When Okta announced that it was acquiring Auth0 yesterday for $6.5 billion, the deal raised eyebrows. After all, it’s a substantial amount of money for one identity and access management (IAM) company to pay to buy another, similar entity. But the deal ultimately brings together two companies that come at identity from different sides of the market — and as such could be the beginning of a beautiful identity friendship.

The deal ultimately brings together two companies that come at identity from different sides of the market — and as such could be the beginning of a beautiful identity friendship.

On a simple level, Okta delivers identity and access management (IAM) to companies who use the service to provide single-sign-on access for employees to a variety of cloud services — think Gmail, Salesforce, Slack and Workday.

Meanwhile, Auth0 is a developer tool providing coders with easy API access to single-sign-on functionality. With just a couple of lines of code, the developer can deliver IAM tooling without having to build it themselves. It’s a similar value proposition to what Twilio offers for communications or Stripe for payments.

The thing about IAM is that it’s not exciting, but it is essential. That could explain why such a large number of dollars are exchanging hands. As Auth0 co-founder and CEO Eugenio Pace told TechCrunch’s Zack Whittacker in 2019, “Nobody cares about authentication, but everybody needs it.”

Putting the two companies together generates a fairly comprehensive approach to IAM covering back end to front end. We’re going to look at why this deal matters from an identity market perspective, and if it was worth the substantial price Okta paid to get Auth0.

Halt! Who goes there?

When you think about identity and access management, it’s about making sure you are who you say you are, and that you have the right to enter and access a set of applications. That’s why it’s a key part of any company’s security strategy.

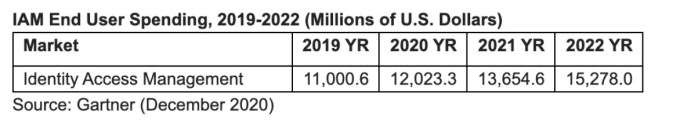

Gartner found that IAM was a $12 billion business last year with projected growth to over $13.5 billion in 2021. To give you a sense of where Okta and Auth0 fit, Okta just closed FY2021 with over $800 million in revenue. Meanwhile Auth0 is projected to close this year with $200 million in annual recurring revenue.

Image Credits: Gartner

Among the top players in this market according to Gartner’s November 2020 Magic Quadrant market analysis are Ping Identity, Microsoft and Okta in that order. Meanwhile Gartner listed Auth0 as a key challenger in their market grid.

Michael Kelly, a Gartner analyst, told TechCrunch that Okta and Auth0 are both gaining something from the deal.

“For Okta, while they have a very good product, they have marketing muscle and adoption rates that are not available to smaller vendors like Auth0. When having [IAM] conversations with clients, Okta is almost always on the short list. Auth0 will immediately benefit from being associated with the larger Okta brand, and Okta will likewise now have credibility in the deals that involve a heavy developer focused buyer,” Kelly told me.

Okta co-founder and CEO Todd McKinnon said he was enthusiastic about the deal precisely because of the complementary nature of the two companies’ approaches to identity. “How a developer interacts with the service, and the flexibility they need is different from how the CIO wants to work with [identity]. So by giving customers this choice and support, it’s really compelling,” McKinnon explained.

Powered by WPeMatico