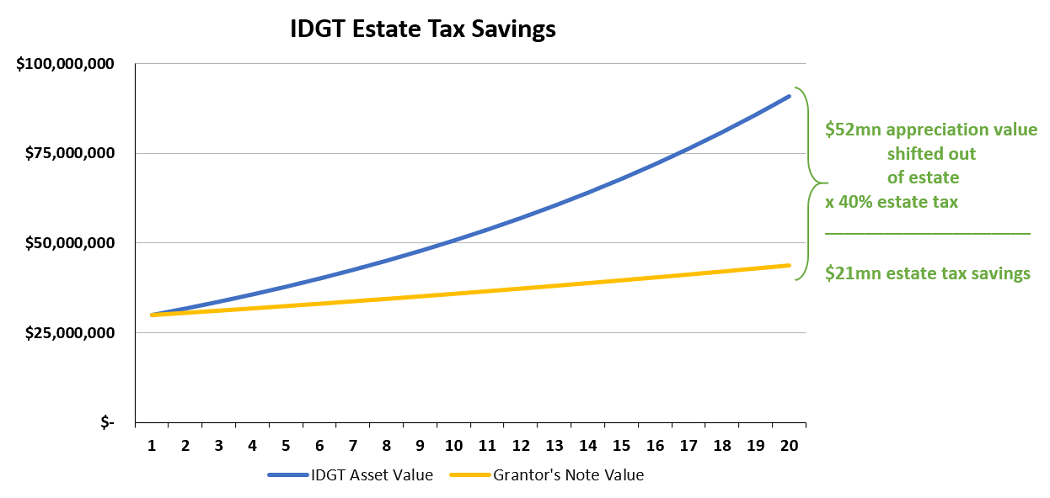

Intentionally defective grantor trust (IDGT)

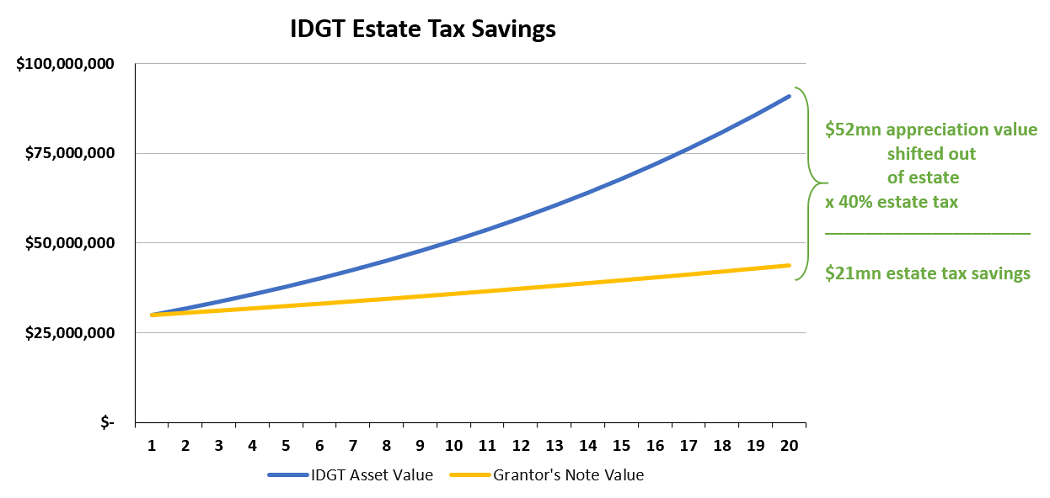

This is similar to the GRAT in that it also enables the founder to minimize their estate tax exposure by transferring wealth outside of their estate, but has some key differences. The grantor must “seed” the trust by gifting 10% of the asset value intended to be transferred, so this approach requires the use of some lifetime gift exemption or gift tax.

The remaining 90% of the value to be transferred is sold to the trust in exchange for a promissory note. This sale is not taxable for income tax or QSBS purposes. The main benefits are that instead of receiving annuity payments back, which requires larger payments, the grantor transfers assets into the trust and can receive an interest-only note. The payments received are far lower because it is interest-only (rather than an annuity).

Image Credits: Peyton Carr

Another key distinction is that the IDGT strategy has more flexibility than the GRAT and can be generation-skipping.

If the goal is to avoid generation-skipping transfer tax (GSTT), the IDGT is superior to the GRAT, because assets are measured for GSTT purposes when they are contributed to the trust prior to appreciation rather than being measured at the end of the term for a GRAT after the assets have appreciated.

The bottom line

Depending on a founder’s situation and goals, we may use some combination of the above strategies or others altogether. Many of these strategies are most effective when planning in advance; waiting until after the fact will limit the benefits you can extract.

When considering strategies for protecting wealth and minimizing taxes as it relates to your company stock, there’s a lot to take into account — the above is only a summary. We recommend you seek proper counsel and choose wealth transfer and tax savings strategies based on your unique situation and individual appetite for complexity.

Powered by WPeMatico