Snapchat launches ‘instant’ tool for creating vertical ads

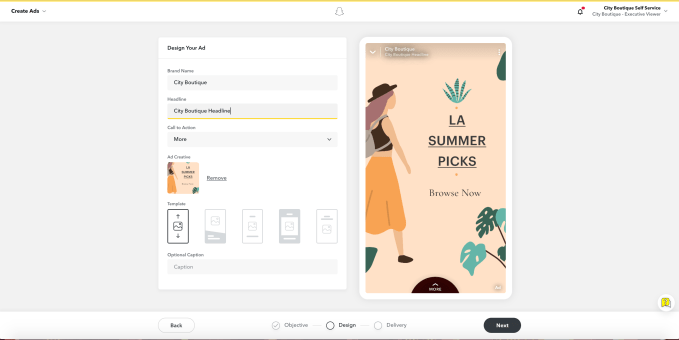

Snapchat is hoping to attract new advertisers (and make advertising easier for the ones already on the platform) with the launch of a new tool called Instant Create.

Some of these potential advertisers may not be used to creating ads in the smartphone-friendly vertical format that Snapchat has popularized, so Instant Create is designed to make the process as simple as possible.

Executives at parent organization Snap discussed the tool during last week’s earnings call (in which the company reported that its daily active users increased to 203 million).

“Just this month we started testing our new Instant Create on-boarding flow, which generates ads for businesses in three simple steps from their existing assets, be it their app or their e-commerce storefront,” said CEO Evan Spiegel.

Now the product is moving from testing to availability for all advertisers using Snapchat’s self-serve Ads Manager.

Those three steps that Spiegel mentioned involve identifying the objective of a campaign (website visits, app installs or app visits), entering your website address and finalizing your audience targeting.

You can upload your creative assets if you want, but that’s not required, as Instant Create will also import images from your website. And Snap notes that you won’t need to do any real design work, because there’s “a streamlined ad creation flow that leverages our most popular templates and simplified ad detail options, enabling you to publish engaging creative without additional design resources.”

The goal is to make Snapchat advertisers accessible to smaller advertisers who may not have the time or resources to try to understand new ad formats. After all, on that same earnings call, Chief Business Officer Jeremi Gorman said, “We believe the single biggest driver for our revenue in the short to medium term will be increasing the number of active advertisers using Snapchat.”

Instant Create is currently focused on Snapchat’s main ad format, Snap Ads. You can read more in the company’s blog post.

Powered by WPeMatico

NASA calls for more companies to join its commercial lunar lander program

NASA has opened up a call for companies to join the ranks of its nine existing Commercial Lunar Payload Services (CLPS) providers, a group it chose in November after a similar solicitation for proposals. With the CLPS program, NASA is buying space aboard future commercial lunar landers to deliver to the surface of the Moon its future research, science and demonstration projects, and it’s looking for more providers to sign up as lunar lander providers. Contracts could prove out to $2.6 billion and extend through 2028.

The list of nine providers chosen in November 2018 includes Astrobotic Technology, Deep Space Systems, Draper, Firefly Aerospace, Intuitive Machines, Lockheed Martin, Masten Space Systems, Moon Express and OrbitBeyond. NASA is looking to these companies, and any new firms added to the list as a result of this second call for submissions, to deliver both small and mid-size lunar landers, with the aim of delivering anything from rovers, to batteries, to payloads specific to future Artemis missions with the aim of helping establish a more permanent human presence on the Moon.

NASA’s goal in building out a stable of providers helps its Moon ambitions in a few different ways, including providing redundancy, and also offering a competitive field so they can open up bids for specific payloads and gain price advantages.

At the end of May, NASA announced the award of more than $250 million in contracts for specific payload delivery missions that were intended to take place by 2021. The three companies chosen from its list of nine providers were Astrobotic, Intuitive Machines and OrbitBeyond, although OrbitBeyond told the agency just yesterday that it would not be able to fulfill the contract awarded due to “internal corporate challenges,” and backed out of the contract with NASA’s permission.

