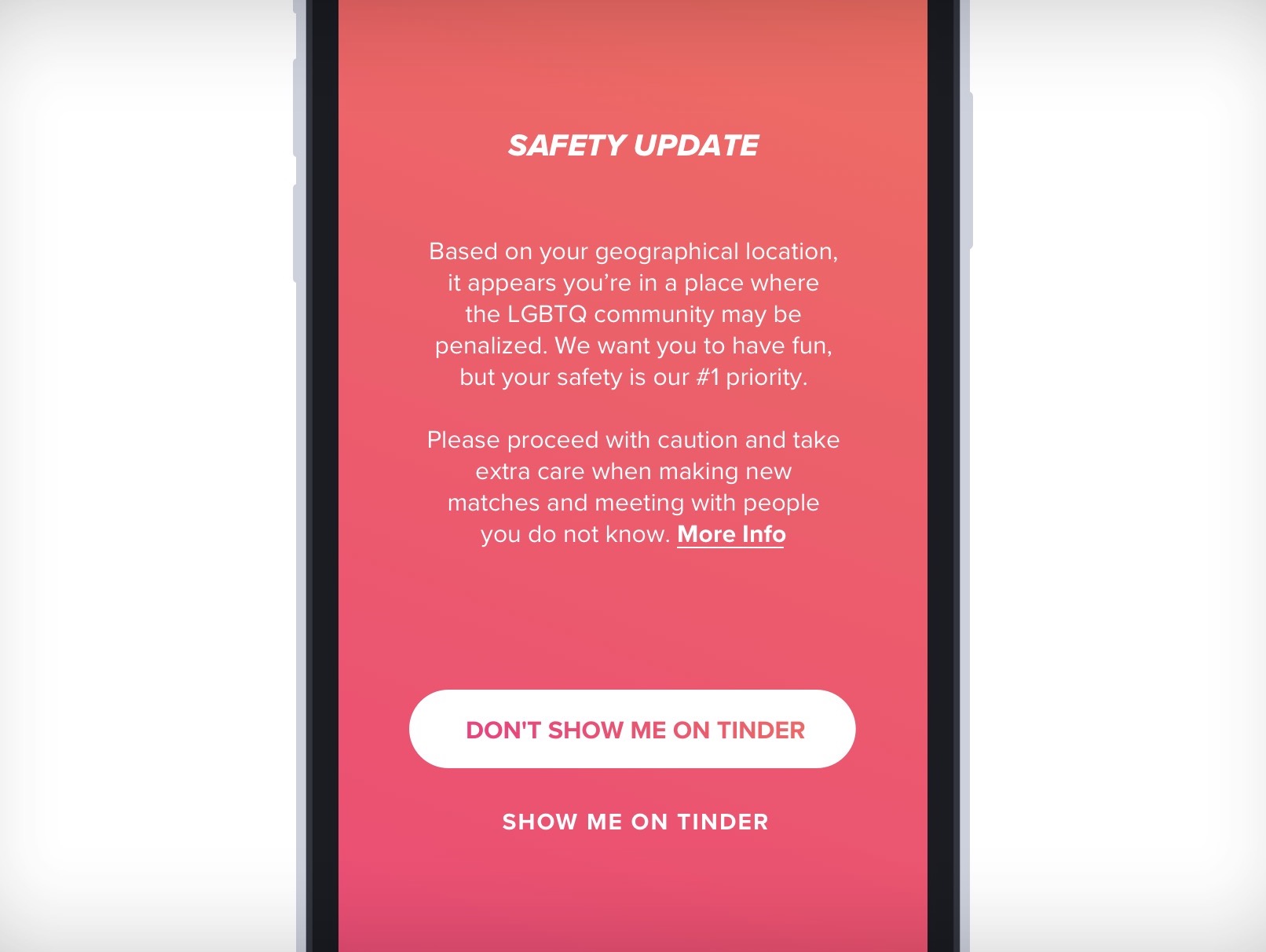

Tinder’s new personal security feature can protect LGBTQ+ users in hostile nations

A new security feature rolling out on Tinder will help protect LBGTQ+ users who travel to dozens of nations that still criminalize same-sex acts or relationships.

