Catalyst raises $15M from Accel to transform data-driven customer success

Managing your customers has changed a lot in the past decade. Out are the steak dinners and ballgame tickets to get a sense of a contract’s chance at renewal, and in are churn analysis and a whole bunch of data science to learn whether a customer and their users like or love your product. That customer experience revolution has been critical to the success of SaaS products, but it can remain wickedly hard to centralize all the data needed to drive top performance in a customer success organization.

That’s where Catalyst comes in. The company, founded in New York City in 2017 and launched April last year, wants to centralize all of your disparate data sources on your customers into one easy-to-digest tool to learn how to approach each of them individually to optimize for the best experience.

The company’s early success has attracted more top investors. It announced today that it has raised a $15 million Series A led by Vas Natarajan of Accel, who previously backed enterprise companies like Frame.io, Segment, InVision, and Blameless. The company had previously raised $3 million from NYC enterprise-focused Work-Bench and $2.4 million from True Ventures. Both firms participated in this new round.

Catalyst CEO Edward Chiu told me that Accel was attractive because of the firm’s recent high-profile success in the enterprise space, including IPOs like Slack, PagerDuty, and CrowdStrike.

When we last spoke with Catalyst a year and a half ago, the firm had just raised its first seed round and was just the company’s co-founders — brothers Edward and Kevin Chiu — and a smattering of employees. Now, the company has 19 employees and is targeting 40 employees by the end of the year.

In that time, the product has continued to evolve as it has worked with its customers. One major feature of Catalyst’s product is a “health score” that determines whether a customer is likely to grow or churn in the coming months based on ingested data around usage. CEO Chiu said that “we’ve gotten our health score to be very very accurate” and “we have the ability to take automated action based on that health score.” Today, the company offers “prefect sync” with Salesforce, Mixpanel, Zendesk, among other services, and will continue to make investments in new integrations.

One high priority for the company has been increasing the speed of integration when a new customer signs up for Catalyst. Chiu said that new customers can be onboarded in minutes, and they can use the platform’s formula builder to define the exact nuances of their health score for their specific customers. “We mold to your use case,” he said.

One lesson the company has learned is that as success teams increasingly become critical to the lifeblood of companies, other parts of the organization and senior executives are working together to improve their customer’s experiences. Chiu told me that the startup often starts with onboarding a customer success team, only to later find that C-suite and other team leads have also joined and are also interacting together on the platform.

An interesting dynamic for the company is that it does its own customer success on its customer success platform. “We are our own best customer,” Chiu said. “We login every day to see the health of our customers… our product managers login to Catalyst every day to read product feedback.”

Since the last time we checked in, the company has added a slew of senior execs, including Cliff Kim as head of product, Danny Han as head of engineering, and Jessica Marucci as head of people, with whom the two Chius had worked together at cloud infrastructure startup DigitalOcean.

Moving forward, Chiu expects to invest further in data analysis and engineering. “One of the most unique things about us is that we are collecting so much unique data: usage patterns, [customer] spend fluctuations, [customer] health scores,” Chiu said. “It would be a hugely missed opportunity not to analyze that data and work on churn.”

Powered by WPeMatico

What Huawei didn’t say in its ‘robust’ half-year results

The media has largely bought into Huawei’s “strong” half-year results today, but there’s a major catch in the report: the company’s quarter-by-quarter smartphone growth was zero.

The telecom equipment and smartphone giant announced on Tuesday that its revenue grew 23.2% to reach 401.3 billion yuan ($58.31 million) in the first half of 2019 despite all the trade restrictions the U.S. slapped on it. Huawei’s smartphone shipments recorded 118 million units in H1, up 24% year-over-year.

What about quarterly growth? Huawei didn’t say, but some quick math can uncover what it’s hiding. The company clocked a strong 39% in revenue growth in the first quarter, implying that its overall H1 momentum was dragged down by Q2 performance.