Given how quickly one of their providers exited one of the few contracts already awarded, and the likely significant demand there will be for commercial lander services should NASA’s Artemis ambitions even match up somewhat closely to the vision, it’s probably a good idea for the agency to build out that stable of service providers.

Powered by WPeMatico

NASA taps SpaceX, Blue Origin and 11 more companies for Moon and Mars space tech

NASA has selected 13 companies to partner with on 19 new specific technology projects it’s undertaking to help reach the Moon and Mars. These include SpaceX, Blue Origin and Lockheed Martin, among others, with projects ranging from improving spacecraft operation in high temperatures to landing rockets vertically on the Moon.

Jeff Bezos-backed Blue Origin will work with NASA on developing a navigation system for “safe and precise landing at a range of locations on the Moon” in one undertaking, and also on readying a fuel cell-based power system for its Blue Moon lander, revealed earlier this year. The final design spec will provide a power source that can last through the lunar night, or up to two weeks without sunlight in some locations. It’ll also be working on further developing engine nozzles for rockets with liquid propellant that would be well-suited for lunar lander vehicles.

SpaceX will be working on technology that will help move rocket propellant around safely from vehicle to vehicle in orbit, a necessary step to building out its Starship reusable rocket and spacecraft system. The Elon Musk-led private space company will also be working with Kennedy Space Center on refining its vertical landing capabilities to adapt it to work with large rockets on the Moon, where lunar regolith (aka Moon dust) and the low-gravity, zero atmosphere environment can complicate the effects of controlled descents.

Lockheed Martin will be working on using solid-state processing to create metal powder-based materials that can help spacecraft deal better with operating in high-temperature environments, and on autonomous methods for growing and harvesting plants in space, which could be crucial in the case of future long-term colonization efforts.

Other projects will tap Advanced Space, Vulcan Wireless, Aerogel Technologies, Spirit AeroSystem, Sierra Nevada Corporation, Anasphere, Bally Ribbon Mills, Aerojet Rocketdyne, Colorado Power Electronics and Maxar; you can read about each in detail here.

NASA’s goals with these private partnerships are to both develop at speed, and decrease the cost of efforts to operate crewed space exploration, as part of its Artemis program and beyond.

Powered by WPeMatico

Inside the history of Silicon Valley labor, with Louis Hyman

As I wrote for TechCrunch recently, immigration is not an issue always associated with tech — not even when thinking about the ethics of technology, as I do here.

So when I was moved to tears a few weeks ago, on seeing footage of groups of 18 Jewish protestors link arms to block the entrances to ICE detention facilities, bearing banners reading “Never Again” in reference to the Holocaust — these mostly young women risking their physical freedom and safety to try to help the children this country’s immigration service is placing in concentration camps today, one of my first thoughts was: I can’t cover that for my TechCrunch column. It’s about ethics of course, but not about tech.

It turns out that wasn’t correct. Immigration is a tech issue. In fact, companies such as Wayfair (furniture), Amazon (web services), and Palantir (the software used to track undocumented immigrants) have borne heavy criticism for their support of and partnership with ICE’s efforts under the current administration.

And as I discussed earlier this month with Jaclyn Friedman, a leading sex ethics expert and one of the ICE protestors arrested in a major demonstration in Boston, social media technology has been instrumental in building and amplifying those protests.

But there’s more. IBM, for example, has an unfortunate and dark history of support for Nazi extermination efforts, and many recent commentators have drawn parallels between what IBM did during the Holocaust and what companies like Palantir are beginning to do now.

I say “companies,” plural, with intention: immigrant advocacy organization Mijente recently released news that Anduril, the company founded by Palmer Luckey and composed of Palantir veterans, now has a $13.5 million contract with the Marine corps for their autonomous surveillance “Lattice” towers at four different USMC bases, including one border base. Documents procured via the Freedom of Information Act show the Marines mention “the intrusion dilemma” in their justification for choosing Anduril.

