School closures due to the pandemic have interrupted the learning processes of millions of kids, and without individual attention from teachers, reading skills in particular are taking a hit. Amira Learning aims to address this with an app that reads along with students, intelligently correcting errors in real time. Promising pilots and research mean the company is poised to go big as education changes, and it has raised $11 million to scale up with a new app and growing customer base.

In classrooms, a common exercise is to have students read aloud from a storybook or worksheet. The teacher listens carefully, stopping and correcting students on difficult words. This “guided reading” process is fundamental for both instruction and assessment: It not only helps the kids learn, but the teacher can break the class up into groups with similar reading levels so she can offer tailored lessons.

“Guided reading is needs-based, differentiated instruction and in COVID we couldn’t do it,” said Andrea Burkiett, director of Elementary Curriculum and Instruction at the Savannah-Chatham County Public School System. Breakout sessions are technically possible, “but when you’re talking about a kindergarten student who doesn’t even know how to use a mouse or touchpad, COVID basically made small groups nonexistent.”

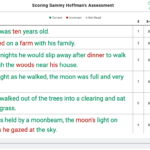

Amira replicates the guided reading process by analyzing the child’s speech as they read through a story and identifying things like mispronunciations, skipped words and other common stumbles. It’s based on research going back 20 years that has tested whether learners using such an automated system actually see any gains (and they did, though generally in a lab setting).

In fact I was speaking to Burkiett out of skepticism — “AI” products are thick on the ground and while it does little harm if one recommends you a recipe you don’t like, it’s a serious matter if a kid’s education is impacted. I wanted to be sure this wasn’t a random app hawking old research to lend itself credibility, and after talking with Burkiett and CEO Mark Angel I feel it’s quite the opposite and could actually be a valuable tool for educators. But it needed to convince educators first.

Not a replacement but a force multiplier

“You have to start by truly identifying the reason for wanting to employ a tech tool,” said Burkiett. “There are a lot of tech tools out there that are exciting, fun for kids, etc., but we could use all of them and not impact growth or learning at all because we didn’t stop and say, this tool helps me with this need.”

Amira was decided on as one that addresses the particular need in the K-5 range of steadily improving reading level through constant practice and feedback.

“When COVID hit, every tech tool came out of the woodwork and was made free and available,” Burkiett recalled. “With Amira you’re looking at a 1:1 tutor at their specific level. She’s not a replacement for a teacher — though it has been that way in COVID — but beyond COVID she could become a force multiplier,” said Burkiett.

You can see the old version of Amira in action below, though it’s been updated since:

Testing Amira with her own district’s students, Burkiett replicated the results that have been obtained in more controlled settings: As much as twice or three times as much progress in reading level based on standard assessment tools, some of which are built into the teacher-side Amira app.

Naturally it isn’t possible to simply attribute all this improvement to Amira — there are other variables in play. But it appears to help and doesn’t hinder, and the effect correlates with frequency of use. The exact mechanism isn’t as important as the fact that kids learn faster when they use the app versus when they don’t, and furthermore this allows teachers to better allocate resources and time. A kid who can’t use it as often because their family shares a single computer is at a disadvantage that has nothing to do with their aptitude — but this problem can be detected and accounted for by the teacher, unlike a simple “read at home” assignment.

“Outside COVID we would always have students struggling with reading, and we would have parents with the money and knowledge to support their student,” Burkiett explained. “But now we can take this tool and offer it to students regardless of mom and dad’s time, mom and dad’s ability to pay. We can now give that tutor session to every single student.”

“Radically suboptimal conditions”

This is familiar territory for CEO Mark Angel, though the AI aspect, he admits, is new.

