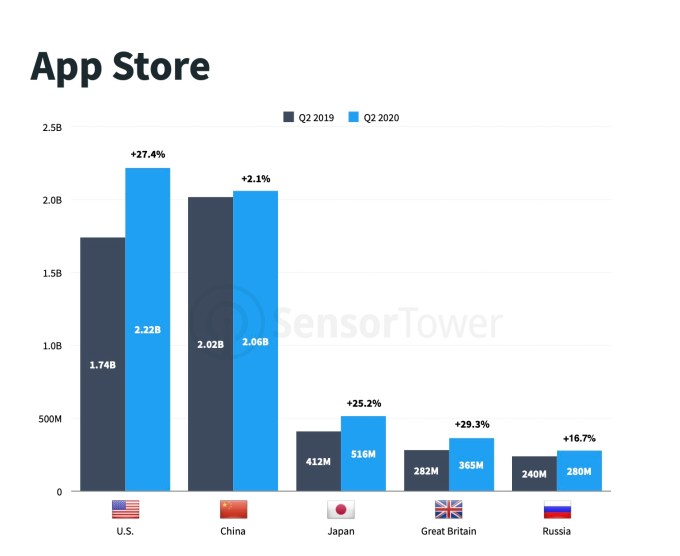

The U.S. App Store’s downloads have surpassed China’s downloads for the first time since 2014. According to data from Sensor Tower’s Q2 2020 report, out today, the U.S. App Store saw 27.4% year-over-year growth in the quarter, compared to the 2.1% growth for the China App Store. During the quarter, the U.S. App Store generated 2.22 billion new installs compared with China’s 2.06 billion downloads, to regain the top position. This then translated to the U.S. beating China on App Store consumer spend, as well.

Contributing to the shift was the impact of the coronavirus pandemic on both China and the U.S.

The U.S. surpassed China on installs beginning in April and lasting all the way through June, the firm found.

China in Q2, meanwhile, was coming down from its own abnormally high number of downloads in March and April, due to COVID-19. But as its download figures began to normalize, the pandemic was wreaking havoc in the U.S., where it hit slightly later.

This led to the U.S. to see a surge in downloads, as suddenly the population was forced to work from home, attend school from home and entertain themselves at home with apps, games and streaming services.

Image Credits: Sensor Tower

Sensor Tower tells TechCrunch there was particularly significant growth in U.S. business and education apps in Q2, as a result. These categories were the largest contributors to the U.S. surpassing China’s installs.

Business app downloads grew 133.3% in Q2, followed by education (84.4%), health & fitness (57.7%), news 44.9%) and social networking (42.4%).

Image Credits: Sensor Tower

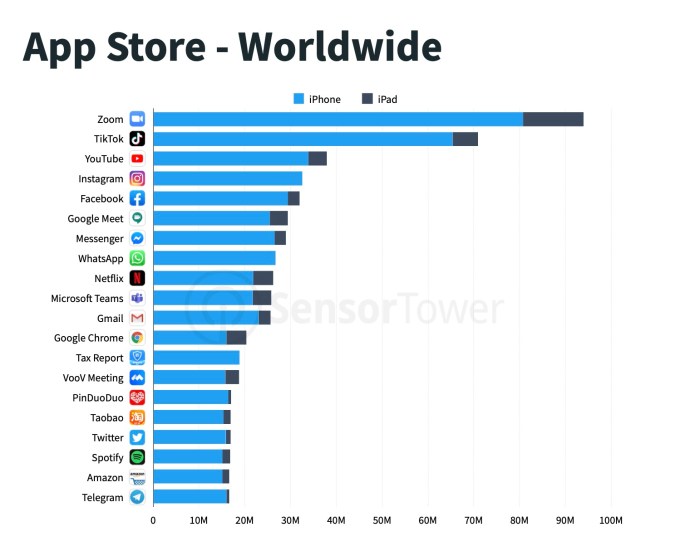

Video conferencing app Zoom, in particular, had a breakout quarter and even shattered the record for App Store installs, with nearly 94 million total downloads in a single quarter. The prior record had been set by TikTok, which had in Q1 2020 seen 67 million downloads in a single quarter. No other non-game app has ever surpassed 50 million installs in a quarter, Sensor Tower noted.

TikTok still had a strong Q2, with nearly 71 million App Store downloads in the quarter, representing 154% year-over-year growth. Its top two download markets were both the U.S. and China — the latter where it’s known as Douyin.

Image Credits: Sensor Tower

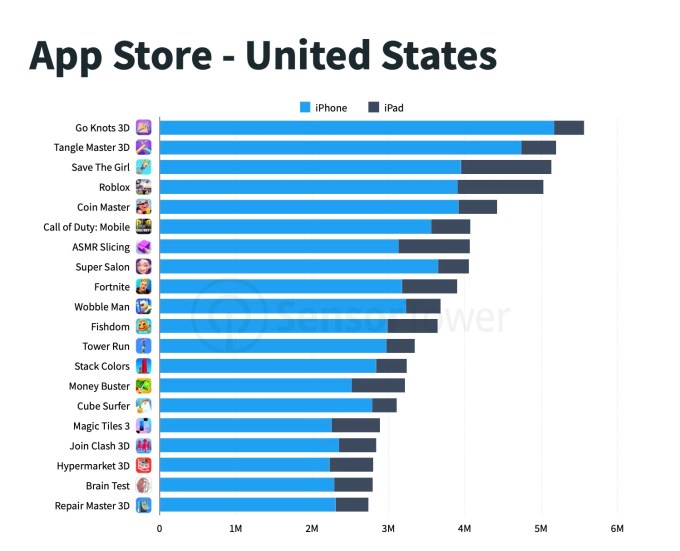

Mobile gaming was also a big hit in the U.S., as people stayed home under government lockdowns. Top mobile games by App Store downloads included titles like Save The Girl, Roblox, Go Knots 3D, Coin Master, Tangle Master 3D, Fishdom, ASMR Slicing, Call of Duty: Mobile and others.

On this front, Roblox had a stellar quarter as kids stayed at home and went online gaming, due to being disconnected from school and their playmates in real life. Roblox’s gaming app shot up the U.S. rankings from No. 11 in Q1 2020 to No. 2 in Q2, and achieved a new high of 8.6 million downloads in the quarter.

Rollic Games had two hits in the quarter, Go Knots 3D and Tangle Master 3D, each with over 5 million App Store downloads. Its Repair Master 3D title also came in at No. 20.

Both Zoom and Rollic Games were the only new top publishers to find themselves in the top 10 on the App Store in Q2, the report found.

Image Credits: Sensor Tower

Though the U.S. surpassed China in the quarter for the first time in years, the rest of the top five — Japan, Great Britain and Russia — remained the same as last quarter, though growing on a year-over-year basis.

Related to the surge of new downloads, the U.S. also surpassed China on consumer spending on the App Store for the first time since Q4 2018 — but that was only by 1.6% (around $53 million). In Q2 2020, the U.S. surpassed China by 14%, or about $717 million.

The U.S. also saw more significant quarter-over-quarter growth in spending during the COVID-19 outbreak, growing 20% between Q1 and Q2. In China, the consumer spending growth on the App Store was just 5% between Q4 2019 and Q1 2020, when it felt the full impact of the virus.

Powered by WPeMatico