Editor’s note: Get this free weekly recap of TechCrunch news that any startup can use by email every Saturday morning (7 a.m. PT). Subscribe here.

And I don’t mean building an app that gets the world addicted to short-form videos. I mean, where you build a huge company that spans the world and then get turned into a political football.

The Bytedance-owned app developer still appears headed for a shutdown in the US, after the already convoluted talks stalled out this past week. Each national government appears to require local ownership of a new entity, as Catherine Shu details, and the business partners are each claiming ownership. It’s a zero sum global game now for control of data and algorithms.

On the other side of the world, Facebook was quick to state that it would not be pulling out of the European Union this week even if it is forced to keep EU user data local, as Natasha Lomas covered. The company was clarifying a recent filing it had made that seemed to threaten otherwise — it doesn’t want to get TikTok’d.

For startups with physical supply chains, existing tensions are squeezing business activity from Chimerica out into other parts of the world, as Brian Heater wrote about the topic for Extra Crunch this week. Here’s what one founder told him:

Many [companies] are considering manufacturing in areas like Southeast Asia and India. Vietnam, in particular, has offered an appealing proposition for a labor pool, notes Ho Chi Minh City-based Sonny Vu, CEO of carbon-fiber products manufacturer Arevo and founder of deep tech VC fund Alabaster. “We’re friendly [with] the Americans and the West in general. Vietnam, they’ve got 100 million people, they can make stuff,” Vu explains. “The supply chains are getting more and more sophisticated. One of the issues has been the subpar supply chain … it’s not as deep and broad as as other places like China. That’s changing really fast and people are willing to do manufacturing. I’ve heard from my friends trying to make stuff in China, labor’s always this chronic issue.”

Danny Crichton blamed nationalistic US policies for undermining the country’s long-term commitment to leading global free trade and threatening its competitive future, in a provocative rant last weekend. There’s truth to that, but the underlying truth is that globalization worked, it just hasn’t work as well as hoped for a lot of people in the US and some other parts of the world. In addition to phenomenon like China’s industrial engine, for example, those cross-border flows of money and technology have helped nurture the startup ecosystem in Europe.

Mike Butcher, who has been covering startups for TechCrunch from London since last decade, writes about a new report from Index Ventures about this trend.

It used to be the case that in order to scale globally, European companies needed to spend big on launching in the U.S. to achieve the kind of growth they wanted. That usually meant relocating large swathes of the team to the San Francisco Bay Area, or New York. New research suggests that is no longer the case, as the U.S. has become more expensive, and as the opportunity in Europe has improved. This means European startups are committing much less of their team and resources to a U.S. launch, but still getting decent results…. Between 2008-2014, almost two-thirds (59%) of European startups expanded, or moved entirely, to the U.S. ahead of Series A funding rounds. However, between 2015-2019, this number decreased to a third (33%).

The report also highlights the economic problem of dividing up markets into political blocks. “European corporates invest three-quarters (76%) less than their U.S. counterparts on software,” Butcher adds about the report. “And this is normally on compliance rather than innovation. This means European startups are likely to continue to look to the U.S. for exits to corporates.”

The pain from failing to trade will come home sooner or later to each government, as Danny observes. But that could be longer than your current company exists. Instead, now is the time to pick the markets you can win, and plan for a world where success has a lower ceiling. And hey, if you’re lucky, your national government could pick you as its winner!

Want $100m ARR? Fix your churn

We’ve been recapping key moments from the Extra Crunch Stage at Disrupt this week, here’s a key segment from a panel Alex Wilhelm hosted about how to achieve the $100m ARR dream, featuring Egnyte CEO Vineet Jain:

After explaining that in the early stages of building a SaaS company it’s common to focus more on adding new revenue than “plugging the holes at the bottom,” [Jain] added that as a company matures and grows, more focus has to be paid to managing churn and retention. He said that dollar-based retention is a key metric in the SaaS world that startups are valued by, meaning that after securing a customer, your ability to upsell that same account over a “defined window of time” really matters.

Noting the impacts of the COVID-19 pandemic and the fact that bonuses at Egnyte are tied to retention, “I say, managing churn is the new revenue,” he added. “Focus on that disproportionately more than you would focus on just top-line growth” … . Egnyte, Jain added, drives to just one or two metrics (net new MRR, or gross MRR adds and churn). “Everything that we’re doing, all of us [at Egnyte] have to be measured with that number to say, ‘How are we doing as a company?’” So if your startup is post-Series A, listen to what Jain says on managing churn. After all his company reached $100 million ARR, has a few dozen million in the bank, grew 22% in Q2 and is EBITDA positive.

