Tesla focuses on service with 25 new service centers in Q2, rate of new openings to ‘increase’

Tesla is set to aggressively ramp up the rate at which it opens new service facilities, according to CEO Elon Musk’s guidance on the company’s Q2 2019 earnings call. In total, Tesla opened 25 new service centers during the quarter, and added 100 new service vehicles to its existing fleet — which is in contrast to an earlier statement made by Musk that they’d look to close most of their physical stores in an effort to reduce costs.

Notably, Musk referred to the locations only as “service centers” during his comments on the subject on Wednesday’s earnings call, and never as stores — asked about “retail locations,” he corrected the analyst asking and again said that what Tesla opened were “service centers” specifically. He also emphasized the importance of ensuring that service scales in line with the size of Tesla’s overall fleet of vehicles in active use. Musk mentioned that the number of Tesla cars on the road doubled in the last year alone, meaning it’s seeing exponential growth in terms of the total size of the fleet it needs to service.

“Service scales not just with new production, but as the whole fleet sales,” Musk said, adding that they want to grow their service capabilities in a way that’s responsible when it comes to cost, but that that is “quite difficult” when it comes to the rate at which the company’s sales and shipments are increasing.

Even so, Tesla is taking on still more of its service work itself, rather than outsourcing to external vendors.

“We’ve in-sourced a great deal of the collision repair activities, which I think had quite a good impact on customer happiness,” Musk said. “This will continue in the months to come.” Musk also noted that the company is working hard to reset its processes in order to ensure that parts are available on-hand when and where needed for service, which is a gap that has prompted customer complaints in the past.

The Tesla CEO said that he meets with the Tesla service team “multiple times a week” to “get updates on the reliability of the vehicle,” noting the best service possible is “no service” because that would represent maximum reliability (and of course, lowest possible ongoing costs for Tesla). He also said that they’ve seen “fewer and fewer service visits for the most recent cars that we’re building, so we’re on a good trend there.”

Jerome Guillen, President of Automotive at Tesla also noted that the number one reason for service visits is actually people looking to learn how to use Autopilot, and in general education represents a high percentage of visits.

Tesla CFO Zach Kirkhorn addressed a question about the service center expansion later in the call, adding that the company is pursuing a path of systematic “focus on service and supercharging, as opposed to a retail presence.” He also noted that he believes efforts to improve their parts distribution, with a focus on ensuring that parts are available on-hand in inventory at the service centers where they’re needed will actually help bring down costs overall versus housing them centrally or ordering on-demand from suppliers and Tesla’s own fabrication facilities.

Powered by WPeMatico

How startups can make the open office work, for employers and employees

The open office plan was intended to help collaboration and productivity across employees and teams while better utilizing less square feet per person. But the results haven’t always proven to be very successful, based on years of analysis.

Yet it is still the norm for tech companies of all sizes, and will likely stay that way.

Based on my years of experience working with hundreds of companies, I’ll lay out a basic framework below to help you think through how to adapt an open-office situation to best meet your needs.

I’ll also walk you through the example of a growing venture-backed startup that’s staffing up in one of the tougher office markets in the world: Manhattan.

But first, take a look at the data. Studies have shown that open floor plans can inhibit productivity and health. Open office workers take 62% more sick days than those in private offices, and a mere three hours of steady noise can cause measurable distress and a decrease in motivation. Face-to-face communication has been observed to actually decrease in open plan environments, with a measurable negative impact on productivity.

Considering that 70% of Americans today work in an open office, the issue of constant noise and distraction is ubiquitous across the country. The result is a bad rap—one doesn’t need to look very far to find one of the many articles online criticizing the design.

Powered by WPeMatico

Tesla has begun preparations for Model Y production at its Fremont factory

Tesla has already started the preparations required to get production started on its forthcoming Model Y compact all-electric SUV, according to Tesla CEO Elon Musk . During his introductory comments on the automaker’s Q2 2019 earnings call, Musk noted that prep had started at its facility in Fremont, confirming a report from CNBC from March.

