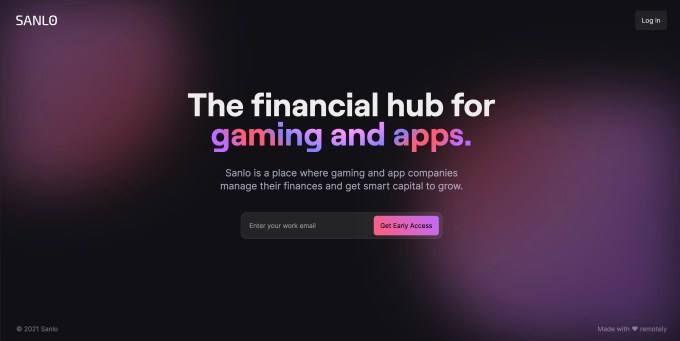

Having a great idea for an app or game is one thing, but scaling it to become a successful business is quite another. A new fintech startup called Sanlo aims to help. The company, which is today announcing an oversubscribed $3.5 million seed round, offers small to medium-sized game and app companies access to tools to manage their finances and capital to fuel their growth.

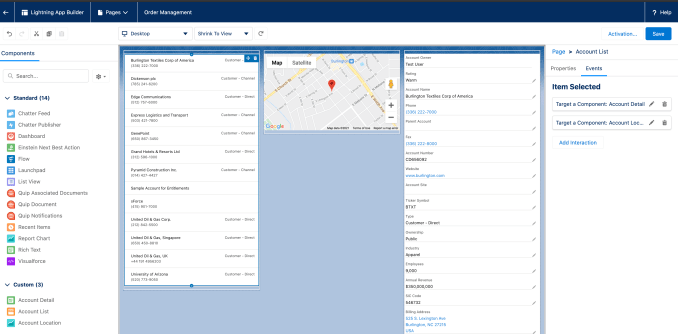

To be clear, Sanlo is not an investor that’s taking an equity stake in the apps and games it finances. Instead, it’s offering businesses access to technology, tools and insights that will allow them to achieve smart and scalable growth while remaining financially healthy — even if they’re a smaller company without time to sit down and structure their finances. Then, when Sanlo’s proprietary algorithms determine the business could benefit from the smart deployment of capital, it will assist by offering financing.

The idea for Sanlo hails from co-founders Olya Caliujnaia and William Liu, who both have backgrounds in fintech and gaming.

Caliujnaia began her career in venture capital in one of the first mobile-focused funds, before moving to operator roles in gaming, stock photography and fintech at EA, Getty Images and SigFig, respectively. She later joined early-stage fintech and enterprise fund XYZ.vc as an Entrepreneur in Residence.

Liu, meanwhile, worked in gaming at EA, but later switched to fintech, working at startups like Earnest and Branch.

After reconnecting in San Francisco, the co-founders realized they could put their combined experience to work in order to help smaller businesses just starting out recognize when it’s time to scale, what areas of the business to invest in and how much capital they need to grow.

Image Credits: Sanlo’s Olya Caliujnaia and William Liu / Sanlo

Caliujnaia has seen how the app and gaming market has evolved over the years, and she realized the difficulties new developers now face.

“You have this explosion of the app economy that’s growing insanely,” she says. “That’s the exciting part of it. That creativity. That passion and that desire to build — that’s so admirable.”

Today, companies benefit from having access to better development tools, broader access to talent, consumer demand, and other forces, she notes, compared with those in the past. But on the flip side, it’s become incredibly difficult to scale a consumer app or game.

“I think a lot of that comes down to, one, that there are dynamics around the free-to-play model — how you monetize and therefore, what kind of players and users you bring on board,” Caliujnaia says. “And then the second aspect is that it’s just harder to get noticed. So, ultimately, it comes down to marketing.”

Many of the decisions that a company has to make on this front are predictable, however. That means Sanlo doesn’t have to sit down with businesses and consult with them one-on-one, the way a financial advisor working in wealth management would do with their clients.

Instead, Sanlo asks companies for certain types of data to get started. This includes product data about how well the app or game monetizes and customer acquisition and retention, for example, as well as marketing data and a subset of financial data. Its predictive algorithms then continually monitor the company’s growth trajectory to surface insights to identify where and how the business can grow.

This concept alone could have worked as a services business for mobile studios, but Sanlo takes the next step beyond advice to actually provide companies with access to capital. The amount of financing provided will vary based on the life stage of the company and risk profile, but it’s non-dilutive capital. That is, Sanlo takes no ownership stake in the companies it finances.

Image Credits: Sanlo

Caliujnaia said it made more sense to go this route rather than return to the VC world, because of potential to reach a wider group.

“There’s this long tail of developers and it’s more about enabling them, rather than producing more hits,” she says. “It’s very different mindsets, different markets that we’re going for.”

Sanlo doesn’t have a lot of direct competitors beyond perhaps, Silicon Valley Bank and other financial lenders, as well as mobile gaming publishers. But the publisher model often implies some sort of ownership, which is a significant differentiating factor. In some cases, you may see a larger gaming company extending debt financing to a smaller one. That was the case with Finnish mobile games company Metacore, which recently raised another debt round from gaming giant Supercell, for example.

Caliujnaia points out that most smaller companies don’t have that kind of access to financing. Now they could, through Sanlo.

“The idea is to have a healthier layer of companies that are able to survive for the long-term,” she says.

That means more companies that won’t have to stress about their futures, leading them to aggressively monetize their users, and later, scrambling for an exit when their financial runway comes to an end.

Sanlo is currently pilot testing its system with a small group of mobile game studios who will serve as its initial customer base, but plans to later support consumer apps, which have similar struggles with customer acquisition costs and growth.

The San Francisco-headquartered startup itself was founded in 2020 and began raising money. It has now raised a total of $3.5 million in seed funding co-led by Index Ventures and Initial Capital, with participation from LVP, Portag3 Ventures and XYZ Venture Capital. Angel investors include Kristian Segestrale (Super Evil Megacorp CEO), Gokul Rajaram and Charley Ma.

Initial Capital co-founder and partner Ken Lamb became a board director with the fundraise, while Index partner Mark Goldberg and XYZ managing partner Ross Fubini joined as board observers.

“Sanlo cracked the code to help mobile gaming and app companies reach maturity with a new level of speed, scale, and fiscal wellbeing,” said Goldberg, in a statement. “The company is building a very sophisticated fintech offering that will give those companies superpowers.”

Sanlo plans to use the funds to grow its team and product suite ahead of its public launch later this year.

Powered by WPeMatico

So if we can show that a huge, diverse set of no-code and low-code startups are raising oodles of capital, we can infer something relatively sturdy about market demand for their products. (It also doesn’t hurt that no-code automation service Zapier is growing like a weed and has reached IPO scale. In other news, Appian just dropped a new version of its low-code automation platform, for whatever that is worth.)

So if we can show that a huge, diverse set of no-code and low-code startups are raising oodles of capital, we can infer something relatively sturdy about market demand for their products. (It also doesn’t hurt that no-code automation service Zapier is growing like a weed and has reached IPO scale. In other news, Appian just dropped a new version of its low-code automation platform, for whatever that is worth.)