Ultra-precise cancer therapies! Human-like hair grown from plants! A way to potentially save the bees!

The spectrum of companies coming out of IndieBio has always been pretty wild, and its latest batch definitely doesn’t disappoint.

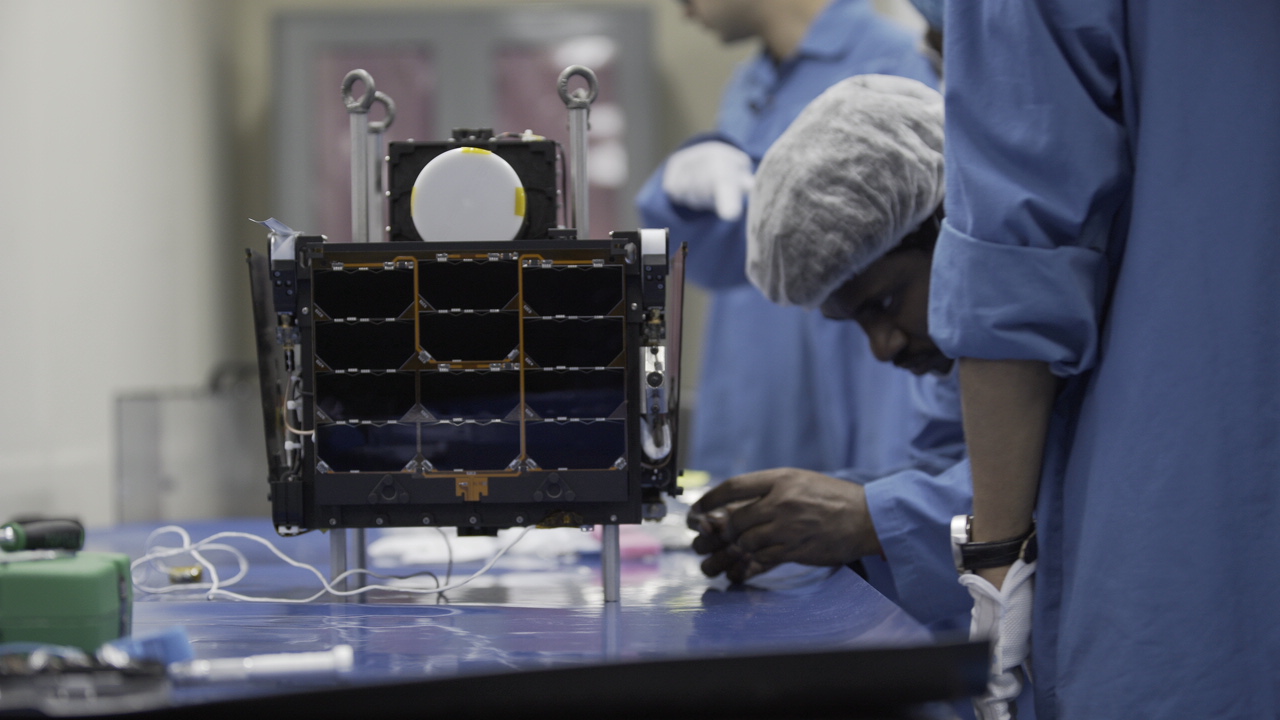

As the early-stage, biology-focused accelerator arm of SOSV, IndieBio gives the companies in its program $250,000+, mentorship and full access to a biology lab to bring their ideas to life.

When founder Arvind Gupta left the accelerator last year to join the venture capital fund Mayfield, Mayfield and IndieBio partnered to form the Genesis Consortium, which offers IndieBio companies an additional $250,000 in optional funding.

IndieBio initially operated solely out of San Francisco, with the accelerator expanding just last year to include a New York cohort that runs in parallel. The SF program is led by Managing Director Po Bronson, while the New York program is led by Managing Director Stephen Chambers.

With its Demo Day still a ways out, IndieBio gave us a peek at the teams currently going through the program. It’s worth noting that IndieBio deliberately invests very early — in many cases, even before it’s entirely clear whether or not the scientific concepts behind a company are fully feasible. “Our program is our diligence,” Bronson tells me. The goal is to prove out concepts — and figure out how to turn them into big businesses — for hundreds of thousands of dollars, rather than millions. “We’re biting off the risk, and de-risking it for the next investors in line.”