In Tesla’s first earnings call for 2019, Musk said that it was in the process of deciding between Fremont and its Gigafactory in Nevada for production of the Model Y, which is going to be based on the Model 3 platform and will share some of its componentry, something that Musk noted will help reduce its cost of production.

The Model Y, revealed in March, looks quite similar at first glance to the Model 3. It has a slightly higher profile, however, putting it in this compact SUV range. It has similar interior features to the Model 3, including the horizontal 15-inch touchscreen, and also features a panoramic roof more like its larger Model X premium all-electric SUV sibling. Pricing for the Model Y will begin at $39,000, and that version will have a 230-mile range. It’s currently planned to ship sometime in the fall of 2020.

Tesla should be able to get to around 7,500 to 8,000 Model Ys produced at Fremont by the end of the year, Musk confirmed in response to a question from an analyst on the call.

Powered by WPeMatico

Peer-to-peer parking marketplace Rover tests monthly subscriptions

In today’s installment of “the future is 100% subscription-based,” Toronto-based startup Rover is testing out subscriptions for its parking marketplace. Rover lets users list their unused parking spots for on-demand rental by others on the service, giving them a passive way to earn some income while hopefully increasing the utilization rate of parking spaces at the same time.

Rover has offered the spots on their platform on a per-use, on-demand basis before now, but it’s going to pilot a monthly subscription starting this summer, with a planned test phase extending into early fall. The company says it’s going to try out a few different versions of a monthly sub, including potential perks like a percentage discount versus individual on-demand parking charges, advanced booking and premium customer service.

Pricing should be in the ballpark of between $5 and $15 Canadian depending on the features you’re willing to pay for, and this should inform eventual subscription price points for the startup’s services should they move beyond this pilot phase. Rover currently offers spots in Toronto, Montreal and Ottawa, with plans to expand to Canada’s west coast and eventually California in the future.

Uber recently debuted a subscription pilot that rolls in its ride-hailing, Eats, bikes and scooter rental services, and Rover cites this move as an example of the move to subscriptions generally in the on-demand space. Subscriptions are a great way for consumers to easily take care of known recurring costs, but the rise of this business model across a range of industries will definitely test the limits of consumer willingness to trade cost for convenience.

Powered by WPeMatico

Dataplor raises $2M to digitize small businesses in Latin America

There’s a gap forming in Latin America between the growing digital food delivery market and the number of businesses in the region that are actually online.

Food delivery startups continue to replicate and expand throughout the region, and VCs are channeling mega rounds into them with the hope of capitalizing on consumer online buying trends within growing digital populations.

VCs from all over the world have collectively invested billions into food delivery in the Latin American region. One of the largest rounds to date in Latin American startup history is Movile’s $400 million raise for Brazilian delivery business iFood. SoftBank recently confirmed a $1 billion investment into Colombia’s Rappi in March.

As big checks, new business models and consolidation mold a new on-demand landscape in Latin America, smaller players are coming in to supplement existing marketplaces like Rappi and iFood.

Dataplor founder and CEO Geoffrey Michener saw an opportunity to bring more vendors online. That’s why he invented Dataplor, a platform that indexes micro businesses in emerging markets. Now, Dataplor has raised a third round of seed capital, bringing the company’s total raised to $2 million. Quest Venture Partners led the company’s most recent funding, along with participation from ffVC, Magma Partners, Sidekick Fund and the Blue Startups accelerator.

What does Dataplor actually do? The 13-person company created a platform that recruits, trains and manages what has grown to more than 100,000 independent contractors — or what Dataplor calls Explorers.

Explorers are tasked with feet-on-the-street visits to businesses to capture information like latitude and longitude points, photos, hours of operation, owners’ names and contact info, and whether or not a business accepts credit cards. Dataplor then licenses that data to companies like American Express, iZettle and PayPal. Dataplor also works within a joint partnership to digitize Mexico with Google and Virket.