As part of the update, users who identify on the app as lesbian, gay, bisexual, transgender or queer will no longer automatically appear on Tinder when they arrive in an oppressive state. This feature, which Tinder dubs the Traveler Alert, relies on your phone’s network connection to determine its location. From there it will give users the choice to keep their location private. If users opt-in to make their profile public again, Tinder will hide their sexual orientation or gender identity from their profile to safeguard the information from law enforcement and others who may target them, the company said.

Once a user leaves the country or changes their location, their profile will become visible again.

“The purpose of this is to protect users who could be persecuted for their identity in these countries,” a spokesperson said.

The dating app maker, which has tens of millions of users in 190 countries, said the update will warn users when they travel to a country where same-sex relationships are punished under law to help keep “all its users safe.”

“It is unthinkable that, in 2019, there are still countries with legislation in place that deprives people of this basic right,” said Elie Seidman, Tinder’s chief executive.

Seidman said it was part of the company’s belief that “everyone should be able to love who they want to love.”

Tinder’s new Traveler Alert feature (Image: supplied)

When traveling internationally, foreign nationals have to abide by the laws of their host country — no matter how different or abhorrent the rules may be. Although LGBTQ+ rights have come a long way in recent years in many Western countries, dozens of less-progressive countries consider same-sex acts or relationships illegal.

In March, the International Lesbian, Gay, Bisexual, Trans and Intersex Association (ILGA) found 69 countries considered same-sex acts illegal — the number of countries included in the Traveler Alert — sans Botswana, which recently decriminalized same-sex relationships.

Nine of the countries, including Iran, Sudan and Saudi Arabia — a major U.S. ally in the Middle East — allow for prosecutors to pursue the death penalty against same-sex acts and relationships.

Despite a slow but promising push for equal rights, several countries have reversed course and doubled down on their laws, despite international condemnation. One such nation — Brunei, a small south Asian absolute monarchy — was forced to back down from its plans to sentence those who had gay sex to be stoned to death amid outcry from several major companies and celebrities who threatened to boycott the country.

ILGA’s executive director André du Plessis praised Tinder’s effort to warn its users.

“We work hard to change practices, laws and attitudes that put LGBTQ people at risk — including the use of dating apps to target our community — but in the meantime, the safety of our communities also depends on supporting their digital safety,” he said.

Read more:

- Jewish dating app JCrush exposed user data and private messages

- Users complain of account hacks, but OkCupid denies a data breach

- Dating apps face questions over age checks after report exposes child abuse

- Happy Valentine’s Day: your dating app account was hacked, says Coffee Meets Bagel

- Apple and Google Play remove three dating apps after FTC warning about underage users

Powered by WPeMatico

RED is working on a Hydrogen Two smartphone

In a post on RED’s message board, founder Jim Jannard reasserted the company’s commitment to the disappointing Hydrogen One handset. It’s a distant memory now, but the pricey niche device was teased and delayed for months, only to be generally run through the ringer in reviews.

The camera module was one of the various complaints about the device, and now RED’s placing the blame firmly at the feet of its ODM partner. In the post, Jannard notes that, while Foxconn has been a solid manufacturer, the design partner essentially blew it:

Our ODM, which was responsible for the mechanical packaging of our design including new technologies along with all software integration with the Qualcomm processor, has significantly under-performed. Getting our ODM in China to finish the committed features and fix known issues on the Hydrogen One has proven to be beyond challenging. Impossible actually. This has been irritating me to death and flooding our reactor.

Given the generally rough reviews for the $1,300 device, a lesser company would have no doubt abandoned the ship. Jannard and RED, however, are using the opportunity to double down. A new camera module (named “Komodo”), he notes, will be coming not only to the Hydrogen One, but a future Hydrogen Two.

“To that end,” he writes, “every Hydrogen One owner will get significant preferential treatment for the Hydrogen Two and/or new Cinema Camera model, both in delivery allocations and pricing.”

Given the time it took for the first gen to launch, it’s probably not worth holding one’s breath for the sequel. That said, the first handset is often the hardest, and creating a phone certainly presented a new paradigm for the high-end camera manufacturer, which is more accustomed to building devices in-house.

Powered by WPeMatico

Google intros Gallery Go offline photo editor

At an event this week in Nigeria, Google introduced Gallery Go, a photo management and editing tool designed for offline use. The new offering joins a suite of Google apps created specifically for users in developing markets, where solid online connections aren’t always a given.

