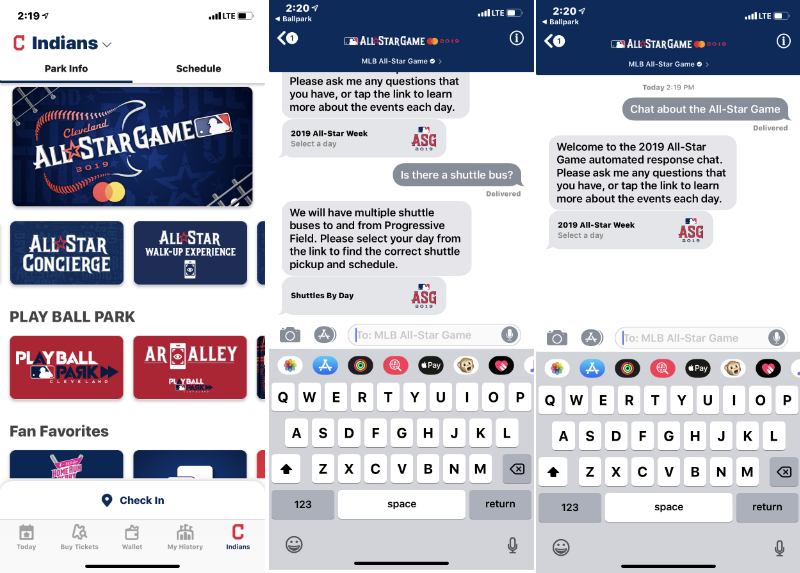

MLB Ballpark app adds Apple Business Chat-powered concierge experience for All-Star game

Just in time for tonight’s Home Run Derby, Major League Baseball is rolling out a new feature on its Ballpark app that utilizes Apple’s Business Chat feature for a customized in-person experience. MLB says it’s the first league to roll out the feature, letting users ask location-specific questions — though Apple Business Chat has been used for things like drink orders in the past.

Clicking into the Indians section will bring you Progressive Field, the center of this week’s festivities, where you can access the new All-Star Concierge feature. Developed alongside New York-based AI startup Satisfi Labs, the feature is designed to answer simple questions.

From there, it will either answer straight away or open the appropriate app, like Maps and Calendar. In the case of this week’s events, that could mean something as simple as the start time for the derby or something more specific like where to pick up a shuttle to a specific hotel.

The feature is being rolled out to start with tonight’s Home Run Derby and tomorrow’s All-Star game, but it should start arriving in more parks after the All-Star break as different stadiums begin to implement it. MLB has been experimenting with a number of different features to enhance the ballpark experience via smartphone, including, notably, the addition of an AR stat feature.

Powered by WPeMatico

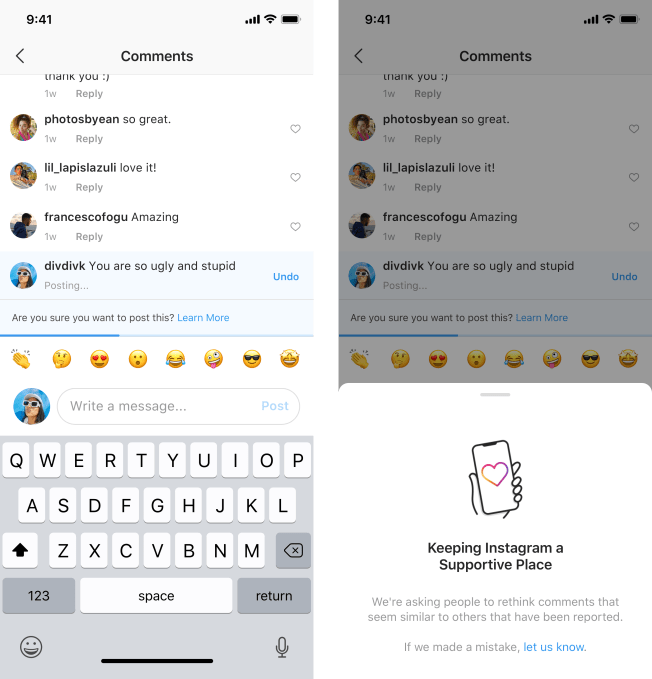

New Instagram features flag potentially offensive comments, allow you to quietly ‘restrict’ users

Instagram announced two new features today that it said are designed to combat online bullying.

