Foldables! Two, probably! Those are your headliners. Samsung tipped its hand with the event invite, which features a pair of geometrical objects that pretty clearly represent the new Galaxy Z Fold and Galaxy Z Flip.

The other headliner is what we won’t be seeing at the event (Deadliner? Endliner?). The company already confirmed via corporate blog that we won’t be seeing the next version of the Galaxy Note next week. That’s a big break from the device’s long-standing annual refresh cycle.

We still don’t know if this is the end-end of the line for the phablet. Samsung told TechCrunch, “We will not be launching new Galaxy Note devices in 2021. Instead, Samsung plans to continue to expand the Note experience and bring many of its popular productivity and creativity features, including the S Pen, across our Galaxy ecosystem. We will share more details on our future portfolio once we are ready to announce.”

Image Credits: Samsung

Rumors surfaced prior to this revelation that the company may have been forced to put the device on hold, as global supply chain issues continue to hamstring manufacturers. There’s also an argument to be made, however, that Samsung has gradually made the Note redundant over the past several Galaxy S updates.

It seems telling that the company referred to a forthcoming “flagship” in its official Unpacked copy. With the Note out of the picture and the Galaxy S about six months out from a refresh, this appears to refer to the Galaxy Fold gaining the (admittedly ceremonial) title. Whether that means two or three flagships in the company’s Armada remains to be seen.

What we do know, however, is that — like the Galaxy S before it — at least one of the forthcoming foldables will be blurring that Note line.

“I hope you’ll join us as we debut our next Galaxy Z family and share some foldable surprises — including the first-ever S Pen designed specifically for foldable phones,” the company’s president and head of Mobile Communications Business, TM Roh wrote. The executive also promised “even more refined style, armed with more durable, stronger material” on the new Galaxy Z Flip.

Previous — and subsequent — leaks have given us good looks at both the Galaxy Z Flip 3 and Galaxy Z Fold 3. Hell, it wouldn’t be a Samsung event if pretty much everything didn’t leak out prior to the event.

A series of tweets from EVLeaks has given us nearly every angle of the upcoming foldable smartphones, along with (European) prices that put the Fold and Flip starting at €1,899 and €1,099, respectively. Both mark a sizable decrease from the previous generation. That’s nice — if not entirely surprising. Samsung’s plan all along has clearly been a prolonged drop in pricing as foldable technology scaled. We’re still a long ways away from cheap here, but perhaps nudging our way toward the realm of possibility for more users.

Other leaked details for the Fold/Flip include a 7.6/6.7-inch internal display, a Snapdragon 888 processor (both) and 12MP triple/dual cameras, respectively. Interestingly, water resistance is also reportedly on board here.

With a year of virtual events under its belt, the company seems to have a better idea of pacing. Samsung — along with many other companies in the space — took liberties when events went more from in-person to online, meting out announcements event by event. Thankfully, next week’s Unpacked is a much bigger, self-contained event.

