The Michigan startup scene is growing and venture capitalists see several key areas of opportunities. What follows is a survey of some of the top VCs in the state and how they see COVID-19 affecting the growth of Detroit, Ann Arbor and all of Michigan’s startup ecosystem. According to the Michigan Venture Capital Association (MVCA), there are 144 venture-backed startup companies in Michigan, which is an increase of 12% over the last five years.

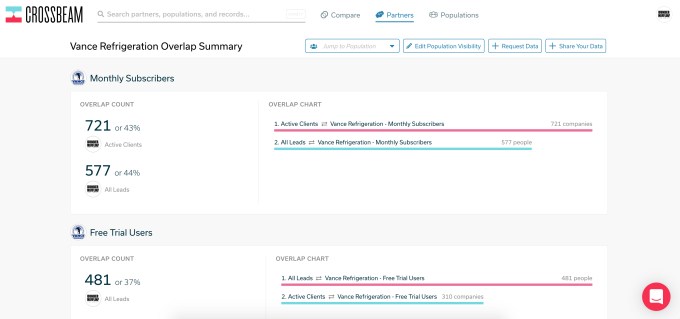

The amount of capital available in the state hit a four-year high in 2019 after shrinking from record levels in 2015. The MVCA says the total amount of VC funds under management in Michigan is $4.3 billion. Out of that, 71% of the capital has been invested into companies and the MVCA states its members estimate an additional $1.2 billion of venture capital is needed to “adequately fund the growth of Michigan’s 144 startup companies in the next two years.”

As the VCs say below, life sciences is a large part of the Michigan ecosystem, attracting 38% of all investments made in the state. Information technology comes in second, receiving 34% of the total capital invested, with 85% going to those focused on software. Mobility, often thought as Michigan’s mainstay, only received 7% of the capital in 2019. Here’s who we spoke to:

- Chris Stallman, partner, Fontinalis Partners

- Patricia Glaza, EVP and managing director, ID Ventures

- Chris Rizik, CEO and fund manager, Renaissance Venture Capital

- Tim Streit, partner, Grand Ventures

- Turner Novak, general partner, Gelt VC

VCs remain bullish on Michigan’s life science startups

Michigan has long been a hub for life science startups and the venture capitalists polled expect that to continue. Chris Stallman of Fontinalis Partners points to Michigan’s long-standing reputation in this field and expects this to continue.

Tim Streit of Grand Ventures agrees and sees the pandemic as accelerating the sector’s growth. In recent weeks he says his firm has seen a “number of promising digital therapeutics deals based in or near Michigan … and the timing couldn’t be more perfect for these kinds of companies to succeed.”

Chris Rizik of Renaissance Venture Capital notes that drug development will continue to drive growth around the country and is a strength of the Michigan ecosystem. He also points to Jeff Williams, CEO of NeuMoDx, as a leader in the life science community and who has led a number of Michigan’s most successful startups.

The notable exception to this are startups directly serving hospitals, according to Patricia Glaza of ID Ventures. She sees this as a challenging market in the era of COVID-19, saying “Hospitals are bleeding cash without elective surgeries and hard to prioritize nonessential technologies.”

Ann Arbor is becoming a hub for security companies

Duo Security’s impressive exit to Cisco in 2018 is still resonating in the scene. As such, many venture capitalists are seeing Ann Arbor becoming a home for security startups.

Stallman of Fontinalis states, “I think the cybersecurity realm will be a bright spot as some of those spillover effects from the 2018 acquisition of Duo Security by Cisco take hold (this is still in its early days — employees will reach the end of their employment agreements and will start new companies, etc.).” Rizik of Renaissance Venture Capital said something similar: “The success of Duo Security highlighted Michigan’s growing reputation as a cybersecurity hub. The University of Michigan has always been strong in this area, and we now see a number of interesting startups in this field popping up around Ann Arbor.”

When asked about leaders in the Michigan startup scene, nearly all of the VCs listed Duo Security founders Dug Song and Jon Oberheide as key players. Perhaps Rizik said it best: “Dug Song is a great leader, who not only created a monster success for the region with Duo Security, but also has devoted much of his time to strategically working to help Michigan move forward as a responsible, startup-friendly community.”

