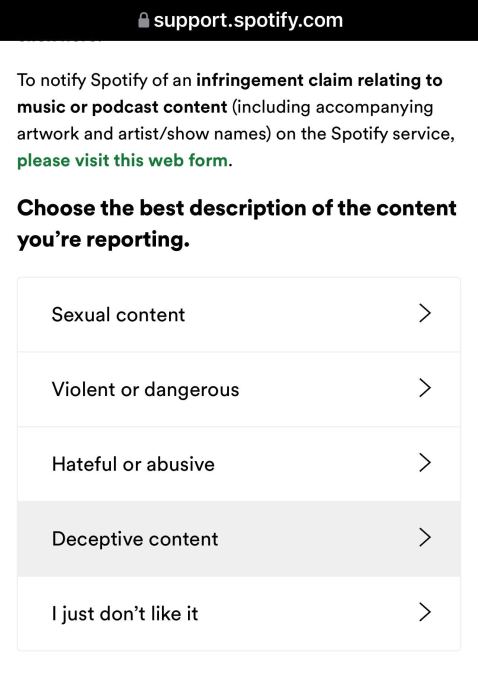

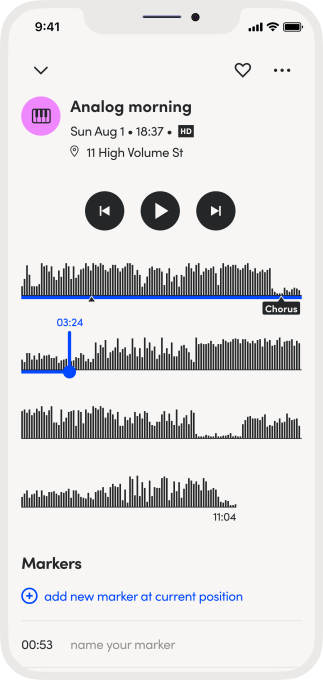

Dispo, the photo-sharing app that emulates disposable cameras, started rolling out a test yesterday that will record user interest in selling photos as NFTs. Some users will now see a sell button on their photos, and when they tap it, they can sign up to be notified when the ability to sell Dispo photos launches.

CEO and co-founder Daniel Liss told TechCrunch that Dispo is still deciding how it will incorporate NFT sales into the app, which is why the platform is piloting a test with its users. Dispo doesn’t know yet what blockchain it would use, if it would partner with an NFT marketplace or what cut of sales Dispo would take.

“I think it’s safe to say from the test that there will be an experience native to the Dispo app,” Liss said. “There are a number of ways it could look — there could be a native experience within Dispo that then connects through an API to another platform, and in turn, they’re our partner, but to the community, it would look native to the Dispo app.”

