Google gets slapped with $5BN EU fine for Android antitrust abuse

Google has been fined a record breaking €4.34 billion (~$5BN) by European antitrust regulators for abusing the dominance of its Android mobile operating system.

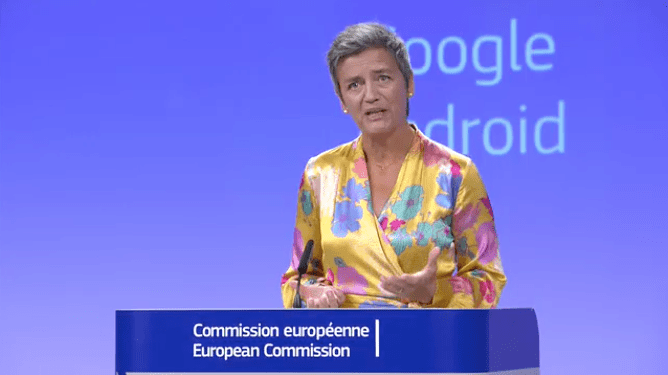

Competition commissioner Margrethe Vestager has tweeted to confirm the penalty ahead of a press conference about to take place. Stay tuned for more details as we get them.

Fine of €4,34 bn to @Google for 3 types of illegal restrictions on the use of Android. In this way it has cemented the dominance of its search engine. Denying rivals a chance to innovate and compete on the merits. It’s illegal under EU antitrust rules. @Google now has to stop it

— Margrethe Vestager (@vestager) July 18, 2018

In a longer statement about the decision, Vestager said:

Today, mobile internet makes up more than half of global internet traffic. It has changed the lives of millions of Europeans. Our case is about three types of restrictions that Google has imposed on Android device manufacturers and network operators to ensure that traffic on Android devices goes to the Google search engine. In this way, Google has used Android as a vehicle to cement the dominance of its search engine. These practices have denied rivals the chance to innovate and compete on the merits. They have denied European consumers the benefits of effective competition in the important mobile sphere. This is illegal under EU antitrust rules.

In particular, the EC has decided that Google:

- has required manufacturers to pre-install the Google Search app and browser app (Chrome), as a condition for licensing Google’s app store (the Play Store);

- made payments to certain large manufacturers and mobile network operators on condition that they exclusively pre-installed the Google Search app on their devices; and

- has prevented manufacturers wishing to pre-install Google apps from selling even a single smart mobile device running on alternative versions of Android that were not approved by Google (so-called “Android forks”).

The decision also concludes that Google is dominant in the markets for general internet search services; licensable smart mobile operating systems; and app stores for the Android mobile operating system.

During the press conference Vestager said the Commission had determined that Google had breached its competition rules with Android since 2011. (Although its press release also notes that during 2013, after being called out by the Commission, Google gradually stopped making illegal payments to device manufacturers to exclusively pre-install Google Search. “The illegal practice effectively ceased as of 2014,” it adds.)

“The decision today concludes that the restrictions Google imposed on manufacturers and network operators using Android have breached [EU] rules since 2011,” said Vestager. “First that’s because Google’s practices have denied rival search engines the possibility to compete on their merits. They made sure that Google search engine is pre-installed on practically all Android devices, which is an advantage that cannot be matched.

“And by making payments to major manufacturers and network operators on condition that no other search app or search engine was pre-installed — well, then rivals were excluded from this opportunity.”

“Google’s practices also harmed competition and further innovation in the wider mobile space, beyond just Internet search — and that’s because they prevented other mobile browsers from competing effectively with the pre-installed Google Chrome browser.

“Finally they obstructed the development of Android forks. This could have provided a platform for rival search engines as well as other app developers to thrive.”

She raised the example of Amazon’s Android fork, Fire OS, as a rival Android platform that has suffered from Google’s contractual arrangements with device manufacturers.