In both cases, the Facebook -owned service seems to be trying to find ways to limit bad behavior without outright blocking posts or banning users.

“We can do more to prevent bullying from happening on Instagram, and we can do more to empower the targets of bullying to stand up for themselves,” wrote Instagram head Adam Mosseri in the announcement. “Today we’re announcing one new feature in both areas. These tools are grounded in a deep understanding of how people bully each other and how they respond to bullying on Instagram, but they’re only two steps on a longer path.”

The first feature is supposed to use artificial intelligence to flag comments that “may be considered offensive.” In those cases, users are asked, “Are you sure you want to post this?” and then given the option button to “undo” their comment before it posts.

This might seem like a relatively tame response, particularly because users can still go ahead and post the original comment if they want, but Mosseri said that in early tests, his team found that the prompt “encourages some people to undo their comment and share something less hurtful once they have had a chance to reflect.”

The other addition, which Mosseri said the service will start testing soon, is the ability to “restrict” users looking at your account.

“We’ve heard from young people in our community that they’re reluctant to block, unfollow, or report their bully because it could escalate the situation, especially if they interact with their bully in real life,” Mosseri wrote.

So by using this new option, you can limit another user’s interaction with your account without making it obvious. If you restrict someone, their comments on your posts will only be visible to them, unless you approve a comment for general consumption. They also won’t be able to see if you’re active on Instagram or if you’ve read their direct messages.

Mosseri described earlier versions of these features at Facebook’s F8 developer conference in April.

Powered by WPeMatico

FCC proposal would let it punish international robocallers

While the FCC and Congress hammer out new rules to (hopefully) banish robocalls forever, there are some short-term solutions that can help in the meantime — and one may arrive in just a few weeks. A new FCC proposal allows the agency to go after scam calls that originate overseas or use other methods to evade existing spoofing laws.

The rule isn’t exactly new in that it is a follow-up to Ray Baum’s Act, which was passed last year and, among other things, bulked up the Truth in Caller ID Act.

Previously, the latter law prohibited scammy spoofing of numbers, a practice that makes robocalling much easier — but it only applied to calls originating in the country. That opened up a huge loophole for scammers, who are not short on means to make calls internationally. Ray Baum’s Act modifies those rules to specifically prohibit international spoofing, as well as robocall techniques using modern infrastructure like VoIP.

But just making it illegal doesn’t necessarily make it possible for the FCC to go after the criminals. If there’s nothing in the agency’s official rules that formalize how it would go about locating and taking action against those in violation of the new law, it has no power to do so. That’s what this new rule is for.

Chairman Ajit Pai’s proposal will be made public later this week and voted on at the FCC’s August 1 open meeting. If adopted, the agency would be able to do what it’s been doing with U.S. robocallers, except abroad.

Naturally tracking down scammers in a foreign country — and perhaps not an overly friendly one — is a very different beast than catching and fining domestic operations. An FCC official on a press call relating to the new rules characterized the operations as extremely complex, involving multiple shell companies and sophisticated obfuscation techniques. (The FTC has encountered similar difficulties.)

But many robocallers may well have been operating hitherto on the justified assumption that they were essentially immune to pursuit by U.S. authorities. Once they are no longer guaranteed impunity it may (one hopes) be deemed an unnecessary risk to continue operations, and some of the scammers may cut and run with their gains and move on to something else.

As for more long-term solutions, the carriers are working on implementing a new system that would more comprehensively block robocalls, though there is some concern that they won’t enable it by default, or may charge for the service. A summit is being held Thursday where the industry’s progress and intentions will be gauged.

