Thinking back to the last time I accepted a job, I can’t recall actually reading any of the material that was sent over. I think I skimmed some docs to make sure the numbers written down matched what I had been told over the phone, but after that it was a blur of digital signing and emailing and precisely no due diligence from myself.

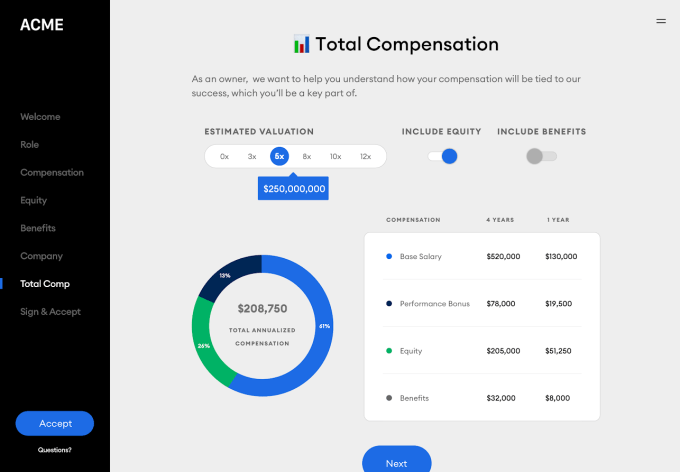

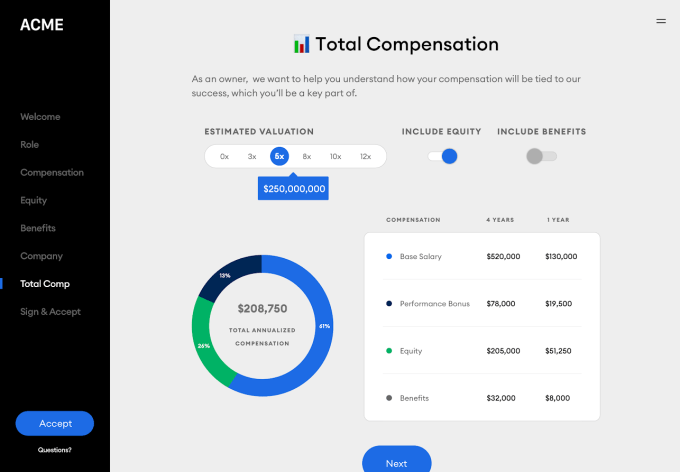

Not great, really. I bet that your experience accepting new gigs has been somewhat similar. In startups, jobs are offered with exotic types of pay, chock full of startup stock options in all their 409A and vesting-period glory. Some folks might not really understand what is being offered. Like what the value of their full comp package really is, when performance pay and other sweeteners are stacked on top of base rates. With remote learning in the equation, it’s even more confusing.

This is the market space that Welcome, a startup that is announcing a $1.4 million fundraise, wants to fix. (Update: Forgot to add the capital sources, which include Ludlow Ventures, the Weekend Fund, Global Founders Capital, both Shrug and Basement, as well as a number of angels.)

The company told TechCrunch it is a “first offer management and closing platform.” Its service helps provide a clear picture of total comp to candidates, helping them accept or deny an offer that they can fully understand.

Here’s a screengrab from the candidate’s side of the employer-employee divide:

If “offer management and closing” sounds like a small niche to target, it both is and is not.

It is, in that if Welcome stayed in its current market-position forever it would have a smaller product target than most startups. But the company has plans to expand its product-set over time. For example, its co-founders Nick Gavronsky and Rick Pereira explained that Welcome wants to offer real-time salary data in the future, based on the information that will flow through its service.

Want to close an engineer in North Carolina with a high level of confidence in the offer? Welcome should be able to tell you, later on, what a comp package should look like if you want make sure the candidate will accept.

Gavronsky and Pereira have experience in product and people work, respectively, making their union at Welcome a good fit. The company’s team is currently just four folks, though the startup expects that it will double in size this year. The capital it raised in January, but is only talking about now, is making the hiring possible.

Now, the $1.4 million number is pretty dated. Normally I’d skip over a round so far from the past, but Welcome caught my eye, as I’ve recently written about another HR tech provider, Sora, and the Welcome deal felt like an illustrative event: This is how seed rounds are announced, long after the fact, which makes reporting on seed-stage trends really hard. Something to keep in mind.

Welcome is barking up a winsome tree with its product, not only because the offer/offer acceptance process is garbage today — let’s email some PDFs and hand a candidate off between departments! — but because it has seen strong early demand from potential customers. Its service is currently in a private alpha that was a bit oversubscribed, though the company is not yet charging for its service. (Welcome will be a SaaS play, priced on company size, which seems reasonable.)

Past all that, what’s exciting about Welcome is that if it can get a number of customers aboard when it makes it to beta or launch, the company will have placed itself in a position where it can expand in several directions. It could, for example, extend its feature set to help with pre-onboarding or onboarding itself, given that it already knows a new candidate and their new employer. Of course, the startup wants to talk more about what it’s building today, but it’s also fun to look ahead.

That’s enough on Welcome, we’ll chatter about them again when they formally launch, or share some neat growth metrics. Until then, good luck getting into the alpha.

Powered by WPeMatico