“In 2012 and 2013 Amazon tried to license to device manufacturers its Android fork, called Fire OS. It wanted to co-operate with manufacturers to increase its chances of commercial success. And manufacturers were interested but due to Google’s restrictions, manufacturers could not launch Fire OS on even a single device,” she said.

“They would have lost the right to sell any Android phone with key Google apps. Nowadays, very few devices run with Fire OS. Namely only those manufactured by Amazon themselves. And this is not a proportionate outcome. Google is entitled to set technical requirements to ensure that functionality and apps within its own Android ecosystem runs smoothly. But these technical requirements cannot serve as a smokescreen to prevent the development of competing Android ecosystems.

“Google cannot have its cake and eat it.”

Vestager also made a point of characterizing Google’s actions as monopolistic towards data, saying that by blocking rival apps and services it “also denied rivals access to valuable data from increased user traffic which in turn could have allowed rivals to improve their products”.

What about breaking Google up?

During the press conference she was asked several times about whether breaking up Google might not be a more effective remedy than the cease & desist decision the Commission has reached today — which hands responsibility for Google to come up with a compliance remedy for its illegal behavior with Android (albeit, subject to ongoing monitoring by the Commission).

She replied that she wasn’t sure that breaking up Google would make for an effective competition remedy, arguing there are “no silver bullets” to ensuring competitive markets.

“Here we have a decision that is very clear, which will allow mobile device producers to have a choice — that will us, as consumers, to have a choice as well. That’s what competition is about. And I think that is much more important than a discussion of whether or not breaking up a company would do that,” she said, when asked whether she would exclude the possibility of breaking up Google — so she was sidestepping a direct answer to that.

“I think what will serve competition is for more players to have a real go, to be able to reach consumers so that we can use our choice to find what suits us the best,” she added. “Test out new search engines, new browsers, have maybe a phone that works in a slightly different way [via an Android fork]… maybe the totality of the phone, in the way it was presented, that would work to allow others to compete on the merits, to show consumers what can we do, what have we invented, this is where we put our efforts, this is the that innovation we want to present for you. This I think would enable competition.”

She also emphasized the importance of passing proposed EU legislation related to transparency and fairness for businesses that are reliant on online platforms.

“I think there is a very important discussion which is to discuss how to pass the legislation that my colleagues have tabled — legislation that will ensure that you have transparency and fairness in the business to platform relationship,” she said.

“So that if you’re a business and you find that ‘oh, my traffic has stopped’, that you know why it happened, when it happened and what to do to get your traffic back…. Because this will change the marketplace, and it will change the way we are protected as consumers but also as businesses.”

Google has tweeted an initial reaction to the decision, claiming Android has created “a vibrant ecosystem, rapid innovation and lower prices”.

.@Android has created more choice for everyone, not less. #AndroidWorks pic.twitter.com/FAWpvnpj2G

— Google Europe (@googleeurope) July 18, 2018

A company spokesperson confirmed to us that it will appeal the Commission’s decision.

In a lengthy blog post response, CEO Sundar Pichai expands on the company’s argument that the Android ecosystem has “created more choice, not less” — writing for example:

Today, because of Android, there are more than 24,000 devices, at every price point, from more than 1,300 different brands,including Dutch, Finnish, French, German, Hungarian, Italian, Latvian, Polish, Romanian, Spanish and Swedish

phone makers.The phones made by these companies are all different, but have one thing in common — the ability to run the same applications. This is possible thanks to simple rules that ensure technical compatibility, no matter what the size or shape of the device. No phone maker is even obliged to sign up to these rules — they can use or modify Android in any way they want, just as Amazon has done with its Fire tablets and TV sticks.

He also has a veiled warning about the consequences should Google’s “free distribution” model for Android come unstuck, writing:

The free distribution of the Android platform, and of Google’s suite of applications, is not only efficient for phone makers and operators—it’s of huge benefit for developers and consumers. If phone makers and mobile network operators couldn’t include our apps on their wide range of devices, it would upset the balance of the Android ecosystem. So far, the Android business model has meant that we haven’t had to charge phone makers for our technology, or depend on a tightly controlled distribution model.