Powered by WPeMatico

Google’s Pixel 4 renders surface and all anyone can do is stare at that top bezel

This time last month, Google took the surprise (and anticlimactic) move of tweeting out images of the Pixel 4 well ahead of its October launch. Of course, that glimpse just focused on the rear of the device. Not only was the company looking to nip leaks in the bud, they were almost certainly attempting to show off their camera array before Apple got the jump on them.

New 3D renders from OnLeaks may reveal why Google wasn’t in a rush to show off the front of the phone. The 6.25-inch phone appears to maintain the company’s staunch indifference to the war of notch attrition, forgoing the hole-punch camera from what appears to be a sizable top bezel (forehead).

Perhaps there’s something to be said for the company sitting this out while the competition battles things out with all sorts of solutions, from pop-up cameras to jamming them into displays. Besides, the Pixel XL got dinged for its giant notch, so you’re damned if you do, etc.

Well, since there seems to be some interest, 1 month after delivering your very first glimpse at the #Pixel4, here comes your very first full look at the #Pixel4XL! 360° video + gorgeous 5K renders + dimensions, on behalf of my Friends @Pricebaba again -> https://t.co/mCQCOp5Pp1 pic.twitter.com/MeAIID0FDz

— Steve H.McFly (@OnLeaks) July 8, 2019

As always, take these early renders with a grain of salt, but the source has a pretty good track record with this stuff.

Questionable aesthetics aside, the latest batch of rumors do reveal a fair number of features coming to the phone three or so months out. The handset appears to ditch the rear fingerprint sensor, leading to speculation that the tech has been ditched for face unlock or Google is doing fingerprint readings through the screen, perhaps using Qualcomm tech.

The device its said to sport two selfie cameras and perhaps some matter of gesture detection up top (that last bit seems to be largely speculation), which could account for that additional bezel real estate. On the back is a triple camera array, maintaining the company’s standard camera innovations.

Powered by WPeMatico

Box CEO Aaron Levie is coming to TC Sessions: Enterprise

Box co-founder, chairman and CEO Aaron Levie took his company from a consumer-oriented online storage service to a publicly traded enterprise powerhouse. Launched in 2005, Box today has more than 41 million users, and the vast majority of Fortune 500 companies use its service. Levie will join us at TC Sessions: Enterprise for a fireside chat about the past, present and future of Box, as well as the overall state of the SaaS and cloud space.

Levie, who also occasionally contributes to TechCrunch, was a bit of a serial entrepreneur before he even got to college. Once he got to the University of Southern California, the idea for Box was born. In hindsight, it was obviously the right idea at the right time, but its early iterations focused more on consumers than business users. Like so many other startups, though, the Box team quickly realized that in order to actually make money, selling to the enterprise was the most logical — and profitable — option.

Before going public, Box raised well over $500 million from some of the most world’s most prestigious venture capital firms. Box’s market cap today is just under $2.5 billion, but more than four years after going public, the company, like many Silicon Valley unicorns both private and public, still regularly loses money.

Early-Bird Tickets are on sale today for just $249 — book here before prices go up by $100!

Powered by WPeMatico

Grasshopper’s Judith Erwin leaps into innovation banking

In the years following the financial crisis, de novo bank activity in the US slowed to a trickle. But as memories fade, the economy expands and the potential of tech-powered financial services marches forward, entrepreneurs have once again been asking the question, “Should I start a bank?”

And by bank, I’m not referring to a neobank, which sits on top of a bank, or a fintech startup that offers an interesting banking-like service of one kind or another. I mean a bank bank.

One of those entrepreneurs is Judith Erwin, a well-known business banking executive who was part of the founding team at Square 1 Bank, which was bought in 2015. Fast forward a few years and Erwin is back, this time as CEO of the cleverly named Grasshopper Bank in New York.

With over $130 million in capital raised from investors including Patriot Financial and T. Rowe Price Associates, Grasshopper has a notable amount of heft for a banking newbie. But as Erwin and her team seek to build share in the innovation banking market, she knows that she’ll need the capital as she navigates a hotly contested niche that has benefited from a robust start-up and venture capital environment.