Michener says that 80% of Mexican businesses don’t have any digital footprint, and less than 5% of businesses have a website. This impacts the reach of what Google can index, as well as from where companies like iFood subsidiaries or Rappi can deliver.

Dataplor, founded in 2016, says it’s responsible for getting 150,000 businesses onto Google in its three years of operation. Michener says Dataplor pays Explorers above-market wages, and is careful about “not using the Uber model to drive down the cost of paying contractors.”

Michener likes to think of his business model as a trifecta of helping small businesses get onto Google for free, creating part-time opportunities for a growing workforce in LatAm and using its tech to help Google and Uber become better populated with accurate info in geos that might be more difficult for a foreign company to access.

Take Mexico for example. Michener says that 80% of Mexican businesses don’t have any digital footprint, and less than 5% of businesses have a website. This impacts the reach of what Google can index, as well as from where companies like iFood or Rappi can deliver. Basically, offline businesses are missing out on new digital distribution opportunities and, therefore, big cash.

In the United States and Europe, companies like Google and Uber scrape data from online directories in order to power their platforms. But this process works differently in Latin America. A small business’ chance of showing up in Google’s index is a lot slimmer, because most businesses are still offline in growing economies. Dataplor first launched in Mexico and bootstrapped its way into Brazil — an aggressive move for a young company due to Brazil’s competitive startup scene and Spanish-Portuguese language barriers. Dataplor says it will expand to Chile, Peru and Colombia in 2019.

Michener tested the minimum viable product by literally going on Craigslist Mexico City and sending money over PayPal to people willing to go out and gather data about small businesses. Turns out there was some traction.

What happens when all the businesses in Latin America are online? Dataplor plans to make money by licensing its data; but there’s another component to the equation. Dataplor is building a relationship with these businesses. Google will pay to know when a menu changes, hours of operation shift or a restaurant goes out of business.

Dataplor’s tech stack could pique interest for any company that wants a hand in the digitization of growing markets. Now that they’ve built a playbook for Explorer logistics, that operational piece of their business may be interesting to companies like Google, Apple and Uber too.

Powered by WPeMatico

DoorDash will change controversial tipping model

DoorDash CEO Tony Xu announced via Twitter that the company will be changing its model for compensating Dashers (a.k.a. DoorDash drivers and other delivery people).

The company faced criticism this year for its payment policies. Under the current system, a Dasher’s payment consists of a $1 base from DoorDash, the customer’s tip and — when the first two items fall below the guaranteed minimum — an additional payment boost from DoorDash.

In other words, although DoorDash insists that Dashers get to keep 100% of their tips, it starts to look like those tips are being used to subsidize payments that would otherwise come from DoorDash. (Instacart has been criticized and sued for similar practices, leading to a CEO apology and policy changes.)

Xu has defended this approach in the past. For example, when the company announced raising a $400 million round shortly after the controversy broke, he said the system was tested “not in a quarter, not in a month, but tested for months” before being implemented in 2017.

However, the issue didn’t go away. Last month, DoorDash tried to address it — not by changing the system, but by offering more transparency.

4/ Going forward, we’re changing our model – the new model will ensure that Dashers’ earnings will increase by the exact amount a customer tips on every order. We’ll have specific details in the coming days.

— Tony Xu (@t_xu) July 24, 2019

In his recent tweets, Xu insisted that the company designed the system “to prioritize transparency, consistency of earnings, and to ensure all customers get their food as fast as possible.” However, he acknowledged that DoorDash “didn’t strike the right balance.”

“We thought we were doing the right thing by making Dashers whole when a customer left no tip,” he said. “What we missed was that some customers who did tip would feel like their tip did not matter.”

So Xu said DoorDash will be changing that model. The company isn’t releasing all the details yet, but the key change is that “Dashers’ earnings will increase by the exact amount a customer tips on every order.”

