This holiday season the next generation of gamers, bless their hearts, will be hoping to receive the next generation of gaming consoles. But confusing branding by the console makers — not to mention a major shortage of consoles — could lead to disappointment during the unwrapping process. Before making any big promises this year, you’ll want to be completely clear on two things: which console you’re actually trying to get, and how much of a challenge it might be to get one.

By the way, it’s totally understandable if you’re a little lost — particularly on Microsoft’s end, the branding is a little weird this time around. Even the lifelong gamers on our staff have mixed up the various Xbox names a few times.

If you’re not 100% sure which brand of console your kid (or partner or whoever) has, go take a look right now. An Xbox will have a big X somewhere on a side without cables coming out of it, and a PS4 will have a subtler “PS” symbol embossed on it. The “Pro” has three “layers” and the regular one has two.

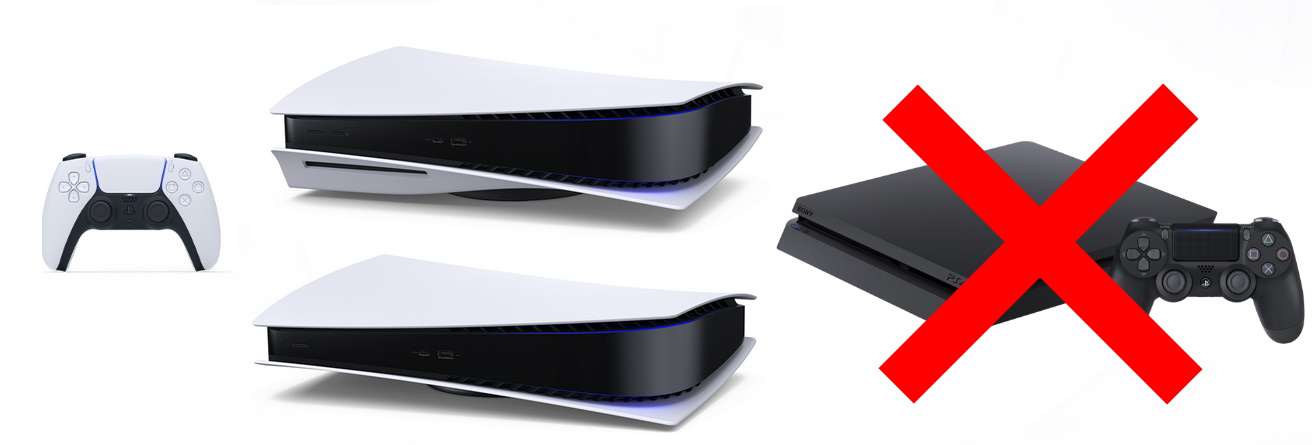

Okay, now that you know what you’ve got, here are the new versions that they want:

Sony PlayStation 5

The PlayStation 5, or PS5 for short, is the newest gaming console from Sony. It’s the one your kids want if they already have a PlayStation 4 or even a PlayStation 4 Pro, which they might have gotten a year or two back.

The PS5 is more powerful than the PS4, but it also plays most PS4 games, so you don’t need to worry about a game you just bought for a birthday or whatever. It has some fancy new features for fancy new TVs, but you don’t need to worry about that — the improved performance is the main draw.

There are two versions of the PS5, and the only real difference between them is that one has a disc drive for playing disc-based games; they both come with a controller and are about the same size. The one with the drive costs $500 and is the one you should choose if you’re not completely certain the recipient would prefer the driveless “Digital Edition.” Saving $100 up front is enticing, but consider that some titles for this generation will cost $70, so the capability to buy used games at half-price might pay for itself pretty quickly.

The PS5 doesn’t come with any “real” next-generation games, and the selection this season is going to be pretty slim. But your best bet for pretty much any gamer is Spider-Man: Miles Morales. I’ve played it and its predecessor — which Miles Morales comes with — and it’s going to be the one everyone wants right off the bat. (Its violence is pretty PG, like the movies.)

The PS4’s controllers sadly won’t work on PS5 games. But don’t worry about getting any extra ones or charging stands or whatnot right now, unless your gamer plays a lot of games with other people on the couch already.

Microsoft Xbox Series X

The Xbox Series X is the latest gaming console from Microsoft, replacing the Xbox One X and One S. Yes, the practice of changing the middle word instead of the last initial is difficult to understand, and it will be the reason lots of kids unwrap last year’s new console instead of this year’s.

The Xbox Series X is more powerful than the Xbox One X, but should also play almost all the old games, so if you bought something recently, don’t worry that it won’t be compatible. There are lots of fancy-sounding new features, but you don’t need to worry about those or buy them separately — stuff like HDR and 4K all depend on your TV, but any TV from the last few years will look great.

There are two versions of the next Xbox, and they have significant differences. The $500 Xbox Series X is the “real” version, with a disc drive for old and used games, and all the power-ups Microsoft has advertised. This one is almost certainly the one any gamer will be expecting and hoping to get.

Like Sony, Microsoft has a version of the Xbox that has no disc drive: the $300 Xbox Series S. Confusingly, this is the same price, same color, and nearly the same name and type of console as last generation’s Xbox One S, so first of all be sure you’re not buying the One. The Xbox Series S is definitely “next-gen,” but has a bit less power than the Series X, and so will have a few compromises in addition to the lack of a drive. It’s not recommended you get this one unless you know what you’re doing or really need that $200 (understandable).

For a day-one game, there isn’t really a big must-have exclusive. Assassin’s Creed: Valhalla is probably a good bet, though, if bloody violence is okay. If not, honestly a gift certificate or subscription to the “Game Pass” service that provides free games is fine.

No need for extra controllers — the Xbox Series X supports the last-gen’s controllers. Genuine thanks to Microsoft for that one.

Difficulty level: Holiday 2020

Now that you know which console to get (again … a PlayStation 5 or an Xbox Series X), I’ve got some bad news and some good news.

The bad news is they’re probably (read: definitely) going to be sold out. Microsoft and Sony are pumping these things out as fast as they can, but the truth is they really rushed this launch to make it in time for the holidays and won’t have enough to go around.

Resist the urge to buy the “next best” in last year’s model — the new ones are a major change and are replacements, not just upgrades, for the old ones. It would literally be better for a kid to receive a pre-order receipt for a new console than a brand new old one. And don’t go wild trying to find one on eBay or whatever — this is going to be a very scammy season and it’s better to avoid that scene entirely.

The pandemic also means you probably can’t or won’t want to wait in line all night to grab a unit in person. Getting a console will almost certainly involve spending a good amount of time on the websites of the major retailers … and a good bit of luck. Follow electronics and gaming shops on Twitter and bookmark the consoles’ pages to check for availability regularly, but expect each shipment to be sold out within a minute or two and for the retailer’s website to crash every single time.

Don’t buy them a Nintendo Switch, either, unless they’ve asked for one of course. The Switch is fantastic, but it’s completely different from the consoles above.

The good news is they won’t be missing out on much right now. Almost every game worth having for the next year will be available on the new and old consoles, and in some cases players may be able to start their game on one and continue it on the next. Good luck figuring out exactly which games will be enhanced, upgraded or otherwise carried between generations (it’s a patchwork mess), but any of the hot new games is a good bet.

Good luck!

Powered by WPeMatico