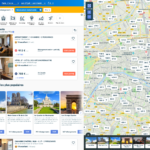

Cozycozy is an accommodation search service that works with hotels and Airbnb

French startup Cozycozy.com wants to make it easier to search for accommodation across a wide range of services. This isn’t the first aggregator in the space and probably not the last one. But this time, it isn’t just about hotels.

When you plan a trip with multiple stops, chances are you end up with a dozen tabs of different services — on Airbnb to look at listings, on a hotel review platform and on a hotel booking platform. Each service displays different prices and has a different inventory.

While there are a ton of services out there, most of them belong to just three companies: Booking Holdings (Booking.com, Priceline, Kayak, Agoda…), Expedia Group (Expedia, Hotels.com, HomeAway, Trivago…) and TripAdvisor (TripAdvisor, HouseTrip, Oyster…). They all operate many different services in order to address as many markets and as many segments as possible.

Cozycozy.com wants to simplify that process by aggregating a ton of services in a single interface — you can find hotels, Airbnb listings, campsites, hostels, boats, home-exchanging apartments… You can filter your results by price or you can exclude some accommodation styles.

The company doesn’t work with hotels and doesn’t handle bookings directly. Instead, the service searches across all the usual suspects. When you want to book, you get redirected to the original listing on Airbnb, Booking.com, Hostelworld, etc.

The startup recently raised a $4.5 million funding round (€4 million) from Daphni, CapDecisif, Raise and many different business angels, such as Xavier Niel, Thibaud Elzière and Eduardo Ronzano.

Cozycozy.com co-founder and chairman Pierre Bonelli also previously founded Liligo.com. It is one of the most popular flight comparison website in France. It was acquired by SNCF in 2010 and then eDreams ODIGEO in 2013.

Powered by WPeMatico

The IPO’d learn investing at First Round’s Angel Track

Startups depend on the angel lifecycle. A few flush post-exit individuals put the first cash into a fresh venture. With some skill and plenty of luck, the early team grows the company into a big success. It sells or goes public and those team members earn a fortune. They then pay it forward by investing in the next generation of startups.

If they hoard their spoils they starve the early-stage ecosystem or leave founders stuck with dumb money from non-strategic financiers. If they redistribute their winnings, they can influence startup culture by deciding what, and more importantly, who gets funding.

But how does a co-founder or VP learn to be a mini-VC? That’s the goal of First Round Capital’s Angel Track, a free three-month workshop series in San Francisco and New York for learning how to source, vet, close, and support angel investments.

A scene from Angel Track’s first cohort

Every two weeks, an expert on some part of the investing process like finding deals or interviewing founders talks to the class, does Q&A, and then leaves the group to openly discuss what they learned and how to use it. Angel Track sessions have been tought by some of the smartest people in the valley like growth master Elad Gil, #ANGELS founding partner and former Twitter VP of corp dev Jessica Verrilli, and Precursor Ventures managing partner Charles Hudson.

Hundreds of startup execs apply for the 15 spots on each coast. After two classes in SF and one in NYC, today First Round unveiled its recently-graduated third cohort from programs in both cities. Those include Lucy Zhang who sold Facebook her chat startup Beluga that became the foundation of Messenger, and Mented Cosmetics co-founder and CEO KJ Miller. By the end of the program they’re taking joint pitch meetings from startups, showing each other the best questions to ask.

As with Y Combinator, it’s as much about the fellowship between new investors as the education. “It’s both a community and a masterclass” says First Round general partner Hayley Barna who oversees the NYC Angel Track. “It’s about bringing a talented group of emerging angels together to build a productive cohort of collaborators.”

She says diversity and inclusion is a big goal of the program, and it features 50% women and 20% underrepresented minorities. Being rich is not a pre-requisite. Barna declares “We’re not pulling in the bankers and the traders doing angel investing as a side-hustle.”

LOS ANGELES, CA – MARCH 29: Confetti falls as Lyft CEO Logan Green (C) rings the Nasdaq opening bell celebrating the company’s initial public offering (IPO) on March 29, 2019 in Los Angeles, California. The ride hailing app company’s shares were initially priced at $72. (Photo by Mario Tama/Getty Images)

After a slew of big 2019 IPOs from Uber, Lyft, Pinterest, Slack, and Zoom, there are plenty of newly-minted potential angels for First Round to teach. The venture firm benefits by building a cadre of co-investors or alternative backers for deals it vets, and through added visibility into the next top fundraises. Unlike some VC scout programs, there’s no formal obligation to send opportunities to First Round or pledge funding alongside it. That keeps it appealing to future investors that innovation hubs need to keep the circle of life flowing.

“A lot of angel investors that got their start in the mid-to late 2000s, they’re almost all fund managers now. They went from angels or super angels to venture investors” First Round partner Brett Berson tells me. “There haven’t been a lot of people who’ve come in and filled that gap”, which could stunt the ecosystem’s growth. Graduates ramp up their angel investing while often staying in their operating roles, though some like former Pinterest head of culture Cat Lee who became a partner at Maveron turn investing into their day job.

First Round VP Ben Cmejla who helped launch the program explains that “Some people are doing it for the financial return. Some people want access to new ideas and are curious. Some people have a specific type of community they want to support with their investments.”

What Investors Learn From Angel Track

Becoming a successful angel means a lot more than evaluating term sheets. Just like how ideas are a dime a dozen and it’s about who can execute, fundraises are frequent but getting into the right ones takes hard work. First Round focuses on many of the soft skills required to win. Participants receive mentorship on how to:

- Develop an area of expertise and personal brand

- Mine their network for deals and post-investment assistance

- Assess market opportunities rigorously

- Judge an unproven startup’s team and product

- Convince a founder to let them into a round and negotiate terms

- Support their portfolio companies without being annoying

How to approach the delicate power balance of meetings with entrepreneurs can be especially tricky, so I spoke at length with First Round’s Phin Barnes about the session he teaches on founder interviews. I wanted to get a taste for what it’d be like in the classroom, despite First Round declining to let me attend the real thing. Turns out having a journalist in the room can disrupt a safe learning environment for budding angels.