Gregg Schoenberg: Good to see you, Judith. To jump right in, in my opinion, you were a key part of one of the most successful de novo banks in quite some time. You were responsible for VC relationships there, right?

…My background is one where people give me broken things, I fix them and give them back.

Judith Erwin: The VC relationships and the products and services managing the balance sheet around deposits. Those were my two primary roles, but my background is one where people give me broken things, I fix them and give them back.

Schoenberg: Square 1 was purchased for about 22 times earnings and 260% of tangible book, correct?

Erwin: Sounds accurate.

Schoenberg: Plus, the bank had a phenomenal earnings trajectory. Meanwhile, PacWest, which acquired you, was a “perfectly nice bank.” Would that be a fair characterization?

Erwin: Yes.

Schoenberg: Is part of the motivation to start Grasshopper to continue on a journey that maybe ended a little bit prematurely last time?

Erwin: That’s a great insight, and I did feel like we had sold too soon. It was a great deal for the investors — which included me — and so I understood it. But absolutely, a lot of what we’re working to do here are things I had hoped to do at Square 1.

Image via Getty Images / Classen Rafael / EyeEm

Schoenberg: You’re obviously aware of the 800-pound gorilla in the room in the form of Silicon Valley Bank . You’ve also got the megabanks that play in the segment, as well as Signature Bank, First Republic, Bridge Bank and others.

Powered by WPeMatico

15Five raises $30.7M to expand its employee development toolkit

Technology has been used to improve many of the processes that we use to get work done. But today, a startup has raised funding to build tech to improve us, the workers.

15Five, which builds software and services to help organisations and their employees evaluate their performance, as well as set and meet goals, has closed a Series B round of $30.7 million, money that it plans to use to continue building out the functionality of its core product — self-evaluations that take “15 minutes to write, 5 minutes to read” — as well as expand into new services that will sit alongside that.

David Hassell, 15Five’s CEO and co-founder, would not elaborate on what those new services might be, but he recently started a podcast with the startup’s “chief culture officer” Shane Metcalf around the subject of “best-self” management that taps into research on organizational development and positive psychology.

At the same time that 15Five works on productizing these principles into software form, it seems that the secondary idea will be to bring in more services and coaching into the mix alongside 15Five’s existing SaaS model.

This Series B is being led by Next47, the strategic investment arm of manufacturing giant Siemens. Others in the round included Matrix Partners, PointNine Capital, Jason Calacanis’s LAUNCH Fund, Newground Ventures, Bling Capital, Chaifetz Group, and Origin Ventures (which had led 15Five’s Series A). It brings the total raised to $42.6 million, but Hassell said that while the valuation is up, the exact number is not being disclosed.

(Previous investors in the company have included David Sacks, 500 Startups and Ben Ling.)

15Five’s growth comes at a time when we are seeing a significant evolution in how companies are run internally. The digital age has made workforces more decentralised — with people using smartphones, video communications and services like Slack to stay in constant contact while otherwise working potentially hundreds of miles from their closest colleagues, or at least not sitting in one office altogether, all the time.

All well and good, but this has also had an inevitable impact on how employees are evaluated by their managers, and also how they are able to gauge how well they are doing versus those with whom they work. So while communication of one kind — getting information across from one person to another across big distances — has seen a big boost through technology, you could argue that another kind of communication — of the human kind — has been lost.

15Five’s approach is to create a focus on building an easy way for employees to think about and set goals for themselves on a regular basis.

Indeed, “regular” is the operative word here, with key thing being frequency. A lot of companies — especially large ones — already use performance management software (other players in this space include BetterWorks, Lattice, and PeopleGoal among many others), but in many cases, it’s based around self-evaluations that you might make annually, or at six-month intervals.

15Five’s focus is on providing a service that people will use much more often than that. In fact, it encourages use all the time, by way of sending praise to each other when something positive happens (it calls these “High fives” appropriately enough), as well as regular evaluations and goals set by the employees themselves.