Powered by WPeMatico

Revolut tweaks business accounts with new pricing structure

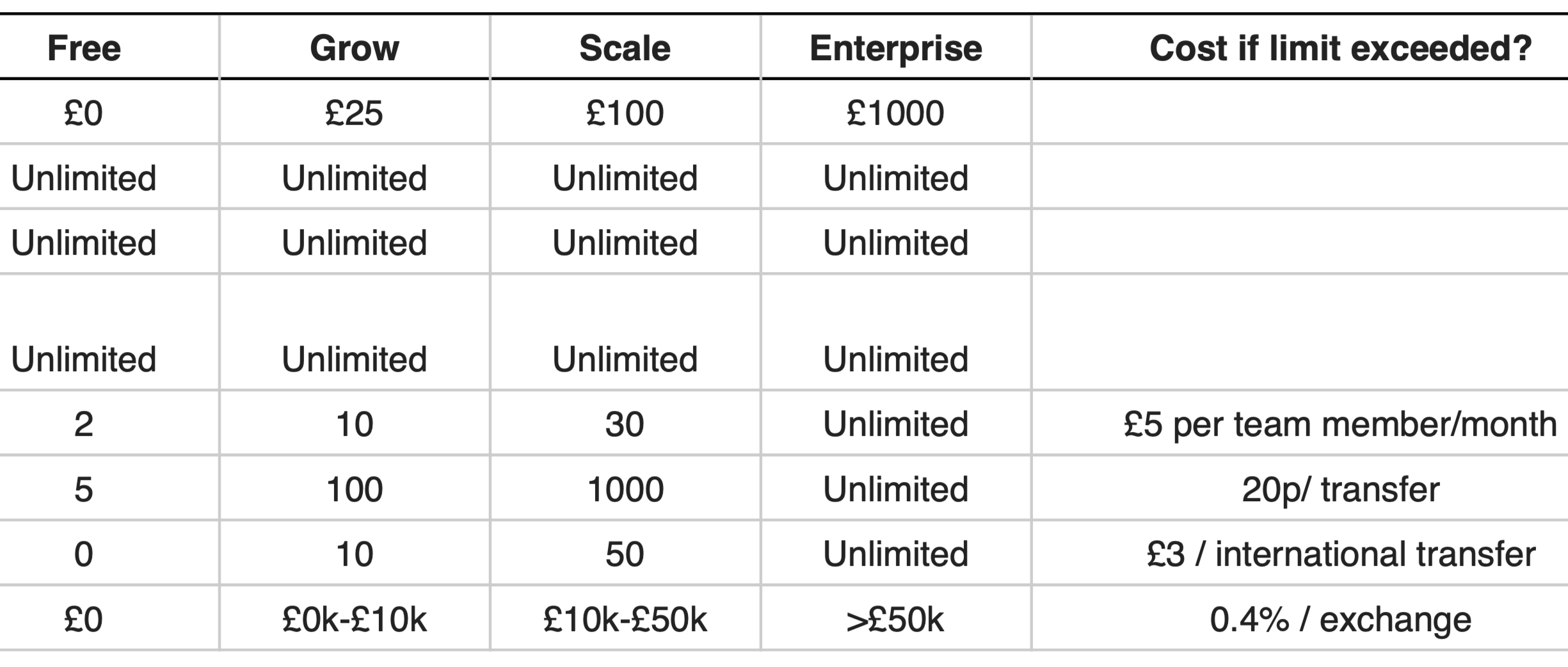

Fintech startup Revolut announced changes to its business accounts this week. The good news is that if you were thinking about trying Revolut for your business needs, it’s now cheaper to get started. But there are some limits.

While Revolut is better known for its regular consumer accounts that let you receive, send and spend money all around the world, the company has been offering launched business accounts for a couple of years.

The main advantage of Revolut for Business is that you can hold multiple currencies. If you work with clients or suppliers in other countries, you can exchange money and send it to your partners directly from Revolut’s interface.

The company also lets you issue prepaid corporate cards and track expenses. Revolut for Business also has an API so you can automate payments and connect with third-party services, such as Xero, Slack and Zapier.

None of this is changing today. Revolut is mostly tweaking the pricing structure.