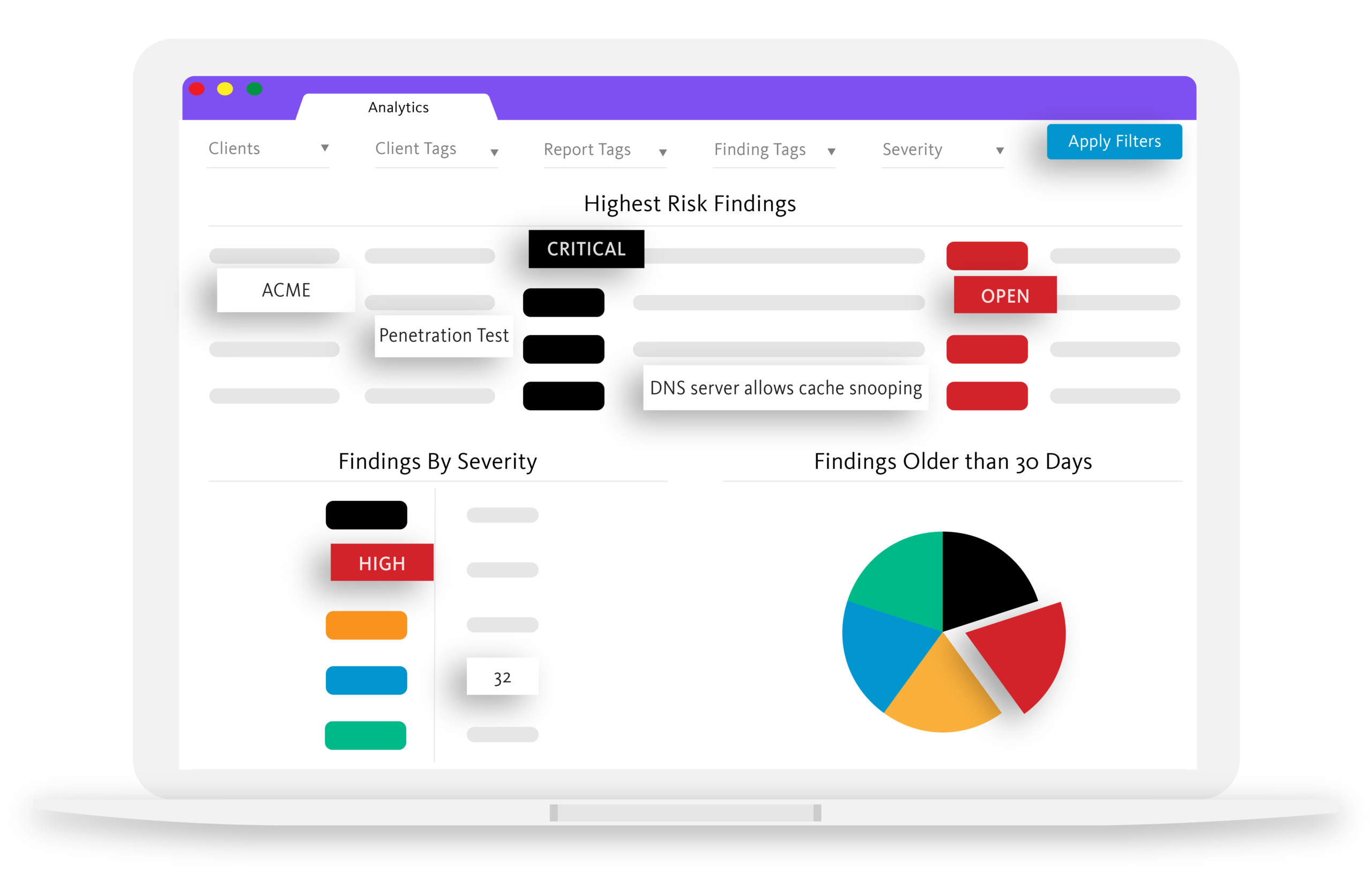

“A lot of the Amira team came from Renaissance Learning. bringing fairly conventional edtech software into elementary school classrooms at scale. The actual tech we used was very simple compared to Amira — the big challenge was trying to figure out how to make applications work with the teacher workflow, or make them friendly and resilient when 6-year-olds are your users,” he told me.

“Not to make it trite, but what we’ve learned is really just listen to teachers — they’re the superusers,” Angel continued. “And to design for radically sub-optimal conditions, like background noise, kids playing with the microphone, the myriad things that happen in real-life circumstances.”

Once they were confident in the ability of the app to reliably decode words, the system was given three fundamental tasks that fall under the broader umbrella of machine learning.

The first is telling the difference between a sentence being read correctly and incorrectly. This can be difficult due to the many normal differences between speakers. Singling out errors that matter, versus simply deviation from an imaginary norm (in speech recognition that is often, effectively, American English as spoken by white people) lets readers go at their own pace and in their own voice, with only actual issues like saying a silent k noted by the app.

On that note, considering the prevalence of English language learners with accents, I asked about the company’s performance and approach there. Angel said they and their research partners went to great lengths to make sure they had a representative dataset, and that the model only flags pronunciations that indicate a word was not read or understood correctly.

The second is knowing what action to take to correct an error. In the case of a silent k, it matters whether this is a first grader who is still learning spelling or a fourth grader who is proficient. And is this the first time they’ve made that mistake, or the tenth? Do they need an explanation of why the word is this way, or several examples of similar words? “It’s about helping a student at a moment in time,” Angel said, both in the moment of reading that word, and in the context of their current state as a learner.