Hassell said in an interview that this is in tune with what modern workplaces, and younger employees, expect today, partly fuelled by the rise of social media.

“Most millennials will get feedback on what they eat for breakfast more than what they do at work,” he said. “The rest of our lives exist in a real-time feedback loop, filled with continuous, positive reinforcement, but then you go into work and have an annual or maybe biannual performance review? It’s simply not enough.”

He said that he knows some millennial employees who have said that they will not work at a company if it’s not already using or planning to adopt 15Five, and since talent is the cornerstone to a company’s success this could have a significant impact.

The startup was born in San Francisco in more than one sense. It’s based there, but also, its principles seem to be uniquely a product of the kind of self-reflection and self-care/quality of life emphasis that has been associated with California culture for a while now, even amidst the relentless march that comes with being at the epicenter of the tech world.

In that regard, its newest investor, Next47, will help put 15Five to the test, both in terms of how the product will be adopted and used at a company whose holdings are as much manufacturing as technology, and in terms of sheer size: Siemens globally has around 400,000 employees, a huge jump up compared to the smaller and medium-sized businesses that form the core of 15Five’s customer base today.

Matthew Cowan, a partner at the firm, noted that while Siemens is currently not a 15Five user, the thinking behind the investment was strategic and the idea will be to incorporate it into the company’s practices for helping employees’ progress.

“It’s very representative of how the workplace is transforming,” he said

Powered by WPeMatico

The startups creating the future of RegTech and financial services

Contributor

Technology has been used to manage regulatory risk since the advent of the ledger book (or the Bloomberg terminal, depending on your reference point). However, the cost-consciousness internalized by banks during the 2008 financial crisis combined with more robust methods of analyzing large datasets has spurred innovation and increased efficiency by automating tasks that previously required manual reviews and other labor-intensive efforts.

So even if RegTech wasn’t born during the financial crisis, it was probably old enough to drive a car by 2008. The intervening 11 years have seen RegTech’s scope and influence grow.

RegTech startups targeting financial services, or FinServ for short, require very different growth strategies — even compared to other enterprise software companies. From a practical perspective, everything from the security requirements influencing software architecture and development to the sales process are substantially different for FinServ RegTechs.

The most successful RegTechs are those that draw on expertise from security-minded engineers, FinServ-savvy sales staff as well as legal and compliance professionals from the industry. FinServ RegTechs have emerged in a number of areas due to the increasing directives emanating from financial regulators.

This new crop of startups performs sophisticated background checks and transaction monitoring for anti-money laundering purposes pursuant to the Bank Secrecy Act, the Office of Foreign Asset Control (OFAC) and FINRA rules; tracks supervision requirements and retention for electronic communications under FINRA, SEC, and CFTC regulations; as well as monitors information security and privacy laws from the EU, SEC, and several US state regulators such as the New York Department of Financial Services (“NYDFS”).

In this article, we’ll examine RegTech startups in these three fields to determine how solutions have been structured to meet regulatory demand as well as some of the operational and regulatory challenges they face.

Know Your Customer and Anti-Money Laundering

Powered by WPeMatico

Startups Weekly: 2019 VC spending may eclipse 2018 record

Hello and welcome back to Startups Weekly, a weekend newsletter that dives into the week’s noteworthy startups & venture capital news. Before I jump into today’s topic, let’s catch up a bit. Last week, I struggled to understand WeWork’s growth trajectory. Before that, I noted some thoughts on scooter companies’ struggle to raise new cash.

Remember, you can send me tips, suggestions and feedback to kate.clark@techcrunch.com or on Twitter @KateClarkTweets. If you don’t subscribe to Startups Weekly yet, you can do that here.

What’s on my mind this week? Data. Now that it’s July, I figured it was time for a VC investment data check-in. How much have VCs invested so far this year? Are they finally investing more in female founders? I’ve got answers. (Data source: PitchBook)

- So far in 2019, VCs have invested $62 billion in U.S. startups. This puts investors on pace to dole out more than $120 billion this year, surpassing last year’s all-time high of $117 billion.