First Round partner Phin Barnes

“Investing is a sell-side product” Barnes stresses. “Capital is a commodity, especially in this market. What you’re saying with a term sheet is that you think the founder’s equity is worth more than your dollars.” That means investors have to close the value gap with sweat.

Barnes gives me what he calls the ‘chocolate soufflé or brownies’ scenario. “The danger of being a smart, talented executive or entrepreneur is that when a founder talks to you about sugar and flour and butter, you start imagining a molten lava soufflé cake you’d build with the ingredients. You invest, and then the founder comes back with a tray of brownies. ‘That’s not what I thought I invested in!’”

The mistake comes in envisioning what you’d do rather than really listening to the founder — the one who’s cooking. Instead of trying to hijack the roadmap or being disappointed by the direction, angels need to help make those brownies as tasty as possible. That means entering into interviews with an open mind.

“You should be positively inclined to invest and have some critical questions. If you don’t think you should invest, you shouldn’t have the meeting in the first place” Barnes explains. “You want to hold that perspective loosely and as new information comes to light, you want to check ‘Am I still interested?’ By the end you want to know what you don’t know, and the open questions you need to answer to validate your hypothesis.”

The four main areas of evaluation are:

The market — Why does this category of product need to exist? What would the world look like if they dominate the category? Can they clearly explain to a five-year old the problem they’re trying to solve? What’s their contrarian thinking? And what motivation will keep them persevering to address the problem despite setbacks and opportunity cost?

The product — Is addressing this specific customer problem unique and defensible? It’s less about if the product is good or bad, or should the button be red or blue. It’s more about how the founder took the inputs and made the decision and how they process information. Have them walk you through the go-to-market plan and see how they shift between high-level strategy and ground-level tactics.

The team — Do they have on-paper talent like PhDs or experience? Can they iterate quickly? You have to weed out victims and look for people who are learners that evolve when faced with adversity. Do your homework on who they are before so you can dig deeper into how they tick. Ask how they show trust in their team and how they get their team to trust them. Have them tell you about the most important thing that happened at the company in the last week to understand their priorities and emotional connection to the process.

The relationship with the founder — Investors need to ask what the best way to work with them is, and what founders are looking for in support from an investor. Do they want a hands-off investor who only chimes in when summoned, or do they expect frequent co-building sessions? Do they need more help accessing a bigger network for hiring and partnerships, or industry-specific expertise to navigate complex decisions?

“We have two roles. We interview and then we coach” Barnes says, providing tips for both. “The very best questions are open-ended. They start with a how/what/why and end with a question mark. Double-barreled questions are terrible. Ask them what would you do, and stop. Get comfortable with silence. They’ll usually fill the silence with something off-script that reveals a deeper truth.” Only once has a founder asked Barnes ‘are you ok?’ in response to his inquisitive stare.

Being able to summarize what you’ve learned lets you quickly cross-check your assumptions with the founder and get helpful corrections. That helps you figure out what questions you still need to ask and keep a diligent list of what you’ll need to research after.

When it comes to giving an answer on whether you’ll invest, “Second best to a quick yes is a quick no with a strong point of view and information for the entrepreneur. The worst is ghosting people. 90% of people operate that way but that’s not the way to do it” Barnes emphasizes. “If you walk out without a yes, no, or what to learn more about in specific detail, you’ve failed as an investor and wasted the time of the entrepreneur.”

The antidote to dumb money

“It was like the perfect mix of your favorite college seminar and a super practical apprenticeship” says Ariana Poursartip, the VP of product for fintech startup Petal who was in the first NYC Angel Track class. “I came away with a better sense of my personal investing approach, and a community of fellow angel investors who I’ll continue to learn from for years.”‘

Fostering better educated angels is crucial for enabling founders. “Dumb money” from investors without expertise in a relevant space, connections they’ll leverage to help, or an understanding of what startups need can be dangerous. It can lead founders to raise more but inefficient capital and make slower progress that puts them at risk of a future down-round that can trigger a startup death spiral.

First Round’s Angel Track cohort 3

First Round is far from the only one trying to fill the angel gap. “Initiatives like Spearhead, YC’s Startup Investor School, and scout programs help lower the barrier to entry for many people who will be terrific and helpful investors for startups” says Cmejla. Sequoia, General Catalyst, Village Global and more run their own scout networks. There are some questionable programs out there too, though, like Venture University which charges from $4,000 to $65,000 for its programs that require students to source deals in exchange for a hazy profit-sharing agreement.

Cmejla insists “It isn’t about providing the capital, a short crash course, or a path to becoming a full-time VC, but about building a durable community that members can lean on and lean into as they level up.” Instead, First Round scores a way to connect founders it funds with relevant angels from its classes. That incentivizes the firm to teach savvy etiquette. Barna warns “You want to be thorough, but if you’re putting in a small check, you can’t ask founders to jump through too many hoops . . . and spend five hours just to get that dinky paycheck.”

Cmejla insists “It isn’t about providing the capital, a short crash course, or a path to becoming a full-time VC, but about building a durable community that members can lean on and lean into as they level up.” Instead, First Round scores a way to connect founders it funds with relevant angels from its classes. That incentivizes the firm to teach savvy etiquette. Barna warns “You want to be thorough, but if you’re putting in a small check, you can’t ask founders to jump through too many hoops . . . and spend five hours just to get that dinky paycheck.”