Here are the companies currently in each program, alphabetically:

New York

Beemmunity: Humans need bees in order to survive, but bee populations are plummeting, with one of the main causes believed to be exposure to neurotoxic pesticides. Pitched as “pesticide protection for bees,” Beemmunity is working on a “micro-sponge” that, after being ingested by a bee, captures these neurotoxins and eliminates them as waste. Expected to enter field trials soon.

Brickbuilt Therapeutics: A biotherapeutic lozenge meant to help prevent and treat things like gum disease and thrush.

Bucha Leather Synthetic, animal-free leather grown from bacterial nanocellulose. Their process allows them to make “massive mats” of material that can be produced in weeks.

Free to Feed: If an infant proves allergic to something in their mother’s breastmilk, determining exactly what they’re allergic to can be a long and incredibly frustrating process. Free to Feed is developing test strips that identify different food proteins in breast milk, helping breastfeeding mothers better determine what proteins are leading to an allergic reaction.

Gypsy Basin Genomics: Developing a test, simple enough to be administered as a gargle-and-a-spit during a dentist visit, that can detect at an early stage the oral cancers caused by HPV.

Harmony Baby Nutrition: Pitched as “the only dairy-free, allergy-free, and environmentally friendly baby formula,” Harmony is producing infant formulas that “closely mirror human breast milk.”

MicroTERRA: Using duckweed water lentils to convert fish-farm wastewater into protein. The duckweed helps to purify the fish waste water as it grows; once grown, this “lemna protein concentrate” can be used as a source of protein in animal feed.

Nyoka Design Labs: Non-toxic, biodegradable and recyclable glowsticks powered by bioluminescence.

Sequential Skin: Wipe your face with their skin test kit, send it to their lab, and get a full report on the products that should work well with your skin’s microbiome.

Stembionix: With personal stem cell banking in mind, Stembionix is developing a “mailable bioreactor system” that would allow for the transporting of stem cells without the freezing/thawing that complicates things and can negatively impact viability.

San Francisco

Aja Labs: Pitched as the “beyond meat of hair extensions,” Aja Labs wants to use plants to grow fibers that look and feel like human hair, potentially eliminating the need for chemical-heavy synthetics or human hair in the production of hair extensions.

Avalo.ai: Using interpretable machine learning to identify genes (and what said genes do) in plants at a much faster pace to help develop better crops.

California Cultured: Lab-grown cocoa. The company says it can grow cocoa that is less bitter, and as such requires far less sugar to be tasty.

Canaery: Aiming to “do for scent what machine vision has done for sight,” Canaery is building a neural interface for analyzing an object’s “scent fingerprint” to identify dangerous compounds at places like ports and inspection points without (or in addition to) x-rays or cameras.

Capra Biosciences: Finding ways to turn the otherwise detrimental biofilms that can develop during fermentation into products like motor oil or retinol for cosmetics.

Lypid: Developing vegan oils that behave like animal fats, melting at the same temperature and providing the same mouthfeel, to further improve plant-based meats.

OncoPrecision: Building a faster way to help oncologists determine which cancer drugs (of hundreds) will work best for a patient by applying drugs to patient-derived cells, with the goal of finding the best drug within 7-14 days.

Ozone Bio: Using dead cell fermentation (or “Zombiezymes”) to produce nylon in a greener way.

Panacea Longevity: Aiming to replicate the health benefits of fasting… without fasting. Identifying dietary compounds that can “mimic the body’s natural response to fasting” and develop them into a supplement.

Prolific Machines: High-resolution control of cell differentiation. In lab-grown meat, for example, one could use their tech to determine what bits of a steak are muscle tissue, fat, etc.

Proteinea: Using fly larva to grow “pharma-grade proteins” for use in medicine cheaper and more quickly.

Sundial Foods: Bringing “skin” to plant-based chicken, beginning with a coating that will allow for plant-based chicken wings.

Vertical Oceans: Taking the concept of vertical farming and applying it to seafood, Vertical Oceans is working on efficient, low-waste, stackable towers to make the production of shrimp more sustainable.

Powered by WPeMatico