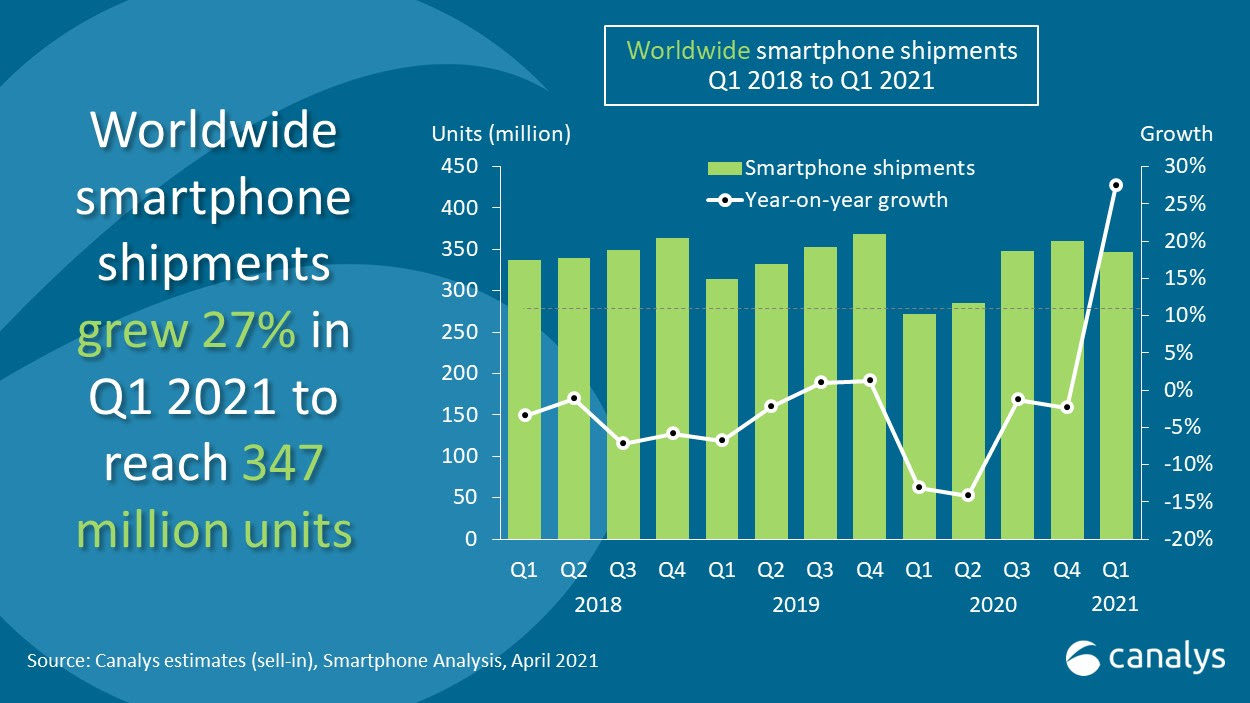

Gaming and streamed video have been two of the biggest pastime winners during the last year+ of pandemic living. Today a startup that has created an app that brings those two entertainment formats together is announcing a notable seed round of funding as it prepares to come out of closed beta.

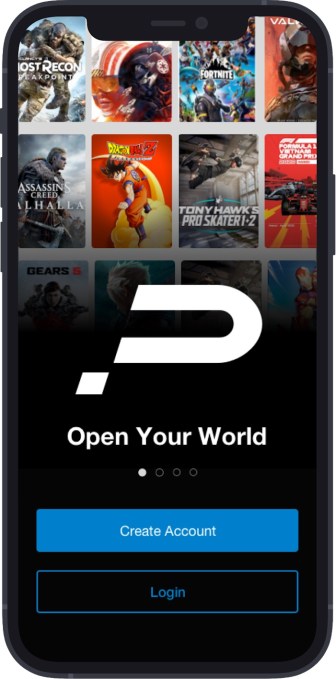

PortalOne, a hybrid gaming startup, is announcing a $15 million seed round of funding as it prepares to come out of closed beta with an app that lets people play on-demand games and also watch live shows in which users can play against a special guest.

