The TechCrunch Exchange newsletter just launched. Soon only a partial version will hit the site, so sign up to get the full download.

Welcome back to The TechCrunch Exchange, a weekly startups-and-markets newsletter for your weekend enjoyment. It’s broadly based on the daily column that appears on Extra Crunch, but free. And it’s made just for you.

You can sign up for the newsletter here. With that out of the way, let’s talk money, upstart companies and the latest spicy IPO rumors.

Affirm dreams of an 11-figure SPAC

If you are tired of reading about special purpose acquisition companies, or SPACs, we hear you. We’re sick of them as well. But they keep cropping up, this time in the form of a possible IPO alternative for Affirm, a fintech unicorn that has raised more than $1 billion to provide consumers with point-of-sale installment loans. (Rates from 0% to 30%, terms of up to 36 months.)

Affirm is effectively a lending company that plugs into e-commerce firms. Researching this entry I had an idea in the back of my head that Affirm had a super-neat credit system to rate users. But reading through its own FAQ and what NerdWallet has to say on the company, its methods seem somewhat pedestrian.

Regardless, distribution is key for the company, and Affirm recently linked up with Shopify. That should provide it another dose of growth. The very sort of thing that IPO investors want. The WSJ reported that Affirm could go public this year, perhaps via a SPAC, at a valuation of $5 to $10 billion.

I did my best to map out what those valuations implied, generally finding that Affirm needs to have hella loan volume to make the sort of money that a $10 billion figure implies. Of course, I was trying to make numerical sense. The stock market in 2020 is a bit more relaxed than that.

All this SPAC talk is still mostly bullshit, mind. We are seeing public debuts this year. And every single one of them that has been of note has been a traditional IPO, at least as far as I can recall. The running history of direct listings and SPAC debuts that matter is pretty slim.

Of course, Coinbase and Asana and DoorDash and Airbnb, among others, are in need of liquidity and could yet pull the trigger on a more exotic debut. Hell, Qualtrics could do something wild in its impending IPO but we doubt it will.

Market Notes

The biggest market news this week had little to do with startups. Instead, it came from the anti-startups, namely the largest American tech companies, which smashed their earnings reports. Alphabet actually shrank year-over-year, but it still beat expectations. Facebook and Amazon and Apple were juggernauts in the quarter.

- Given the positive notes we’ve heard from startups and startup investors about how Q2 sales performance was better than expected, and is in some cases besting plans set at the start of the year, the SuperMegaTech results are not a shock.

- Many tech-powered companies of all maturities seem to be catching a boost.

The startups that aren’t are DOA. As Freestyle Capital’s Jenny Lefcourt told TechCrunch the other week, every investor wants into the next round of startups that have caught a COVID tailwind. And precisely zero investors want into the proximate funding event for startups that haven’t.

Moving along, don’t re-invest your retirement funds just yet, but bitcoin is back over $10,000 and is currently trading for $11,300 as I write to you. Given that the price of bitcoin is a workable barometer for consumer interest, trading volume and, perhaps, development work in the crypto space, the recent market movement is good news for crypto-fans.

Turning our heads to breaking news this Friday, news was brewing that the Trump administration was looking to force ByteDance, a Chine-based mega-startup, to sell the U.S. operations of TikTok, the super-popular social app.

- How? When? We don’t know, but the political and economic situation between the United States and China is getting worse, not better. How you feel about that will depend on your politics.

There were 25 equity-only rounds of $50 million or more in the last week, 22 if you strip out private equity-led rounds and post-IPO investments. That’s a little over $2.6 billion in late-stage capital collected by Crunchbase in a single week. No matter what you might hear from startups stuck on the wrong side of the COVID-19 divide, money is still flowing and quickly.

- Ro’s $200 million deal valuing the firm at $1.5 billion was just the fourth largest deal of the week, by our count. Traveloka, Thrive Earlier Detection and Ascendant Digital, which is a SPAC and thus earns our ire instead of praise, were next in the list.

Stack Overflow’s $85 million round was the tenth largest deal of the week. Damn.

Other rounds you may have missed: $33 million for San Mateo-based Helix, Argo AI is now worth $7.5 billion after its most recent fundraising, $11 million for Brazil-focused wealth manager Magnetis, $16 million for construction-tech company Buildots and $20 million for Instrumental, my favorite round of the week,

Investment into AI-focused startups suffered in Q2, but descended from all-time highs so the numbers were still pretty ok.