Past Angel Track participants like Poursartip and Instacart VP of growth Bengaly Kaba tell me they wish the program got them spending more time together both during and after the class, which could spur deeper alliances. “Currently the program ends and there is no formal programming to keep the alumni cohorts engaged and connected” Kaba notes. Many already back startups brought to the class by their peers. Still, Square Cash app product lead Ayo Omojola wanted a stronger structure like perhaps a syndicate so cohort-mates could do more investing together.

What they all cited was the massive value of learning to codify what they’re looking for and what they bring to the table. Kaba highlighted how he enjoyed “Hearing how Elad Gil, [Floodgate co-founding partner] Ann Muira-Ko, Charles Hudson and other guest speakers defined their investment theses around macro trends, industry specific insights, and founder traits.”

When the lock-ups expire on recent IPOs and employees start getting liquidity, “you’re going to see a whole new generation of investors get going over the next couple of years” says Berson.

Not every company spawns the same quality of investor, though. Companies like Uber that empower less-senior team members as the ride sharing company does with regional general managers tend to develop talent with the self-direction and conviction to be great angels. Looking back, you similarly see more angels and founders emerging from more decentralized Google than top-down Apple.

As software eats the world, unicorns proliferate, and the proceeds of tech’s winning streak are spread wide, more and more people will be ready to write angel checks. “It will most likely materially accelerate over the next 12-24 months” Berson concludes. Those without the skills could squander what they’ve earned. Angels who know what makes them special and can evaluate startups without getting swept up in the hype will crown the queens of tomorrow.

Powered by WPeMatico

How a martial arts gym trained me to build an inclusive culture

A wave of unease immediately swept through my body. Constant puffing and growling echoed around me as heavily-tattooed fighters threw forceful punches into the heavy bags. This was the scene I encountered when I stepped into Five Points Academy, a martial arts fighting gym in New York, for the first time a few years ago. Having grown up in a sheltered environment — the last time I had gotten into a fight was in kindergarten — I wasn’t sure I would fit in.

Emily, one of the instructors, immediately introduced herself and showed me some basic Muay Thai movements. The class focused on pad work, so students paired up and held Thai pads for each other to practice their moves. Emily rotated me through different partners during the class, offering me a taste of what it was like to hit pads, and I was hooked.

A year ago, my friend, Diane Wu, wrote a wonderful post arguing that “inclusion is the cause, and diversity is the effect. When an inclusive mindset is in place, diversity naturally follows.” My experience at Five Points reflects this sentiment. Despite being in a traditionally male-dominant field, roughly 40% of our instructors, half of our fighters, and half of our members are women. It’s not a coincidence that they are also widely regarded as one of the most inclusive and least “bro-y” fighting gyms in New York.

Tech has only been male-dominant in the last few decades — the first coders in the 1940s were women — while martial arts has been male-dominant for the last few millennia. If a martial arts gym can overcome systemic obstacles, we, in tech, can do better. After interviewing the owners, coaches, fighters, and members of the gym, here is what I learned about how they created an inclusive community.

Culture starts from the top

Studies have shown that culture stems from leadership, and this is demonstrated by the three owners of Five Points, Steve, Simon, and Kevin. Multiple members noted that Steve’s laid-back demeanor, Simon’s British humor, and Kevin’s always-friendly attitude were a big part of what made Five Points feel like family. As Steve explained, “People learn better if you’re encouraging as opposed to intimidating.” This welcoming culture from the top certainly encouraged a wider range of people to join and prosper, especially among more recreational fighters.

Companies are no different when it comes to establishing cultures from the top. If inclusivity is a priority, executives have to demonstrate that.

I’ve seen cases where the CEO created a committee to collaborate on establishing core values for the company, only to scrap that conversation and send out a survey asking employees to rate cultural values the CEO personally came up with. Over time, people with different viewpoints left the company, and the ones who stayed were predominantly from the same backgrounds in terms of work experience, gender, and ethnicity. Ultimately, building a culture of inclusion requires both executive buy-in and genuine follow-through actions, or else it will be hard to sustain.

“Inclusion” includes everyone

Five Points didn’t start out aiming to achieve gender parity or market to certain demographics. Instead, they focused on creating a community where everyone was welcomed. Simon summarized it well, “An inclusive culture includes everyone. By not having the right culture, you might turn away a person — not just women, but also other men — that can potentially help improve your gym directly.” He further elaborated, “We don’t want an asshole culture not just because women might be turned off—but men would, too.”

This is an important distinction. For example, it is tempting to generalize that a frat-house gym culture could keep women away. However, many men dislike such a culture as well. Instead of lumping people into groups, we can look at each individual and ask ourselves, “what environment would be welcoming for him or her?” For instance, Kevin always makes sure to take time to understand each prospective new member, give them a tour of the facilities, and discuss how the academy could cater to their needs.

We can extend this idea further: surface-level characteristics are often times just a proxy for deeper attributes, so why not go straight to the root? When I took Muay Thai classes at other gyms, the instructor would often remind everyone, “Guys, if you are paired with a girl, please go lighter.” This gender-based generalization is just a proxy for the root attribute: size. At Five Points, the instructor would instead say, “Guys (and gals), if you are paired with someone a lot smaller than you, please adjust your power to keep your partner safe.” Safety is a concern for anyone facing a bigger opponent, regardless of the gender they identify themselves with.

In tech, there has been a lot of discussion around creating a more inclusive environment for underrepresented demographics. I believe we can be more effective by augmenting this effort. In addition to asking “how can we make women feel comfortable contributing to meetings?”, we can also ask “how can we help all employees feel comfortable contributing to meetings?”[1] In addition to discussing “how can we provide support mechanisms for minorities?”, we can also discuss “how can we provide support mechanisms for employees who are not well-versed in mainstream corporate America culture?” I believe this hybrid approach can cover more ground and ensure that help is delivered to the people who need it most [2].