So now it seems the kinds of surveillance tech we know are badly biased at best — facial recognition? Panopticon-style observation? Algorithms of various other kinds — will be put to work by the most powerful fighting force ever designed, for expanded intervention into our immigration system.

Will the Silicon Valley elite say “no”? To what extent will new protests emerge, where the sorts of people likely to be reading this writing might draw a line and make work more difficult for their peers at places like Anduril?

Maybe the problem, however, is that most of us think of immigration ethics as an issue that might touch on a small handful of particularly libertarian-leaning tech companies, but surely it doesn’t go beyond that, right? Can’t the average techie in San Francisco or elsewhere safely and accurately say these problems don’t actually implicate them?

Turns out that’s not right either.

Which is why I had to speak this week with Cornell University historian Louis Hyman. Hyman is a Professor at Cornell’s School of Industrial and Labor Relations, and Director of the ILR’s Institute for Workplace Studies, in New York. In our conversation, Hyman and I dig into Silicon Valley’s history with labor rights, startup work structures and the role of immigration in the US tech ecosystem. Beyond that, I’ll let him introduce himself and his extraordinary work, below.

Greg Epstein: I discovered your work via a piece you wrote in the Washington Post, which drew from your 2018 book, Temp: How American Work, American Business, and the American Dream Became Temporary. In it, you wrote, “Undocumented workers have been foundational to the rise of our most vaunted hub of innovative capitalism: Silicon Valley.”

And in the book itself, you write at one point, “To understand the electronics industry is simple: every time someone says “robot,” simply picture a woman of color. Instead of self-aware robots, workers—all women, mostly immigrants, sometimes undocumented—hunched over tables with magnifying glasses assembling parts, sometimes on a factory line and sometimes on a kitchen table. Though it paid a lot of lip service to automation, Silicon Valley truly relied upon a transient workforce of workers outside of traditional labor relations.”

Can you just give us a brief introduction to the historical context behind these kinds of comments?

Louis Hyman: Sure. One of the key questions all of us ask is why is there only one Silicon Valley. There are different answers for that.

Powered by WPeMatico

LG’s smartphone sales dropped another 21%

Let’s start with the good news. LG actually had a pretty good quarter (on the strength of appliance sales). The LG Home Appliance & Air Solution division made $5.23 billion for Q2. Anyone who’s been following the company for the past several years can guess where the bad news comes.

Smartphone sales dipped 21.3% year over year for the South Korean company. The culprits are as you’d expect: an overall slowing of the smartphone market, coupled with aggressive undercutting from Chinese manufacturers. Huawei seems to lead the pack on that front, with a big increase in sales, in spite of a confluence of external factors.

The smartphone unit saw an operating loss of $268.4 million, in spite of a 6.8% increase in sales from the quarter prior. LG chalks up the loss to higher marketing on new models and April’s move from Seoul to Vietnam for smartphone production for longer-term cost cutting.

In spite of this, the company says it’s still bullish about smartphone sales for Q3. “The introduction of competitive mass-tier smartphones and growing demand for 5G products are expected to contribute to improved performance in the third quarter,” it writes in an earnings release.

LG is, of course, among the first companies to release a 5G handset, with the V50 ThinQ. The next-gen wireless technology is expected to increase stagnating global smartphone sales, though much of that will depend on the speed with which carriers are able to roll it out. It seems unlikely that 5G in and of itself will be a quick or even longer-term fix for a struggling category.

Powered by WPeMatico

DigitalOcean gets a new CEO and CFO

DigitalOcean, the cloud infrastructure service that made a name for itself by focusing on low-cost hosting options in its early days, today announced that it has appointed former SendGrid COO and CFO Yancey Spruill as its new CEO and former EnerNOC CFO Bill Sorenson as its new CFO. Spruill will replace Mark Templeton, who only joined the company a little more than a year ago and who had announced in May his decision to step down for personal reasons.