Michigan is well-suited to benefit from remote work

Of course Michigan-based venture capitalists would be bullish on their own state, but nearly all of the VCs share the same reasons on why Michigan is a good place. They list low cost of living, amazing STEM-focused schools and a community of founders, VCs and business leaders eager to help each other.

Few VCs mention mobility as a bright spot for Michigan startups

Surprisingly, few of the VCs in the survey mention mobility or automotive as a highlight of the Michigan startup scene, which runs counter to the national narrative. Stallman sums up the situation this way: “The mobility space will see both headwinds and tailwinds. Companies vying for automotive customers may find that the industry’s challenges have resulted in a shorter ‘priority list’ for many automakers and suppliers; on the other side, companies helping to remove enterprise risk through innovation in supply chain, automation, workforce efficiency, etc. will have arguably more opportunity going forward.”

Chris Stallman, partner, Fontinalis Partners

How much is local investing a focus for you now? If you are investing remotely in general now, are you filtering for local founders?

We have always been a thematically focused investor rather than a geographically focused investor; prior to COVID-19, we had invested 99% of our capital outside of Michigan. With that said, we’d love to invest more in Michigan and support more local founders.

What do you expect to happen to the startup climate in Detroit/Ann Arbor/Michigan longer term, with the shift to more remote work, possibly from more remote areas. Will it stay a tech hub?

Southeast Michigan has always been a story of two different startup worlds: health/life sciences and hardware/software tech. On the life sciences side, this region has a long-standing reputation of innovation and university research, and I expect that to remain largely the same going forward. It would seem to me that life sciences companies may not have as easy of a time adapting to new remote-work environments since much of the innovation work remains lab/clinic/facility-based.

For the world of other technology, I think there will certainly be more embracing of remote work and distributed teams — this area has always had some degree of that since it’s not uncommon to see companies with another office elsewhere or a few remote employees that come from very specific backgrounds that are hard to recruit for locally. Since this area has always had some of that, I could see a case that this new paradigm will be an easier adjustment for this region. However, the flip side of that is that so much of tech innovation and developing an ecosystem is about density and serendipitous collisions — for an area that was still on the come-up, losing what ground had been gained in recent years will no doubt make the spillover benefits of this aspect harder to come by. I worry a bit that angel and seed activity will slow locally (and hopefully that the growth in seed funds nationally will offset that).

Are there particular industry sectors that you expect to do uniquely well or poorly, locally?

I think a larger theme that is arising out of this COVID-19 situation is that people have a heightened sense of health, safety and security. Life sciences will remain resilient so long as there’s funding for continued research, and I think the cybersecurity realm will be a bright spot as some of those spillover effects from the 2018 acquisition of Duo Security by Cisco take hold (this is still in its early days — employees will reach the end of their employment agreements and will start new companies, etc.).

The mobility space will see both headwinds and tailwinds. Companies vying for automotive customers may find that the industry’s challenges have resulted in a shorter “priority list” for many automakers and suppliers; on the other side, companies helping to remove enterprise risk through innovation in supply chain, automation, workforce efficiency, etc. will have arguably more opportunity going forward.

In the short term, what challenges are facing Michigan’s startup scene?

Detroit has not yet hit a full critical mass from a startup ecosystem standpoint, and that is most evident in the more limited amount of angel and seed capital available to companies here; and, to a lesser extent, a more shallow pool of mentors and advisors for founders than what you would find in SF, LA, NYC, Boston, etc.

Who are some founders (who you’ve invested in or otherwise) that are leaders in the community?

Here are some of the prominent ones (note that we have invested in any): Dug Song and Jon Oberheide (Duo Security), Mina Sooch (has founded and led several prominent biotech companies), Amanda Lewan (Bamboo Detroit), Kyle Hoff (Floyd), Josh Luber and Greg Schwartz (StockX).

A lot of Bay Area founders and developers are looking to relocate. Why Michigan?

Quality research institutions, access to talent locally and ability to pull from Toronto/Ohio/etc., significant industry (automotive, logistics, manufacturing and financial services) in its footprint, supportive state programs for startups, cost of living, international airport with easy access (when the world moves again, that is), etc.

Patricia Glaza, EVP and managing director, ID Ventures

Powered by WPeMatico