Dutch social enterprise, Fairphone, has moved a little closer to the sustainability dream of a circular economy by announcing the launch of a modular upgrade for its flagship smartphone.

The backwards compatible hardware units mean users of last year’s Fairphone 3 only need swap out a few modules to be holding the Fairphone 3+ in their hand instead of buying a whole new device.

Fairphone pulled off a similar feat with an earlier model of its ‘ethical smartphone’ but this time it’s managed to shrink the time it took it to offer ‘plug and play’ upgrade modules for its latest gen device.

“What we’ve been able to do is get that whole idea of plug and play to the consumer within the smartphone business,” says Fairphone co-founder Bas van Abel . “That part is not trivial because you have to imagine that getting everything into that module and being able to put it into the old phone… Not only the hardware has to fit and everything has to connect in the right way in that previous kind of architecture but also the software.

“But we’ve been able to do that, and it took some time but we’ve done it way faster than we were able to do it with the Fairphone 2. So we’re proud of that as well.”

“The most important part is it’s really also a signal towards the industry that it’s possible to do upgrades with your phone and not have to come out with a totally new phone every year,” he adds.

Finding clever ways to extend device longevity is a core plank of Fairphone’s mission. The biggest resource sinkhole associated with smartphone consumption is the annual or biennial upgrade cycle which encourages consumers to swap perfectly functional phones for a shiny new model. Fairphone 3 owners can get its latest kit with a cleaner conscience.

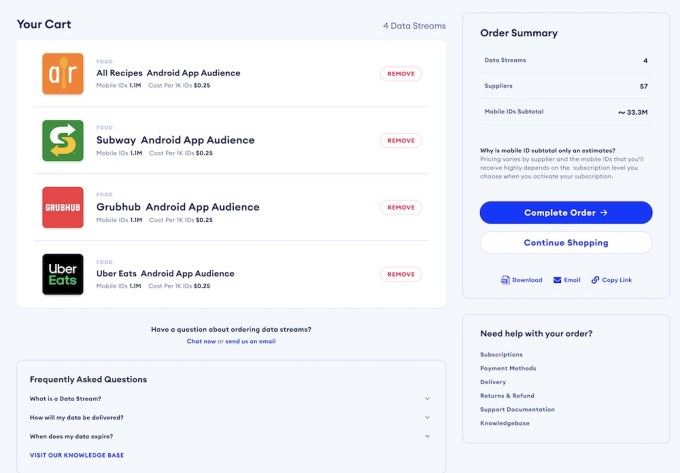

Fairphone is selling the Fairphone 3+ camera modules separately for current Fairphone 3 users — at an initial cost of €70 until the end of September (rising to ~€95 from October).

It is also selling a Fairphone 3+ handset for an RRP of €469, aimed at new to the brand users — opening up pre-sales from today on its website and via partner retailers, with a release date of September 14 across Europe.

Specs wise, the 4G Fairphone 3+ has a 5.7in Full-HD display with an 18:9 aspect ratio and is powered by a Qualcomm Snapdragon 632 chipset. Out of the box it runs Android 10. On board there’s 4GB of RAM and 64GB of ROM, expandable via microSD. The removable battery is 3,000mAh. There’s also Bluetooth 5.0, NFC and a fingerprint scanner.

van Abel confirms the business will continue to sell last year’s flagship — but at a reduced price of around €400.

The 3+ modules are only backwards compatible one generation of Fairphone which means anyone still using a Fairphone 2 can’t get this plug and play upgrade. The blocker there is the core module, per van Abel, who says not being able to swap the SOC out for an upgraded chipset remains the biggest challenge for modular upgrades that are able to span more than one smartphone generation.

“Our vision is definitely there that you can also eventually replace the core module… where the modem and the processor is,” he says, hazarding that it might be possible “within a couple of years”.

However the wider issue is the component industry still moves so fast it remains way out of step with Fairphone’s goal of longevity. The social enterprise pledges to provide up to five years of support for each device it sells, meaning it needs relevant spare parts to still be available in order that it can offer replacements or else stockpile them itself — a capital intensive process. And one that’s at sharp odds with the blistering upgrade trajectory of processor manufacturers.

