Snowflake filed to go public today joining a bushel of companies making their S-1 documents public today. TechCrunch has a longer digest of all the IPO filings coming soon, but we could not wait to get into the Snowflake numbers, given the huge anticipation that the company has generated in recent quarters.

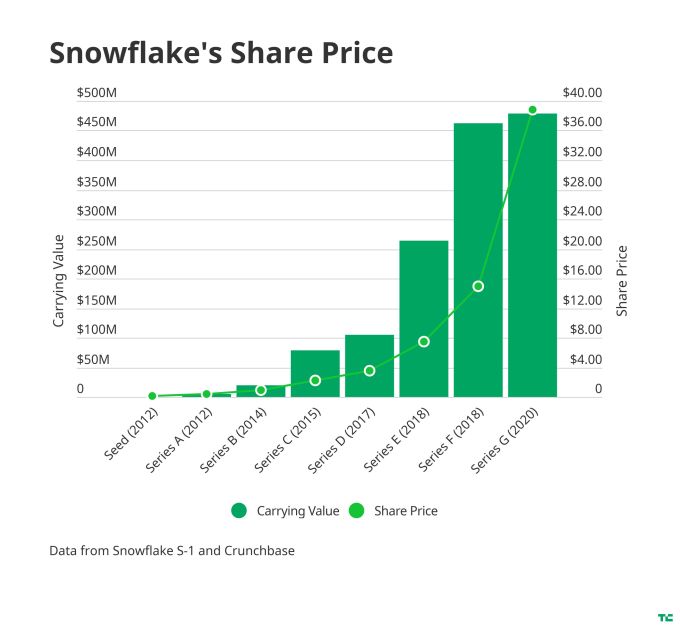

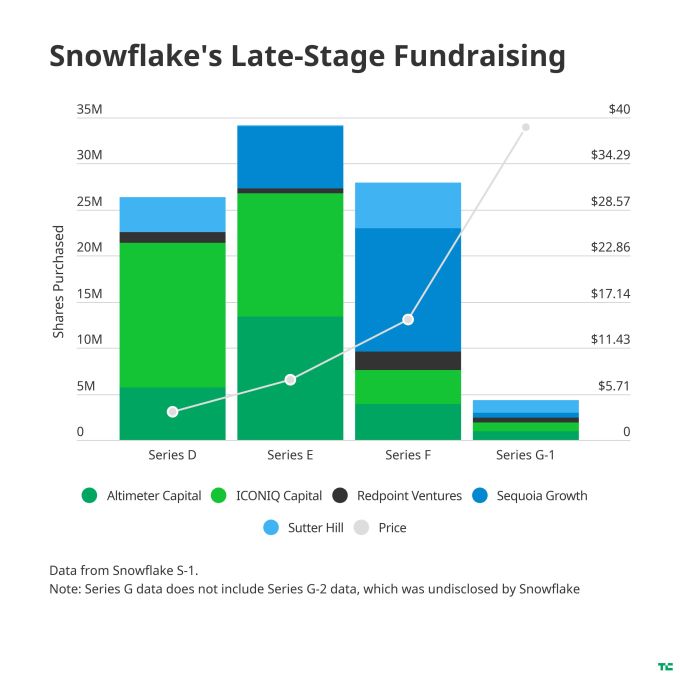

Why? Because the cloud data warehouse company has been on a fundraising tear in recent years, including a $450 million Series F in late 2018 and a $479 million Series G in February of this year. The latter round valued the mega-unicorn at around $12.5 billion. More on this later.

Snowflake is, then, one of the world’s most valuable former startups that is still private. Its public debut will make a splash. But what did its $1.4 billion in capital raised (Crunchbase data) build? Let’s take a peek at the numbers.

Growth

Even glancing at the Snowflake S-1 makes it clear what investors are excited about when it comes to the big-data storage service: Its growth. In its fiscal year ending January 31, 2019, for example, Snowflake had revenue of $96.7 million. A year later that number was $264.7 million, or growth of around 150% at scale.

More recently, the company’s growth has remained impressive. In the six months ending July 31, 2019, Snowflake’s revenue was $104.0 million. A year later, those two quarters generated revenues of $242.0 million. That’s growth of 132.7% on a year-over-year basis. Impressive, and just the sort of top line expansion that private investors want to staple their wallet to.