Treat everyone equally

A common theme among the female coaches and members I interviewed was that they felt that gender was something that did not cross their minds during class. Multiple members have commented that the instructors treated everyone equally. For example, if you were late, independent of what demographic or skill level you were, you had to do 30 pushups [3]. Giving everyone the same standards ensured that people couldn’t pick on others or make snide comments such as “Amy got off easier because she was a girl.”

One of the rules during Muay Thai drills class is to lower the power level and focus on technique. One time, Steve took Emily’s Muay Thai drills class and hit his partner a bit too hard. Emily immediately reminded Steve, “that was probably a bit too hard.” It didn’t matter that Steve was an owner and Emily was an employee — as the instructor of the class she made sure everyone followed the same rules.

Likewise, treating everyone equally starts from the beginning: the candidate experience. A common question I get is “how do we improve diversity without lowering the bar?” What I propose is to define a set of capabilities that all candidates need to demonstrate. For example, if a productive software engineer needs to be good at algorithms, system design, communication, teamwork, and breaking problems down, we should evaluate each of the five areas fairly during recruiting.

Unfortunately, many companies only look at the first two, which not only results in a non-diverse group of employees, but also those with skillsets that don’t fully map to their jobs. By communicating the standards transparently, we ensure that all employees understand that they belong, and are equally a part of the community.

Pay attention to details

Details often reflect the thoughtfulness put in to creating a culture. Ting, a Kali (a weapons-based martial art) instructor and former fighter, explained, “Many martial arts gym are dirty and smell like sweat. Five Points pays attention to details: there are hair ties and multiple hair dryers for women’s locker rooms. The mats are mopped every hour in between classes. This removes one extra stress for a lot of women who want to try out martial arts.”

Needless to say, the attention to detail applies to classes as well. A new member shared the following story with me: “Once I was getting ready to do a private session with Steve after Emily’s Muay Thai class. Emily went to Steve and said ‘she needs more work on her left roundhouse kick.’ Of course Steve then made me do left roundhouses for 30 minutes straight.”

While the member was cursing inside, she was also grateful for the attention Emily paid to her. Sonya, a long-time Kali student, also recalled that Simon would often notice when she’s flustered with a particular drill. With his classic British humor, he would remark “too much water in the bucket?” before proceeding to break down the drill further to ensure she could absorb the information.

There are many zero-cost things companies can do that could make the employees feel taken care of. For example, in the early days, Palantir, my former employer, would proactively offer employees the option to early-exercise their stock options. They also brought in tax accountants to explain how to handle the alternative minimum tax (AMT). However, I’ve also seen companies with 60+ employees where no one was given the option to early-exercise, even though it financially costs the company practically nothing.

Be adaptive to change and proactively improve

When Five Points first started, they followed the Western boxing mindset where members sparred hard. The mentality was to identify fighters who were tough and wanted it so bad they’d return after getting beaten up. Over time, as Steve and Simon traveled to Thailand, they witnessed a different style of sparring, where fighters sparred lightly and focused on technique and timing.

They revamped their sparring classes to “Thai Style Technical Sparring,” and had a few designated “hard sparring” classes. Although a few fighters were upset, Steve and Simon were convinced that this was the right approach. As Steve explained, “the old style can help you find tough people but not necessarily the best people.” Furthermore, the best fighter can come in all shapes, sizes, genders, and backgrounds, not necessarily the “tough person” who comes in day one wanting to fight.

This open mindset certainly uncovered many great fighters they wouldn’t have found otherwise, increasing the diversity of the community. One of their fighters, a former model and actress, came to Five Points never thinking she would fight. The welcoming environment and emphasis on technique during sparring made her feel safe as she leveled up her skills. Three years in, Steve asked her if she wanted to do a fight. She ended up getting hooked and went on to win multiple US Kickboxing Association International Championships.

This adaptive mindset is applicable to other areas as well. When I interviewed at Google, one of my interviewers told me that for a long time Google focused heavily on brain-teasers and algorithmic puzzles. As a result, during lunch with his team, the predominantly white and Asian male engineers with backgrounds in coding would discuss brain teasers and algorithmic puzzles.

Over time, Google’s leadership realized that brain teasers and algorithmic puzzles have little correlation with one’s performance. They then restructured their interview process, and the diversity of the team improved. Obviously there are still areas for improvement, but being able to recognize issues and adapt to new findings is critical to fostering an inclusive culture.

Enforce the rules fairly when needed

The journey to building a diverse and inclusive martial arts community is not without the occasional bumps. As a community grows bigger, there will inevitably be bad actors, and how a leader responds to them will set the tone for how the culture develops.

Emily has kicked students out of her class a few times when a bigger or more experienced fighter beat up on a smaller or less-experienced student. It did not matter if the bully was highly skilled or fought for the gym — she enforced the rules fairly with everyone. Similarly, after a 200+ lbs experienced man repeatedly beat up others during Muay Thai sparring and refused to let go on locks during Brazilian Jiu Jitsu classes, Steve asked him to leave the gym.

On the contrary, in a work environment, I have witnessed situations where someone would repeatedly yell at colleagues in front of everyone — including executives — during meetings. It got so toxic that four people from various departments requested to switch projects because they did not want to work with the person anymore. However, because the employee was deemed important by executives, they continued to let him yell at others during meetings with no repercussions.

Culture is not just slogans hung on the walls of your conference rooms. UCSF Psychiatry professor Cameron Sepah says, “Your Company Culture is Who You Hire, Fire, and Promote.” One of the triggers for a recent employee walk-out at Google was because the company paid ex-executives tens of millions of dollars after discovering allegations of sexual misconduct. Ensuring improper behavior is dealt with immediately and fairly is vital to fostering an inclusive culture.

