Even as hundreds of millions of people in India have a bank account, only a tiny fraction of this population invests in any financial instrument.

Fewer than 30 million people invest in mutual funds or stocks, for instance. In recent years, a handful of startups have made it easier for users — especially the millennials — to invest, but the figure has largely remained stagnant.

Now, an Indian startup believes that it has found the solution to tackle this challenge — and is already seeing good early traction.

Nishchay AG, former director of mobility startup Bounce, and Misbah Ashraf, co-founder of Marsplay (sold to Foxy), founded Jar earlier this year.

The startup’s eponymous six-month-old Android app enables users to start their savings journey for as little as 1 Indian rupee.

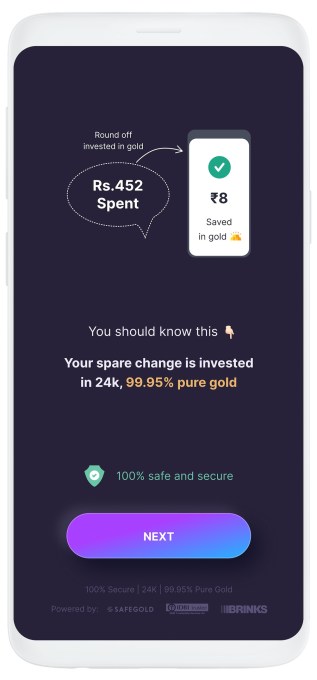

Users on Jar can invest in multiple ways and get started within seconds. The app works with Paytm (PhonePe support is in the works) to set up a recurring payment. (The startup is the first to use UPI 2.0’s recurring payment support.) They can set up any amount between 1 Indian rupee to 500 for daily investments.

The Jar app can also glean users’ text messages and save a tiny amount based on each monetary transaction they do. So, for instance, if a user has spent 31 rupees in a transaction, the Jar app rounds that up to the nearest tenth figure (40, in this case) and saves nine rupees. Users can also manually open the app and spend any amount they wish to invest.

Once users have saved some money in Jar, the app then invests that into digital gold.

The startup is using gold investment because people in the South Asian market already have an immense trust in this asset class.

India has a unique fascination for gold. From rural farmers to urban working class, nearly everyone stashes the yellow metal and flaunts jewelry at weddings.

Indian households are estimated to have a stash of over 25,000 tons of the precious metal whose value today is about half of the country’s nominal GDP. Such is the demand for gold in India that the South Asian nation is also one of the world’s largest importers of this precious metal.

Jar’s Android app (Image Credits: Jar)

“When you’re thinking about bringing the next 500 million people to institutional savings and investments, the onus is on us to educate them on the efficacies of the other instruments that are in the market,” said Nishchay.

“We want to give them the instrument they trust the most, which is gold,” he said. The startup plans to eventually offer several more investment opportunities, he said.

The founders met several years ago when they were exploring if MarsPlay and Bounce could have any synergies. They stayed in touch and, last year during one of their many conversations, realized that neither of them knew much about investments.

“That’s when the dots started to connect,” said Misbah, drawing stories from his childhood. “I come from a small town in Bihar called Bihar Sharif. During my childhood days, I saw my family deeply troubled with debt because of poor financial decisions and no savings,” he said.

“We both understand what a typical middle class family goes through. Someone who comes from this background never had any means in the past but their aspirations are never-ending. So when you start earning, you immediately start to spend it all,” said Nishchay.

“The market needs products that will help them get started,” he said.

That idea, which is similar to Acorn and Stash’s play in the U.S. market, is beginning to make inroads. The app has already amassed about half a million downloads, the founders said. Investors have taken notice, too.

On Wednesday, Jar announced it has raised $4.5 million from a clutch of high-profile investors, including Arkam Ventures, Tribe Capital, WEH Ventures, and angels including Kunal Shah (founder of CRED), Shaan Puri (formerly with Twitch), Ali Moiz (founder of Stonks), Howard Lindzon (founder of Social Leverage), Vivekananda Hallekere (co-founder of Bounce), Alvin Tse (of Xiaomi) and Kunal Khattar (managing partner at AdvantEdge).

“Over 400 million Indians are about to embrace digital financial services for the first time in their lives. Jar has built an app that is poised to help them — with several intuitive ways including gamification — start their investment journey. We love the speed at which the team has been executing and how fast they are growing each week,” said Arjun Sethi, co-founder of Tribe Capital, in a statement.

Transactions and AUM on the Jar app are surging 350% each month, said Nishchay. The startup plans to broaden its product offerings in the coming days, he said.

Powered by WPeMatico