Africa is the last frontier for basically anything. Mobile gaming is no exception. For a continent that is home to more than 1 billion millennials and Gen Zers, mobile gaming has never really picked up, despite the continent witnessing rapid economic growth and smartphone adoption.

Two issues have proved detrimental to this growth: distribution and payments. With fragmented and unresolved distribution and digital payments ecosystems, game studios have found it difficult to serve African consumers and make a ton of money doing so. Carry1st is a mobile games publishing platform fixing this problem, and today it is announcing the close of its $6 million Series A round.

This month last year, we reported that the company had just raised a $2.5 million seed investment. CRE Ventures led that round, but this time, the company, which has offices in Cape Town and New York, brought in a blue-chip group of investors spanning gaming, media and fintech.

U.S. VC firm Konvoy Ventures led the Series A round. The firm is known for its investment in the video gaming industry’s infrastructure, technology, tools and platforms. Riot Games (developer of League of Legends), Tokyo’s Akatsuki Entertainment Technology Fund (the company behind Dragon Ball Z), Raine Ventures and fintech VC TTV Capital participated.

Carry1st was founded by Cordel Robbin-Coker, Lucy Hoffman and Tinotenda Mundangepfupfu in 2018. The company started as a game studio, developing and launching its own mobile games. But a projection on what it could be in the long run made the company switch tactics.

Instead of the studio model (quite popular among gaming companies in Africa), Carry1st sought to become a regional publisher, thereby opening the continent to international studios. Also, the company helps local studios that find it difficult to create games with a global appeal by pairing them with strong operators.

“We learned that African users don’t need their own games; they want to play the best games in the world,” CEO Robbin-Coker told TechCrunch.

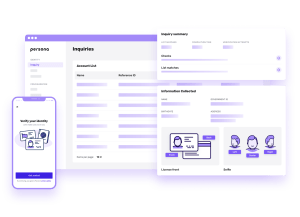

COO Hoffman said that the company provides a full-stack publishing platform for its partners. It also handles localization, distribution, user acquisition, monetization, customer experience for studios and licenses their games on exclusive, long-term contracts.

“We fund user acquisition so that the games are played by as many users as possible, and then send our partners a royalty in return for the ability to leverage their IP,” Hoffman said.

L-R: Cordel Robbin-Coker (CEO), Lucy Hoffman (COO) and Tinotenda Mundangepfupfu (CTO). Image Credits: Carry1st

This is somewhat akin to how Tencent-backed Sea Limited (parent company of Garena) took off. The company was the publisher of League of Legends across Southeast Asia but launched its own game, Free Fire. Now, the company has built out the largest consumer payments and e-commerce platform in the region, which is now worth over $130 billion. Carry1st aspires to do the same for Africa.

Although there aren’t many details about its e-commerce activity, Carry1st is tackling payments and difficult monetization issues by partnering with some fintechs like Paystack, Safaricom and Cellulant. These partnerships have been pivotal to developing its in-house payments platform Pay1st, which allows customers to pay in their preferred way. “For global studios, this is the difference between making money and not,” Robbin-Coker added.

Demand for Carry1st has grown rapidly. Since its seed round last year, the company has signed seven games with well-known mobile gaming studios. They include Sweden’s Raketspel (the company has more than 120 million downloads across its portfolio), Cosi Games and Ethiopia’s Qene Games.

All these signups happened in 2020 and the catalyst for this growth has pandemic-induced lockdowns written all over it. The African mobile gaming market has always pointed toward a strong growth market, but being forced indoors surely skyrocketed mobile usage and gaming.

People who might not have previously needed a mobile phone have now come to rely on them to keep in touch with family and friends. For the average user using a smartphone for the first time, there’s a natural tendency to explore the fun things available on their device.

“Typically, the first things people do when they get their first smartphone is to chat with friends and play games. This is the same all over the world — Africa is no different. For that reason, we are seeing more and more mobile gamers across Africa,” remarked Robbin-Coker.

The company has also grown its team from 18 to 26 across 11 countries with recruits from Carlyle, King, Jumia, Rovio, Socialpoint, Ubisoft and Wargaming — a testament to the company’s global ambitions to be a top gaming publisher.

Expanding the team, which cuts across product, engineering and growth departments, is one way Carry1st will put the new investment to use. The company also plans to secure new partnerships with global gaming studios while launching and scaling its existing games like Carry1st Trivia and All-Star Soccer.

User playing a Carry1st game. Image Credits: Carry1st

With this investment, Carry1st has raised a total of $9.5 million. On the caliber of investors brought on, Robbin-Coker said their investment in the company would put them in a place to “delight millions of users across Africa and the globe.”

Carry1st is Konvoy Ventures first foray into the African gaming market (same can be said for Riot Games), and representatives from both teams (Konvoy managing partner Jackson Vaughan and Riot Games head of corporate development Brendan Mulligan) believe the company is unequivocally solving the continent’s distribution and gaming experience problems. Vaughan will also join the company’s board.

Africa’s gaming industry has lacked innovation in times past. While we’ve seen companies try to change the narrative, most have operated as studios. Carry1st is one of the few companies to operate a hybrid model, but the endgame for the company really is to be one of the region’s dominant consumer internet companies.

“We think social games and payments is the best first step to doing so, but we have very large ambitions. If we execute this, we will catalyze massive growth in the digital ecosystem across the region, creating tons of high-quality jobs in the process. We think all of the ingredients are in place — we want to be the catalyst,” Hoffman said.

Powered by WPeMatico