Gallery Go works with devices running Android 8.1 (Oreo) and newer, taking up just 10 MB of storage space on a mobile device. The app uses similar machine learning tools as Google Photos to organize and manage images, but does so without requiring a constant connection. Users can create folders and access images directly from an SD card with the app.

There are a handful of simple editing tools on board as well here, including filters, auto enhance for quick fixes, rotate and crop. The app joins similar offerings from companies like Facebook, designed to open services to users in areas where handsets are prevalent computing devices, but mobile connections tend to be a bit more spotty.

It’s available now through the Play Store and will be available as the default gallery app on select devices starting next month.

Powered by WPeMatico

Nintendo Switch might soon go on sale in China via Tencent

After months of anticipation, Nintendo Switch is ready to shed more light on its China launch. The Japanese console giant and Tencent are “working diligently” to bring the Switch to the world’s largest market for video games, the partners announced on Weibo (the Twitter equivalent in China) today.

The pair did not specify a date when the portable gaming system will officially launch, as the government approval process can take months. But there are signs that things are moving forward. For example, Tencent has been given the green light to run a trial version of the New Super Mario Mario Bros. U Deluxe and a few other blockbuster titles in China.

On August 2, the partners will jointly host a press conference for Switch — no product launch yet — in Shanghai, Tencent confirmed to TechCrunch. It appears to be a strategic move that coincides with the country’s largest gaming expo China Joy beginning on the same day in the city.

Tencent and Nintendo are hosting a media event on August 2nd 2019 in Shanghai for Nintendo Switch.

Steven Ma, Senior Vice President of Tencent and Satoru Shibata, executive at Nintendo, will attend.

Should be more details of Switch launch in China. pic.twitter.com/MULC7jMSqg

— Daniel Ahmad (@ZhugeEX) July 24, 2019

Sales of Nintendo Switch in China, made possible through a distribution deal with Tencent, will likely add fuel to Nintendo’s slowing growth. It can also potentially diversify Tencent’s gaming revenues, which took a hit last year as Beijing tightened controls over online entertainment.

Switch faces an uphill battle as consoles, including Sony PS4 and Microsoft Xbox, have for years struggled to catch on in China. The reasons are multifaceted. China had banned consoles until 2014 to protect minors from harmful content. The devices are also much less affordable than mobile games, making it difficult as a form of social interaction in the mobile-first nation.

Powered by WPeMatico

LIV, a startup making VR gaming more interactive for audiences, raises $1M from Oculus founder and Seedcamp

LIV, a Prague-based company that wants to make VR gaming more fun to watch, and in turn bring players and spectators closer together, has picked up $1 million in funding. That’s a pretty modest raise as far as ambitious upstarts go — and LIV is certainly ambitious. However, the list of backers includes noteworthy names, such as the founder of Oculus (and designer of Oculus Rift), Palmer Luckey.

Other investors in LIV include Jaroslav Beck, CEO and co-founder of Beat Games (the studio behind VR streaming hit Beat Saber); early-stage VC Seedcamp; accelerator Techstars; Prague’s Credo Ventures; VR company VIVE; and mixed reality production specialist Splitverse.

Founded in 2016, LIV is betting on the premise that VR gaming represents an entirely new platform, and it is new platforms with nascent ecosystems where the biggest opportunities lie. Furthermore, while the watching of video game live streams shows no signs of abating — made popular via sites such as Twitch — the spectator experience hasn’t transitioned very gracefully to VR.

“Creating content in VR is incredibly hard, there are no tools for it, and no shareable content form factor that conveys the experience of being in VR,” says LIV co-founder AJ Shewki, who was previously a competitive gamer under the moniker “Dr Doom.”

“LIV empowers developers and content creators to grow their audience through shareable VR content. Developers integrate our SDK, and content creators are then able to create content with those games and experiences using the LIV App. The content format is called ‘Mixed Reality Capture’ (MRC).”

The “Mixed Reality Capture” experience is inevitably best watched rather than conveyed through the written word (you can see an example below). However, what MRC essentially does is inject a live video or, alternatively, a 3D avatar of the player’s body, inside the video game stream so spectators experience not only what the player sees (the classic VR first-person perspective) but can also follow the “real-world” movements the player makes to execute moves within the game. As a player moves their arms, for example, their avatar can be seen replicating the same moves based on sensor data pulled from the VR gear the player is wearing.