Previously, you had to pay £25 per month to access the service with a £100,000 top-up limit per month. Bigger companies had to pay more to raise that ceiling.

Now, Revolut is moving a bit more toward a software-as-a-service approach. Instead of making you pay more to receive and hold more money, you pay more as your team gets bigger and you use Revolut for Business more intensively.

The basic plan is free with two team members, five free local transfers per month and 0.4% in foreign exchange fees. If you want to add more team members or initiate more transfers, you pay some small fees.

If you were paying £25 before, you can now top up as much money as you want in your Revolut account, but there are some limits when it comes to team members (10), local transfers (100 per month) and international transfers (10 per month, interbank exchange rate up to £10,000).

Once again, going over the limits doesn’t necessarily mean that you need to change to a new plan. You’ll pay £0.20 per extra local transfer, £3 per extra international transfer, etc.

Here’s a full breakdown of the new plans:

If you’re a freelancer, there’s now a free plan. You’ll pay 0.4% on foreign exchange and £3 per international transfer, but there’s no top-up limit anymore.

Similarly, the old £7 plan for freelancers has been replaced by a new £7 plan that removes the limit on inbound transfers but adds some limits on transfers.

It’s good news if you’re a small customer. But if you vastly exceed the transfer limit in one of the categories, you might pay more than before. With this change, the company wanted to make Revolut for Business more accessible instead of making small customers subsidize bigger customers with high entry pricing.

Existing customers can switch to a new plan starting today. Revolut plans to switch everyone to the new plans on October 1st, 2019.

Powered by WPeMatico

What lower Netflix pricing tells us about competing in India

At a conference in New Delhi early last year, Netflix CEO Reed Hastings was confronted with a question that his company has been asked many times over the years. Would he consider lowering the subscription cost in India?

It’s a tactic that most Silicon Valley companies have adapted to in the country over the years. Uber rides aren’t as costly in India as they are elsewhere. Spotify and Apple Music cost less than $2 per month to users in the country. YouTube Premium as well as subscriptions to U.S. news outlets such as WSJ and New York Times are also priced significantly lower compared to the prices they charge in their home turf.

Hastings had also come prepared: He acknowledged that the entertainment viewing industry in India is very different from other parts of the world. To be sure, much of the pay-TV in India is supported by ads and the access fee remains too low ($5). But that was not going to change how Netflix likes to roll, he said.

“We want to be sensitive to great stories and to fund those great stories by investing in local content,” he said. “So yes, our strategy is to build up the local content — and of course we have got the global content — and try to uplevel the industry,” he said, identifying movie-goers who spend about Rs 500 ($7.25) or more on tickets each month as Netflix’s potential customers.

Indian commuters walking below a poster of “Sacred Games”, an original show produced by Netflix (Image: INDRANIL MUKHERJEE/AFP/Getty Images)

Less than a year and a half later, Netflix has had a change of heart. The company today rolled out a lower-priced subscription plan in India, a first for the company. The monthly plan, which restricts usage of the service to mobile devices only, is priced at Rs 199 ($2.8) — a third of the least expensive plan in the U.S.

At a press conference in New Delhi today, Netflix executives said that the lower-priced subscription tier is aimed at expanding the reach of its service in the country. “We want to really broaden the audience for Netflix, want to make it more accessible, and we knew just how mobile-centric India has been,” said Ajay Arora, Director of Product Innovation at Netflix.

The move comes at a time when Netflix has raised its subscription prices in the U.S. by up to 18% and in the UK by up to 20%.

Netflix’s strategy shift in India illustrates a bigger challenge that Silicon Valley companies have been facing in the country for years. If you want to succeed in the country, either make most of your revenue from ads, or heavily subsidize your costs.

But whether finding users in India is a success is also debatable.

Powered by WPeMatico

Duo’s Wendy Nather to talk security at TC Sessions: Enterprise

When it comes to enterprise security, how do you move fast without breaking things?

Enter Duo’s Wendy Nather, who will join us at TC Sessions: Enterprise in San Francisco on September 5, where we will get the inside track on how to keep enterprise networks secure without slowing growth.