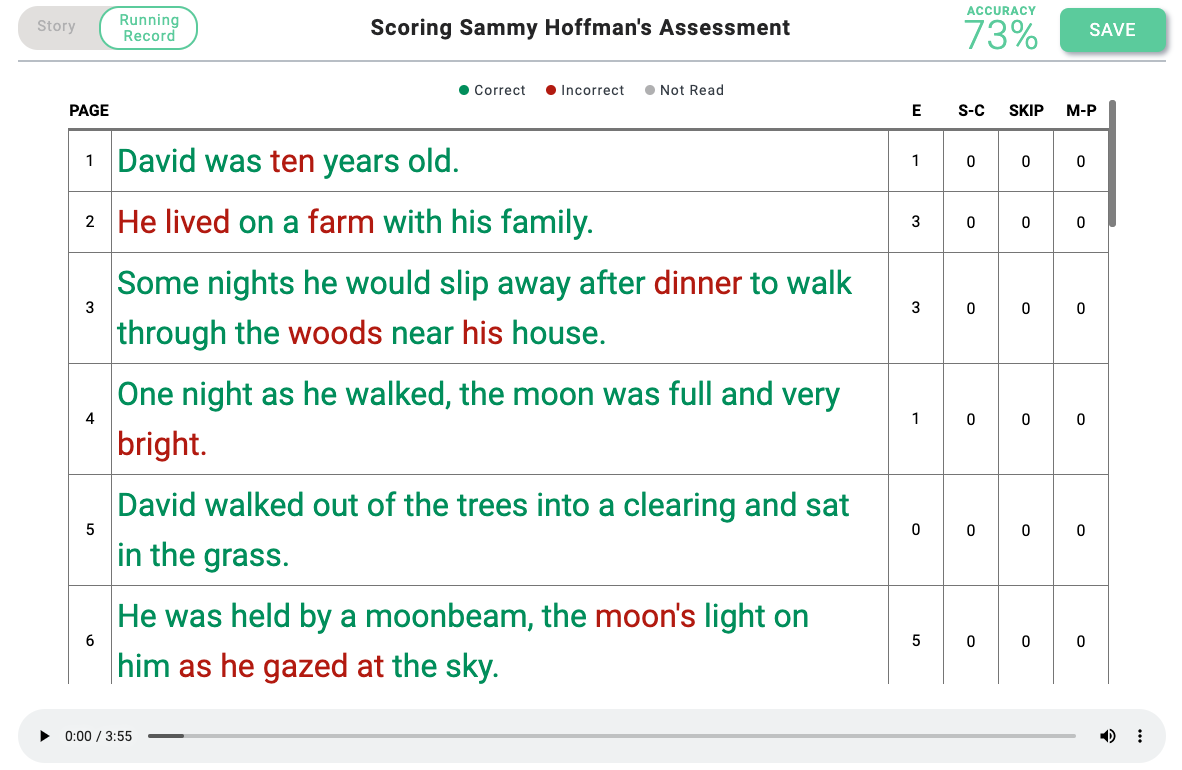

Third is a data-based triage system that warns students and parents if a kid may potentially have a language learning disorder like dyslexia. The patterns are there in how they read — and while a system like Amira can’t actually diagnose, it can flag kids who may be high risk to receive a more thorough screening. (A note on privacy: Angel assured me that all information is totally private and by default is considered to belong to the district. “You’d have to be insane to take advantage of it. We’d be out of business in a nanosecond.”)

The $11 million in funding comes at what could be a hockey-stick moment for Amira’s adoption. The round was led by Authentic Ventures II, LP, with participation from Vertical Ventures, Owl Ventures and Rethink Education.

“COVID was a gigantic spotlight on the problem that Amira was created to solve,” Angel said. “We’ve always struggled in this country to help our children become fluent readers. The data is quite scary — more than two-thirds of our fourth graders aren’t proficient readers, and those two-thirds aren’t equally distributed by income or race. It’s a decades-long struggle.”

Having basically given the product away for a year, the company is now looking at how to convert those users into customers. It seems like, just like the rest of society, “going back to normal” doesn’t necessarily mean going back to 2019 entirely. The lessons of the pandemic era are sticking.

“They don’t have the intention to just go back to the old ways,” Angel explained. “They’re searching for a new synthesis — how to incorporate tech, but do it in a classroom with kids elbow to elbow and interacting with teachers. So we’re focused on making Amira the norm in a post-COVID classroom.”

Part of that is making sure the app works with language learners at more levels and grades, so the team is working to expand its capabilities upward to include middle-school students as well as elementary. Another is building out the management side so that success at the classroom and district levels can be more easily understood.

The company is also launching a new app aimed at parents rather than teachers. “A year ago 100% of our usage was in the classroom, then three weeks later 100% of our usage was at home. We had to learn a lot about how to adapt. Out of that learning we’re shipping Amira and the Story Craft that helps parents work with their children.”

Hundreds of districts are on board provisionally — aided by a distribution partnership with Houghton Mifflin Harcourt, also an investor — but decisions are still being kicked down the road as they deal with outbreaks, frustrated parents and every other chaotic aspect of getting back to “normal.”

Perhaps a bit of celebrity juice may help tip the balance in their favor. A new partnership with Miami Dolphins (former Houston Texans) linebacker Brennan Scarlett has the NFL player advising the board and covering the cost of 100 students at a Portland, OR school through his education charity, the Big Yard Foundation — and more to come. It may be a drop in the bucket in the scheme of things, with a year of schooling disrupted, but teachers know that every drop counts.

Powered by WPeMatico