Box gets some financial ammunition against an activist investor, Samsung launches the Galaxy SmartTag+ and we look at the history of CryptoPunks. This is your Daily Crunch for April 8, 2021.

The big story: KKR invests $500M into Box

Private equity firm KKR is making an investment into Box that should help the cloud content management company buy back shares from activist investor Starboard Value, which might otherwise have claimed a majority of board seats and forced a sale.

After the investment, Aaron Levie will remain with Box as its CEO, but independent board member Bethany Mayer will become the chair, while KKR’s John Park is joining the board as well.

“The KKR move is probably the most important strategic move Box has made since it IPO’d,” said Alan Pelz-Sharpe of Deep Analysis. “KKR doesn’t just bring a lot of money to the deal, it gives Box the ability to shake off some naysayers and invest in further acquisitions.”

The tech giants

Samsung’s AirTags rival, the Galaxy SmartTag+, arrives to help you find lost items via AR — This is a version of Samsung’s lost-item finder that supports Bluetooth Low Energy and ultra-wideband technology.

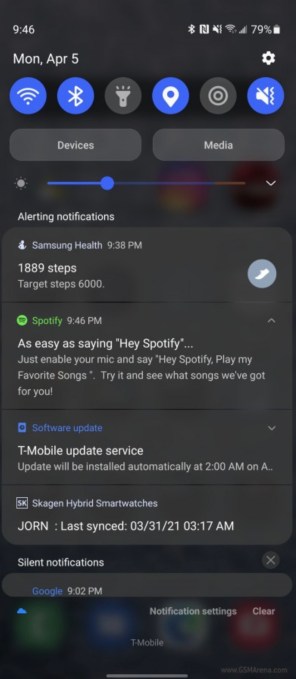

Spotify stays quiet about launch of its voice command ‘Hey Spotify’ on mobile — Access to the “Hey Spotify” voice feature is rolling out more broadly, but Spotify isn’t saying anything officially.

Verizon and Honda want to use 5G and edge computing to make driving safer — The two companies are piloting different safety scenarios at the University of Michigan’s Mcity, a test bed for connected and autonomous vehicles.

Startups, funding and venture capital

Norway’s Kolonial rebrands as Oda, bags $265M on a $900M valuation to grow its online grocery delivery business in Europe — Oda’s aim is to provide “a weekly shop” for prices that compete against those of traditional supermarkets.

Tines raises $26M Series B for its no-code security automation platform — Tines co-founders Eoin Hinchy and Thomas Kinsella were both in senior security roles at DocuSign before they left to start their own company in 2018.

Yext co-founder unveils Dynascore, which dynamically synchronizes music and video — This is the first product from Howard Lerman’s new startup Wonder Inventions.

Advice and analysis from Extra Crunch

Four strategies for getting attention from investors — MaC Venture Capital founder Marlon Nichols joined us at TechCrunch Early Stage to discuss his strategies for early-stage investing, and how those lessons can translate into a successful launch for budding entrepreneurs.

How to get into a startup accelerator — Neal Sáles-Griffin, managing director of Techstars Chicago, explains when and how to apply to a startup accelerator.

Understanding how fundraising terms can affect early-stage startups — Fenwick & West partner Dawn Belt breaks down some of the terms that trip up first-time entrepreneurs.

(Extra Crunch is our membership program, which helps founders and startup teams get ahead. You can sign up here.)

Everything else

The Cult of CryptoPunks — Ethereum’s “oldest NFT project” may not actually be the first, but it’s the wildest.

Biden proposes gun control reforms to go after ‘ghost guns’ and close loopholes — President Joe Biden has announced a new set of initiatives by which he hopes to curb the gun violence he described as “an epidemic” and “an international embarrassment.”

Apply to Startup Battlefield at TechCrunch Disrupt 2021 — All you need is a killer pitch, an MVP, nerves of steel and the drive and determination to take on all comers to claim the coveted Disrupt Cup.

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here.

Powered by WPeMatico