The fine is the second major penalty for the ad tech giant for breaching EU competition rules in just over a year — and the highest ever issued by the Commission for abuse of a dominant market position.

In June 2017 Google was hit with a then-record €2.4BN (~$2.7BN) antitrust penalty related to another of its products, search comparison service, Google Shopping. The company has since made changes to how it displays search results for products in Europe.

According to the bloc’s rules, companies can be fined 10 per cent of their global revenue if they are deemed to have breached European competition law.

Google’s parent entity Alphabet reported full year revenue of $110.9 billion in 2017. So the $5BN fine is around half of what the company could have been on the hook for if EU regulators had levied the maximum penalty possible.

“It’s a very serious illegal behavior”

The Commission said the size of the fine takes into account “the duration and gravity of the infringement”.

It also specified it had been calculated on the basis of the value of Google’s revenue from search advertising services on Android devices in the European Economic Area (per its own guidelines on fines).

Pressed during the press conference on how the Commission had determined the size of the penalty, which is double the penalty it issued in the Google Shopping case, Vestager emphasized the time period over which it had been going on, the fact of it having three components, and the effect of it, combined with Google’s rising turnover — adding finally for emphasis: “It’s a very serious infringement. It’s a very serious illegal behavior.”

Google will have three months to pay the fine but has confirmed it will appeal the decision — and legal wrangling could drag the process out for many years.

Vestager confirmed that while antitrust fines must technically be paid to the EU within the three month deadline they are placed in a closed account until the end of any appeals process — meaning the money cannot be used in the meanwhile.

So, in the Android case, the $5BN will likely be locked up until the late 2020s — assuming Google’s appeals aren’t successful. Should Google fail to overturn the Commission’s decision in the courts, Vestager said the money would be returned to EU Member States “using the same key as the contribution to the European budget”.

“You can impose a fine if someone has done someone wrong, you cannot impose a fine because you need the money. That would be wrong,” she added. “This of course means that it will take quite some time… if we win in court — and I can assure you we have done our best to make that possible — then, eventually, the money will come back to Member States to serve European citizens.”

Prior to the Commission’s record pair of fines for Google products, its next highest antitrust penalty is a €1.06BN antitrust fine for chipmaker Intel all the way back in 2009.

Yet only last year Europe’s top court ruled that the case against Intel — which focused on it offering rebates to high-volume buyers — should be sent back to a lower court to be re-examined, nearly a decade after the original antitrust decision. So Google’s lawyers are likely to have a spring in their step going into this next European antitrust battle.

The latest EU fine for Android has been on the cards for more than two years, given the Commission’s preliminary findings and consistently prescriptive remarks from Vestager during the course of what has been a multi-year investigation process.

And, indeed, given multiple EU antitrust investigations into Google businesses and business practices (the EU has also been probing Google’s AdSense advertising service — a separate investigation that Vestager today confirmed remains ongoing).

The Commission’s prior finding that Google is a dominant company in Internet search — a judgement reached at the culmination of its Google Shopping investigation last year — is also important, making the final judgement in the Android case more likely because the status places the onus on Google not to abuse its dominant position in other markets, adjacent or otherwise.

Announcing the Google Shopping penalty last summer, Vestager made a point of emphasizing that dominant companies “need to be more vigilant” — saying they have a “special responsibility” to ensure they are not in breach of antitrust rules, and also specifying this applies “in the market where it’s dominant” and “in any other market”. So that means — as here in the Android case — in mobile services too.

While a one-off financial penalty — even one that runs to so many billions of dollars — cannot cause lasting damage to a company as wealthy as Alphabet, of greater risk to its business are changes the regulators can require to how it operates Android which could have a sustained impact on Google if they end up reshaping the competitive landscape for mobile services.