So, lots of growth. But how high-quality is the revenue?

Margins

Let’s take a look at the company’s gross margins over different time periods. The data will help us better understand the company’s value, and its gross margin improvement, or impairment over time. Given Snowflake’s soaring valuation over time, we are expecting to see improvements as time passes:

- Fiscal year ending January 31, 2019: 46.5%

- Fiscal year ending January 31, 2020: 56.0%

- Six months ending July 31, 2019: 49.4%

- Six months ending July 31, 2020: 61.6%

Et voilà ! Just like we expected, improving gross margins over time. Recall that the higher (stronger) a company’s gross margins are, the more of its revenue it gets to keep to cover its operating costs. Which is, notably, where the Snowflake story goes from super-exciting to slightly harrowing.

Let’s talk losses.

Losses

In no way does Snowflake’s operations pay for themselves. Indeed, the company is super unprofitable on both an operating and net basis.

In its fiscal year ending January 31, 2019, Snowflake lost $178.0 million on a net basis. A year later the figure swelled to $348.5 million. In the six months ending July 31, 2019, the company’s net loss was $177.2 million. In the same two quarters of this year, it was slightly lower at $171.3 million.

And that’s why the company is probably trying to go public. Now that it can point to falling net losses as its revenues grow and its gross margins improve, you can chart a path to break-even. And Snowflake’s operations are burning less cash over time. The pace was north of $50 million a quarter in the two three-month periods ending July 31, 2019, for example.

And even more, if we look inside the last two quarters, the most recent period (three months ending July 31, 2019) is larger than the one preceding it in revenue terms ($133.1 million versus $108.8 million), and its net loss is smaller ($77.6 million versus $93.6 million). This lowered the company’s net margin from -86% to -58%. Still bad! But far less bad in short order, which could cut worries about Snowflake’s enormous history of unprofitability at scale.

How we got here

Since Snowflake first appeared in 2012, its ability to take the idea of a data warehouse, a concept that has existed on prem for years, and move into a cloud context had great appeal — and it attracted great investment. Imagine taking virtually all your data and having it in a single place in the cloud.

The money train started slowly at first, with $900,000 in seed money in February 2012, followed quickly by a $5 million Series A later that year. Within a few years investors would be handing the company bundles of cash and the train would be the high-speed variety, first with former Microsoft executive Bob Muglia leading the way, and more recently with former ServiceNow CEO Frank Slootman in charge.

By 2017 there were rapid-fire rounds for big money: $105 million in 2017, $263 million in January 2018, $450 million in October 2018 and finally $479 million this past February. With each chunk of money came gaudier valuations, with the most recent weighing in at an eye-popping $12.4 billion. That was triple the company’s $3.9 billion valuation in that October 2018 investment.

Telegraphing the inevitable

In February, Slootman did not shy away from the IPO question. Unlike so many startup CEOs, he actually embraced the idea of finally taking his company public, whenever the time was right, and apparently that would be now, pandemic or not.

He actually almost called the timing in a conversation with TechCrunch at the time of the $479 million round:

I think the earliest that we could actually pull that trigger is probably early- to mid-summer time frame. But whether we do that or not is a totally different question because we’re not in a hurry, and we’re not getting pressure from investors.

All money talk aside, at its core, what Snowflake offers is this ability to store vast amounts of data in the cloud without fear of locking yourself in to any particular cloud vendor. While all three cloud players have their own offerings in this space, Snowflake has the advantage of being a neutral vendor — and that has had great appeal to customers, who are concerned about vendor lock-in.

As Slootman told TechCrunch in February:

One of the key distinguishing architectural aspects of Snowflake is that once you’re on our platform, it’s extremely easy to exchange data with other Snowflake users. That’s one of the key architectural underpinnings. So content strategy induces network effect which in turn causes more people, more data to land on the platform, and that serves our business model.

So what?

When it rains it pours. Unity filed. JFrog filed. We still need to talk X-Peng. Corsair has filed as well. And there are still a host of companies that have filed privately, like Airbnb and DoorDash, that could drop a new filing at any moment. What an August!

Powered by WPeMatico