It is this ability to closely watch and potentially learn from the best players that has made video game streaming so popular. But, argues Shewki, the move to VR was initially a backwards step in this regard, as it required additional technology to close the gap between player and spectator.

“The LIV App gives streamers the tools to broadcast themselves as themselves, or as their favourite avatars, inside any of the 100s of games that we support. We support hundreds if not thousands of avatars, including the popular Japanese VRM avatar format,” says Shewki.

“The LIV App also brings utilities like stream chat, stream alerts, scene controls and camera controls natively into the headset using our proprietary 3D overlay system, built specifically with performance in mind (which in VR is already a scarce resource). The LIV SDK is integrated by developers to get their games LIV-ready. We support Unity, Unreal as well as custom engines, and have done integrations with all of them.”

Longer term, Shewki says he wants LIV to not only enable a better live-streaming experience but to evolve into what the company is describing as a “real-time audience interaction platform” for VR streamers and games developers. The thinking here is that spectators of VR can also become participants beyond the simple chatroom experience that exists today.

Dubbed “LIV Play” and targeting a closed alpha release by the end of the year, the idea is to give audiences the ability to influence what happens in-game and in real time, such as purchasing health potions when a player most needs them or spawning extra monsters when they least expect it.

“Our hypothesis was: If we give viewers more engaging ways to participate, as opposed to what you have today with chat, polls and donations, they will,” explains Shewki. “We ran experiments with Beat Saber where we let audiences replace cubes with bombs and do more fun donations. Our experiment results over 120 days were incredible. Week 1 and 2: 700% higher revenue/minute through higher engagement. It petered out to 300% higher rev/min at 120 days, where it’s stayed.”

In other words, take the same monetisation approach that we have seen in games like Fortnite and apply it to the audience side of live-gaming spectatorship. “Creativity is our only limit here,” enthuses Shewki.

Powered by WPeMatico

Netflix launches Rs 199 ($2.8) mobile-only monthly plan in India

Netflix has a new plan to win users in India: make the entry point to its service incredibly cheap. The streaming giant today introduced a low-priced mobile tier in the country that costs Rs 199 ($2.8) per month in a bid to take on Disney, Amazon and dozens of other aggressively priced competitors in the country.

The new subscription tier from Netflix restricts the usage of the service to one mobile device — and permits only one concurrent stream — and offers the standard definition viewing (~480p). Users also can opt to have the new plan on their tablets, but again, several features such as the ability to cast (or mirror) the content to a TV are restricted.

Netflix began testing a lower-priced subscription plan in India and some other Asian markets late last year. (During the test, Netflix charged users about $3.6 per month.) At a press conference in New Delhi, company officials said today that there is currently no plan to expand this offering to other regions. During the trial period, Netflix was also testing a weekly subscription plan; that too, is no longer being pursued, officials said.

The announcement comes days after Netflix reported that it added 2.7 million new subscribers in the quarter that ended in June this year, far fewer than the 5.1 million figure it had projected earlier this year. Jessica Lee, VP of Communications at Netflix, said the company’s recent performance in other markets did not influence its move in India.

During its earnings report, Netflix said last week that it planned to introduce a mobile-only subscription offering in India by Q3 this year. But the company has moved to make the new offering already live in the country. Previous subscription tiers that start at Rs 499 ($7.2) and go up to Rs 799 ($11.5) will continue to be offered in the country.

Mobile devices are increasingly driving media consumption in India, said Ajay Arora, director of Product Innovation at Netflix. The streaming service’s users in India have shown far richer appetite for consuming content on mobile devices than users in any other nation, he said.

India has turned into an intense battleground for video streaming services in recent years. Netflix today competes with more than three-dozen local and international players in the country. Hotstar, owned by Disney, currently leads the market with over 300 million users. The ad-supported service offers about 80% of its catalog at no cost to users. Its yearly plan, which includes titles from HBO and Showtime, is priced at Rs 999 ($14.5). Amazon Prime Video is similarly priced in India.

Indians spend 30% of their smartphone time and over 70% of their mobile data on entertainment services, a recent industry report estimated.

A cheaper plan could significantly help Netflix grow its user base in the country, analysts say. “Netflix had a good early start, but growth has been slow in the last six months given the mass Indian consumer market remains value-conscious,” Mihir Shah, vice president of research firm Media Partners Asia, told TechCrunch.

