The last few years haven’t proven too friendly to hardware companies in the augmented reality world. Enterprise-centric efforts like ODG, Daqri and Meta flared out, Magic Leap raised massive amounts of cash only to scale back its dreams this year in the face of looming disaster and just about every other hardware player has suffered some form of an identity crisis. As someone who covers the space closely, this has led me to keep an eye on companies I’ve covered that seem to have been a bit quiet.

Over the past three years, every few months or so, I’d check in on the AR startup Mira just to see if they had any updates. I met with them in 2017 after they announced they’d raised funding from Sequoia, notable as one of that firms few public AR/VR investments. Back then, Mira pitched its device as a Google Cardboard for AR, something that could give people a lightweight introduction to the world of augmented reality. They teased both workplace and at-home use cases, but there was an early skew toward approaching developers building consumer apps.

Over on Extra Crunch, read about why the first wave of AR hardware companies died and what the next generation of startups need to do to succeed.

The company has been keeping a pretty low profile since it publicly launched in 2017, but they’re finally ready to give some updates.

Mira now tells TechCrunch that they’ve raised about $10 million worth of funding over a few top-ups, which the team is collectively deeming as a seed extension round. Sequoia and SF-based Happiness Ventures led these financings, of which the startup did not break out the specific terms. The team has now raised just under $13 million to date. Mira has used this cash to refocus its business and refine its hardware.

By late-2018, the founders had decided to move their focus solely toward industrial rollouts of their headset.

“As we looked across the consumer landscape, as we looked across the industrial landscape, as we looked across government, it became very clear that where that value-driven use case is ripe today is much more in the industrial landscape,” Mira co-founder and COO Matt Stern told TechCrunch in an interview.

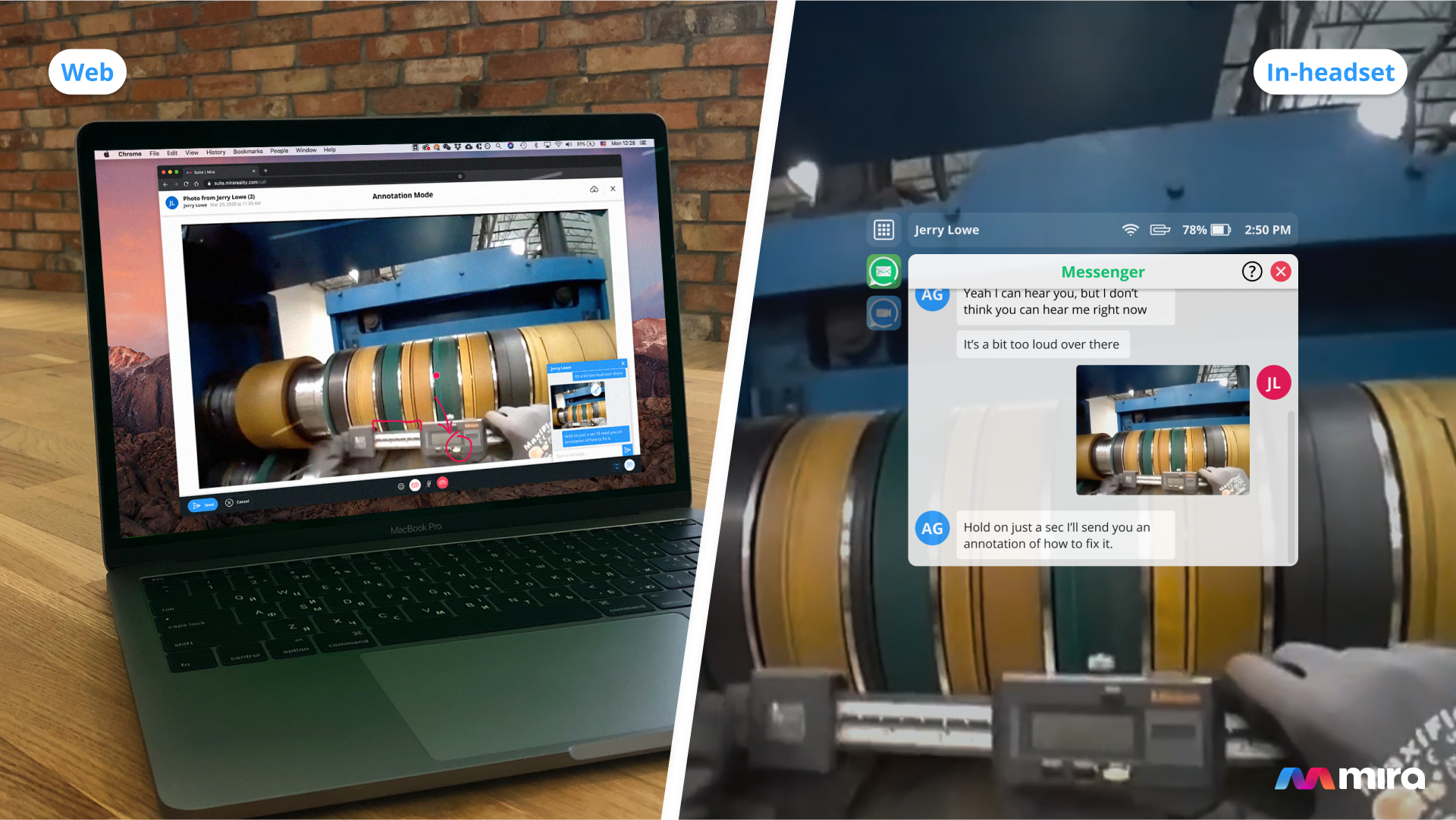

Photo via Mira.

The company’s Prism Pro headset sidesteps the technical complexity that has been a major stumbling block for previous entrants in the space that have struggled with their devices holding up in the field. Mira’s device is about as simple as the task requires, integrating a slot-in design for users to pop in an older-generation iPhone and physically connect it to a head-mounted camera that allows workers to scan items and markers. There are a number of advantages to this type of device. It’s cheaper, it’s simpler to operate and it’s easier to integrate into a company’s enterprise device management structure.

Compared to the experience a worker might get with a HoloLens, there’s a much lower ceiling to the capabilities of these devices. The Prism Pro hardware eschews what some consider “true AR” capabilities, dumping spatial tracking and mapping, and opting instead to augment your vision with a heads-up display window. The added camera is for scanning items, not generating depth maps so that holograms can be projected onto a space’s geometry, i.e. there are no floating whales to be had here. This isn’t a dramatic rethinking of the future of work so much as it’s a rethinking of form factors already being used; it’s a tablet for your face that you can control with taps and your gaze.

The AR world is still certainly a rough place to be building a startup, but Mira’s founders feel good about where the company has ended up after refocusing on manufacturing, especially within the competitive landscape.

“I can’t confirm this because I don’t work at Magic Leap, but we have literally onboarded more customers to our platform that are using our device every single day than companies like Magic Leap that have raised literally hundreds of times our funding,” CEO Ben Taft tells TechCrunch. “And it’s just been by trying to grow a business in a conservative manner and actually keeping up with the rate of adoption.”

Powered by WPeMatico