If you’ve spent any time on TikTok lately, then you’ve probably seen a number of Popl’s ads. The startup has been successfully leveraging social media to get its modern-day business card alternative in front of a wider audience. Packaged as either a phone sticker, keychain or wristband, Popl uses NFC technology to make sharing contact information as easy as using Apple Pay. To date, Popl has sold somewhere over 700,000 units and has generated $2.7 million in sales for its digital business card technology.

Popl co-founder and CEO Jason Alvarez-Cohen, a UCLA grad with a background in computer science, first realized the potential for NFC business cards through a different use case — a device he encountered in someone’s home while attending a party. But it sparked the idea to use NFC technology for sharing information person-to-person, which would be faster than alternatives, like AirDrop or manual entry. And so, Popl was born.

Image Credits: Popl

Though startup history is littered with would-be “business card killers” that eventually died, what makes Popl different from early contenders is that it combines both an app with a physical product — the Popl accessory. This accessory can be purchased in a variety of form factors, including the popular Popl phone sticker that you can apply right to the back of your phone case (or even the top of your PopSocket), and customized with a photo of your choosing.

“I knew that, in the past, people would tap phones and share information like that. But I learned quickly that you can’t do this just phone-to-phone with pure software,” says Alvarez-Cohen. “So I [wondered to myself], what’s the closest way we can get the phone tapping? And that’s how I came up with this back-of-the-phone product.”

Each Popl accessory is actually an NFC tag which enables the handoff of the user’s contact information. When the phones are close, the recipient will get a notification that alerts them to your shared Popl data.

There are, of course, other ways to quickly exchange contact information. You can easily enter in someone’s digits into your phone’s contacts app directly, for example, which may work better for more casual encounters — like meeting someone at a bar. But Popl lets you share a full business cards’ worth of contact data with just a tap, which makes it better for professional encounters, or any other time you want to share more than just your phone number.

While the Popl tags make for a nice gimmick, the Popl mobile app is what makes the overall service useful. And to be clear, the app is only necessary for the Popl’s owner — the recipient doesn’t need the app installed for Popl to work. They will, however, need to have a phone that can read NFC tags, which can leave out some older devices. Or, as a backup, they’ll need the ability to scan the QR code the app provides as a workaround.