“At 200 rupees, Netflix could address a sizable target market in India. One could draw parallels from the Indian multiplex industry, which caters to 100 million consumers spending an average $4 per movie,” he added.

Netflix is estimated to have less than two million subscribers in India. However, despite its relatively smaller user base, it was the top video streaming app in the country by revenue last year, according to research firm App Annie. Research firm IHS Markit estimates that the service could scale to 4 million subscribers in the country by year-end.

At a conference last year, Netflix CEO Reed Hastings said that India could contribute as many as 100 million users to the platform in the coming years.

Netflix CEO “expects to see 100m” subscribers in India. A reminder, only ~80m Indians (top 10%) make more than $3000/yr. Even for them a $90 annual Netflix sub is well over a week’s wages. And they can get local content for basically free. So no, not 100m https://t.co/323RHe6hmS

— Stanley Pignal (@spignal) February 23, 2018

Some analysts say Netflix also needs to focus on its content catalog to make it more appealing to Indians. Hotstar has grown its business largely on top of live streaming of high-profile cricket matches. Netflix, which has produced over two-dozen titles in India to date, currently has very few titles that focus on sports.

“Netflix will need to strike the right balance of ensuring a steady supply of original local content,” Shah said.

Powered by WPeMatico

WeWork accelerates IPO plans, plots September listing

WeWork chief executive officer Adam Neumann is already rich, but soon all of the early employees and investors of the co-working giant will be too.

The business, now known as The We Company, has accelerated its plans to go public, according to a new report from The Wall Street Journal. WeWork is expected to unveil is S-1 filing next month ahead of a September initial public offering.

WeWork declined to provide comment for this story.

The New York-based company, valued at $47 billion earlier this year, has long been rumored to be plotting a massive IPO. The WSJ reports it’s now in the process of meeting with Wall Street banks to secure an asset-backed loan upwards of $6 billion in what could be an effort to downsize its upcoming stock offering. WeWork disclosed massive 2018 net losses of $1.9 billion in March on revenue of $1.8 billion. To convince Wall Street it’s a business worthy of their investment will be a challenge, to say the least. Seeking capital elsewhere ahead of the IPO manages expectations and ensures WeWork ultimately has the cash it needs to continue its global expansion. Here’s a look at WeWork’s expanding revenues and losses:

- WeWork’s 2017 revenue: $886 million

- WeWork’s 2017 net loss: $933 million

- WeWorks 2018 revenue: $1.82 billion (+105.4%)

- WeWork’s 2018 net loss: $1.9 billion (+103.6%)

WeWork has raised a total of $8.4 billion in a combination of debt and equity funding since it was founded in 2011. Its IPO is poised to become the second largest offering of the year behind only Uber, which was valued at $82.4 billion following its May IPO on the New York Stock Exchange.

WeWork is said to have initially filed paperwork with the U.S. Securities and Exchange Commission for an IPO in December, in part so it was ready to hit the public markets if other avenues for cash fell through. The business is one of several tech unicorns to attract billions from the SoftBank Vision Fund. Recently, the Japanese telecom giant eyed a majority stake in the company worth $16 billion, but scaled back their investment down to $2 billion at the last minute.

WeWork, despite mounting losses, is growing — fast. The company established a 90% occupancy rate in 2018 as membership totals rose 116%, to 401,000.

Still, whether WeWork, backed by SoftBank, Benchmark, T. Rowe Price, Fidelity and Goldman Sachs, will be able to match its $47 billion valuation when it goes public this fall is questionable. Early investors will be sure to see a nice return, but late-stage investors may be nervous about their prospects.

Neumann, for his part, has reportedly cashed out of more than $700 million from his company ahead of the IPO. The size and timing of the payouts, made through a mix of stock sales and loans secured by his equity in the company, is unusual, considering that founders typically wait until after a company holds its public offering to liquidate their holdings.

Powered by WPeMatico

Healthcare startups struggle to navigate a business world that’s set up for them to fail

Contributor

Digital health startups seem to be struggling to the point of failure. Many insights into why have addressed how technology’s traditional model of quickly putting out a minimum viable product then finding useful applications and business models isn’t working. The model might work in the general technology startup space, but it rarely goes well in the complex world of healthcare. Dr. Paul Yock, a cardiologist and founder of the Byers Center for Biodesign at Stanford University, built his brainchild program on one philosophy to help healthcare startups: need-based innovation.