Success breeds success

When an initiative has early traction, it is much easier to continue the momentum. Culture is the same way. When Five Points first started in 2002, they already had three high-level female fighters—one of them, Emily, even went on to win the Muay Thai World Championships. Having diversity early on helped provide role models for members from underrepresented backgrounds who were interested in fighting.

Once an inclusive culture is established, the community members will continue to be inclusive and others will want to join. One of the coaches and fighters, Gianna, explained, “Nobody made me feel like sh*t when I was new, so I want to make sure other noobs don’t feel that way either.”

Another Kali student, Sonya, who describes herself as a “girly girl,” had to work extra hard honing her skills because she did not come from an athletic background like most of the other members. However, Simon was always patient with her, continually breaking down techniques until she grasped them. Looking back, she is extremely appreciative that Simon tried very hard to make her feel comfortable, and now she recommends all her female friends to try out Kali. Her motivation? “I want girly girls to know that they’re welcome here.”

The same applies to the tech industry. I have seen series A companies with 50 employees struggle to hire women due to their gender imbalance (15% female), only to see the ratio further decrease as the company grows (10%). On the other hand, Flatiron Health, also a former employer, focused on diversity & inclusion from the get-go, including hiring senior female leaders across all functions early on. When I was there, they had roughly 50% female employees and 50% female managers.

From inclusion to diversity

Five Points Academy never started with the intent of building a gym with 50% women and members from all different ethnic and socio-economic backgrounds. Instead, the owners simply wanted to build a gym where anyone can belong, and anyone can enjoy being part of the community. By starting with inclusion, diversity followed.

I am not at all advocating for halting initiatives on diversity. It is important that we focus on diversity, and many companies are doing just that. However, just like Five Points Academy, we also need to invest in building an inclusive culture to help people thrive and grow at the company, which will further attract more diverse employees.

Footnotes

[1] Studies have shown that a man’s ideas are often taken more seriously than a woman’s. As a result, many women choose not to participate in meetings but ask a male colleague of theirs to present their ideas.

[2] For example, according to Ascend Research, Asians score the lowest in executive parity index, doing worse than Blacks and Hispanics. However, they are not considered an “underrepresented minority,” so relatively little has been done to mentor young Asian professionals on career progression.

[3] If you had physical limitations, you could substitute them with pushups on knees or another exercise.

Powered by WPeMatico

Startups at the speed of light: Lidar CEOs put their industry in perspective

As autonomous cars and robots loom over the landscapes of cities and jobs alike, the technologies that empower them are forming sub-industries of their own. One of those is lidar, which has become an indispensable tool to autonomy, spawning dozens of companies and attracting hundreds of millions in venture funding.

But like all industries built on top of fast-moving technologies, lidar and the sensing business is by definition built somewhat upon a foundation of shifting sands. New research appears weekly advancing the art, and no less frequently are new partnerships minted, as car manufacturers like Audi and BMW scramble to keep ahead of their peers in the emerging autonomy economy.

To compete in the lidar industry means not just to create and follow through on difficult research and engineering, but to be prepared to react with agility as the market shifts in response to trends, regulations, and disasters.

I talked with several CEOs and investors in the lidar space to find out how the industry is changing, how they plan to compete, and what the next few years have in store.

Their opinions and predictions sometimes synced up and at other times diverged completely. For some, the future lies manifestly in partnerships they have already established and hope to nurture, while others feel that it’s too early for automakers to commit, and they’re stringing startups along one non-exclusive contract at a time.

All agreed that the technology itself is obviously important, but not so important that investors will wait forever for engineers to get it out of the lab.

And while some felt a sensor company has no business building a full-stack autonomy solution, others suggested that’s the only way to attract customers navigating a strange new market.

It’s a flourishing market but one, they all agreed, that will experience a major consolidation in the next year. In short, it’s a wild west of ideas, plentiful money, and a bright future — for some.

The evolution of lidar

I’ve previously written an introduction to lidar, but in short, lidar units project lasers out into the world and measure how they are reflected, producing a 3D picture of the environment around them.

Powered by WPeMatico

Rocket Lab successfully launches seventh Electron rocket for ‘Make It Rain’ mission

Private rocket launch startup Rocket Lab has succeeded in launching its ‘Make It Rain’ mission, which took off yesterday from the company’s private Launch Complex 1 in New Zealand. On board Rocket Lab’s Electron rocket (its seventh to launch so far) were multiple satellites flow for various clients in a rideshare arrangement brokered by Rocket Lab client Spaceflight.

Payloads for the launch included a satellite for Spaceflight subsidiary BlackSky, which will join its existing orbital imaging constellation. There was also a CubeSat operated by the Melbourne Space Program, and two Prometheus satellites launched for the U.S. Special Operations Command.

Rocket Lab had to delay launch a couple of times earlier in the week owing to suboptimal launch conditions, but yesterday’s mission went off without a hitch at 12:30 AM EDT/4:30 PM NZST. After successfully lifting off and achieving orbit, Rocket Lab’s Electron also delayed all of its payloads to their target orbits as planned.

Later this year, Rocket Lab hopes to have a second privately owned launch complex fully constructed and operational, located in Virginia on Wallops Island. The company, founded by engineer Peter Beck, intends to be able to serve both U.S. government and commercial missions as frequently as monthly from this second launch site.

Powered by WPeMatico

Startups Weekly: What’s next for WeWork?

Hello and welcome back to Startups Weekly, a weekend newsletter that dives into the week’s noteworthy startups & venture capital news. Before I jump into today’s topic, let’s catch up a bit. Last week, I wrote about scooter companies struggling to raise cash. Before that, I noted my key takeaways from Recode + Vox’s Code Conference in Scottsdale, Arizona.

Remember, you can send me tips, suggestions and feedback to kate.clark@techcrunch.com or on Twitter @KateClarkTweets. If you don’t subscribe to Startups Weekly yet, you can do that here.