From a sustainability and resource perspective, the best option is also for a smartphone user to keep using the same chipset for as long as possible. The maturity of the smartphone market and commoditization of the tech — leading to the more iterative device refreshes we generally see now — also tacitly supports that.

van Abel can point to consumers holding onto a handset for an average of about double the time they did when Fairphone got started. It’s a drift that’s providing uplift to environmentally sensitive brand focused on innovating to produce smartphones with a longer lifespan.

“We’ve done a lifecycle assessment on the Fairphone 3 and what comes out of that we’ve also tested what parts of the phone have what kind of footprint and you also see that almost 80% of the CO2 footprint of the phone is within the making and the production of the SOC,” he says. “So that means that if you really want to look at it from a sustainability perspective it really makes sense to keep that part of the phone just as long as possible. Because most of the harm on nature is on that part. So even replacing that part — being able to swap that part — it’s great but it’s kind of a shame that we throw away a lot of stuff and modules and components in the phone.”

“Recycling in the phone business at the moment is plain stupid,” he adds. “How it’s done is you collect the phones and they put them in an oven — they burn them. And then they get the minerals out… You can still reuse the minerals but there’s nothing smart about that. Nothing really has been reused so all the capacitors, the glass of the screen… So it does make sense at a certain point to being also able to swap the processor like you were able to do with the computers in the old days.”

When we reviewed the Fairphone 3 last year we were impressed by how normal the Android device felt — belying its modular, deconstructable interior and all the years of effort Fairphone has ploughed into scrutinising and reworking supply chains to be able to stand up its bold claim of a phone that “dares to be fair”.

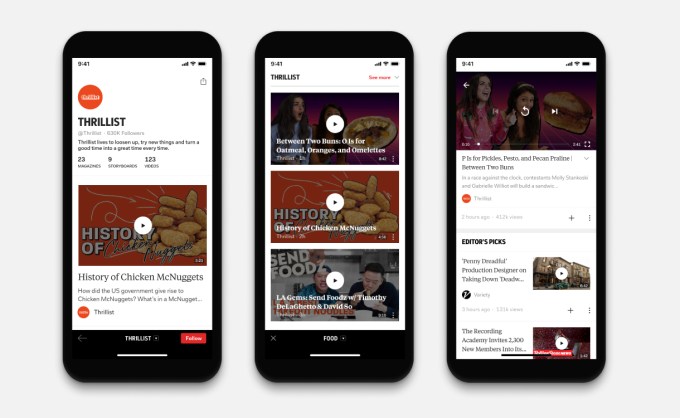

Now, with the launch of the Fairphone 3+ modules, last year’s handset is getting a boost to its camera hardware — with a 48MP main lens and a 16MP front-facing lens offered as replacements to last year’s 12MP and 8MP units via the new modules (the main and front modules can be purchased separately or as an upgrade bundle).

On the surface that looks like a huge step up in hardware but it’s down to the camera module using the Samsung GM1 sensor — which uses tiny pixels of 0.8-micro to deliver light sensitivity equal to 1.6-micro pixels.

So it’s actually a software technique to eke more out of the hardware, with a trade off in that it entails some compression of picture quality. A Fairphone spokeswoman confirmed the main lens’ “effective output” is still 12MP. “This is common practice in the industry with phones such as the Samsung S5KGM1, Samsung Galaxy A90 5G, Nokia 7.2 and the Sony IMX363,” she added.

As we noted in our review of the Fairphone 3 last September, the 2019 flagship took a fairly standard snap — with photo quality closer to acceptable, than stand out. The performance gap vs the premium end of the smartphone market was noticeable, even as Fairphone had substantially bested performance vs its earlier handsets.

The company looks keen to further shrink the photo quality gap. Now it touts “significantly” improved photo and video quality via the 3+ upgrade — which it says supports “sharper selfies and clearer video calls”.

It’s also done work to optimize the software, noting support for enhanced object tracking, faster autofocus and image stabilization “for more reliable shots”, as well as “louder, crisper sound” on the audio front, per its press release.

A focus on boosting photo and video performance makes sense given how central the camera has become for smartphone users — feeding into the rise of trendy social video sharing apps like TikTok.

Successfully convincing consumers to hold onto their existing handset for longer means paying attention to such app trends to make sure hardware and software are keeping up with how people are using their phones.