Huawei said its H1 revenue is up 23.2% year-on-year — but when you consider that Q1 revenue rose by 39%, Q2 must have been a real struggle…https://t.co/dFQo4gxEVbhttps://t.co/HABAQ6fmfK

— Jon Russell (@jonrussell) July 30, 2019

The firm shipped 59 million smartphones in the first quarter, which means the figure was also 59 million units in the second quarter. As tech journalist Alex Barredo pointed out in a tweet, Huawei’s Q2 smartphone shipments were historically stronger than Q1.

Huawei smartphones Q2 sales were traditionally much more stronger than on Q1 (32.5% more on average).

This year after Trump’s veto it is 0%. That’s quite the effect pic.twitter.com/x3dQlOePDA

— Alex B

(@somospostpc) July 30, 2019

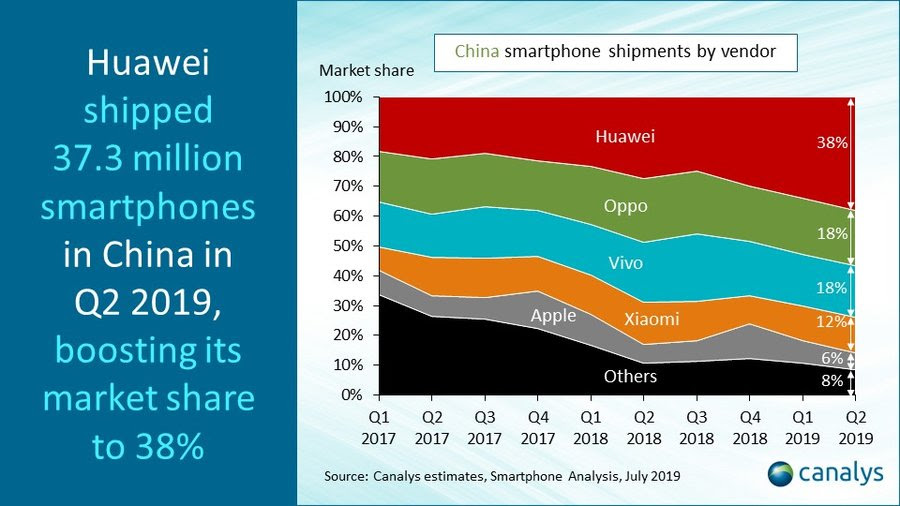

And although Huawei sold more handset units in China during Q2 (37.3 million) than Q1 (29.9 million) according to data from market research firm Canalys, the domestic increase was apparently not large enough to offset the decline in international markets. Indeed, Huawei’s founder and chief executive Ren Zhengfei himself predicted in June that the company’s overseas smartphone shipments would drop as much as 40%.

The causes are multi-layered, as the Chinese tech firm has been forced to extract a raft of core technologies developed by its American partners. Google stopped providing to Huawei certain portions of Android services, such as software updates, in compliance with U.S. trade rules. Chip designer ARM also severed business ties with Huawei. To mitigate the effect of trade bans, Huawei said it’s developing its own operating system (although it later claimed the OS is primarily for industrial use) and core chips, but these backup promises may take some time to materialize.

Consumer products are just one slice of the behemoth’s business. Huawei’s enterprise segment is under attack, too, as small-town U.S. carriers look to cut ties with Huawei. The Trump administration has also been lobbying its western allies to stop purchasing Huawei’s 5G networking equipment.

In other words, being on the U.S.’s entity list — a ban that prevents American companies from doing business with Huawei — is putting a real squeeze on the Chinese firm. Washington has given Huawei a reprieve that allows American entities to resume buying from and selling to Huawei, but the damage has been done. Ren said last month that all told, the U.S. ban would cost his company a staggering $30 billion loss in revenue.

Huawei chairman Liang Hua (pictured above) acknowledged the firm faces “difficulties ahead” but said the company is “fully confident in what the future holds,” he said today in a statement. “We will continue investing as planned – including a total of CNY120 billion in R&D this year. We’ll get through these challenges, and we’re confident that Huawei will enter a new stage of growth after the worst of this is behind us.”

