If you ask Nik Bonaddio why he wanted to build a new mobile trivia app, his answer is simple.

“In my life, I’ve got very few true passions: I love trivia and I love sports,” Bonaddio told me. “I’ve already started a sports company, so I’ve got to start a trivia company.”

He isn’t kidding about either part of the equation. Bonaddio actually won $100,000 on “Who Wants To Be A Millionaire?”, which he used to start the sports analytics company numberFire (acquired by FanDuel in 2014).

And today, after a period of beta testing, Bonaddio is launching BigBrain. He’s also announcing that the startup has raised $4.5 million in seed funding from FirstRound Capital, Box Group, Ludlow Ventures, Golden Ventures and others.

Of course, you can’t mention mobile trivia without thinking of HQ Trivia, the trivia app that shut down last year after some high-profile drama and a spectacular final episode.

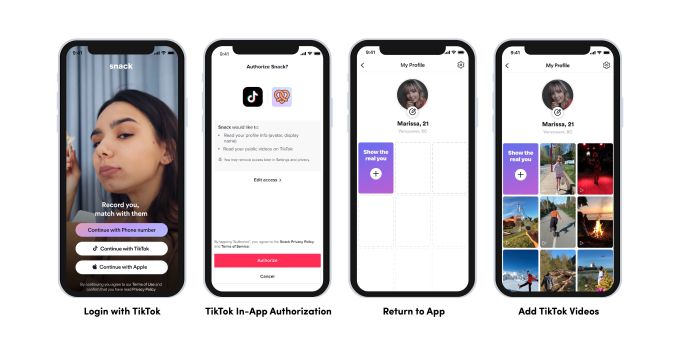

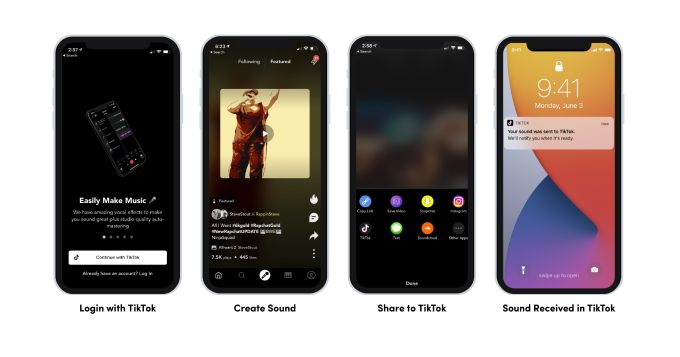

Image Credits: BigBrain

But Bonaddio said BigBrain is approaching things differently than HQ in a few key ways. For starters, although there will be a handful of free games, the majority will require users to pay to enter, with the cash rewards coming from the entry fees. (From a legal perspective, Bonaddio said this is distinct from gambling because trivia is recognized as a game of skill.)

“The free-to-play model doesn’t really work for trivia,” he argued.

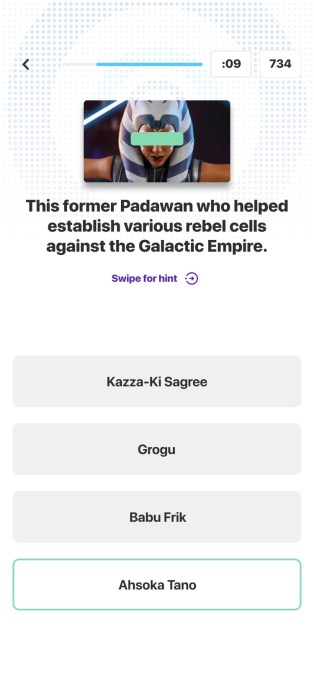

In addition, there will be no live video with a live host — Bonaddio said this would be “very, very difficult from a technical perspective and very cost ineffective.” Instead, he claimed the company has found a middle ground: “We have photos, we have different interactive elements, it’s not just a straight multiple choice quiz. We do try to keep it interactive.”

Plus, the simpler production means that where HQ was only hosting two quizzes a day, BigBrain will be hosting 20, with quizzes every 15 minutes at peak times.

Topics will range from old-school hip hop to college football to ’90s movies, and Bonaddio said different quizzes will have different prize structures — some might be winner take all, while others might award prizes to the top 50% of participants. The average quiz will cost $2 to $3 to enter, but prices will range from free to “$20 or even $50.”

What kind of quiz might cost that much money to enter? As an example, Bonaddio said that in a survey of potential users, he found, “There are no casual ‘Rick and Morty’ fans … They’re almost completely price sensitive, and since they’ve seen every episode, they can’t fathom a world where someone knows more about ‘Rick and Morty’ than they do.”

Powered by WPeMatico