For buyers of the Fairphone 3+ handset there’s another improvement: It boasts 40% recycled plastics — up from just 9% in last year’s model. Fairphone says the volume of recycled plastics is now equivalent to a 33cl plastic drinking bottle — so that’s one piece of plastic waste prevented from ending up in the sea (for now).

While some might wonder if there’s a subtle contradiction in a sustainable smartphone brand launching a new model only a year after unboxing last year’s flagship, van Abel says expanding the portfolio in important — as part of the overall mission to grow demand for ethical smartphones.

That demand is in turn needed to build momentum for the kind of industry-wide shift required for a wholesale upgrade to a circular economy. And the potential of offering devices as a services.

“We want to sell as many phones as possible — because our mission is to show that there is a demand for ethical phones,” he tells TechCrunch. “So the more phones we sell the more we can show that the demand is really there. But that also makes a problem in terms of longevity so we have another KPI where we say we want people to use our phone as long as possible — so we measure how long people actually use our phones and that’s improving every year as well. So a sales person at Fairphone they get a very hard kind of assignment because they have to sell as many phones as possible but they can’t approach people that already have them.”

“We’re challenging ourselves to disconnect the business model from these resources as much as possible but because we take that challenge in the core of our business I think we’re also ahead of where the industry needs to move towards,” he adds.

“Nobody can neglect the fact that we’re running out of resources and it’s getting harder and harder to get these resources. Look at cobalt, for example. Lithium ion batteries. There’s a run on cobalt. It’s gone like 10x, 20x the price it used to be — because we have this energy transition that we need all kinds of batteries for. So even sustainability needs these resources that you can’t get purely from recycling. So we know that this has to change. Even for geopolitical reasons I think that what we’re doing forces us to be ahead of the game.”

Demand for Fairphones has been building steadily over the past decade and the social enterprise is now “almost” at profitability, per van Abel. “We’ve sold over 200k phones — of which 60k were Fairphone 1s. We’ve sold over 100k Fairphone 2s. And last year we sold almost 50k Fairphone 3s and this year we’re aiming for over 100k Fairphone 3+,” he says.

“We’ve never had a portfolio. Now we actually have a portfolio of two phones, Fairphone 3 and 3+, because we’re going to sell the 3 as well at a lower price with the older modules — the previous modules — and the 3+ with the new modules. So that we also have a price point for people that don’t need the newest camera improvements.”

Fairphone remains very much a European project — one that’s perfectly positioned to benefit from a pan-EU push towards sustainability and a circular economy in the coming years. (A ‘right to repair’ Commission proposal for mobiles certainly looks helpful.)

For now, the biggest market for Fairphones is still Germany, per van Abel. While he says its focus for sales of the new portfolio is to push for more growth in Germany, with France, Holland and the UK its other main markets of continued focus. “We’re aiming more also at Scandinavia,” he adds.

“The danger of a commoditizing industry is where you get a lot of easy, cheap access to all these technologies and you see it moving towards two sides: The high end and the really low end stuff. But I hope that customers will also value the companies themselves, and the brands and what they stand for. Whereas [iPhone maker] Apple stands for design; they have a premium to it — you buy something more than just the phone. And I think Fairphone has that as well.

“We have a compelling story. Especially you see the group of conscious consuming growing within every report I read. You see it growing steadily each year. So people do take more notice of what they actually buy.”

Funding wise, the social enterprise is comfortably positioned with the debt, equity and growth financing it raised a few years back from impact investors. Though van Abel moots the possibility of taking in more funding to put towards marketing and help it keep scaling.

“But at the moment we’re good,” he adds. “The impact investors are very patient. It goes with the mission of the company. I think people really are part of Fairphone — participate in this company because they believe not only in the cash return but also in the impact.”

He also notes that Fairphone is also doing separate financing for some related initiatives in the supply chain which are required to underpin its claim of fair and ethical electronics.

“A good example of that is the fair cobalt alliance that we’ve just set up,” he says. “We’re really proud of that. We have set up a great consortium with mining companies, with refineries, with big companies like Signify, that are part of that supply chain of cobalt. It’s partly funded, as well, by the Dutch government. So we have more of a broker position — and that is the nice thing about being a social enterprise. You sometimes can be in between the non-profit and the for-profit sector. You can bridge easily those two worlds.”

Powered by WPeMatico