The startup and its funding are notable in part because of who is doing the investing.

It includes Atari and camera maker ARRI, Founders Fund, TQ Ventures (the firm led by Scooter Braun and financiers Schuster Tanger and Andrew Marks), Coatue Management (specifically Arielle Zuckerberg), Rogue Capital Partners (Alice Lloyd George’s new fund), Signia Venture Partners (via Sunny Dhillon), Seedcamp, Talis Capital and SNÖ Ventures out of Europe.

Other investors included Kevin Lin, the co-founder of Twitch; Mike Morhaime, co-founder of Blizzard and Dreamhaven; Amy Morhaime, co-founder of Dreamhaven; Marc Merrill, co-founder of Riot Games; Xen Lategan, former CTO and executive advisor at various companies such as Hulu; and Eugene Wei, former head of Video at Oculus and head of Product at Hulu.

PortalOne is part tech startup and part media company. On the one hand, it has spent the last three years building a full stack of hardware and software that can be used to build games, record live shows and integrate the two into an experience that blends both on-demand and real-time gaming and entertainment.

“One of the benefits of building first is that what we are doing is extremely hard to do on a technical level,” said co-founder and CEO Bård Anders Kasin. “The way we do it is the key. It is our secret sauce.”

On the other, it is using that tech to create a gaming and live events platform and brand — providing a place for itself and third parties to build games and bigger live experiences around them. It believes that it’s managed to do something here that has eluded others for years.

“We come from the entertainment industry and have also been in games many years,” said Stig Olav Kasin, Bård’s brother and the other co-founder (and chief content officer). “We’ve talked to all the big companies and know that hybrid gaming combining games and TV is difficult,” not least because of the silos in companies where different groups “own” TV and gaming.

The Oslo-based company has so far been running a pared-down, early version of its service in the U.S. and Norway — two games so far, one called Blockbuster that, well, involves you throwing a massive ball and knocking over blocks, and another a reimagined version of Centipede — with corresponding talk shows set out of a living room that’s actually all computer-generated on a green screen.

Users can play and watch all this either through a VR headset or over a phone, and they win “prizes” for placing well in gaming competitions. Alongside that, PortalOne will sell virtual goods, much as companies like Fortnite do today.

The plan is to more widely launch the first iteration of its service — PortalOne Arcade, a selection of 80s-themed, old-school arcade games reimagined as multiplayer, immersive experiences combined with interactive talk shows — in the U.S. and Norway later this year before extending to other markets.

Bård Anders Kasin — who previously built a VR company and worked as a technical director at Warner Brothers, making movies such as “The Matrix” trilogy — and Stig Olav Kasin — who worked with his brother on VR and before that was a media exec on shows like “The Voice” and “Who Wants to Be a Millionaire?” — founded PortalOne back in 2018.

Between then and June 2020, when PortalOne launched its closed beta, the startup’s focus was on building out its technology and its content strategy and early partners.

From the sounds of it, it was no small task. Its tech stack incorporates virtual reality, computer vision, gaming technology and software and hardware to capture and stream video that drastically reduces the resources required for both, among other IP. Some of it PortalOne built itself; other areas it worked with Arri, a major player in motion picture camera equipment, which built a new kind of 3D camera for PortalOne.

Part of the challenge that PortalOne has been tackling has been the very process of creating content for a hybrid platform like the one it envisioned.

Typically, recording immersive experiences is complex and expensive because of the volumetric equipment that is used, the set-up of studios necessary to capture the experiences and more, which involve Hollywood movie studio size, staffing and costs.

PortalOne’s breakthrough has been to turn that process into something that can be produced more easily and at a much lower cost, necessary “since we have daily shows and we want to scale and mass produce more daily shows for each game,” said Bård.