“DigitalOcean is a brand I’ve followed and admired for a while — the leadership team has done a tremendous job building out the products, services and, most importantly, a community, that puts developer needs first,” said Spruill in today’s announcement. “We have a multi-billion dollar revenue opportunity in front of us and I’m looking forward to working closely with our strong leadership team to build upon the current strategy to drive DigitalOcean to the company’s full potential.”

Spruill does have a lot of experience, given that he was in CxO positions at SendGrid through both its IPO in 2017 and its sale to Twilio in 2019. He also previously held the CFO role at DigitalGlobe, which he also guided to an IPO.

In his announcement, Spruill notes that he expects DigitalOcean to focus on its core business, which currently has about 500,000 users (though it’s unclear how many of those are active, paying users). “My aspiration is for us to continue to provide everything you love about DO now, but to also enhance our offerings in a way that is meaningful, strategic and most helpful for you over time,” he writes.

Spruill’s history as CFO includes its fair share of IPOs and sales, but so does Sorenson’s. As CFO at EnerNOC, he guided that company to a sale to investor Enel Group. Before that, he led business intelligence firm Qlik to an IPO.

It’s not unusual for incoming CEOs and CFOs to have this kind of experience, but it does make you wonder what DigitalOcean’s future holds in store. The company isn’t as hyped as it once was and while it still offers one of the best user experiences for developers, it remains a relatively small player in the overall cloud game. That’s a growing market, but the large companies — the ones that bring in the majority of revenue — are looking to Amazon, Microsoft and Google for their cloud infrastructure. Even a small piece of the overall cloud pie can be quite lucrative, but I think DigitalOcean’s ambitions go beyond that.

Powered by WPeMatico

Special offer: discounted hotels and flights for Disrupt SF 2019

Disrupt San Francisco 2019 takes place on October 2-4, and we’re working every angle to make it financially accessible to as many people as possible. It starts with early-bird pricing on four types of passes for different needs and budgets. Plus, we offer discounts for students, nonprofit organizations, government employees and military personnel.

But did you know you can score discounted rates on flights and hotels for your Disrupt adventure? Yup. United Airlines offers Disrupt SF attendees discounted fares on flights to San Francisco International Airport or San Jose International Airport. Head on over to United.com and book your flight under “Advanced Search” using offer code ZFWZ101320. It’s an easy way to save.

Whether it’s just you or your entire team, you can reserve discounted hotel rooms through room blocks TechCrunch has secured at multiple hotels throughout the City by the Bay. Many of the hotels also offer special perks, including free Wi-Fi and gym access, when you book through this website. Your extras may vary depending on which hotel you choose. The supply of rooms is limited, so get booking!

Once you have your Disrupt pass and your travel reservations well in hand, you can start strategizing to make the most of your time at Disrupt SF — three short days packed with early-startup programming across four stages.

Whether on the Main stage, the Extra Crunch stage, on a panel or during a fireside chat, Disrupt speakers represent an impressive range of expertise. We’re talking up-and-coming boundary-pushers to the top players in the startup world — iconic technologists, investors and founders.

Witness the glory that is Startup Battlefield, TechCrunch’s epic pitch competition. Watch as the world’s most innovative startups launch and compete for the Disrupt Cup, investor and media love and, of course, $100,000.

Explore and network your way through Startup Alley, where you’ll find more than 1,200 startups and sponsors displaying products, platforms and services spanning the tech spectrum. While you’re there, be sure to visit the TC Top Picks, our hand-picked cadre of outstanding startups.

Want a tool that cuts through the crowds to help you meet the people who can help move your business forward? Then use CrunchMatch, the free business match-making service. It makes networking easier than ever.

Grab your discounts, people, and join us at Disrupt San Francisco 2019 on October 2-4. Buy your early-bird passes today, and then book your discounted flights and hotel rooms before they all disappear.

