Most American retail banks are designed the same way: Customers must pass several desks set aside for loan and mortgage officers before they can talk to a customer representative.

I only step inside a bank a few times each year, but even pre-pandemic, I can’t remember the last time I saw someone sitting at one of those desks. Everyone I know who’s obtained a home or business loan in the recent past started with an online application process.

For this morning’s column, Alex Wilhelm interviewed Dave Girouard, CEO of Upstart, an AI-powered fintech lender that expects to see growth increase 114% this year.

A forecast like that suggests that retail banks have gotten comfortable with using automated tools to calculate risk, which may help explain all the empty desks at my local branch.

“If Upstart hits its 2021 numbers, we will be able to read into them broader adoption of AI among old-guard firms,” says Alex.

According to PitchBook, investors are also more bullish on AI: Q4 2020 saw record funding for AI and ML startups, and exit totals are increasing as well.

I wouldn’t mind adding a gently used desk to my home office; perhaps I should call my bank and see if they have one to spare.

Thanks very much for reading Extra Crunch. Have a great weekend!

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Full Extra Crunch articles are only available to members.

Use discount code ECFriday to save 20% off a one- or two-year subscription.

A crypto company’s journey to Data 3.0

Data is a gold mine for a company. If managed well, it provides the clarity and insights that lead to better decision-making at scale, in addition to an important tool to hold everyone accountable.

However, most companies are stuck in Data 1.0.

Dear Sophie: What type of visa should we get to fundraise in Silicon Valley?

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie:

A friend and I founded a tech startup last year. Like a lot of other startups, we’re looking for funding.

Should we come to Silicon Valley to meet with venture capitalists?

How should we begin that process? What type of visa should we get and how easy is it to get?

—Logical in Lagos

To solve all the small things, look to everyday Little AI

Image Credits: Yuichiro Chino / Getty Images

Why are developers still solving everyday pain points with manual, archaic processes, as opposed to employing “Little AI”?

There are millions of everyday use cases for AI, where technology is empowered to learn and decide on a course of action that offers the best outcome for consumers and companies alike.

How to recruit data scientists without paying top dollar

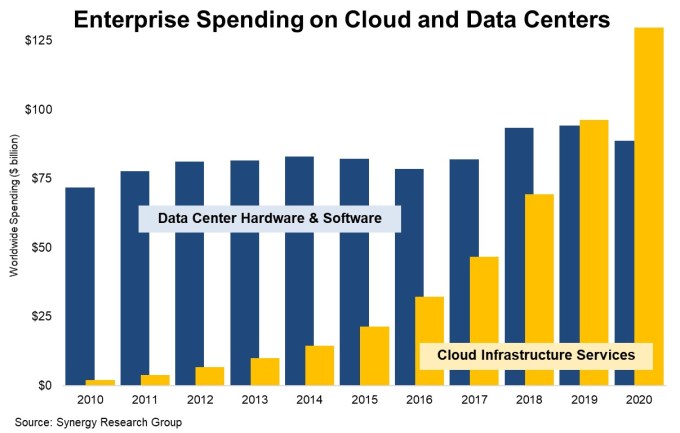

The increasing demand for AI and data science experts, driven in part by the pandemic’s economic impact, is showing no sign of abating.

Many employers are failing to identify viable job candidates, much less interviewing or hiring them. What’s holding them back?

Often, it’s a poorly drafted job posting.

3 steps to aid the transition to becoming a no-code company

Image Credits: Korrawin / Getty Images

No-code is changing how organizations build and maintain applications.

It democratizes application development by creating “citizen developers” who can quickly build out apps that meet their business-facing needs in real time, realigning IT and business objectives by bringing them closer together.

How can your company get ahead of the trend?

No taxation without innovation: The rise of tax startups

Image Credits: jokerpro / Getty Images

The idiosyncrasies of sales taxes are a burden on small- and medium-sized businesses, but a new legion of startups is emerging to help companies manage the intricacies of cross-jurisdictional taxes.

Snowflake gave up its dual-class shares: Should you?

Image Credits: VectorInspiration / Getty Images

Some founders and investors argue that these preferred shares protect them from the whims of the market, but the perspective isn’t universally accepted.

Dual-class shares are a controversial governance structure, and some wonder if they are setting up an unfair playing field by allowing a cabal to wield outsized power.

So why would Snowflake give up such a powerful tool?

MaaS transit: The business of mobility as a service

Image Credits: Bryce Durbin

As transit agencies seek to win back riders, a flurry of platforms — some backed by giants like Uber, Intel and BMW — are offering new technology partnerships.