Summer of tech IPOs continues with Root, Corsair Gaming and of course, Palantir

While public markets have waffled on tech stocks lately, the overall momentum of unicorn IPOs has continued.

Except, Danny may have slowed things down a bit for Palantir? Here are the key headlines from the week:

As tech stocks dip, is insurtech startup Root targeting an IPO? (EC)

Chamath launches SPAC, SPAC and SPAC as he SPACs the world with SPACs

Palantir publishes 2020 revenue guidance of $1.05B, will trade starting Sept 30th

Following TechCrunch reporting, Palantir rapidly removes language allowing founders to ‘unilaterally adjust their total voting power’

In its 5th filing with the SEC, Palantir finally admits it is not a democracy

How has Corsair Gaming posted such impressive pre-IPO numbers? (EC)

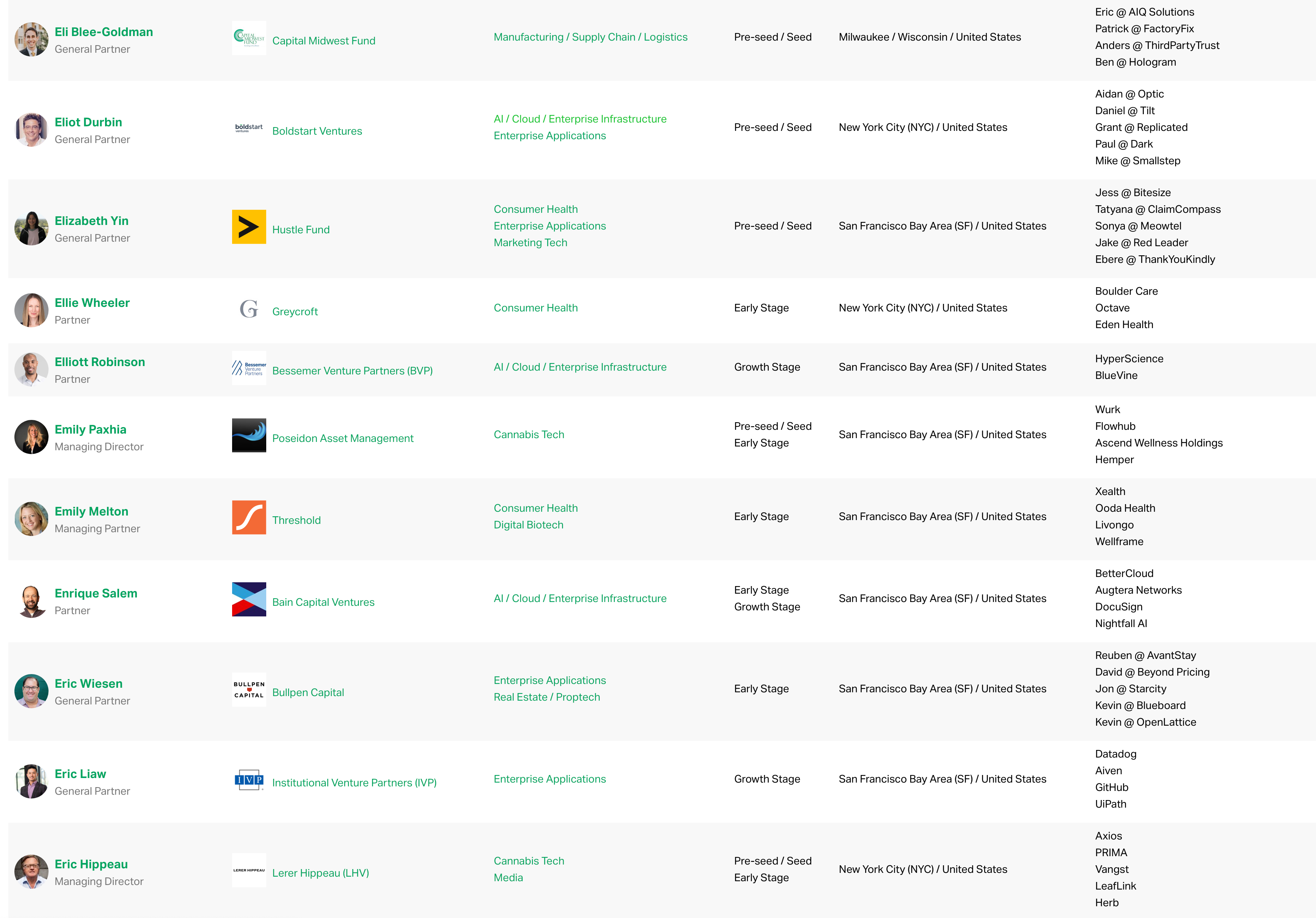

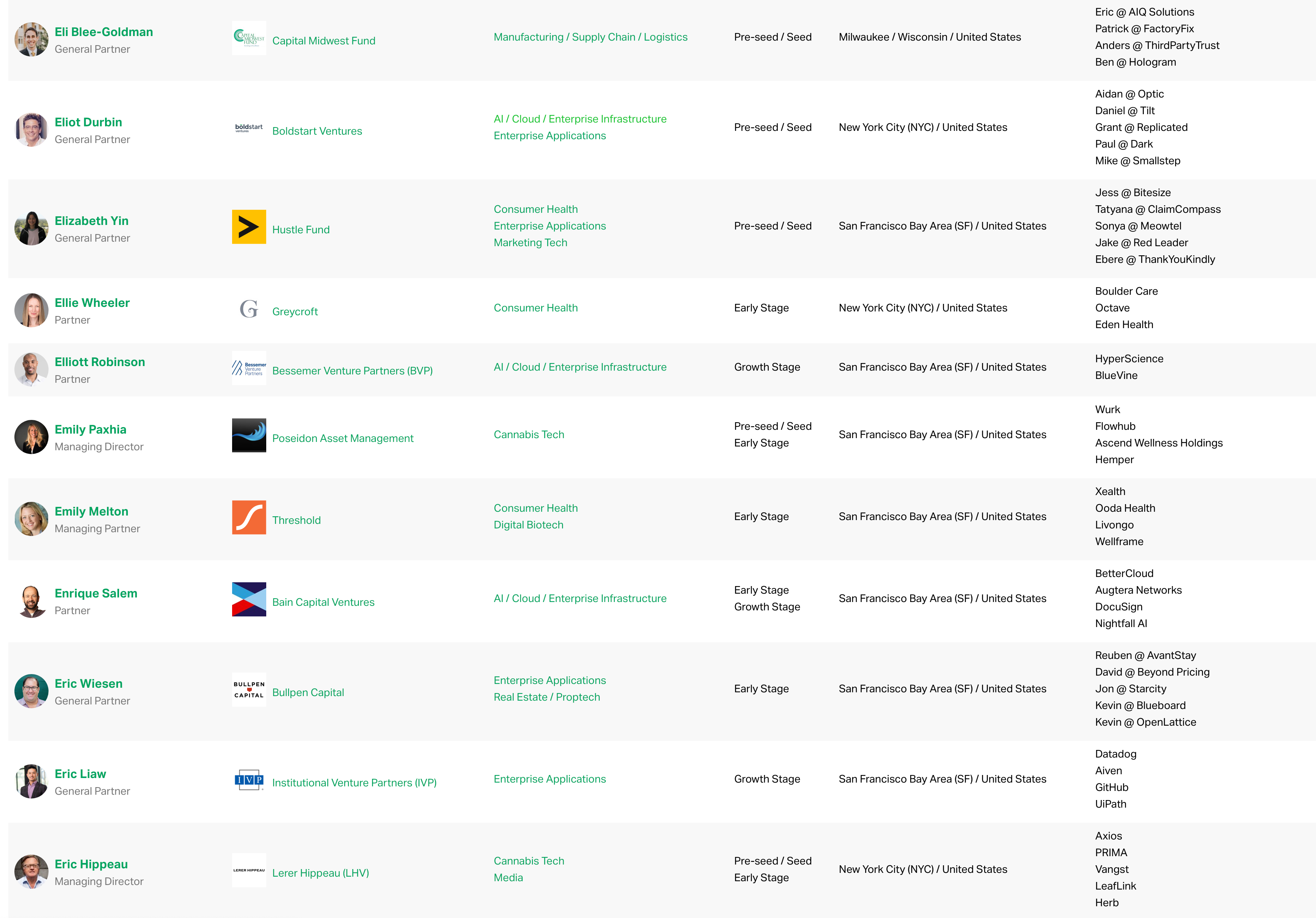

Even more info about the best investors for you

We’re making another big update to The TechCrunch List of startup investors who write the first checks and lead the scary rounds, based on thousands of recommendations that we’ve been receiving from founders. Here’s more, from Danny:

Since the launch of the List, we’ve seen great engagement: tens of thousands of founders have each come back multiple times to use the List to scout out their next fundraising moves and understand the ever-changing landscape of venture investing.

We last revised The TechCrunch List at the end of July 30 with 116 new VCs based on founder recommendations, but as with all things venture capital, the investing world moves quickly. That means it’s already time to begin another update.

To make sure we have the best information, we need founders — from new founders who might have just raised their VC rounds to experienced founders adding another round to their cap tables — to submit recommendations. Thankfully, our survey is pretty short (about two minutes), and the help you can give other founders fundraising is invaluable. Please submit your recommendation soon.

Since our last update in July, we have already had 840 founders submit new recommendations, and we are now sitting at about 3,500 recommendations in total now. Every recommendation helps us identify promising and thoughtful VCs, helping founders globally cut through the noise of the industry and find the leads for their next checks.

Around TechCrunch

Extra Crunch Live: Join Index Ventures VCs Nina Achadjian and Sarah Cannon Sept 29 at 2 pm EDT/11 am PDT on the future of startup investing

TC Sessions Mobility 2020 kicks off in two weeks

Announcing the final agenda for TC Sessions: Mobility 2020

Explore the global markets of micromobility at TC Sessions: Mobility

Don’t miss the Q&A sessions at TC Sessions: Mobility 2020

Across the week

TechCrunch

Calling Helsinki VCs: Be featured in The Great TechCrunch Survey of European VC

The highest valued company in Bessemer’s annual cloud report has defied convention by staying private

Human Capital: The Black founder’s burden

Thanks to Google, app store monopoly concerns have now reached India

Free VPNs are bad for your privacy

Extra Crunch

The Peloton effect

Edtech investors are panning for gold

3 founders on why they pursued alternative startup ownership structures

How Robinhood and Chime raised $2B+ in the last year

Dear Sophie: Possible to still get through I-751 and citizenship after divorce?

Equity: Why isn’t Robinhood a verb yet?

From Alex Wilhelm:

Hello and welcome back to Equity, TechCrunch’s VC-focused podcast (now on Twitter!), where we unpack the numbers behind the headlines.

This week Natasha Mascarenhas, Danny Crichton and your humble servant gathered to chat through a host of rounds and venture capital news for your enjoyment. As a programming note, I am off next week effectively, so look for Natasha to lead on Equity Monday and then both her and Danny to rock the Thursday show. I will miss everyone.

But onto the show itself, here’s what we got into:

- Zoom’s earliest investors are betting millions on a better Zoom for schools: Built on Natasha’s reporting, we took a look at a neat company that wants to make Zoom better for the educational environments where it had suddenly taken the center stage. Teachers need more.

- The first rule of BookClub? No boring book clubs. Another Natasha story this week, this time about a startup that we somewhat like but can’t decide how its market will be. Still, the bibliophiles in your life should read this piece and get hyped about rising access to authors.

- Robinhood raised $460 million more, extending its preceding $200 million Series G to a $660 million total investment. Chime also added $485 million at a new, $14.5 billion valuation. We dug into what’s up with the pair and why they are raising so much money.

- The short answer is hella growth, leading us to a question and this week’s headline: Why isn’t Robinhood a verb yet?

- Willow, the startup making the wearable breast pump, raises $55 million: Natasha talked us through some of the issues with the phrase femtech, before Danny explained to us the need for what Willow offers. Here’s to more tech being used to help more folks at more stages of life.

- Then we turned to VC media, namely our notes on a new venture capital game show, and, a16z launching a podcast network. We also worked what Casey Newton is up to into the same conversation.

Bon voyage for a week, please stay safe and don’t forget to register to vote.

Equity drops every Monday at 7:00 a.m. PDT and Thursday afternoon as fast as we can get it out, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

(@crockerbytes)

(@crockerbytes)