Is your company interested in sponsoring or exhibiting at Disrupt San Francisco 2019? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

The dreaded 10x, or, how to handle exceptional employees

The “10x engineer.” Shudder. Wince. I have rarely seen my Twitter feed unite against an idea so loudly, or in such harmony.

I refer of course to the thread last month by Accel India’s Shekhar Kirani, explaining “If you have a 10x engineer as part of your first few engineers, you increase the odds of your startup success significantly” and then going on to address, in his opinion, “How do you spot a 10x engineer?”

The resulting scorn was tsunami-like. The very concept of a 10x engineer seems so… five years ago. Since then, the Valley has largely come to the collective conclusion that 1) there is no such thing as a 10x engineer 2) even if there were, you wouldn’t want to hire one, because they play so poorly with others.

The anti-10x squad raises many important and valid — frankly, obvious and inarguable — points. Go down that Twitter thread and you’ll find that 10x engineers are identified as: people who eschew meetings, work alone, rarely look at documentation, don’t write much themselves, are poor mentors, and view process, meetings, or training as reasons to abandon their employer. In short, they are unbelievably terrible team members.

Is software a field like the arts, or sports, in which exceptional performers can exist? Sure. Absolutely. Software is Extremistan, not Mediocristan, as Nassim Taleb puts it.

Powered by WPeMatico

Vacasa to acquire Wyndham Vacation Rentals for $162M

Vacasa, a provider of vacation rental management services akin to Airbnb, has agreed to acquire Wyndham Vacation Rentals from Wyndham Destinations.

Portland-based Vacasa will pay Wyndham a total of $162 million, including at least $45 million in cash at closing and upwards of $30 million in Vacasa equity.

Vacasa, founded in 2009, has raised $207.5 million in venture capital funding to date from investors such as Assurant Growth Investing and NewSpring Capital.

Its acquisition of Wyndham Vacation Rentals will bring a number of brands, including ResortQuest, Kaiser Realty and Vacation Palm Springs, under its ownership and will expand its portfolio to include 9,000 new properties.

“We are excited to partner with the pioneering company in the short-term rental industry that helped make vacation homes popular for so many families around the world,” Vacasa founder and chief executive officer Eric Breon said in a statement. “Combining Wyndham Vacation Rentals’ decades of operational excellence with Vacasa’s next-generation technology will deliver the industry’s best vacation rental experiences.”

The deal comes amid a period of growth for the Oregon business, which says it expects to bring in more than $1 billion in gross bookings and roughly $500 million in net revenue in the next year.

The acquisition, announced this morning, is projected to close this fall.

Powered by WPeMatico

Nintendo Switch sales are up, even with new models on the way

Quarterly sales for the Switch remained brisk for Nintendo’s most recent quarterly earnings. The number made a jump from 1.88 to 2.13 million units year over year. Modest, sure, but still solid for a console that’s getting slightly long in the tooth — especially given the fact that we’ve been aware new versions are on the way.

Two were confirmed earlier this month, addressing concerns with the product. There’s the Switch Lite, a $200 version of the console ($100 less than the standard price) that swaps convertibility for portability, and a unit with longer battery life. The arrival of both will almost certainly boost sales as the company heads into the holiday season.

With the new quarter factored in, Switch sales are now at 36.9 million for the life of the product. Nintendo, meanwhile, expects total unit sales to hit 18 million for the full year. In spite of positive numbers on the console front, operating profit dropped ~10% year over year for the quarter.

The 3DS, meanwhile, while still alive, has unsurprisingly begun a death rattle, slowing to 200,000 for the quarter. Still, it was a respectable life, with more than 75 million sold over the life of Nintendo’s previous portable. Farewell, 3DS, it was a good run.

Mobile numbers saw a nice 10% bump for the quarter, and Nintendo’s got plenty of solid titles lined up for the back half of the year, so likely most aren’t too concerned by some lackluster financials this time out.

Powered by WPeMatico