Powered by WPeMatico

Confluera snags $9M Series A to help stop cyberattacks in real time

Just yesterday, we experienced yet another major breach when Capital One announced it had been hacked and years of credit card application information had been stolen. Another day, another hack, but the question is how can companies protect themselves in the face of an onslaught of attacks. Confluera, a Palo Alto startup, wants to help with a new tool that purports to stop these kinds of attacks in real time.

Today the company, which launched last year, announced a $9 million Series A investment led by Lightspeed Venture Partners . It also has the backing of several influential technology execs, including John W. Thompson, who is chairman of Microsoft and former CEO at Symantec; Frank Slootman, CEO at Snowflake and formerly CEO at ServiceNow; and Lane Bess, former CEO of Palo Alto Networks.

What has attracted this interest is the company’s approach to cybersecurity. “Confluera is a real-time cybersecurity company. We are delivering the industry’s first platform to deterministically stop cyberattacks in real time,” company co-founder and CEO Abhijit Ghosh told TechCrunch.

To do that, Ghosh says, his company’s solution watches across the customer’s infrastructure, finds issues and recommends ways to mitigate the attack. “We see the problem that there are too many solutions which have been used. What is required is a platform that has visibility across the infrastructure, and uses security information from multiple sources to make that determination of where the attacker currently is and how to mitigate that,” he explained.

Microsoft chairman John Thompson, who is also an investor, says this is more than just real-time detection or real-time remediation. “It’s not just the audit trail and telling them what to do. It’s more importantly blocking the attack in real time. And that’s the unique nature of this platform, that you’re able to use the insight that comes from the science of the data to really block the attacks in real time.”

It’s early days for Confluera, as it has 19 employees and three customers using the platform so far. For starters, it will be officially launching next week at Black Hat. After that, it has to continue building out the product and prove that it can work as described to stop the types of attacks we see on a regular basis.

Powered by WPeMatico

Huawei is shipping a lot more phones in spite of it all

There are a lot of reasons to assume Huawei’s numbers would be on the decline. Even without getting caught smack in the middle of increasing trade tensions between two superpowers, the smartphone market has been trending down for some time now. A confluence of factors have contributed, including slowed upgrade cycles and stagnate economies in both China and abroad.

The market continues to “soften” in China as early adopters await the launch of 5G before jumping on with a new handset. In spite of everything, however, Huawei appears to be the one company currently bucking the trend. And not just by a little bit, either. New numbers from Canalys put the company at a 31% year on year grown for the second quarter — a stark contrast to the 6% global decline for the category.

The company shipped 37.3 million handsets in China for Q2, with China accounting for 64% of that number. Unsurprisingly, its home market has become an increasingly important sales driver as trade blacklists and the like have barred it from sales in some overseas markets.

An interesting, if unsurprising, factor in that growth is a kind of hometown pride for the embattled brand, which sported a 38% market share for the quarter.

“[T]he US-China trade war is also creating new opportunities. Huawei’s retail partners are rolling out advertisements to link Huawei with being the patriotic choice, to appeal to a growing demographic of Chinese consumers willing to take political factors into account when making a purchase decision,” Canalys’ Mo Jia said in a release tied to the news. “Huawei itself has also been eager to give more exposure to its founder and CEO, Ren Zhengfei, to enhance its brand appeal to local consumers. At the same time, Huawei’s internal chipset and modem technologies will give it an edge over its competitors as 5G is commercialized by Chinese operators.”

That last bit means that Huawei will almost certainly see more growth in the coming years as 5G begins to roll out in China, starting this fall. This is, of course, as long as a ban on the use of American software and components don’t hamper the company entirely in the meantime.

Huawei was cautiously optimistic reporting its quarterly earnings this week. “Given the foundation we laid in the first half of the year, we continue to see growth even after we were added to the entity list,” Chairman Liang Hua said on a call. “That’s not to say we don’t have difficulties ahead. We do, and they may affect the pace of our growth in the short term.”