- Around the world, VCs have invested a total of $104 billion in 2019. Last year, investment soared to $251 billion. We’re unlikely to observe a global record of VC investment this year.

- Here’s the best news of all: Companies founded solely by women have secured a record 3% of the total capital invested in VC-backed startups in the U.S. this year: “Capital invested crossed the $1 billion mark for female-founded startups in 1Q 2019—the highest ever for any quarter to date. And out of roughly 300 VC deals for companies led solely by women, four of those businesses have reached unicorn status so far this year. That number includes online luxury reseller The RealReal, which debuted on the NASDAQ in a high-profile exit last month,” – PitchBook.

Pod Foods gets VC backing to reinvent grocery distribution

DotLab gets $10M to bring endometriosis test to market

Waresix hauls in $14.5M to digitize logistics in Indonesia

Calm gets $27M for its meditation app

Mobi nabs $50M for its new broadcast service

There were so many deep dives this week on TechCrunch ranging from Jony Ive’s influence on Apple written by TechCrunch editor-in-chief Matthew Panzarino, a look at the intense backlash on Superhuman and whether its justified, plus my own look at Fin’s pivot to enterprise analytics platform. Here are the ones I recommend clicking:

Higher Ground Labs is betting tech can help sway the 2020 elections by Jon Shieber

Superbacklash by Matthew Panzarino

From Seed to Series A: Scaling a startup in Latin America by Nathan Lustig

Andrew Kortina and Sam Lessin on Fin’s workplace pivot by Kate Clark

Apple sans Ive by Matthew Panzarino

E.ventures, an early-stage global fund, brought in a fresh $400 million this week, Sony announced a new $185 million fund and…

Filing scoop: @lancearmstrong‘s Next Ventures plans to raise $75M for its debut fund to invest in sports, fitness, nutrition and wellness startups: https://t.co/gREk0iUuAX

— Kate Clark (@KateClarkTweets) July 5, 2019

When is the right time to pitch VCs for funding?

A compelling pitch deck that quickly and clearly presents your startup as an exceptional investment opportunity is a clear edge when raising a round. But could fundraising be more effective if you knew when to send your pitch deck – the times of year when it’s more likely to be reviewed and when it’s likely to be viewed more often? If we all had a magical algorithm that could predict exactly which investors would review your deck and when, we’d be fundraising geniuses — closing our round faster and with far less effort. No such algorithm exists (at least not yet), but I can share some useful data that offers insights into some of these seasonal fundraising trends, with a few that seem to defy conventional wisdom…

Extra Crunch readers can read the rest of Russ Heddleston’s story here. If you’ve been unsure whether to sign up for TechCrunch’s awesome new subscription service, now is the time.

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, I interview Revolution’s Clara Sieg. We discuss the Rise of the Rest and investing in underrepresented geographies.

Extra Crunch subscribers can read a transcript of each week’s episode every Saturday. Read last week’s episode here and learn more about Extra Crunch here. Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico

A 23-year-old B2B company has shown how keen India is for tech IPOs

Away from the limelight of the press and the frenzy of fundraising, a tech startup in India has achieved a feat that few of its peers have managed: going public.

IndiaMART, the country’s largest online platform for selling products directly to businesses, raised nearly $70 million in a rare tech IPO for India this week.

The milestone for the 23-year-old firm is so uncommon for India’s otherwise burgeoning startup ecosystem that, beyond being over-subscribed 36 times, pent up demand for IndiaMART’s stock saw its share price pop 40% on its first day of trading on National Stock Exchange on Thursday — a momentum that it sustained on Friday.

The stock ended Friday at Rs 1326 ($19.3), compared to its issue price of Rs 973 ($14.2).

IndiaMART is the first business-to-business e-commerce firm to go public in India. Its IPO also marks the first listing for a firm following the May reelection of Narendra Modi as the nation’s Prime Minister and the months-long drought that led to it.