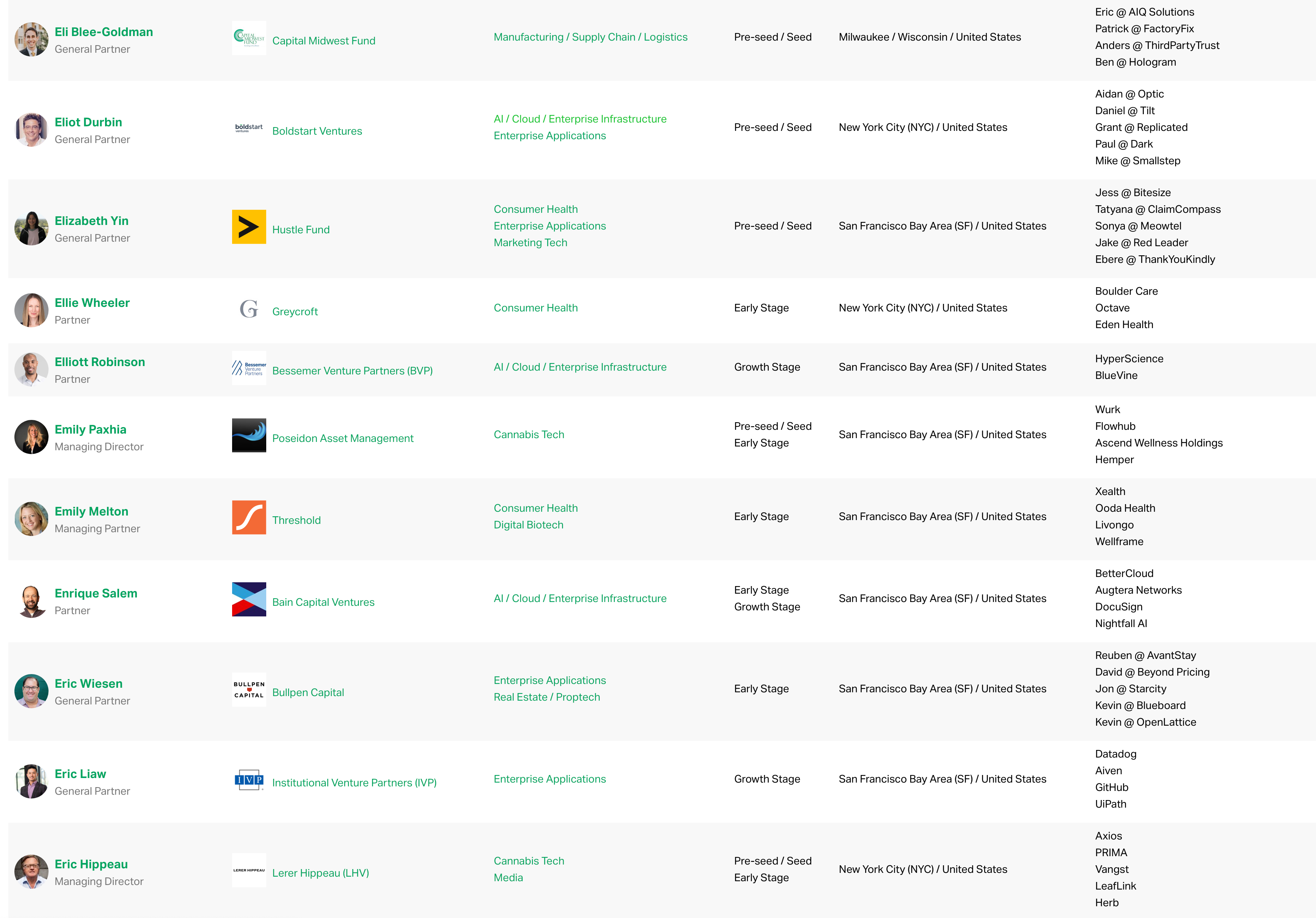

On the VC topic, TechCrunch’s own Danny Crichton (he’s on the podcast with me every week) has updated the TechCrunch list with another 116 VCs that are willing to write first checks. The project has been oceans of work, so please do check it out if you have the time, or are looking to fundraise.

Various and Sundry

And, to wrap up, as always, here’s a collection of data, news and other miscellania that is worth your time from this super insane week:

- DocSend data underscores that Q2 VC was not a flop. (Q2 VC coverage from The Exchange this week can be found here.)

- This is a hell of a look from the Facebook board.

- Startup crowdfunding site Republic looks back on “4 years, 200 companies, $150 million, and 700,000 members.”

- The Exchange is still digging into no-code, and low-code startups.

- PwC data on tech deal volume shows a slow Q2, while “July is off to a strong start.”

- Chorus.ai raised $45 million for its sales-tech service, claiming to have tripled its revenue in 2019. Does anyone have a more recent result for the company?

- Continuing our research-and-data-dump, this set of notes from Dave Kellogg on “Are We Due for a SaaSacre?” is worth your time.

- I teamed up with TechCrunch’s Lucas Matney to ask investors about investing in remote-work startups today.

Moving toward the close, Redpoint VP Jamin Ball is writing a series on cloud/SaaS that I’m reading here and there. Take a peek.

And, speaking of VCs out there doing my job, Floodgate partner Iris Choi (an Equity regular) does frequent live streams that she calls Market Musings that I try to snag when I can. It’s always interesting to hear how people with more money than I do think about the market as they are ever-so-slightly more invested in its outcomes.

Excuse the pun, give yourself a hug for making it through the week, make sure to hit up the latest Equity episode and let’s all go for a run. — Alex

Powered by WPeMatico