ICO services: Lots of barnacles but no whales

Nearly every aspect of the current ICO market is pay-for-play or otherwise tainted. I do not paint the industry with such a broad brush lightly but this sort of chicanery hasn’t existed since the heyday of print media when journalists – myself included – took long, convoluted trips to distant headquarters where they enjoyed, as I wrote back in 2007, “suckling on the sweet teat of junket whoredom.”

As I said in this post on payola that briefly made waves a few months ago, payola is stupid and everybody should be able to see through it. But many can’t and that’s a big problem.

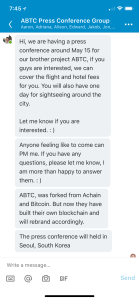

The ICO market is hot right now and there is money flowing from hand to hand in a torrent. One litigious company I spoke to took $10,000 to write a white paper and then returned a two page squib, refusing ultimately to refund a founder’s money. Another company, below, is sponsoring an all-inclusive trip to Seoul for a press conference. Other companies take $400,000 or more to manage your ICO, offering PR and services look to have been cobbled together in a rush yet promise millions in returns.

Any time there is a gold rush there are carpet baggers. Any time there is a bubble there are those who would take advantage of it. And anywhere there is a new, unregulated way to make – or raise – millions of dollars you’d better believe there is someone skimming.

Arguably not everyone knows the rules. They are, quite simply: don’t take free stuff in exchange for positive coverage and don’t take trips. Most tech journalists have a closet full of junk that needs to go back to manufacturers but they should never expect cash from a manufacturer to smooth things along. Junkets are dangerous primarily because they cloud a journalist’s judgment. You can imagine Syria sponsoring a fancy junket into its war zone to understand the extreme chilling effect and bias this would introduce.

Arguably not everyone knows the rules. They are, quite simply: don’t take free stuff in exchange for positive coverage and don’t take trips. Most tech journalists have a closet full of junk that needs to go back to manufacturers but they should never expect cash from a manufacturer to smooth things along. Junkets are dangerous primarily because they cloud a journalist’s judgment. You can imagine Syria sponsoring a fancy junket into its war zone to understand the extreme chilling effect and bias this would introduce.

Further, the other services – legal, PR, social media – that are cropping up in the market are taking a huge cut and often stand unchallenged. ICOs are hard work and very confusing. Instructions, to say the least, are unclear and anyone who has done one successfully – including this team that simulated and exit scam to send people to their ICO consultancy – is considered a global expert. It’s as if someone discovered a working Bloomberg terminal an abandoned building and then began telling everyone they could make them millions. It’s not that easy.

Ultimately these barnacles will be shaken off. TechCrunch was born out of the confusion of the second startup boom and, in turn, this created the modern VC industry, the modern pitch-off, and the accelerator. The good guys, so to speak, outnumbered the pay-for-play “incubators” and the rapacious investors and created what you see today: a tame but useful system for unlocking wealth. Now that that system has been supplanted – and make no mistake: VC is over – the new organism has its own parasites and none of them are particularly new.

This does not mean the current system is perfect. Angel funding is almost impossible to find outside of major cities. Team and a dream has been replaced by team and multi-million dollar revenue. VC has become a spectator sport and its practitioners are – or feel like – rock stars. There is plenty of nastiness in that business.

But crypto is a different beast entirely.

“Everyone I talk to in this space is corrupt,” railed one founder to me last week. He didn’t know where to turn so he did it all himself. It worked, but not without much trial and error.

Another founder is handing out legal documents his legal team produced for him because he was sick they cost so much. Given that the average equity investment in a startup requires one document and a handshake, to spend upwards of $100,000 for documentation galls. Add in an opaque, hype-filled market and a secretive investment class and you get an explosive mixture.

This will not lost. The barnacles will fall off. But until then it’s sad that such a promising technology will be tainted by the behavior of a few growth marketers who are using the techniques they learned selling penis pills to sell securities. Don’t expect financial authorities to cut these cheaters down, either. That can only be done by the market, a market that knows when enough is enough and that it shouldn’t cost dumb money to raise smart money.

You can’t pay for coverage. You shouldn’t charge to pitch. You shouldn’t make profit on wild inequity. But people will do these things and more and things will not change until the entire industry – from the founders to the service companies to the investors to the media – agrees to scrape them off.

Photo by Thomas Kelley on Unsplash

Powered by WPeMatico