The payments space — amazingly — remains up for grabs for startups. Yes, dear reader, despite the success of Stripe, there seems to be a new payments startup virtually every other day. It’s a mess out there! The accelerated growth of e-commerce due to the pandemic means payments are now a booming space. And here comes another one, with a twist.

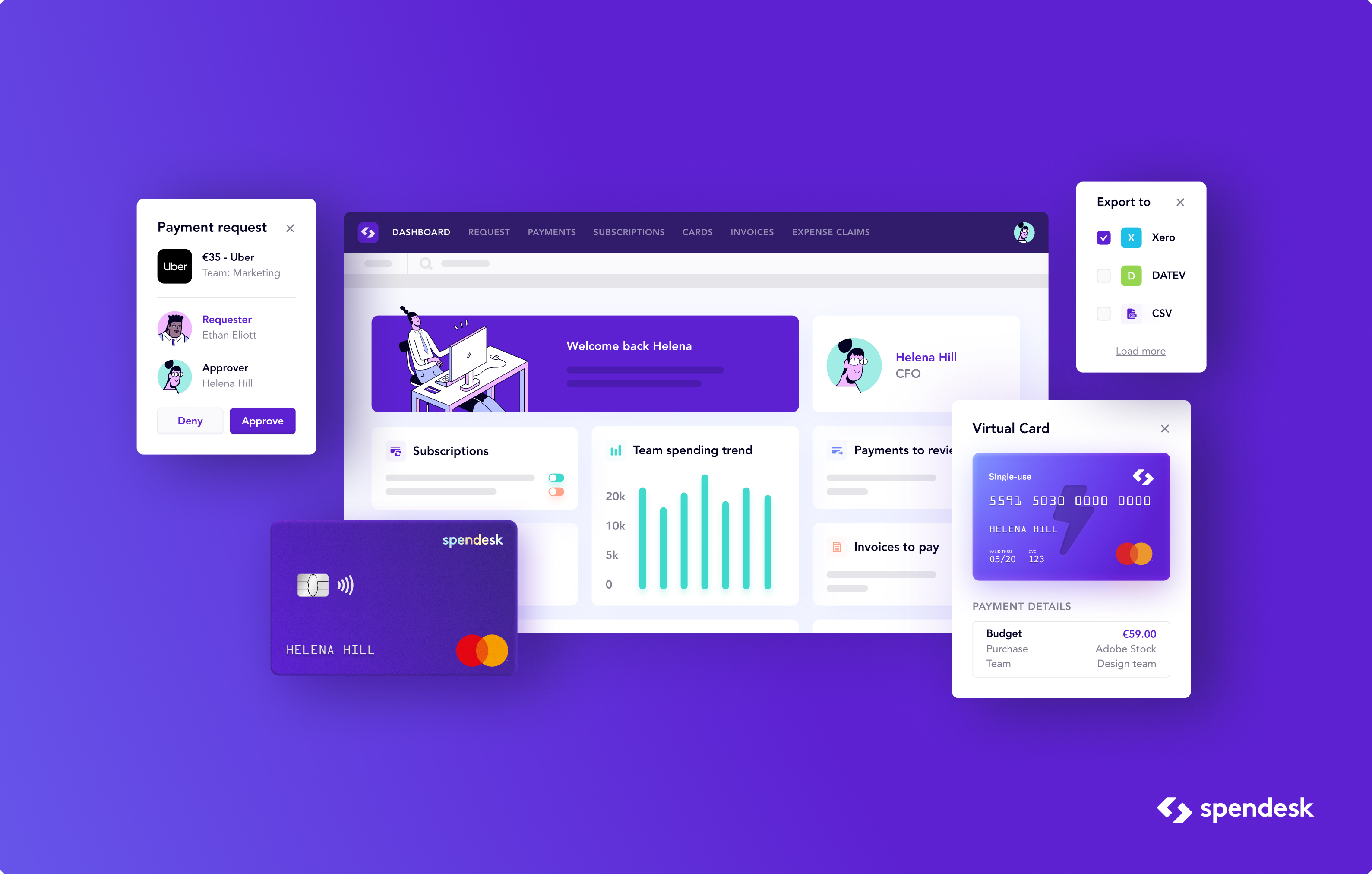

WhenThen has built a no-code payment operations platform that, they claim, streamlines the payment processes “of merchants of any kind”. It says its platform can autonomously orchestrate, monitor, improve and manage all customer payments and payments ops.

The startup’s opportunity has arisen because service providers across different verticals increasingly want to get into open banking and provide their own payment solutions and financial services.

Founded six months ago, WhenThen has now raised $6 million, backed by European VCs Stride and Cavalry.

The founders, Kirk Donohoe, Eamon Doyle and Dave Brown, are three former Mastercard Payment veterans.

Based out of Dublin, CEO Donohoe told me: “We see traditional businesses embracing e-comm, and e-comm merchants now operating multiple business models such as trade supply, marketplace, subscription, and more. There is no platform that makes it easy for such businesses to create and operate multiple payment flows to support multiple business models in one place — that’s where we step in.”

He added: “WhenThen is helping e-commerce digital platforms build advanced payment flows and payment automation, in minutes as opposed to months. When you start to integrate different payment methods, different payment gateways, how you want the payment to move from collection through to payout gets very, very complex. I’ve been doing this for over a decade now, as an entrepreneur building different businesses that had to accept, collect and pay payments.”

He said his founding team “had to build very complex payment flows for large merchants, airlines, hotels, issuers, and we just found it was ridiculous that you have to continue to do the same thing over and over again. So we decided to come up with WhenThen as a better way to be able to help you build those flows in minutes.”

Claude Ritter, managing partner at Cavalry, said: “Basic payment orchestration platforms have been around for some time, focusing mostly on maximizing payment acceptance by optimizing routing. WhenThen provides the first end-to-end payment flow platform to equip businesses with the opportunity to control every stage of the payment flow from payment intent to payout.”

WhenThen supports a wide range of popular payment providers such as Stripe, Braintree, Adyen, Authorize.net, Checkout.com, etc., and a variety of alternative and locally preferred payment methods such as Klarna Affirm, PayPal and BitPay.

“For brave merchants considering global reach and operating multiple business models concurrently, I believe choosing the right payment ops platform will become as important as choosing the right e-commerce platform. Building your entire e-comm experience tightly coupled to a single payment processor is a hard correction to make down the line — you need a payment flow platform like WhenThen”, added Fred Destin, founder of Stride.VC.

Powered by WPeMatico