Need-based innovation is a process in which problems are identified and sorted based on impact and opportunity. Once the top problem has been selected, solutions and commercialization are approached.

While I completely agree with need-based innovation, our healthcare system is set up to discourage all forms of innovation right now. We also must tackle changing the ecosystem that healthcare startups need to navigate. As a physician-innovator, I have experienced how institutional policies, hierarchical and administrator-driven systems and pilot program dynamics are creating a stunted ecosystem that is not reaching its full potential.

When approaching any stakeholder a health startup usually works with — an advisor, a healthcare system, a pilot site — the wheel often needs to be reinvented. The entrepreneur is faced with a time-consuming and costly disadvantage that frequently forces them to enter deals that hurt them. The deals also counter-intuitively hurt the stakeholder that they are bringing on board because the technologies and companies on which they are counting are set up to fail. There needs to be a clear set of rules for everyone to play by to accelerate growth, with the philosophy that “a rising tide lifts all boats.”

These are the most crushing challenges of the current ecosystem that need a hard look and innovation themselves before healthcare startups can deliver.

Challenge 1: Institutional policies and hierarchical systems stunt innovation

Many healthcare startups are born during a founder’s time at a healthcare or educational institution. The institution promises to foster the innovation and make the nuances of the legal landscape easier. However, institutional innovation policies are not optimized to foster innovation, but rather to maximize ownership and financial returns. Most policies will require all filed patents to run through a “Tech Transfer Office,” which is assumed to provide value by performing Freedom to Operate searches and helping file for provisional patents.

Unfortunately, in today’s world of software, patents are somewhat less valuable and relevant than they once were. If any IP is filed, the institution will claim ownership and will consider licensing it to the inventor for a royalty agreement. Sometimes, if the institution does not believe in the ability of the inventor to carry the IP forward to commercialization, they will even cut them out entirely from the agreement.

An additional approach that is becoming more common within innovation policies is an equity stake in any companies started by an institutional employee, regardless of the existence of IP or whether the institution was interested in it. All of the above scenarios obviously take more from the healthcare startup than they give before an innovator even has time to blink.

Challenge 2: Healthcare doesn’t understand early-stage tech companies

Why are these policies designed this way? Part of the problem stems from stakeholders confusing medical technology with biotechnology (aka pharma). The innovation pathway within biotech is very well-defined, with established business models, established precedent and understandable risk profiles. It is quite common for drug discovery to start in the academic setting. Investors, boards and executive teams are accustomed to this model and can plan accordingly. Licensing patents and collecting a royalty on biotech sales is a market norm.

When it comes to early-stage technology companies, their challenges and early development are drastically different. The two critical resources an early-stage company has are cash and time. The goal is to unlock additional capital with product-market fit, and these companies need maximum flexibility to be able to move quickly to find it. Unfortunately, investors see the healthcare space as complex and high risk, which is true. So these startups face fundraising challenges for the space they are in, as well as unnecessary additional hurdles from the home institutions, increasing the likelihood of scaring away already skittish investors.

Challenge 3: Pilots are set up to hurt more than help

Startups are often completely dependent on partnerships or deals with larger healthcare organizations in order to grow and survive. These deals often start with a pilot. Unfortunately, the dynamic between giant healthcare institutions and tiny idealistic startups for pilots is not actually set up to be mutually beneficial.

In this scenario, healthcare systems have nothing to lose, orders of magnitude more resources and seemingly infinite amounts of time. Their incentive is to differentiate and “own” unique technologies so their competitors cannot get their hands on them. This is where startups often and understandably can make a big mistake — they believe the partner brings more value to the table than they do. For example, just having a pilot, even if it’s unpaid, with a major institution seems like it could help win over investors or additional customers. This leads to a spiral of events that frequently ends in sending startups into a trajectory toward failure (aka death by pilots).

We need innovators and administrators to come together and agree on common standards and rules to make the process more efficient, fair and effective.

