In an overcrowded market of online fashion brands, consumers are spoilt for choice on what site to visit. They are generally forced to visit each brand one by one, manually filtering down to what they like. Most of the experience is not that great, and past purchase history and cookies aren’t much to go on to tailor user experience. If someone has bought an army-green military jacket, the e-commerce site is on a hiding to nothing if all it suggests is more army-green military jackets…

Instead, Psycke (it’s brand name is “PSYKHE”) is an e-commerce startup that uses AI and psychology to make product recommendations based both on the user’s personality profile and the ‘personality” of the products. Admittedly, a number of startups have come and gone claiming this, but it claims to have taken a unique approach to make the process of buying fashion easier by acting as an aggregator that pulls products from all leading fashion retailers. Each user sees a different storefront that, says the company, becomes increasingly personalized.

It has now raised $1.7 million in seed funding from a range of investors and is announcing new plans to scale its technology to other consumer verticals in the future in the B2B space.

The investors are Carmen Busquets, the largest founding investor in Net-a-Porter; SLS Journey, the new investment arm of the MadaLuxe Group, the North American distributor of luxury fashion; John Skipper, DAZN chairman and former co-chairman of Disney Media Networks and president of ESPN; and Lara Vanjak, chief operating officer at Aser Ventures, formerly at MP & Silva and FC Inter-Milan.

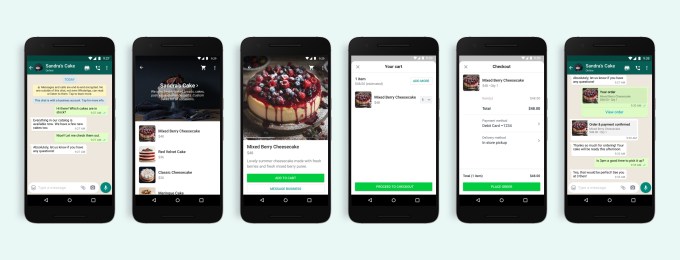

So what does it do? As a B2C aggregator, it pools inventory from leading retailers. The platform then applies machine learning and personality-trait science, and tailors product recommendations to users based on a personality test taken on sign-up. The company says it has international patents pending and has secured affiliate partnerships with leading retailers that include Moda Operandi, MyTheresa, LVMH’s platform 24S and 11 Honoré.

The business model is based around an affiliate partnership model, where it makes between 5-25% of each sale. It also plans to expand into B2B for other consumer verticals in the future, providing a plug-in product that allows users to sort items by their personality.

How does this personality test help? Well, Psykhe has assigned an overall psychological profile to the actual products themselves: over 1 million products from commerce partners, using machine learning (based on training data).

So for example, if a leather boot had metal studs on it (thus looking more “rebellious”), it would get a moderate-low rating on the trait of “Agreeableness”. A pink floral dress would get a higher score on that trait. A conservative tweed blazer would get a lower score tag on the trait of “Openness”, as tweed blazers tend to indicate a more conservative style and thus nature.

So far, Psykhe’s retail partnerships include Moda Operandi, MyTheresa, LVMH’s platform 24S, Outdoor Voices, Jimmy Choo, Coach and size-inclusive platform 11 Honoré.

Its competitors include The Yes and Lyst. However, Psykhe’s main point of differentiation is this personality scoring. Furthermore, The Yes is app-only, U.S.-only, and only partners with monobrands, while Lyst is an aggregator with 1,000s of brands, but used as more of a search platform.

Psykhe is in a good position to take advantage of the ongoing effects of COVID-19, which continue to give a major boost to global e-commerce as people flood online amid lockdowns.

The startup is the brainchild of Anabel Maldonado, CEO & founder, (along with founding team CTO Will Palmer and lead Data Scientist, Rene-Jean Corneille, pictured above), who studied psychology in her hometown of Toronto, but ended up working at the U.K.’s NHS in a specialist team that made developmental diagnoses for children under 5.

She made a pivot into fashion after winning a competition for an editorial mentorship at British Marie Claire. She later went to the press department of Christian Louboutin, followed by internships at the Mail on Sunday and Marie Claire, then spending several years in magazine publishing before moving into e-commerce at CoutureLab. Going freelance, she worked with a number of luxury brands and platforms as an editorial consultant. As a fashion journalist, she’s contributed industry op-eds to publications such as The Business of Fashion, T: The New York Times Style Magazine and Marie Claire.

As part of the fashion industry for 10 years, she says she became frustrated with the narratives which “made fashion seem more frivolous than it really is. “I thought, this is a trillion-dollar industry, we all have such emotional, visceral reactions to an aesthetic based on who we are, but all we keep talking about is the ‘hot new color for fall and so-called blanket ‘must-haves’.”

But, she says, “there was no inquiry into individual differences. This world was really missing the level of depth it deserved, and I sought to demonstrate that we’re all sensitive to aesthetic in one way or another and that our clothing choices have a great psychological pay-off effect on us, based on our unique internal needs.” So she set about creating a startup to address this “fashion psychology” – or, as she says “why we wear what we wear”.

Powered by WPeMatico