Powered by WPeMatico

Monday.com raises $150M more, now at $1.9B valuation, for workplace collaboration tools

Workplace collaboration platforms have become a crucial cornerstone of the modern office: workers’ lives are guided by software and what we do on our computers, and collaboration tools provide a way for us to let each other know what we’re working on, and how we’re doing it, in a format that’s (at best) easy to use without too much distraction from the work itself.

Now, Monday.com, one of the faster growing of these platforms, is announcing a $150 million round of equity funding — a whopping raise that points both to its success so far and the opportunity ahead for the wider collaboration space, specifically around better team communication and team management.

The Series D funding — led by Sapphire Ventures, with Hamilton Lane, HarbourVest Partners, ION Crossover Partners and Vintage Investment Partners also participating — is coming in at what reliable sources tell me is a valuation of $1.9 billion, or nearly four times Monday.com’s valuation when it last raised money a year ago.

The big bump is in part due to the company’s rapid expansion: it now has 80,000 organizations as customers, up from a mere 35,000 a year ago, with the number of actual employees within those organizations numbering as high as 4,000 employees, or as little as two, spanning some 200 industry verticals, including a fair number of companies that are non-technical in their nature (but that still rely on using software and computers to get their work done). The client list includes Carlsberg, Discovery Channel, Philips, Hulu and WeWork and a number of Fortune 500 companies.

“We have built flexibility into the platform,” said Roy Mann, the CEO who co-founded the company with Eran Zinman, which is one reason he believes why it’s found a lot of stickiness among the wider field of knowledge workers looking for products that work not unlike the apps that they use as average consumers.

All those figures are also helping to put Monday.com on track for an IPO in the near future, said Mann.

“An IPO is something that we are considering for the future,” he said in an interview. “We are just at 1% of our potential, and we’re in a position for huge growth.” In terms of when that might happen, he and Zinman would not specify a timeline, but Mann added that this potentially could be the last round before a public listing.

On the other hand, there are some big plans up ahead for the startup, including adding a free usage tier (to date, the only thing free on Monday.com is a free trial; all usage tiers have been otherwise paid), expanding geographically and into more languages, and continuing to develop the integration and automation technology that underpins the product. The aim is to have 200 applications working with Monday.com by the end of this year.

While the company is already generating cash and it has just raised a significant round, in the current market, that has definitely not kept venture-backed startups from raising more. (Monday.com, which first started life as Dapulse in 2014, has raised $234.1 million to date.)

Monday.com’s rise and growth are coming at an interesting moment for productivity software. There have been software platforms on the market for years aimed at helping workers communicate with each other, as well as to better track how projects and other activity are progressing. Despite being a relatively late entrant, Slack, the now-public workplace chat platform, has arguably defined the space. (It has even entered the modern work lexicon, where people now Slack each other, as a verb.)

That speaks to the opportunity to build products even when it looks like the market is established, but also — potentially — competition. Mann and Zinman are clear to point out that they definitely do not see Slack as a rival, though. “We even use Slack ourselves in the office,” Zinman noted.

The closer rivals, they note, are the likes of Airtable (now valued at $1.1 billion) and Notion (which we’ve confirmed with the company was raising and has now officially closed a round of $10 million on an equally outsized valuation of $800 million), as well as the wider field of project management tools like Jira, Wrike and Asana — although as Mann playfully pointed out, all of those could also feasibly be integrated into Monday.com and they would work better…

The market is still so nascent for collaboration tools that even with this crowded field, Mann said he believes there is room for everyone and the differentiations that each platform currently offers: Notion, he noted as an example, feels geared toward more personal workspace management, while Airtable is more about taking on spreadsheets.

Within that, Monday.com hopes to position itself as the ever-powerful and smart go-to place to get an overview of everything that’s happening, with low chat noise and no need for technical knowledge to gain understanding.