Due to the lack of urgency and the intense bureaucracy, the sales cycle is long, sometimes one to two years, often lasting longer than startups have cash left to burn. Second, as mentioned, the pilot is frequently unpaid, or I have seen situations where an institution will even charge a startup for a pilot, leading to less cash and equity, which is already in short supply. Finally, onerous terms are often instituted, in which companies agree to unnecessary exclusivity or impossible goals. This doesn’t even take into consideration the challenges around deployment with HIPAA, security concerns and data sharing.

The ultimate result is that healthcare institutions that want to add value to their system by improving outcomes and decreasing costs will often doom the very technologies they believe are worthwhile. This dynamic is so well-established that many investors, even those well-versed in healthcare, will refuse to invest in institutional-oriented technology companies. My company, Osso VR, has had representatives of hospital systems approach us saying, “Don’t work with us. It will kill your company.”

Promising opportunities ahead

What if innovation policies were designed so that instead of focusing on what they can take from their spin-out companies, they focus on what value they can add? Stanford’s StartX accelerator program has a model where they commit to investing in 10% of any round a company raises after they leave the program, but it’s up to the company to choose whether or not they want StartX to participate. Unsurprisingly, almost all companies take advantage of the investment offer. These incentives help companies succeed and allow StartX to share in that success.

We need innovators and administrators to come together and agree on common standards and rules to make the process more efficient, fair and effective. One example we might follow is from Y Combinator. Raising money used to be expensive due to the amount of confusing legal documents required and corresponding legal fees. The time and expense could sometimes cause a deal to fall through, or a company would run out of money.

Its SAFE note investment document solves accounting difficulties and challenges around early-stage investment. This document has been validated by founders and investors, allowing entrepreneurs to raise money with little to no legal fees and a turnaround time of a day or two. Organizations like the American Medical Association, AdvaMed and the Consumer Technology Association have the buy-in, validation and potential to start tackling these processes. Standards could be set for protected innovation time, structured innovation positions and fellowships for organizational employees, and deal templates and best practices to shorten sales cycles and avoid onerous terms.

These problems are large, endemic and complex, but I am optimistic we can begin to work together to solve them to maximize our common interest: increasing the value of global healthcare.

Powered by WPeMatico

How Axis went from concept to shipping its Gear smart blinds hardware

Axis is selling its first product, the Axis Gear, on Amazon and direct from its own website, but that’s a relatively recent development for the four-year-old company. The idea for Gear, which is a $249.00 ($179.00 as of this writing thanks to a sale) aftermarket conversion gadget to turn almost any cord-pull blinds into automated smart blinds, actually came to co-founder and CEO Trung Pham in 2014, but development didn’t begin until early the next year, and the maxim that “hardware is hard” once again proved more than valid.

Pham, whose background is actually in business but who always had a penchant for tech and gadgets, originally set out to scratch his own itch and arrived upon the idea for his company as a result. He was actually in the market for smart blinds when he moved into his first condo in Toronto, but after all the budget got eaten up on essentials like a couch, a bed and a TV, there wasn’t much left in the bank for luxuries like smart shades — especially after he actually found out how much they cost.

“Even though I was a techie, and I wanted automated shades, I couldn’t afford it,” Pham told me in an interview. “I went to the designer and got quoted for some really nice Hunter Douglas. And they quoted me just over $1,000 a window with the motorization option. So I opted just for manual shades. A couple of months later, when it’s really hot and sunny, I’m just really noticing the heat so I go back to the designer and ask him ‘Hey can I actually get my shades motorized now, I have a little bit more money, I just want to do my living room.’ And that’s when I learned that once you have your shades installed, you actually can’t motorize them, you have to replace them with brand new shades.”

With his finance background, Pham saw an opportunity in the market that was ignored by the big legacy players, and potentially relatively easy to address with tech that wasn’t all that difficult to develop, including a relatively simple motor and the kind of wireless connectivity that’s much more readily available thanks to the smartphone component supply chain. And the market demand was there, Pham says — especially with younger homeowners spending more on their property purchases (or just renting) and having less to spare on expensive upgrades like motorized shades.

The Axis solution is relatively affordable (though its regular asking price of $249 per unit can add up, depending on how many windows you’re looking to retrofit) and also doesn’t require you to replace your entire existing shades or blinds, so long as you have the type with which the Gear is compatible (which includes quite a lot of commonly available shades). There are a couple of power options, including an AC adapter for a regular outlet, or a solar bar with back-up from AA batteries in case there’s no outlet handy.