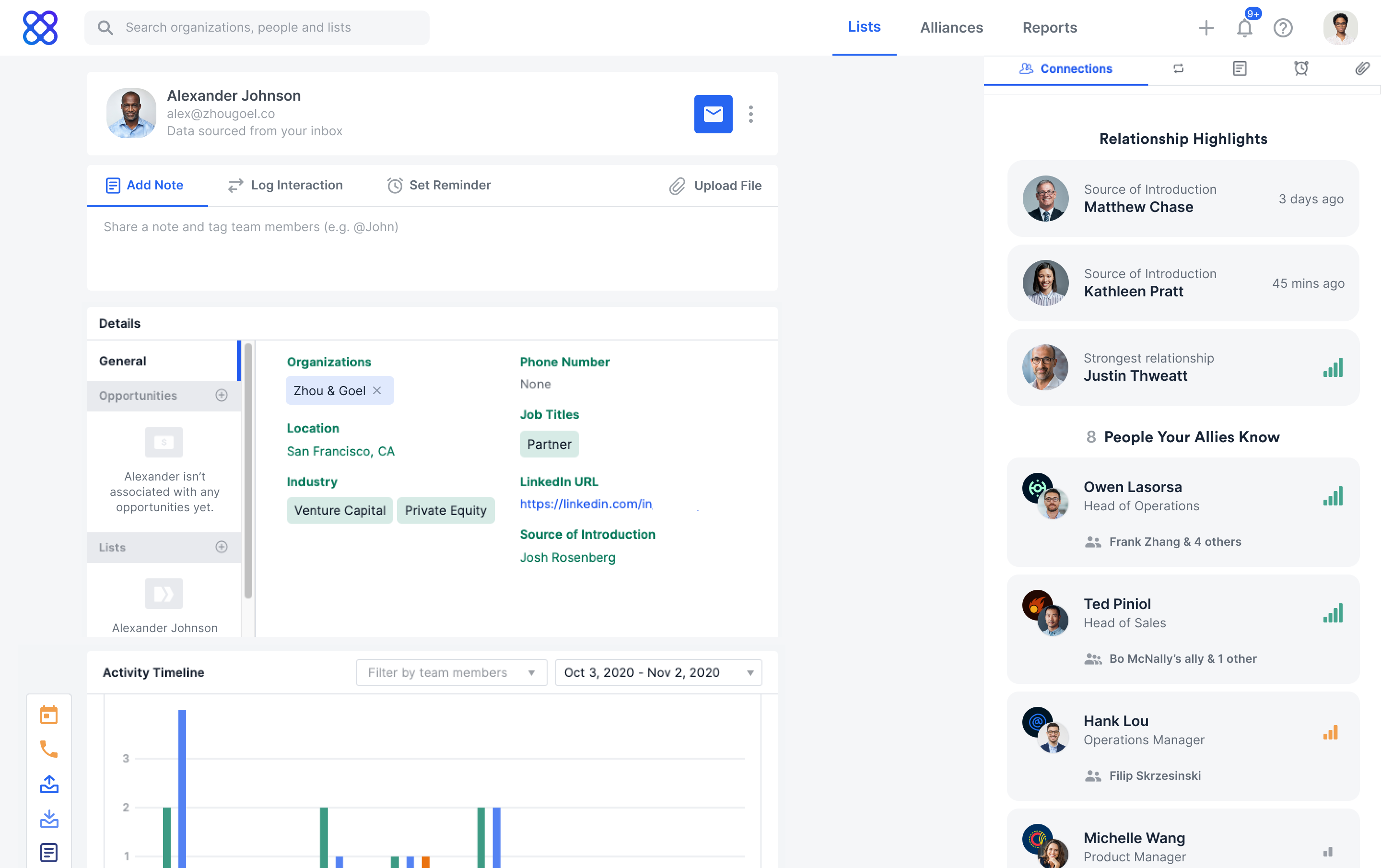

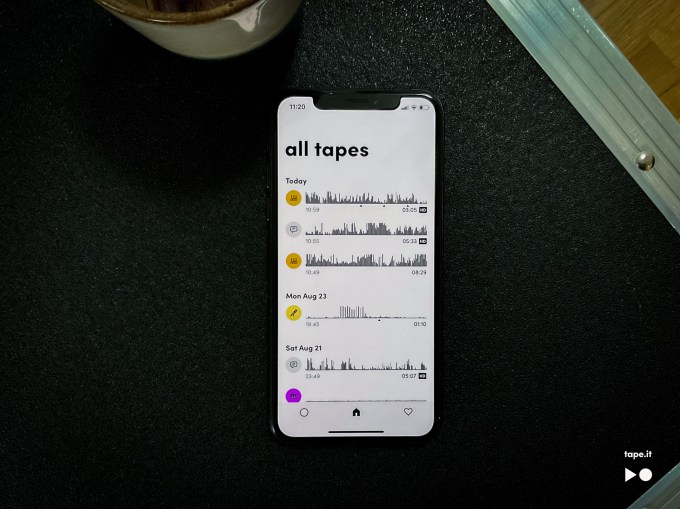

Image Credits: Dispo

This marks a new direction for the social media app, which seeks to redefine the photo-sharing experience by only letting users see the photos they took at 9 AM the next morning. From Dispo’s perspective, this gimmick helps users share more authentically, since you take one photo and then you’re done — the app isn’t conducive to taking dozens of selfies and posting the “best” image of yourself. But though it only launched in December 2019, Dispo has already faced both buzzy hype and devastating controversy.

Until about a year ago, the app was called David’s Disposables, named after co-founder and YouTuber David Dobrik. The app was downloaded over a million times in the first week after its release and hit No. 1 on the App Store charts. In March 2021, the app dropped its waitlist and relaunched with social network features, but just weeks later, Insider reported sexual assault allegations against a member of Vlog Squad, Dobrik’s YouTube prank ensemble. In response, Spark Capital severed ties with the company, leading to Dobrik’s departure. Other investors like Seven Seven Six and Unshackled Ventures, which contributed to the company’s $20 million Series A round, announced that they would donate any profits from their investments in Dispo to organizations working with survivors of sexual assault.

Liss told TechCrunch in June, when the company confirmed its Series A, that Dobrik’s role with the company was as a marketing partner — Liss has been CEO since the beginning. In light of the controversy, Liss said the app focused on improving the product itself and took a step back from promotion.

According to data from the app analytics firm SensorTower, Dispo has reached an estimated 4.7 million global installs to date since launch. Though the app saw the most downloads in January 2020, when it was installed over 1 million times, the app’s next best month came in March 2021, when it removed its waitlist — that month, about 616,000 people downloaded Dispo. Between March and the end of August, the app was downloaded around 1.4 million times, which is up 118% year over year compared to the same time frame in 2020 — but it should be expected that this year’s numbers would be higher, since last year, the app’s membership was exclusive.

Image Credits: Dispo

Now, with the announcement that Dispo is pursuing NFTs, Liss hopes that his company won’t just change how people post photos, but what the relationship will be between platforms and the content that users create.

“Why NFTs? The most powerful memories of our lives have value. And they have economic value, because we created them, and the past of social media fails to recognize that,” Liss told TechCrunch. “As a result, the only way that a creator with a big following is compensated is by selling directly to a brand, as opposed to profiting from the content itself.”

Adding NFT sales to the app offers Dispo a way to profit from a cut of user sales, but it stands to question how adding NFT sales could impact the community-focused feel of Dispo.

“I think there is tremendous curiosity and interest,” Liss said. “But these problems and questions are why we need more data.”

Powered by WPeMatico

So many curators and artists are suffering because of constant, groundless playlist reports on

So many curators and artists are suffering because of constant, groundless playlist reports on