“Monday.com is revolutionizing the workplace software market and we’re delighted to be partnering with Roy, Eran, and the rest of the team in their mission to transform the way people work,” said Rajeev Dham, managing partner at Sapphire Ventures, in a statement. “Monday.com delivers the quality and ease of use typically reserved for consumer products to the enterprise, which we think unlocks significant value for workers and organizations alike.”

Powered by WPeMatico

China’s Vivo is eyeing smartphone users in Africa and the Middle East

Africa’s mobile phone industry has in recent times been dominated by Transsion, a Shenzhen-based company that is little known outside the African continent and is gearing up for an initial public offering in China. Now, its Chinese peer Vivo is following its shadow to this burgeoning part of the world with low-cost offerings.

Vivo, the world’s fifth-largest smartphone maker, announced this week that it’s bringing its budget-friendly Y series smartphones into Nigeria, Kenya and Egypt; the line of products is already available in Morocco.

It’s obvious that Vivo wants in on an expanding market as its home country China experiences softening smartphone sales. Despite a global slowdown, Africa posted annual growth in smartphone shipments last year for the first time since 2015 thanks in part to the abundance of entry-level products, according to market research firm IDC.

Affordability is the key driver for any smartphone brands that want to grab a slice of the African market. That’s what vaulted Transsion into a top dog on the continent where it sells feature phones for less than $20. Vivo’s Y series smartphones, which are priced as little as $170, are vying for a place with Transsion, Samsung and Huawei that have respective unit shares of 34.3%, 22.6% and 9.9% in Africa last year.

The Middle East is also part of Vivo’s latest expansion plan despite the region’s recent slump in smartphone volumes. The Y series, which comes in several models sporting features like the 89% screen-to-body ratio or the artificial intelligence-powered triple camera, is currently for sale in the United Arab Emirates and will launch in Saudi Arabia and Bahrain in the coming months.

Vivo’s new international push came months after its sister company, Oppo, also owned by BBK, made a similar move into the Middle East and Africa by opening a new regional hub in Dubai.

“Since our first entry into international markets in 2014, we have been dedicated to understanding the needs of consumers through in-depth research in an effort to bring innovative products and services to meet changing lifestyle needs,” said Vivo’s senior vice president Spark Ni in a statement.

“The Middle East and Africa markets are important to us, and we will tailor our approach with consumers’ needs in mind. The launch of Y series is just the beginning. We look forward to bringing our other widely popular products beyond Y series to consumers in the Middle East and Africa very soon,” the executive added.

Powered by WPeMatico

Mobile messaging financial advisory service Stackin’ adds banking features and raises cash

When Stackin’ initially pitched itself as part of the Techstars Los Angeles accelerator program two years ago, the company was a video platform for financial advice targeting a millennial audience too savvy for traditional advisory services.

Now, nearly two years later, the company has pivoted from video to text-based financial advice for its millennial audience and is offering a new spin on lead generation for digital banks.

The company has launched a new, no-fee, checking and savings account feature in partnership with Radius Bank, which offers users a 1% annual percentage yield on deposits.

And Stackin’ has raised $4 million in new cash from Experian Ventures, Dig Ventures and Cherry Tree Investments, along with supplemental commitments from new and previous investors including Social Leverage, Wavemaker Partners and Mucker Capital.

“Stackin’ has a unique and highly effective approach to connect and communicate with an entire generation of younger consumers around finance,” said Ty Taylor, group president of Global Consumer Services at Experian, in a statement.

Founded two years ago by Scott Grimes, the former founder of Uproxx Media, and Kyle Arbaugh, who served as a senior vice president at Uproxx, Stackin’ initially billed itself as the Uproxx of personal finance.

It turns out that consumers didn’t want another video platform.

“Stackin’ is fundamentally changing the shape and context of what a financial relationship means by creating a fun, inclusive and judgement free environment that empowers our users to learn and take action through messaging,” said Scott Grimes, CEO and co-founder of Stackin’, in a statement. “This funding allows us to build out new features around banking and investing that will enhance the relationship with our customers.”