I’m sure you’re familiar with the co-working behemoth WeWork at this point but if not, here’s a quick primer: The real estate business posing as a “tech startup” offers office spaces to individuals and companies across thousands of co-working spots scattered across the globe.

I’m sure you’re familiar with the co-working behemoth WeWork at this point but if not, here’s a quick primer: The real estate business posing as a “tech startup” offers office spaces to individuals and companies across thousands of co-working spots scattered across the globe.

Led by an eclectic chief executive by the name of Adam Neumann, WeWork made headlines this week after announcing its acquisition of building access app Waltz. The deal represents WeWork’s third M&A transaction of 2019, following that of spatial analytics platform Euclid and office management system Managed By Q. As is often the case, WeWork didn’t disclose terms of the deal.

In the last few years, WeWork has acquired nearly a dozen startups, making it one of the most — if not the most — acquisitive unicorn in the valley. Those acquisitions, a revolving door of venture capital investment and an eventual IPO are all part of WeWork’s world domination plan.

Adam Neumann (WeWork) at TechCrunch Disrupt NY 2017

WeWork filed confidentially to go public this spring shortly after securing new capital from the SoftBank Vision Fund. Now, WeWork is preparing itself for Wall Street’s scrutiny by buying growth, investing in new technologies and doubling down on talented teams. As we’ve pointed out before, WeWork isn’t profitable nor anywhere near profitability. Rather, the company’s value (a laughably high $47 billion) is based on its potential future growth, not its current revenue. Making strategic investments to expand its revenue streams is good business.

WeWork could be a bit more choosy with its deals, though. I will never forget when it took a big stake in Wavegarden, a company that makes wave pools. Yes, really, that happened.

Now that WeWork has officially entered the pre-IPO stage, it must take a closer look at its leadership. The 9-year-old company has an all-male board, something Canvas Ventures’ Rebecca Lynn pointed out to me on this week’s episode of Equity, TechCrunch’s venture capital-focused podcast. We were discussing a new lawsuit filed by former WeWork executives that alleges age and gender discrimination when she noted the troubling statistic.

For a company of that stature to not have appointed a woman to its board by now is mind-boggling. It may be one of the most highly-valued companies in the world on paper, but to succeed as a public company, it has more than one thing to figure out.

Anyways…

IPO Corner:

The Real Real: The marketplace for luxury consignment jumped 50% Friday in its Nasdaq IPO. The company, led by founder and CEO Julie Wainwright, raised $300 million in the process.

Livongo: The digital health business submitted paperwork for an IPO this week, joining a long line of companies opting to go public in 2019. Livongo posted $68.4 million in revenue last year.

Postmates: Google’s vice president of finance Kristin Reinke joined Postmates’ board of directors this week in what was the latest sign the on-demand food delivery startup is prepping for an imminent IPO.

Startup Capital:

SpaceX seeks $300M in fresh funding

Corporate travel platform TripActions secures $250M

Fungible gets $200M from the SoftBank Vision Fund

StockX raises $110M at $1B valuation

Cameo nabs $50M to deliver personalized messages from celebrities

Superhuman secures $33M Series B

SV Academy raises $9.5M to offer tuition-free training for tech jobs

Data!

Social Capital co-founder Chamath Palihapitiya is spinning out a company from his venture capital fund-turned-family-office, TechCrunch has learned. The new entity, temporarily dubbed CaaS (short for capital-as-a-service) Technologies, will focus on providing data-driven insights to VC firms. We’ve got the scoop here.

Elizabeth Holmes, the founder of the now-defunct biotech unicorn Theranos, will face trial in federal court next summer with penalties of up to 20 years in prison and millions of dollars in fines. Jury selection will begin July 28, 2020, according to U.S. District Judge Edward J. Davila, who announced the trial will commence in August 2020 in a San Jose federal court Friday morning.

Extra Crunch:

If you’ve been unsure whether to sign up for TechCrunch’s awesome new subscription service, now is the time. We’ve been publishing a lot of great content, here are my favorites this week:

- What startup names are most effective?

- How to scale a startup in school

- The next service marketplace wave: Vertical market-networks

#EquityPod:

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, TechCrunch editor Connie Loizos, Canvas Ventures general partner Rebecca Lynn and I discuss Brandless’ current dilemma and big rounds for Cameo and StockX.

Powered by WPeMatico

Google finance head joins Postmates board ahead of anticipated IPO

Google’s vice president of finance, has joined Postmates’ board of directors, the latest sign that the on-demand food delivery startup is prepping to take the company public.

Postmates announced Friday that Kristin Reinke, vice president of Finance at Google, will join the San Francisco startup as an independent director.

Reinke has been with Google since 2005. Prior to Google, Reinke was at Oracle for eight years. Reinke also serves on the Federal Reserve Bank of San Francisco’s Economic Advisory Council.

Her skill set will come in handy as Postmates creeps towards an IPO.

Earlier this year, the company lined up a $100 million pre-IPO financing that valued the business at $1.85 billion. Postmates is backed by Tiger Global, BlackRock, Spark Capital, Uncork Capital, Founders Fund, Slow Ventures and others. Spark Capital’s Nabeel Hyatt tweeted the news earlier Friday.

Happy to welcome Kristin to the board of @Postmates.

Great times ahead. https://t.co/nEqu3A2YkE

— Nabeel Hyatt (@nabeel) June 28, 2019

“Postmates has established itself as the market leader with a focus on innovation and route efficiency in the fast‐growing on‐demand delivery sector. Given their strong execution, accelerating growth, and financial discipline, they are well positioned for continued market growth across the U.S.,” said Reinke. “I’m thrilled to join the board.”