In the PortalOne setup, in addition to the host — an affable Norwegian with a mostly American English accent called Markus Bailey — and his guest, there are only two other people involved, technician-producers triggering effects and controlling when the action switches from talk to game and back again.

From previously needing large sets and dozens of people, “now we can do all of this in a YouTube-sized studio,” said Bård.

On the content front, PortalOne is building its own games, but it is also tapping into an old-school gaming aesthetic, it said.

Atari is not only investing, but has inked a seven-year deal with PortalOne, giving the latter exclusive global distribution rights to some of its most popular arcade game franchises, which PortalOne is reimagining and rebuilding for its hybrid platform.

Bård said that the company wants to work with brands in music, sport, travel and education to build other games, too. (Braun’s reach here might not extend to Taylor Swift, but he’s pulled in Justin Bieber for the promo video, and possibly more.)

“Massive opportunities continue to emerge in the interactive entertainment space as distribution and business models evolve,” said Kirill Tasilov, a principal at Talis Capital, in a statement. “PortalOne is redefining mobile by unlocking new hybrid experiences at the intersection of games and video, and we are thrilled to be a part of their journey.”

Blurring the lines

In some ways, what PortalOne is doing is not completely new, since the lines between what is a game, what is interactive and what is linear entertainment have been getting blurred for decades.

You could argue that even game shows, one of the earliest TV formats, was an early stage in hybrid interactivity, although more modern programs like the ones that Stig helped build out, with interactive voting from at-home audiences using phones, definitely pushed the concept in new ways.

The coronavirus pandemic and the fact that so many in-person live events were cancelled, meanwhile, definitely paved the way for content players to think outside the box when it came to building new kinds of “live” shows. With Marshmello getting a huge response to his Fortnite “show” in 2019, the game saw 12 million people flock to its Travis Scott concert last year; and Roblox said in December its show with Lil Nas will pave the way for future events.

“When we see virtual concerts inside of TikTok, Roblox and Fortnite, it’s great but PortalOne offers an evolution of interactive metaverse entertainment — true real-time, one-to-many interaction between gamers around the world, all in a mobile-native hybrid game format,” said Dhillon, a partner at Signia Venture Partners.

Yet if well-established platforms really pick up on this trend, that’s an endorsement of what PortalOne has built. But they could also feasibly build their own live game shows, too, and blow PortalOne out of the water just as it’s dipping its toes in.

This is also where its time spent building tech could prove either to be a boost or a bust. Gaming is a notoriously tough one to call when it comes to resonating and taking off with audiences, and so too will presumably the experiences that are built around those games.

“The next big social platform will likely be a convergence of media with gaming at its core — a truly new immersive interactive experience — and PortalOne is a major contender for becoming such a platform,” said Kevin Lin.

Indeed, if PortalOne finds an audience for what it’s making, it will have the tools to serve them more content efficiently and and cheaply. But if it doesn’t strike the right note, the question will be how and if that tech will otherwise be used.

For investors right now, it’s more about the opportunity.

“As PortalOne continues to grow, it is seamlessly integrating the gaming and entertainment worlds to create a single interactive experience and endless opportunities for content creation,” said Braun. “Creators and performers alike want new and innovative ways to bring their craft to life, and PortalOne is meeting that demand in a way that no other business has done. I’m excited to work with the entire team to realize their trailblazing vision. I have never seen anything like this before.”

Delian Asparouhov, a principal at Founders Fund — in the news today for another reason, his role in bringing a lot of attention to Miami as a new tech hot spot — also thinks that the building of infrastructure and tech combined with the media element will give the startup a lot of runway.

“We back companies that we believe have strong potential to become global category leaders,” he said in a statement. “PortalOne creates a new category and simultaneously the platform that is clearly set to dominate that new category. The market is ripe, the opportunity is clear, and the potential is unlimited. PortalOne is poised to create a before and after in the industry.”

Powered by WPeMatico