In search of a remedy

At least that’s the Commission’s intention: To reset what has been judged an unfair competitive advantage for Google via Android, and foster competitive innovation because rival products get a fairer chance to impress consumers. Although it is avoiding prescribing any specific remedies — beyond telling Google to stop it.

For instance Vestager was asked whether the Commission might want Google to send push notifications to existing Android users to highlight alternatives, and thereby offer a remedy to consumers who had already been impacted by the choice constraints it placed on device makers and carriers.

“It is for Google to figure out how to lift this responsibility,” she told reporters. “It’s for them to do this… Google may make that kind of choice [i.e. sending push notifications] — on that we have taken no position.”

However the popularity and profile of Google services suggests that even if Android users are offered a choice as a result of an EU antitrust remedy — such as of which search engine, maps service, mobile browser or even app store to use — most will likely pick the Google-branded offering they’re most familiar with.

That said, the antitrust remedy could have the chance to shift consumers’ habits over time — if, for instance, OEMs start offering Android devices that come preloaded with alternative mobile services, thereby raising the visibility of non-Google apps and services. Which is clearly the Commission’s hope.

Interestingly, Google has been striking deals with Chinese OEMs in recent months — to brings its ARCore technology to markets where its core services are censored and its Play Store is restricted. And its strategy to workaround regional restrictions in China by working more closely with device makers may also be part of a plan to hedge against fresh regulatory restrictions being placed on Android elsewhere.

Complainants in the EU’s earlier Google Shopping antitrust case continue to express displeasure with the outcome of the remedies Google has come up with on that front. And in a pointed statement responding to news that another EU antitrust penalty was incoming for Android, Shivaun Raff, CEO of Foundem, the lead complainant in Google Shopping case, said: “Fines make headlines. Effective remedies make a difference.”

So the devil will be in the detail of the Android remedies that Google comes up with.

“The decision requires Google to bring its illegal conduct to an end within 90 days in an effective manner,” said Vestager today. “At a minimum, our decision requires Google to stop and not to re-engage in the three types of restrictions that I have described. In other words our decision stops Google from controlling which search and browser apps manufacturers can pre-install on Android devices, or which Android operating system they can adopt. But it is Google’s sole responsibility to make sure that it changes its conduct in a way that brings the infringements to an effective end.”

“We will monitor this very closely,” she added, warning that failure to comply would invite further penalty payments — of up to 5% of the average daily turnover of Alphabet for each day of non-compliance, back dated to when the non-compliance started. “Our decision requires Google to change the way it operates and face the consequences of its action.”

Aptoide, one of the original app store complainants — which filed an antitrust complaint with the European Commission in 2014 complaining that Google’s policies did not allow any alternative app stores which competed with the Play Store to be valid content — welcomed today’s decision, albeit cautiously, as a “positive first step”. So there’s a lot of ‘wait and see’ in the air.

CEO Paulo Trezentos told us: “The EU’s ruling justifying our antitrust arguments is a positive first step forward, for a market more open, more competitive and better tailored for the users. It is these types of decisions that push industries to bigger levels and we hope that this will help everyone evolve.”

On the Google Shopping compliance front, Vestager had some additional words of warning for Google — saying: “We have not yet taken a position on whether Google has complied with the decision. And since we haven’t done so this remains very much an open question.”

She also said the Commission is continuing to investigate other elements of Google’s business practices related to other vertical search services.

“I cannot prejudge the outcome of these ongoing investigations,” she said, also citing the ongoing AdSense probe, and adding that they continue to be “a top priority for us”.

Android as an antitrust ‘Trojan horse’

The European Commission announced its formal in-depth probe of Android in April 2015, saying then that it was investigating complaints Google was “requiring and incentivizing” OEMs to exclusively install its own services on devices on Android devices, and also examining whether Google was hindering the ability of smartphone and tablet makers to use and develop other OS versions of Android (i.e. by forking the open source platform).