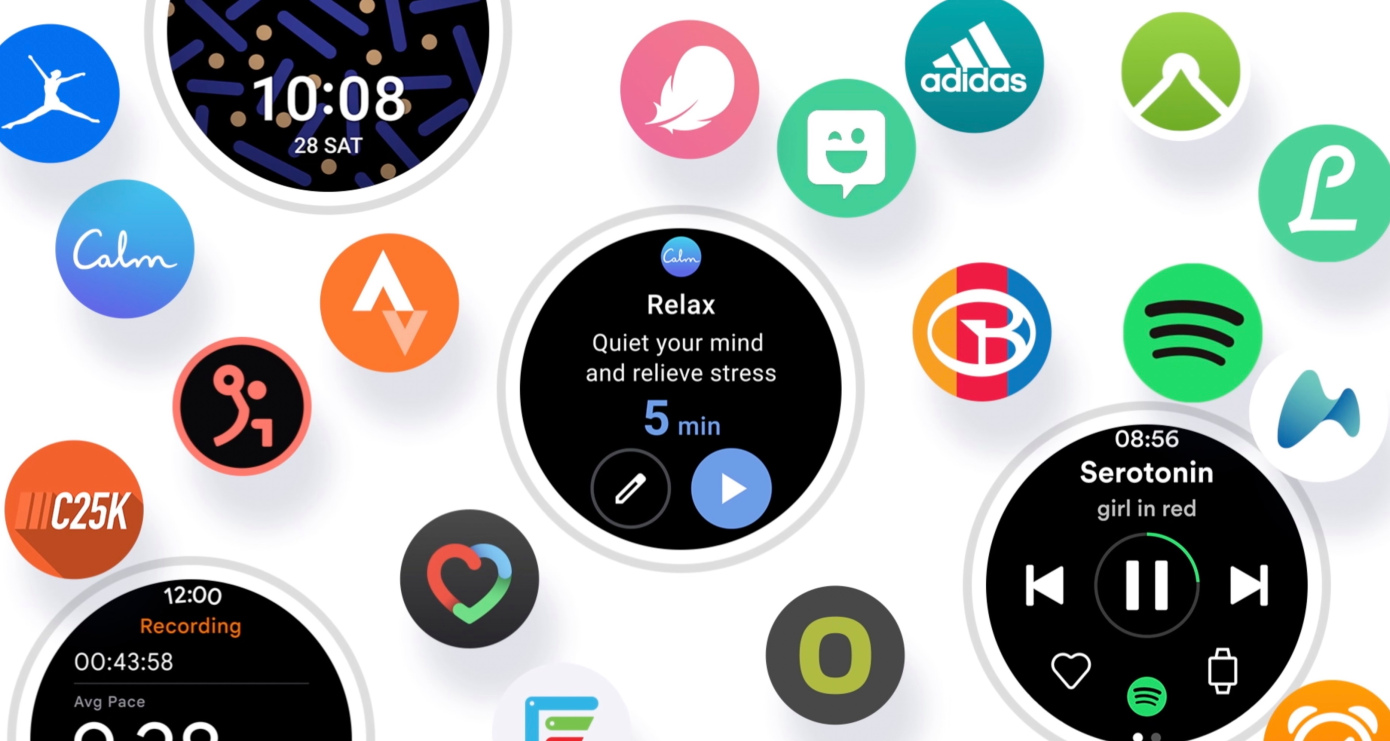

The other expected highlights are both wearables. First is the long-awaited fruits of the partnership between Samsung and Google that was announced at I/O. We didn’t get a lot of info at the time, beyond the fact that it will potentially be a boon for users and developers, with the ability to jointly create apps for both the beleaguered Wear OS and Samsung’s custom brand of Tizen.

Image Credits: Samsung

“Samsung and Google have a long history of collaboration, and whenever we’ve worked together, the experience for our consumers has been dramatically better for everyone,” Google SVP Sameer Samat said at a June follow-up to the I/O news. “That certainly holds true for this new, unified platform, which will be rolling out for the first time on Samsung’s new Galaxy Watch. In collaboration with Samsung, we’re thrilled to bring longer battery life, faster performance and a wide range of apps, including many from Google to a whole new wearable experience.”

The company held an (admittedly disappointing) event at MWC focused on the forthcoming watch. There was, however, one key thing missing: the watch. Based on pure speculation, I’d suggest that the wearable just didn’t come together on the timeline Samsung was expecting, but the company went ahead and did a virtual presser at the (mostly virtual) trade show.

The company did, however, announced One UI Watch — a wearable version of its streamlined OS interface. Samsung notes in a press release:

One UI Watch together with the new unified platform will create an entirely new Galaxy Watch experience. As part of the new experience, once you install watch-compatible apps on your smartphone, they will be swiftly downloaded onto your smartwatch. If you’ve customized your clock app on your phone to show the time in different cities around the globe, this will be automatically reflected on your watch as well. And if you block calls and messages from your watch, they will now be blocked on your smartphone, too.

Leaks have also revealed the Galaxy Watch 4 and Galaxy Watch 4 Classic models along with (again) European pricing. They’re reportedly set to start at €279 and €379, respectively, with each featuring multiple sizing options. That last bit was always a sticking point for me with Samsung watches, which have traditionally been fairly massive, knocking out a good number of potential buyers in the process.

The last big piece of the puzzle are the Galaxy Buds 2. The latest upgrade to the company’s entry-level buds are said to be gaining active noise canceling.

Will there be surprises once things kick off at 7AM PT/10AM ET on August 11? Little, ones, probably. These leaks have a tendency to capture things in broad strokes but miss some of the key nuances in the process. And while the company is more than a little familiar with pre-show leaks, it’s still managed to surprise us in the past.

Powered by WPeMatico