Epic Games takes on Apple, Instagram fixes a security issue and Impossible Foods raises $200 million. This is your Daily Crunch for August 13, 2020.

The big story: Apple removes Fortnite from the App Store

The controversy over Apple’s App Store policies has expanded to include Epic Games and its hit title Fortnite. The company introduced a direct payment option for its in-game currency on mobile, leading Apple to remove the app for violating App Store rules.

“Epic enabled a feature in its app which was not reviewed or approved by Apple, and they did so with the express intent of violating the App Store guidelines regarding in-app payments that apply to every developer who sells digital goods or services,” Apple said.

Epic, meanwhile, said it’s taking legal action against Apple, and that the game’s removal is “yet another example of Apple flexing its enormous power in order to impose unreasonable restraints and unlawfully maintain its 100% monopoly over the iOS In-App Payment Processing Market.”

The tech giants

Bracing for election day, Facebook rolls out voting resources to US users — The hub will centralize election resources for U.S. users and ideally inoculate at least some of them against the platform’s ongoing misinformation epidemic.

Instagram wasn’t removing photos and direct messages from its servers — A security researcher was awarded a $6,000 bug bounty payout after he found Instagram retained photos and private direct messages on its servers long after he deleted them.

Slack and Atlassian strengthen their partnership with deeper integrations — At the core of these integrations is the ability to get rich unfurls of deep links to Atlassian products in Slack.

Startups, funding and venture capital

Impossible Foods gobbles up another $200 million — Since its launch the plant-based meat company has raised $1.5 billion from investors.

Omaze raises $30 million after expanding beyond celebrity campaigns — The Omaze model has shifted away from celebrity-centric campaigns to include fundraisers offering prizes like an Airstream Caravel or a trip to the Four Seasons resort in Bora Bora.

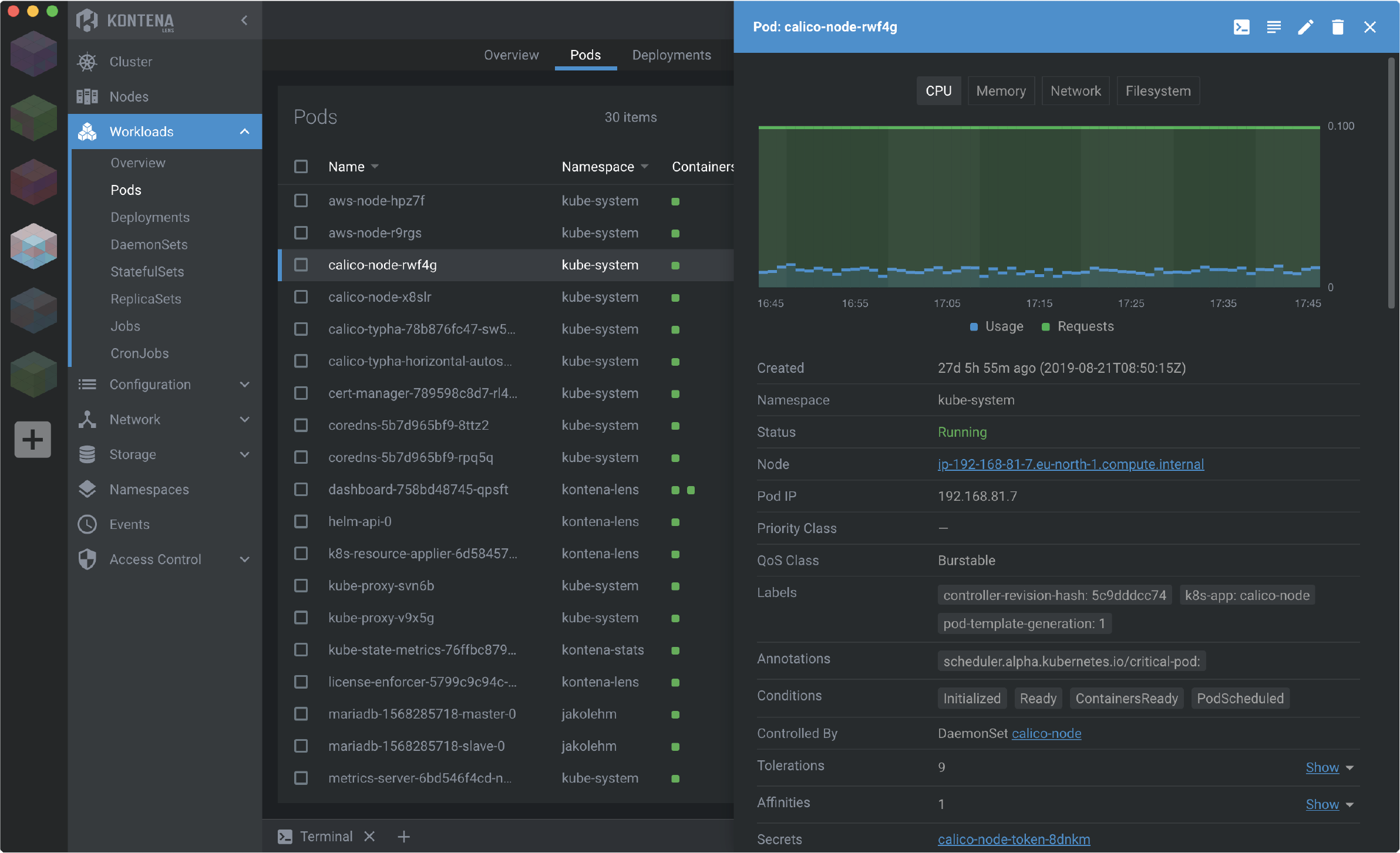

We’re exploring the future of SaaS at Disrupt this year — We’re bringing Canaan Partners’ Maha Ibrahim, Andreessen Horowitz’s David Ulevitch and Bessemer Venture Partners’ Mary D’Onofrio together to help explain how the landscape has changed.

Advice and analysis from Extra Crunch

How to get what you want in a term sheet — Lior Zorea discusses the reality of term sheets.

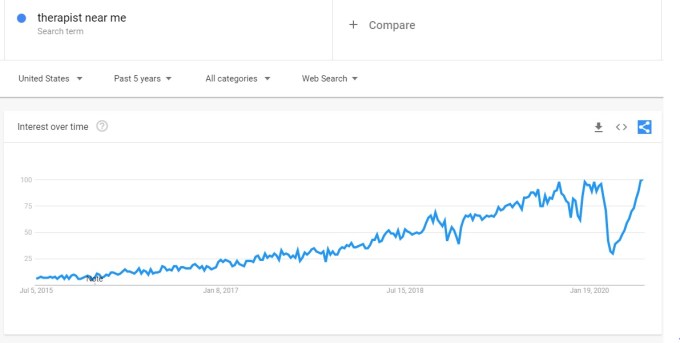

Five success factors for behavioral health startups — Courtney Chow and Justin Da Rosa of Battery Ventures argue that behavioral health is particularly suited to benefit from the digitization trends COVID-19 has accelerated.

Minted.com CEO Mariam Naficy shares ‘the biggest surprise about entrepreneurship’ — Naficy got into the weeds with us on topics that founders don’t often discuss.

Everything else

Digital imaging pioneer Russell Kirsch dies at 91 — It’s hard to overstate the impact of his work, which led to the first digitally scanned photo and the creation of what we now think of as pixels.

AMC will offer 15-cent tickets when it reopens 100+ US theaters on August 20 — The theater juggernaut announced plans to reopen more than 100 theaters in the U.S. on August 20.

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 3pm Pacific, you can subscribe here.

Powered by WPeMatico