Accounting firm EY said it expects more companies from India to follow suit and file for IPO in the coming months.

“Now that national elections are over and favorable results secured, IPO activity is expected to gain momentum in H2 2019 (second half of the year). Companies that had filed their offer documents with the Indian stock markets regulator during H2 2018 and Q1 2019 may finally come to market in the months ahead,” it said in a statement (PDF).

IndiaMART’s origin

The fireworks of the IPO are just as impressive as IndiaMART’s journey.

The startup was founded in 1996 and for the first 13 years, it focused on exports to customers abroad, but it has since modernized its business following the wave of the internet.

“The thesis was, in 1996, there were no computers or internet in India. The information about India’s market to the West was very limited,” Dinesh Agarwal, co-founder and CEO of IndiaMART, told TechCrunch in an interview.

Until 2008, IndiaMART was fully bootstrapped and profitable with $10 million in revenue, Agarwal said. But things started to dramatically change in that year.

“The Indian rupee became very strong against the dollar, which dwindled the exports business. This is also when the stock market was collapsing in the West, which further hurt the exports demand,” he explained.

Dinesh Agarwal, founder and CEO of IndiaMart.com, poses for a profile shot on July 29, 2015 in Noida, India.

By this time, millions of people in India were on the internet and, with tens of millions of people owning a feature phone, the conditions of the market had begun to shift towards digital.

“This is when we decided to pursue a completely different path. We started to focus on the domestic market,” Agarwal said.

Over the last 10 years, IndiaMART has become the largest e-commerce platform for businesses with about 60% market share, according to research firm KPMG. It handles 97,000 product categories — ranging from machine parts, medical equipment and textile products to cranes — and has amassed 83 million buyers and 5.5 million suppliers from thousands of towns and cities of India.

According to the most recent data published by the Indian government, there are about 50 to 60 million small and medium-sized businesses in India, but only around 10 million of them have any presence on the web. Some 97% of the top 50 companies listed on National Stock Exchange use IndiaMART’s services, Agarwal said.

That’s not to say that the transition to the current day was a straightforward process for the company. IndiaMART tried to capitalize on its early mover advantage with a stream of new services which ultimately didn’t reap the desired rewards.

In 2002, it launched a travel portal for businesses. A year later, it launched a business verification service. It also unveiled a payments platform called ABCPayments. None of these services worked and the firm quickly moved on.

Part of IndiaMART’s success story is its firm leadership and how cautiously it has raised and spent its money, Rajesh Sawhney, a serial angel investor who sits on IndiaMART’s board, told TechCrunch in an interview.

IndiaMART, which employs about 4,000 people, is operationally profitable as of the financial year that ended in March this year. It clocked some $82 million in revenue in the year. It has raised about $32 million to date from Intel Capital, Amadeus Capital Partners and Quona Capital. (Notably, Agarwal said that he rejected offers from VCs for a very long time.)

The firm makes most of its revenue from subscriptions it sells to sellers. A subscription gives a seller a range of benefits including getting featured on storefronts.

4/4. So many Indian small businesses have so much to thank @DineshAgarwal for. And after the iconic IPO, so many Indian entreprenuers will have so much to thank him for – forever unlocking the Indian public markets to current & future generation of Indian internet companies

— Kunal Bahl (@1kunalbahl) July 4, 2019

Where the industry stands

There are only a handful of internet companies in India that have gone public in the last decade. Online travel service MakeMyTrip went public in 2010. Software firm Intellect Design Arena and e-commerce store Koovs listed in 2014, then travel portal Yatra and e-commerce firm Infibeam followed two years later.

India has consistently attracted billions of dollars in funding in recent years and produced many unicorns. Those include Flipkart, which was acquired by Walmart last year for $16 billion, Paytm, which has raised more than $2 billion to date, Swiggy, which has bagged $1.5 billion to date, Zomato, which has raised $750 million, and relatively new entrant Byju’s — but few of them are nearing profitability and most likely do not see an IPO in their immediate future.