Whether it’s bundling bookings, payments or just trip planning, startups are selling these mobility-as-a-service (MaaS) offerings as a lifeline to make transit agencies the backbone of urban mobility.

What eToro’s investor presentation and $10B valuation tells us about Robinhood

Israeli consumer stock-trading service eToro is going public in the United States via a SPAC. One thing that points to?

Trading platforms are being valued like high-margin video games.

The global inequity in venture backing is staggering

I knew African founders lacked the same access to capital as entrepreneurs based in Europe or the United States, but the numbers are far less favorable than I thought.

According to Dauda Barry, CEO of Adaplay Esports, African startups have raised $500 million so far in 2021. If that trend continues, he estimates that the region’s tech companies will exceed the $1.4 billion they raised in 2020.

For perspective: “Stripe raised more yesterday than Barry had reported for the entire African continent this year,” Alex Wilhelm noted in today’s column.

Digging deeper, he pulled numbers from Crunchbase and PitchBook to track VC activity in Africa over the last three months. Once he filtered private equity funding from nonequity investments, the numbers were “staggering.”

“I am surprised that more VCs aren’t investing in Africa,” says Alex. “It smells like investing arbitrage.”

Farmland could be the next big asset class modernized by marketplace startups

Companies that help farmers raise money for agricultural development projects are revolutionizing the way farm and forestland are acquired, developed and commercialized across the United States.

While private equity has gotten a lot of press for expanding the size of their farmland investments, those investments are still dwarfed by the size of the potential farm industry in the U.S., meaning there’s still plenty of opportunity for investors to provide additional capital.

The NFT market is just getting started, but where is it headed?

The crypto art craze might seem silly and expensive, but it could empower artists from emerging economies and underrepresented groups to access the global art market in ways that they couldn’t before.

Can it outlive the hype?

Olo raises IPO range as DigitalOcean sees possible $5B debut valuation

That Olo raised its IPO price is not a huge surprise, given the software company’s rapid growth and profits. In the case of DigitalOcean, we have more work to do as its approach to growth is a bit different.

Stripe’s epic new valuation and the value-capture gap between public and private markets

Stripe’s $600 million round values the payments and banking software company at $95 billion, near the top end of the valuation range at which the company was said to be raising funds back in November 2020.

Sadly, Stripe is still being coy with growth metrics. The Exchange digs in, no matter how vague.

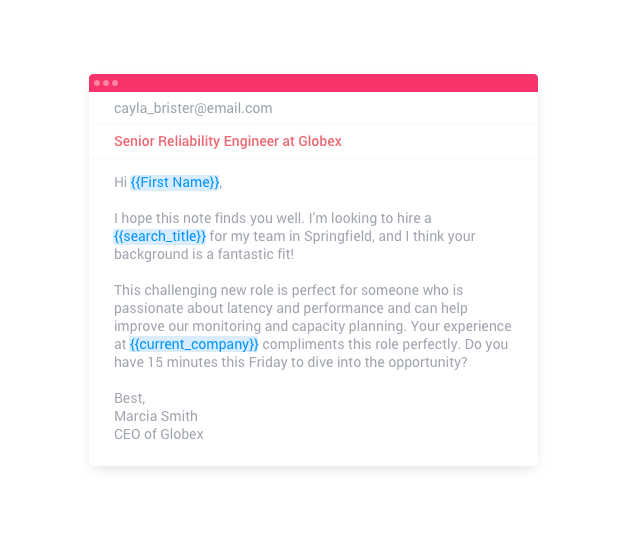

Julia Collins and Sarah Kunst outline how to build a fundraising process

Julia Collins, the first Black woman to co-found a venture-backed unicorn, and investor Sarah Kunst offer fundraising pointers on Extra Crunch Live.

Kunst says good design is critical, but:

If you’re not a graphic designer, then any incremental minute that you’re spending on trying to make your deck pretty is a waste of time. You need to be focusing on content. Hire somebody, pay them a tiny bit of money to be able to do a nice graphics pass on your deck, and it’s going to make it a lot easier for people to to get the information that you need them to know.

How nontechnical talent can break into deep tech

Image Credits: Getty Images

Startup hiring processes can be opaque, and breaking into the deep tech world as a nontechnical person seems daunting. This column offers tactical advice for finding, reaching out to, cultivating relationships with and working at deep tech companies as a nontechnical candidate.

Powered by WPeMatico