If you miss hanging out with your co-workers but don’t want to spend a single second more on Zoom, the latest product from Donut might be the answer.

The startup is launching its new Watercooler product today while also announcing that it has raised $12 million in total funding, led by Accel and with participation from Bloomberg Beta, FirstMark, Slack Fund and various angel investors.

Co-founder and CEO Dan Manian told me that this is actually money that the startup raised before the pandemic, across multiple rounds. It just didn’t announce the fundraising until now.

The startup’s vision, Manian said, is “to create human connection between people at work.” Its first product, Intros, connects via Slack teammates who didn’t already know each other, often with the goal of setting up quick coffee meetings (originally in-person and now virtual).

Donut says it has facilitated 4 million connections across 12,000 companies (including The New York Times, Toyota and InVision), with 1 million of those connections made since the beginning of the pandemic.

However, Manian said customers have been asking Donut to facilitate more frequent interactions, especially since most people aren’t going to have these coffee meetings every day. At the same time, people face the dueling issues of isolation and Zoom fatigue, where “the antidote to one thing makes the other pain worse.” And he suggested that one of the hardest things to recreate while so many of us are working remotely are “all the little microinteractions that you have while you’re working.”

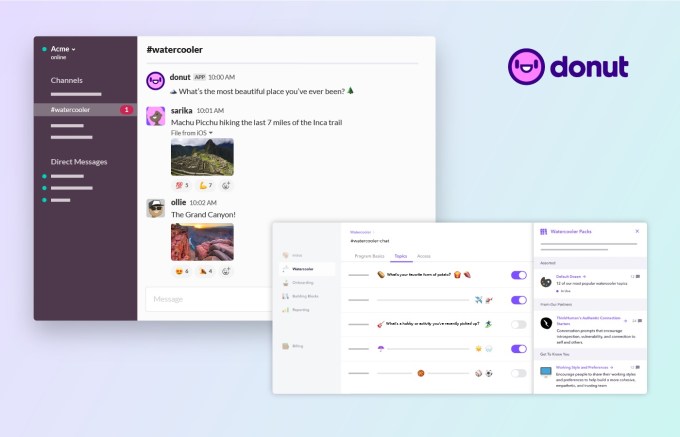

That’s where Watercooler comes in — as the name suggests, it’s designed to replicate the feeling of hanging out at the office watercooler, having brief, low-key conversations. Like Intros, it integrates with Slack, creating a new channel where Watercooler will post fun, conversation-starting questions like “‘What’s your favorite form of potato?” or “What’s one thing you’ve learned in your career that you wish you knew sooner?”

Talking about these topics shouldn’t take much time, but Manian argued that brief conversations are important: “Those things add up to friendship over time, they’re what actually transform you from co-worker to friend.” And those friendships are important for employers too, because they help with team cohesion and retention.

I fully endorse the idea of a Slack watercooler — in fact, the TechCrunch editorial team has a very active “watercooler” channel and I’m always happy to waste time there. My big question was: Why do companies need to purchase a product for this?

Donut Watercooler. Image Credits: Donut

Manian said that there were “a bunch of our early adopters” who had tried doing this manually, but it was always in the “past tense”: “It got too hard to come up with the questions, or it took real work coming up with them, whoever was doing it already had a it full time job.”

With Watercooler, on the other hand, the company can choose from pre-selected topics and questions, set the frequency with which those questions are posted and then everything happens automatically.

Manian also noted that different organizations will focus on different types of questions. There are no divisive political questions included, but while some teams will stick to easy questions about things like potatoes and breakfast foods, others will get into more substantive topics like the ways that people prefer to receive feedback.

And yes, Manian thinks companies will still need these tools after the pandemic is over.

“Work has fundamentally changed,” he said. “I don’t think we’ll put remote work back in the bottle. I think it’s here to stay.”

At the same time, he described the past few months as “training wheels” for a hybrid model, where some team members go back to the office while others continue working remotely. In his view, teams will face an even bigger challenge then: To keep their remote members feeling like they’re connected and in-the-loop.

Powered by WPeMatico