Later this fall the company said it would launch a new investment feature that will encourage Stackin’ users to participate in the stock market. It’s likely that this feature will look something like the Acorns model, which encourages users to invest in diversified financial vehicles to get them acquainted with the stock market before enabling individual trades on stocks.

According to Grimes, the company made the switch from video to text in March 2018 and built a custom messaging platform on Twilio to service the company’s 500,000 users.

“In a short time, we have built a large customer base with a demographic that is typically hard to reach. Having financial institutions like Experian come on board as an investor is a testament that this model is working,” Grimes wrote in an email.

Powered by WPeMatico

Tesla has a new energy product called Megapack

Tesla has launched a new utility-scale energy storage product called Megapack modeled after the giant battery system it deployed in South Australia as the company seeks to provide an alternative to natural gas “peaker” power plants.

Megapack is the third and largest energy storage system offered by Tesla. The company also sells the residential Powerwall and the commercial Powerpack systems.

Megapack, which Tesla announced Monday in a blog post, is the latest effort by the company to retool and grow its energy storage business, which is a smaller revenue driver than sales of its electric vehicles. Of the $6.4 billion in total revenue posted in the second quarter, just $368 million was from Tesla’s solar and energy storage product business.

Tesla did deploy a record 415 megawatt-hours of energy storage products in the second quarter, an 81% increase from the previous quarter, according to Tesla’s second-quarter earnings report that was released July 24. Powerwalls are now installed at more than 50,000 sites.

The Megapack offering could provide an even bigger boost if Tesla can convince utilities to opt for it instead of the more common natural gas peaker plants used today. And it seems it already has.

Tesla’s Megapack will provide 182.5 MW of the upcoming 567 MW Moss Landing energy storage project in California with PG&E.

The so-called Megapack was specifically designed and engineered to be an easy-to-install utility-scale system. Each system comes fully assembled — that includes battery modules, bi-directional inverters, a thermal management system, an AC main breaker and controls — with up to 3 megawatt-hours of energy storage and 1.5 MW of inverter capacity.

The system includes software, developed by Tesla, to monitor, control and monetize the installations, the company said in a blog post announcing Megapack.

All Megapacks connect to Powerhub, an advanced monitoring and control platform for large-scale utility projects and microgrids, and can also integrate with Autobidder, Tesla’s machine-learning platform for automated energy trading, the company said.

Megapack was inspired by Tesla’s Hornsdale project, which combined its 100 MW Powerpack system with Neoen’s wind farm near Jamestown in South Australia. The Tesla Powerpack system stored power generated by the wind farm and then delivered the electricity to the grid during peak hours. The facility saved nearly $40 million in its first year.

Today, the go-to option for utilities are natural gas “peaker” power plants. Peaker power plants are used when a local utility grid can’t provide enough power to meet peak demand, an occurrence that has become more common as temperatures and populations rise.

Tesla hopes to be the sustainable alternative. And in states like California, which have ambitious emissions targets, Tesla could gain some ground. Instead of using a natural gas peaker plant, utilities could use the Megapack to store excess solar or wind energy to support the grid’s peak loads.

Powered by WPeMatico

With Y Combinator’s seal of approval, MyPetrolPump raises $1.6 million for its car refueling business

Even before pitching onstage at Y Combinator, Indian car refueling startup MyPetrolPump has managed to snag $1.6 million in seed financing.

The business, which is similar to startups in the U.S. like Filld, Yoshi and Booster Fuels, took 10 months to design and receive approval for its proprietary refueling trucks that can withstand the unique stresses of providing logistics services in India.

Together with co-founder Nabin Roy, a serial startup entrepreneur, MyPetrolPump co-founder and chief executive Ashish Gupta pooled $150,000 to build the company’s first two refuelers and launch the business.

MyPetrolPump began operating out of Bangalore in 2017 working with a manufacturing partner to make the 20-30 refuelers that the company expects it will need to roll out its initial services. However, demand is far outstripping supply, according to Gupta.

“We would need hundreds of them to fulfill the demand,” Gupta says. In fact the company is already developing a licensing strategy that would see it franchise out the construction of the refueling vehicles and regional management of the business across multiple geographies.