The Axis solution is relatively affordable (though its regular asking price of $249 per unit can add up, depending on how many windows you’re looking to retrofit) and also doesn’t require you to replace your entire existing shades or blinds, so long as you have the type with which the Gear is compatible (which includes quite a lot of commonly available shades). There are a couple of power options, including an AC adapter for a regular outlet, or a solar bar with back-up from AA batteries in case there’s no outlet handy.

Pham explained how in early investor meetings, he would cite Dyson as an inspiration, because that company took something that was standard and considered central to their very staid industry and just removed it altogether — specifically referring to their bagless design. He sees Axis as taking a similar approach in the smart blind market, which has too much to gain from maintaining its status quo to tackle Axis’ approach to the market. Plus, Pham notes, Axis has six patents filed and three granted for its specific technical approach.

“We want to own the idea of smart shades to the end consumer,” he told me. “And that’s where the focus really is. It’s a big opportunity, because you’re not just buying one doorbell or one thermostat – you’re buying multiple units. We have customers that buy one or two right away, come back and buy more, and we have customers that buy 20 right away. So our ability to sell volume to each household is very beneficial for us as a business.”

Which isn’t to say Axis isn’t interested in larger-scale commercial deployment — Pham says that there are “a lot of [commercial] players and hotels testing it,” and notes that they also “did a project in the U.S. with one of the largest developers in the country.” So far, however, the company is laser-focused on its consumer product and looking at commercial opportunities as they come inbound, with plans to tackle the harder work of building a proper commercial sales team. But it could afford Axis a lot of future opportunity, especially because their product can help building managers get compliant with measures like the Americans with Disabilities Act to outfit properties with the requisite amount of units featuring motorized shades.

To date, Axis has been funded entirely via angel investors, along with family and friends, and through a crowdfunding project on Indiegogo, which secured its first orders. Pham says revenue and sales, along with year-over-year growth, have all been strong so far, and that they’ve managed to ship “quite a few units so far” — though he declined to share specifics. The startup is about to close a small bridge round and then will be looking to pin down its Series A funding as it looks to expand its product line — with a focus on greater window coverings style compatibility as top priority.

Powered by WPeMatico

Buy a demo table at TC Sessions: Enterprise 2019

Early-stage enterprise startup founders listen up. That sound you hear is opportunity knocking. Answer the call, open the door and join us for TC Sessions: Enterprise on September 5 in San Francisco. Our day-long conference not only explores the promises and challenges of this $500 billion market, it also provides an opportunity for unparalleled exposure.

How’s that? Buy a Startup Demo Package and showcase your genius to more than 1,000 of the most influential enterprise founders, investors, movers and shakers. This event features the enterprise software world’s heaviest hitters. People like SAP CEO Bill McDermott; Aaron Levie, Box co-founder, chairman and CEO; and George Brady, executive VP in charge of technology operations at Capital One.

Demo tables are reserved for startups with less than $3 million, cost $2,000 and include four tickets to the event. We have a limited number of demo tables available, so don’t wait to introduce your startup to this very targeted audience.

The entire day is a full-on deep dive into the big challenges, hot topics and potential promise facing enterprise companies today. Forget the hype. TechCrunch editors will interview founders and leaders — established and emerging — on topics ranging from intelligent marketing automation and the cloud to machine learning and AI. You’ll hear from VCs about where they’re directing their enterprise investments.

Speaking of investors and hot topics, Jocelyn Goldfein, a managing director at Zetta Venture Partners, will join TechCrunch editors and other panelists for a discussion about the growing role of AI in enterprise software.

Check out our growing (and amazing, if we do say so ourselves) roster of speakers.

Our early-bird pricing is still in play, which means tickets cost $249 and students pay only $75. Plus, for every TC Sessions: Enterprise ticket you buy, we’ll register you for a complimentary Expo Only pass to TechCrunch Disrupt SF on October 2-4.

TC Sessions: Enterprise takes place September 5 at San Francisco’s Yerba Buena Center for the Arts. Buy a Startup Demo Package, open the door to opportunity and place your early-stage enterprise startup directly in the path of influential enterprise software founders, investors and technologists.

Looking for sponsorship opportunities? Contact our TechCrunch team to learn about the benefits associated with sponsoring TC Sessions: Enterprise 2019.

Powered by WPeMatico