Rivals — banding together under the banner ‘FairSearch‘ — complained Google was essentially using the platform as a ‘Trojan horse’ to unfairly dominate the mobile web. The lobby group’s listing on the EU’s transparency register describes its intent as promoting “innovation and choice across the Internet ecosystem by fostering and defending competition in online and mobile search within the European Union”, and names its member organizations as: Buscapé, Cepic, Foundem, Naspers, Nokia, Oracle, TripAdvisor and Yroo.

On average, Android has around a 70-75% smartphone marketshare across Europe. But in some European countries the OS accounts for an even higher proportion of usage. In Spain, for example, Android took an 86.1% marketshare as of March, according to market data collected by Kantar Worldpanel.

In recent years Android has carved an even greater market share in some European countries, while Google’s Internet search product also has around a 90% share of the European market, and competition concerns about its mobile OS have been sounded for years.

Last year Google reached a $7.8M settlement with Russian antitrust authorities over Android — which required the company to no longer demand exclusivity of its applications on Android devices in Russia; could not restrict the pre-installation of any competing search engines and apps, including on the home screen; could no longer require Google Search to be the only general search engine pre-installed.

Google also agreed with Russian antitrust authorities that it would no longer enforce its prior agreements where handset makers had agreed to any of these terms. Additionally, as part of the settlement, Google was required to allow third parties to include their own search engines into a choice window, and to allowing users to pick their preferred default search engine from a choice window displayed in Google’s Chrome browser. The company was also required to develop a new Chrome widget for Android devices already being used in Russia, to replace the standard Google search widget on the home screen so they would be offered a choice when it launched.

A year after Vestager’s public announcement of the EU’s antitrust probe of Android, she issued a formal Statement of Objections, saying the Commission believed Google has “implemented a strategy on mobile devices to preserve and strengthen its dominance in general Internet search”; and flagging as problematic the difficulty for Android users whose devices come pre-loaded with the Google Play store to use other app stores (which cannot be downloaded from Google Play).

She also raised concerns over Google providing financial incentives to manufacturers and mobile carriers on condition that Google search be pre-installed as the exclusive search provider. “In our opinion, as we see it right now, it is preventing competition from happening because of the strength of the financial incentive,” Vestager said in April 2016.

Google was given several months to respond officially to the antitrust charges against Android — which it finally did in November 2016, having been granted an extension to the Commission’s original deadline.

Thriving competition?

In its rebuttal then, Google argued that, contrary to antitrust complaints, Android had created a thriving and competitive mobile app ecosystem. It further claimed the EU was ignoring relevant competition in the form of Apple’s rival iOS platform — although iOS does not hold a dominant marketshare in Europe, nor Apple have a status as a dominant company in any EU markets.

Google also argued that its “voluntary compatibility agreements” for Android OEMs are a necessary mechanism for avoiding platform fragmentation — which it said would make life harder for app developers — as well as saying its requirement for Android OEMs to use Google search by default is effectively its payment for providing the suite for free to device makers (given there is no formal licensing fee for Android).

It also couched “free distribution is an efficient solution for everyone” — arguing it lowers prices for phone makers and consumers, while “still letting us sustain our substantial investment in Android and Play”.

In addition, Google sought to characterize open source platforms as “fragile” — arguing the Commission’s approach risked upsetting the “balance of needs” between users and developers, and suggesting their action could signal they favor “closed over open platforms”.

During today’s press conference, Vestager was asked whether she has concerns that the costs of handsets might rise should Google respond to the antitrust remedy by deciding to charge a licensing fee for OEMs to use Android, instead of distributing it for free.

She pointed to the revenue Google generates via the Play Store. “The revenue made from that is quite substantial so I think there is still a possibility for Google to recoup the investment made in developing the Android operating system,” she suggested.

“I think a number of different choices can be made by Google and it is for Google to make these choices,” she added. “What we see in general is that competition makes prices come down, gives you better choices. So you can have a theory that prices will come up, it is as likely that prices will come down because of more competition. The thing is now it’s open — there can be competition as to how this should work. And that’s the very point of the decision.”

Powered by WPeMatico