Bootstrapped until this $1.6 million financing, MyPetrolPump already has five refueling vehicles in its fleet and counts 2,000 customers already on its ledger.

These are companies like Amazon and Zoomcar, which both have massive fleets of vehicles that need refueling. Already the company has delivered 5 million liters of fuel with drivers working daily 12-hour shifts, Gupta says.

While services like MyPetrolPump have cropped up in the U.S. as a matter of convenience, in the Indian context, the company’s offering is more of necessity, says Gupta.

“In the Indian context, there’s pilferage of fuel,” says Gupta. Bus drivers collude with gas station operators to skim money off the top of the order, charging for 50 liters of fuel but only getting 40 liters pumped in. Another problem that Gupta says is common is the adulteration of fuel with additives that can degrade the engine of a vehicle.

There’s also the environmental benefit of not having to go all over to refill a vehicle, saving fuel costs by filling up multiple vehicles with a single trip from a refueling vehicle out to a location with a fleet of existing vehicles.

The company estimates it can offset 1 million tons of carbon in a year — and provide more than 300 billion liters of fuel. The model has taken off in other geographies as well. There’s Toplivo v Bak in Russia (which was acquired by Yandex), Gaston in Paris and Indonesia’s everything mobility company, Gojek, whose offerings also include refueling services.

And Gupta is preparing for the future as well. If the world moves to electrification and electric vehicles, the entrepreneur says his company can handle that transition as well.

“We are delivering a last-mile fuel delivery system,” says Gupta. “If tomorrow hydrogen becomes the dominant fuel we will do that… If there is electricity we will do that. What we are building is the convenience of last-mile delivery to energy at the doorstep.”

Powered by WPeMatico

Google teams up with VMware to bring more enterprises to its cloud

Google today announced a new partnership with VMware that will make it easier for enterprises to run their VMware workloads on Google Cloud. Specifically, Google Cloud will now support VMware Cloud Foundation, the company’s system for deploying and running hybrid clouds. The solution was developed by CloudSimple, not VMware or Google, and Google will offer first-line support, working together with CloudSimple.

While Google would surely love for all enterprises to move to containers and utilize its Anthos hybrid cloud service, most large companies currently use VMware. They may want to move those workloads to a public cloud, but they aren’t ready to give up a tool that has long worked for them. With this new capability, Google isn’t offering anything that is especially new or innovative, but that’s not what this is about. Instead, Google is simply giving enterprises fewer reasons to opt for a competitor without even taking its offerings into account.

“Customers have asked us to provide broad support for VMware, and now with Google Cloud VMware Solution by CloudSimple, our customers will be able to run VMware vSphere-based workloads in GCP,” the company notes in the announcement, which we got an early copy of but which for reasons unknown to us will only go live on the company’s blog tomorrow. “This brings customers a wide breadth of choices for how to run their VMware workloads in a hybrid deployment, from modern containerized applications with Anthos to VM-based applications with VMware in GCP.”

The new solution will offer support for the full VMware stack, including the likes of vCenter, vSAN and NSX-T.

“Our partnership with Google Cloud has always been about addressing customers’ needs, and we’re excited to extend the partnership to enable our mutual customers to run VMware workloads on VMware Cloud Foundation in Google Cloud Platform,” said Sanjay Poonen, chief operating officer, customer operations at VMware. “With VMware on Google Cloud Platform, customers will be able to leverage all of the familiarity and investment protection of VMware tools and training as they execute on their cloud strategies, and rapidly bring new services to market and operate them seamlessly and more securely across a hybrid cloud environment.”

While Google’s announcement highlights that the company has a long history of working with VMware, it’s interesting to note that at least the technical aspects of this partnership are more about CloudSimple than VMware. It’s also worth noting that VMware has long had a close relationship with Google’s cloud competitor AWS, and Microsoft Azure, too, offers tools for running VMware-based workloads on its cloud.

Powered by WPeMatico