The startup has been beefing up its executive quiver, most recently hiring Apple veteran and author Ken Kocienda as a principal software engineer at Postmates X, the team building the food delivery company’s semi-autonomous sidewalk rover, Serve.

Kocienda, author of “Creative Selection: Inside Apple’s Design Process During the Golden Age of Steve Jobs,” spent 15 years at Apple focused on human interface design, collaborating with engineers to develop the first iPhone, iPad and Apple Watch.

Powered by WPeMatico

Theranos founder Elizabeth Holmes to stand trial in 2020

Elizabeth Holmes, the founder of the now-defunct biotech unicorn Theranos, will face trial in federal court next summer with penalties of up to 20 years in prison and millions of dollars in fines.

Jury selection will begin July 28, 2020, according to U.S. District Judge Edward J. Davila, who announced the trial will commence in August 2020 in a San Jose federal court Friday morning.

Holmes and former Theranos president Ramesh “Sunny” Balwani were indicted by a grand jury last June with 11 criminal charges in total. Two of those charges were conspiracy to commit wire fraud (against investors, and against doctors and patients). The remaining nine are actual wire fraud, with amounts ranging from the cost of a lab test to $100 million.

According to Bloomberg, Holmes’ legal team plans to argue that The Wall Street Journal’s John Carreyrou “had an undue influence on federal regulators,” and “went beyond reporting the Theranos story.”

“The jury should be aware that an outside actor, eager to break a story, and portray the story as a work of investigative journalism, was exerting influence on the regulatory process in a way that appears to have warped the agencies’ focus on the company and possibly biased the agencies’ findings against it,” her attorneys wrote, per Bloomberg. “The agencies’ interactions with Carreyrou thus go to the heart of the government’s case.”

Theranos, founded in 2003 by then 19-year-old Stanford dropout Holmes, raised more than $700 million from private market investors in what’s been referred to by the Securities and Exchange Commission as an “elaborate, years-long fraud in which they exaggerated or made false statements about the company’s technology, business, and financial performance.”

Theranos first came under scrutiny in October 2015, when Carreyrou published his first of many investigative pieces questioning the efficacy of Theranos’ blood-testing technology. At the time, Theranos was one of the most buzzworthy companies in Silicon Valley, boasting a valuation of $9 billion and the support of high-profile investors like Tim Draper and Robert Murdoch.

Theranos, as a result of Carreyrou’s reporting, was discovered to be a threat to public health. Its technology, as it turns out, was light years away from processing an expansive range of laboratory tests from just a few drops of blood.

According to The Wall Street Journal, federal prosecutors have collected more than 2 million pages of evidence for the defense teams. Holmes, despite ample evidence, has maintained her innocence since the grand jury indictment last year.

Following criminal charges, Holmes stepped down from Theranos last year; shortly after, the company ceased operations. Carreyrou, for his part, released a best-selling book, ‘Bad Blood,’ documenting Theranos’ secrets and lies. A documentary chronicling Holmes’ and Theranos’ rapid rise and fall was released by HBO in 2019. A Hollywood production starring Jennifer Lawrence as Elizabeth Holmes is reportedly in the works.

