The fintech endgame: New supercompanies combine the best of software and financials

If money is the ultimate commodity, how can fintechs — which sell money, move money or sell insurance against monetary loss — build products that remain differentiated and create lasting value over time?

And why are so many software companies — which already boast highly differentiated offerings and serve huge markets— moving to offer financial services embedded within their products?

A new and attractive hybrid category of company is emerging at the intersection of software and financial services, creating buzz in the investment and entrepreneurial communities, as we discussed at our “Fintech: The Endgame” virtual conference and accompanying report this week.

These specialized companies — in some cases, software companies that also process payments and hold funds on behalf of their customers, and in others, financial-first companies that integrate workflow and features more reminiscent of software companies — combine some of the best attributes of both categories.

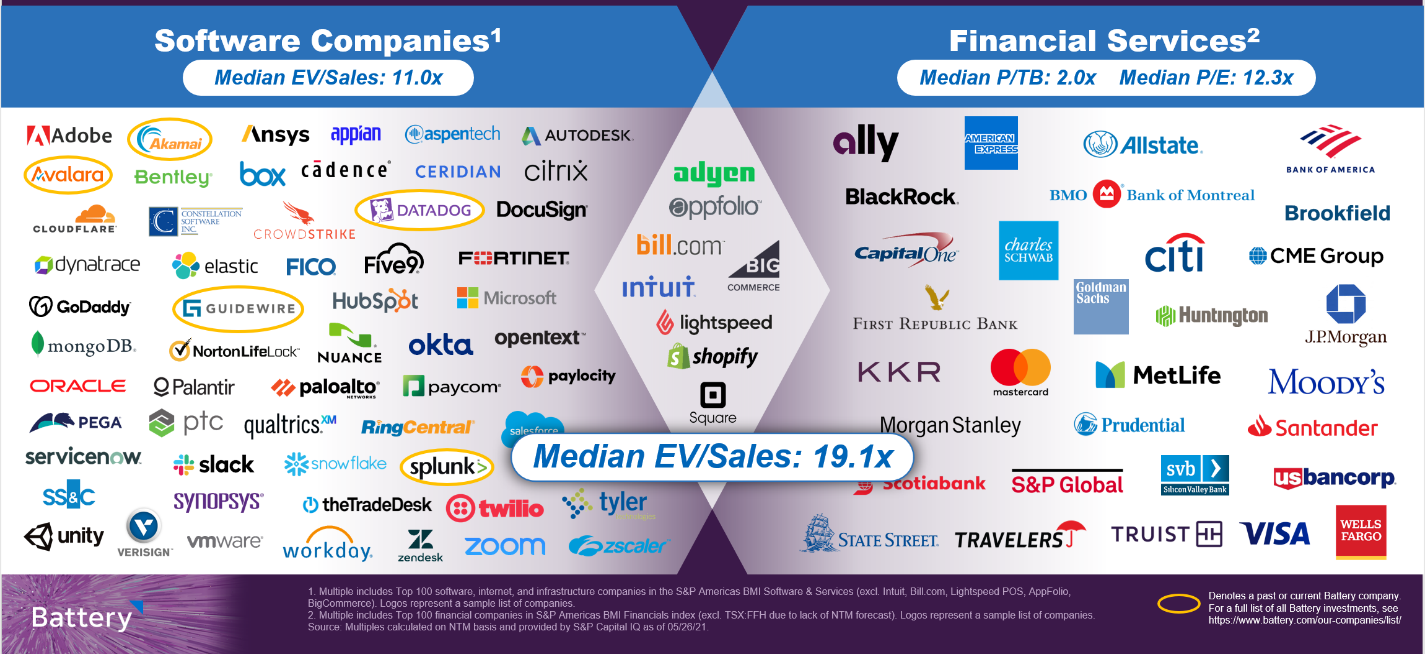

Image Credits: Battery Ventures

From software, they design for strong user engagement linked to helpful, intuitive products that drive retention over the long term. From financials, they draw on the ability to earn revenues indexed to the growth of a customer’s business.

Fintech is poised to revolutionize financial services, both through reinventing existing products and driving new business models as financial services become more pervasive within other sectors.

The powerful combination of these two models is rapidly driving both public and private market value as investors grant these “super” companies premium valuations — in the public sphere, nearly twice the median multiple of pure software companies, according to a Battery analysis.

The near-perfect example of this phenomenon is Shopify, the company that made its name selling software to help business owners launch and manage online stores. Despite achieving notable scale with this original SaaS product, Shopify today makes twice as much revenue from payments as it does from software by enabling those business owners to accept credit card payments and acting as its own payment processor.

The combination of a software solution indexed to e-commerce growth, combined with a profitable payments stream growing even faster than its software revenues, has investors granting Shopify a 31x multiple on its forward revenues, according to CapIQ data as of May 26.

How should we value these fintech companies, anyway?

Before even talking about how investors should value these hybrid companies, it’s worth making the point that in both private and public markets, fintechs have been notoriously hard to value, fomenting controversy and debate in the investment community.

Powered by WPeMatico