In that context, IndiaMART may set a benchmark for others to follow.

“The fact that we have a homegrown digital commerce business, serving both the urban and smaller cities, and having struggled and been around for so long building a very difficult business and finally going public in the local exchange is a phenomenal story,” Ganesh Rengaswamy, a partner at Quona Capital, told TechCrunch in an interview. “It keeps the story of India tech, to the Western world, going.”

Congratulations @DineshAgarwal for an iconic IPO! @IndiaMART has set an example and hope for all Indian Internet companies looking to go public. Cheers! https://t.co/yJumFjfitS

— Vani Kola (@VaniKola) July 4, 2019

Generally, it is agreed that there are too few IPOs in India and the industry can benefit from momentum and encouragement of high profile and successful public listings.

“There is a firm consensus that in India, markets will prefer only the IPOs of companies that are profitable. And investors in India might not value those companies. Both of these issues are being addressed by IndiaMART,” said Sawhney.

“We need 30 to 40 more IPOs. This will also mean that the stock market here has matured and understands the tech stocks and how it is different from other consumer stocks they usually handle. More tech companies going public would also pave the way for many to explore stock exchanges outside of India.

“Indian market is ready for more tech stocks. We just need to get more companies to go out there,” Sawhney added, although he did predict that it will take a few years before the vast majority of leading startups are ready for the public market.

The Indian government, for its part, this week announced a number of incentives to uplift the “entrepreneurial spirit” in the nation.

Finance minister Nirmala Sitharaman said the government would ease foreign direct investment rules for certain sectors — including e-commerce, food delivery, grocery — and improve the digital payments ecosystem. Sitharaman, who is the first woman to hold this position in India, said the government would also launch a TV program to help startups connect with venture capitalists.

The path ahead for IndiaMART

IndiaMART has managed to build a sticky business that compels more than 55% of its customers to come back to the platform and make another transaction within 90 days, Agarwal — its CEO — said. With some 3,500 of its 4,000 employees classified as sales executives, the company is aggressive in its pursuit of new customers. Moving forward, that will remain one of its biggest focuses, according to Agarwal.

“Most of our time still goes into educating MSMEs on how to use the internet. That was a challenge 20 years ago and it remains a challenge today,” he told TechCrunch.

In recent years, IndiaMART has begun to expand its suite of offerings to its business customers in a bid to increase the value they get from its platform and thus increase their reliance on its service.

IndiaMART has built a customer relationship management (CRM) tool so that customers need not rely on spreadsheets or other third-party services.

“We will continue to explore more SaaS offerings and look into solving problems in accounting, invoice management and other areas,” said Agarwal.

The firm also recently started to offer payment facilitation between buyers and sellers through a PayPal -like escrow system.

“This will bridge the trust gap between the entities and improve an MSME’s ability to accept all kinds of payment options including the new age offerings.”

There’s an elephant in the room, however.

A bigger challenge that looms for IndiaMART is the growing interest of Amazon and Walmart in the business-to-business space. Several startups including Udaan — which has raised north of $280 million from DST Global and Lightspeed Venture Partners — have risen up in recent years and are increasingly expanding their operations. Agarwal did not seem much worried, however, telling TechCrunch that he believes that his prime competition is more focused on B2C and serving niche audiences. Besides he has $100 million in the bank himself.

Indeed, as Quona Capital’s Rengaswamy astutely noted, competition is not new for IndiaMART — the company has survived and thrived more than two decades of it.

“Alibaba came and gave up,” he noted.

An important — and unanswered question — that follows the successful IPO is how IndiaMART’s stock will fare over the coming months. A glance to the U.S. — where hyped companies like Uber, Lyft and others have seen prices taper off — shows clearly that early demand and sustained stock performance are not one and the same.

Nobody knows at this point, and the added complexity at play is that the concept of a tech IPO is so uncommon in India that there is no definitive answer to it… yet. But IndiaMART’s biggest achievement may be that it sets the pathway that many others will follow.

Powered by WPeMatico