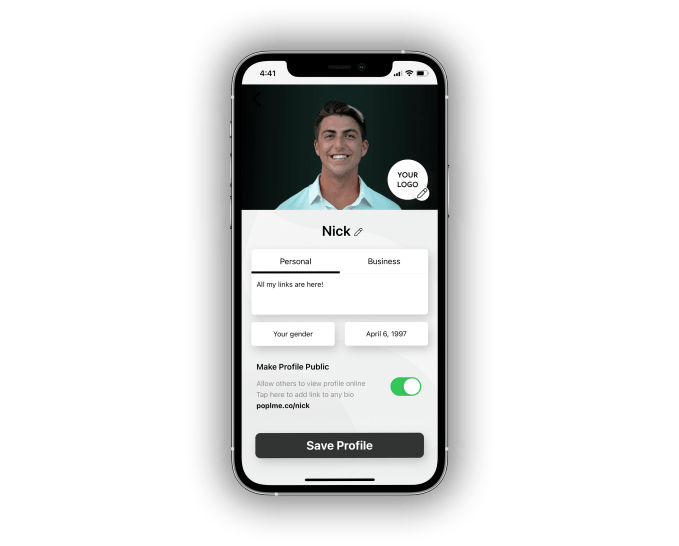

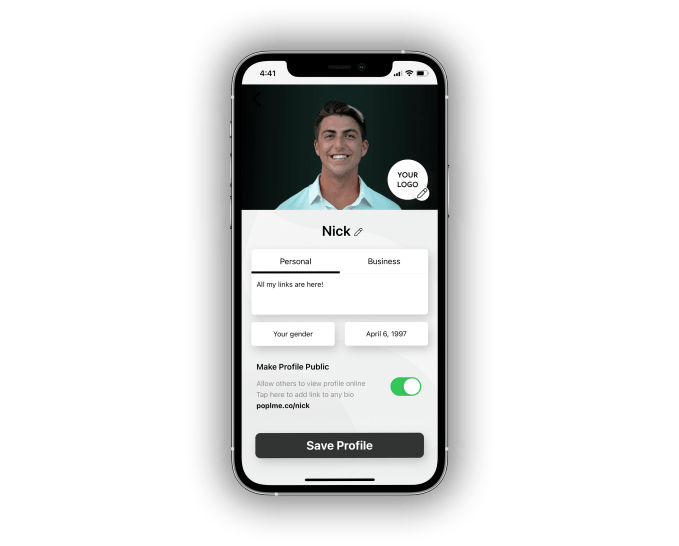

Image Credits: Popl

In the Popl app, you can customize which data you want to share with others — including your contact info, social profiles, website links, etc. — all via an easy-to-use interface. Like some business card apps in the past, you can flip between a personal profile and a business profile in Popl in order to share the appropriate information when out networking. To actually make the exchange of contact information with another person, you simply hold up your phone to theirs and they’ll get a notification directing them to your Popl profile webpage. (The phones don’t have to physically touch or bump together, however. It’s more like Apple Pay, where they have to be near each other.)

From the Popl website, that’s shared via the notification that pops up, the recipient can tap on the various options to connect with the sender — for example, adding them on a social network like LinkedIn or Instagram, grabbing their phone number to send a quick text, or even downloading a full contact card to their phone’s address book, among other things.

Image Credits: Popl

The app’s more clever feature, however, is something Popl calls “Direct.”

This patented feature won’t send over the Popl website where the recipient then has to choose how they want to connect. Instead, it opens the destination app directly. For example, if you have LinkedIn Direct on, the recipient will be taken directly to your profile on LinkedIn when they tap the notification. Or if you put your Contact Card on Direct, it will just pop your address book entry onto the screen so the user can choose to save it to their phone.

For paid users, the app also lets you track your history of Popl connections on a map, so you can recall who you met, where and when, along with other analytics.

Image Credits: Popl

Work on Popl, which is co-founded by Alvarez-Cohen’s UCLA roommate, Nick Eischens, now Popl COO, began in late 2019. The startup then launched in February 2020 — just before the coronavirus lockdowns in the U.S. That could have been a disastrous time for a business designed to help people exchange information during in-person meetings when the world was now shifting to Zoom and remote work. But Alvarez-Cohen says they marketed Popl as a “contactless solution.”

“If I have this, and I have to meet someone for my business, I don’t even have to tap it — you can just hover, and it will still send that information,” Alvarez-Cohen says. “So I’m able to share my business card with you without handing you a business card, which is safe.”

But what really helped to sell Popl were its video demos. One TikTok ad, which I’m sure you’ve seen if you use TikTok at all, features the co-founders’ friend Arev sharing her TikTok profile with a new friend just as she’s leaving the gym.

In the video, the recipient — clearly dumbfounded by the technology after she taps his phone — responds “what? what? Whoa! What? How’d you do that?!”

It’s now been viewed over 80 million times.

Today, Popl’s TikTok videos get high tens of thousands, hundreds of thousands and sometimes still millions of views per video. The company also has an active presence on other social media. For instance, Popl posts regularly to Instagram, where it has over 100,000 followers. Today, the startup’s growth is about 60% driven by Facebook and Instagram marketing and 40% organic, Alvarez-Cohen says.

Now, the company is preparing new products for the post-pandemic era when in-person events return. Though it had before sold Popl’s in bulk for this purpose, it’s now readying an “event bracelet” that just slips on your wrist (and is reusable). The bracelet could be used at any big event — like music festivals or business conferences, where you’re meeting a lot of new people. And because Popl uses NFC, phones have to be close to make the contact info exchange — it won’t just randomly share your info with everyone as you pass by them.

Popl is also fleshing out the business networking side of its app with integrations for Salesforce, Oracle, HubSpot and CSV export, that come with its Popl Pro subscription ($4.99 per month). The in-app subscription is already at $450,000-plus in annual recurring revenue and growing 10% every week, as of early April.

A Y Combinator Winter 2021 participant, Popl is backed by Twitch co-founder Justin Kan (via Goat Capital), YC, Urban Innovation Fund, Cathexis Ventures and others angels, including Wish.com CEO Peter Szulczewski and PlanGrid co-founder Ralph Gootee.

The app is available on iOS and Android, and the Popl accessories are sold on its website and on Target.com.

Update, 4/19/21, 6:45 PM ET: Post updated with a more current revenue figure after publication.

Powered by WPeMatico