Nather is head of advisory CISOs at Duo Security, a Cisco company, and one of the most respected and trusted voices in the cybersecurity community as a regular speaker on a range of topics, from threat intelligence to risk analysis, incident response, data security and privacy issues.

Prior to her role at Duo, she was the research director at the Retail ISAC, and served as the research director of the Information Security Practice at independent analyst firm 451 Research.

She also led IT security for the EMEA region of the investment banking division of Swiss Bank Corporation — now UBS.

Nather also co-authored “The Cloud Security Rules,” and was listed as one of SC Magazine’s Women in IT Security “Power Players” in 2014.

We’re excited to have Nather discuss some of the challenges startups and enterprises face in security — threats from both inside and outside the firewall. Companies large and small face similar challenges, from keeping data in to keeping hackers out. How do companies navigate the litany of issues and threats without hampering growth?

Who else will we have onstage, you ask? Good question! We’ll be joined by some of the biggest names and the smartest and most prescient people in the industry, including Bill McDermott at SAP, Scott Farquhar at Atlassian, Julie Larson-Green at Qualtrics, Aaron Levie at Box and Andrew Ng at Landing AI and many, many more. See the whole agenda right here.

Early-bird tickets are on sale right now! For just $249 you can see Nather and these other awesome speakers live at TC Sessions: Enterprise. But hurry, early-bird sales end on August 9; after that, prices jump up by $100. Book here.

If you’re a student on a budget, don’t worry, we’ve got a super-reduced ticket for just $75 when you apply for a student ticket right here.

Enterprise-focused startups can bring the whole crew when you book a Startup Demo table for just $2,000. Each table gives you a primo location to be seen by attendees, investors and other sponsors, in addition to four tickets to enjoy the show. We only have a limited amount of demo tables and we will sell out. Book yours here.

Powered by WPeMatico

Hear Hans Vestberg talk about the 5G opportunity at Disrupt SF 2019

The promise of 5G is staggering. With its ultra-high bandwidth and low latency, it has the potential to alter how consumers interact with technology. However, questions remain around its deployment, use cases and marketing.

We’re excited to have Verizon CEO Hans Vestberg sit down for a fireside chat at Disrupt SF to talk about the telecom’s 5G efforts. Vestberg took over Verizon on the eve of 5G.

Here’s the thing: Hans Vestberg is my boss. (Technically, he’s my boss’s boss’s boss’s boss.) TechCrunch is owned by Verizon, operating under the Verizon Media Group, yet we remain editorially independent. Verizon doesn’t tell us what to write or not to write. Likewise, nothing is off-limits for this interview.

Verizon and other telecoms began rolling out the next-generation network to their subscribers this year. And the company has announced plans to launch 5G in at least 30 U.S. cities by the end of this year, even though there are limited hardware options and few marketable use cases.

How will consumers use 5G? When should startups begin building for 5G? How will Verizon educate consumers about real 5G versus fake 5G? We have questions, and we hope Vestberg has answers.

Vestberg became CEO of Verizon in August 2018, succeeding Lowell McAdam. Vestberg joined Verizon in 2017 as its CTO and VP of Network and Technology. Previously, he worked at Ericsson for 25 years, six of which he spent as CEO until he was ousted in 2016 following poor financial results.

Under McAdam, Verizon looked to media companies for additional channels for growth, notably acquiring Aol and Yahoo and merging the two into an ad-serving giant called Oath. Earlier this year Oath was renamed Verizon Media. Its future remains in question as rumors persist about Verizon wanting to spin out the division en masse or by dumping various brands like Huffpo or even TechCrunch.

Vestberg is joining Disrupt SF’s long list of speakers that includes other chief executives, such as Sebastian Thrun, Evan Spiegel, Rachel Haurwitz and many more. The three-day conference is shaping up to feature a fantastic speaker lineup covering all aspects of the startup world.

Tickets to the show, which runs October 2 to October 4 in SF, are available now.

Powered by WPeMatico