Powered by WPeMatico

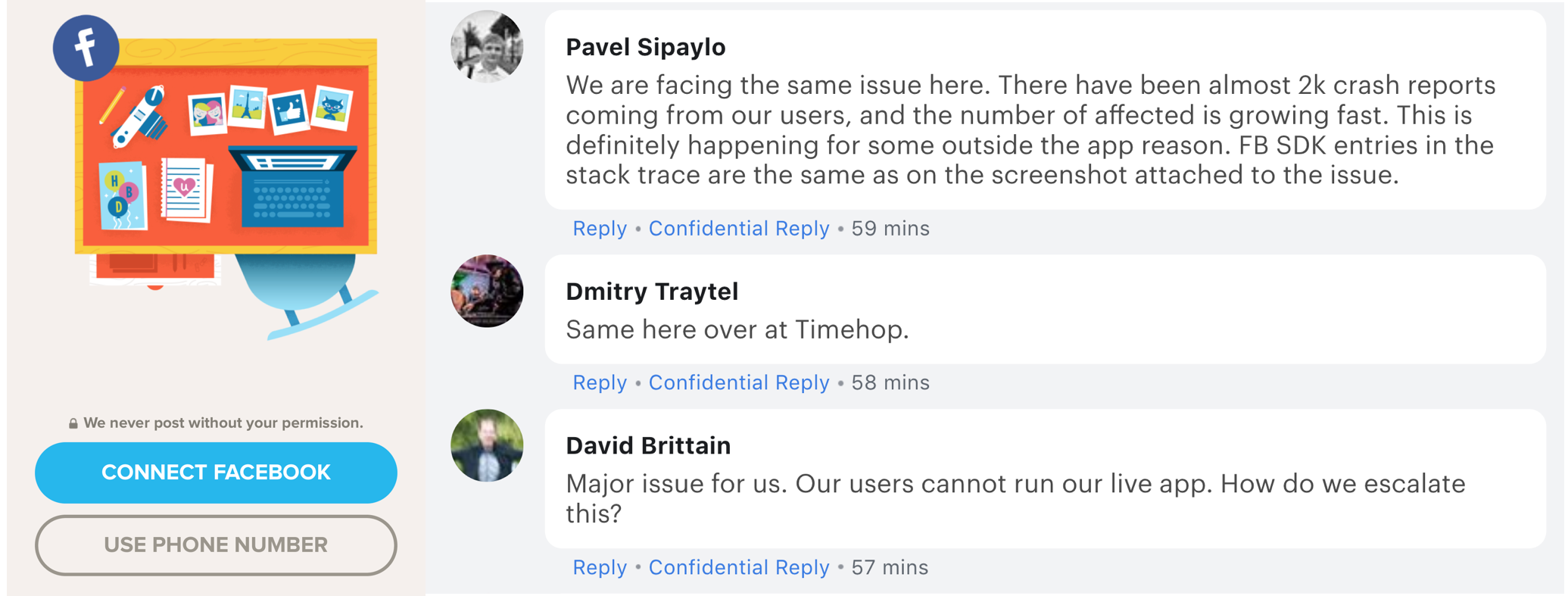

Facebook SDK bug crashed apps like Timehop

A malfunction in Facebook’s Software Development Kit that lets apps add Login With Facebook, sharing, and other features caused apps that integrate it like Timehop to repeatedly crash for about three hours. TechCrunch received a tip that developers were getting tons of user complaints and crash reports starting around noon pacific today due to a problem with the Facebook for iOS SDK. TechCrunch’s testing verified that products like Timehop, Joytunes’ Simply Piano, Momento GIFs, and more kept breaking when users access Facebook features or in some cases just opened the app.

This is a big issue for Facebook because it relies on these apps to drive user lock-in. If people use Facebook to log into or share from other apps, they’re less likely to delete their account. But if the Facebook developer platform screws up like this morning, developers could instead highlight sharing via Twitter or SMS, and divert ad buys to other platforms. Most problematically, the bug could push developers to other login platforms like Google’s or Apple’s new Sign In With Apple.

[Update: 3:45pm PT: Facebook has fixed the bug and apps integrated with the SDK are starting to work normally again. A Facebook spokesperson tells me “We started to work on the issue as soon as it was reported to us, and it has been resolved.” Facebook engineer Ram Sharma posted that “Our engineering team worked to resolve this issue as soon as it was discovered. It is now mitigated and app function should be restored.” Developers confirm the bug has been fixed. The rest of this article remains as originally published.]

The bug was initially submitted to Facebook’s developer forums by Ryan Layne. These crashes thwart normal usage of other apps, costing their developers ad views and in-app purchases, or leading their users to uninstall or abandon them.

Hitting the Connect Facebook button on Timehop causes the app to crash. Developers in Facebook’s bug reporting forum pile on saying their apps are breaking

The situation highlights the increasing centralization of the web as more and more companies depend on a small number of mobile, hosting, and social platforms. Earlier this month, a Google Cloud outage knocked down Snapchat and Discord. While these tools make it simpler to start a company or launch an app without having to build everything in-house, they introduce platform risk. Beyond technical outages, there’s also the concern that a platform could use its insights to copy its clients, or block them if they compete with the gatekeeper too vigorously as Facebook has done to chat and social media apps in the past.

Powered by WPeMatico

Enterprise SaaS revenue hits $100B run rate, led by Microsoft and Salesforce

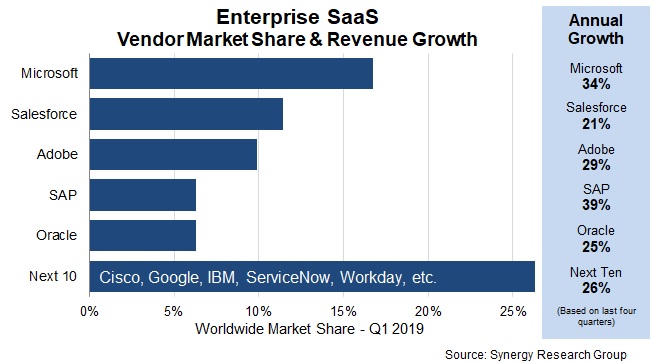

In its most recent report, Synergy Research, a company that monitors cloud marketshare, found that enterprise SaaS revenue passed the $100 billion run rate this quarter. The market was led by Microsoft and Salesforce.

It shouldn’t be a surprise at this point that these two enterprise powerhouses come in at the top. Microsoft reported $10.1 billion in Productivity and Business Processes revenue, which includes Office 365, the Dynamics line and LinkedIn, the company it bought in 2016 for $26.2 billion. That $10.1 billion accounted for the top spot with 17 percent

Salesforce was next with around 12%. It announced $3.74 billion in revenue in its most recent earnings statement with Service Cloud alone accounting for $1.02 billion in revenue, crossing that billion-dollar mark for the first time.

Adobe came in third, good for around 10% market share, with $2.74 billion in revenue for its most recent report. Digital Media, which includes Creative Cloud and Document Cloud, accounted for the vast majority of the revenue with $1.8 billion. SAP and Oracle complete the top companies

A growing market

While that number may seem low, given we are 20 years into the development of the SaaS market, it is still a significant milestone, not to be dismissed lightly. As Synergy pointed out, while the market feels mature, if finds that SaaS revenue still accounts for just 20 percent of the overall enterprise software market. There’s still a long way to go, showing as with the infrastructure side of the market, things change much more slowly than we imagine, and the market is growing rapidly, as the impressive growth rates show.

“While SaaS growth rate isn’t as high as IaaS (Infrastructure as a Service) and PaaS (Platform as a Service), the SaaS market is substantially bigger and it will remain so until 2023. Synergy forecasts strong growth across all SaaS segments and all geographic regions,” the company wrote in its report.

Salesforce is the only one of the top five that was actually born in the cloud. Adobe, an early desktop software company, switched to cloud in 2013. Microsoft, of course, has been a desktop stalwart for many years before embracing the cloud over the last decade. SAP and Oracle are traditional enterprise software companies, born long before the cloud was even a concept, that began transitioning when the market began shifting.

Getting to a billion

Yet in spite of being late to the game, these numbers show that the market is still dominated by the old guard enterprise software companies and how difficult it is to achieve market dominance for companies born in the cloud. Salesforce emerged 20 years ago as an early cloud adherent, but of all of the enterprise SaaS companies that were started this century only ServiceNow and WorkDay show up in the Synergy list lumped in “the next 10.”

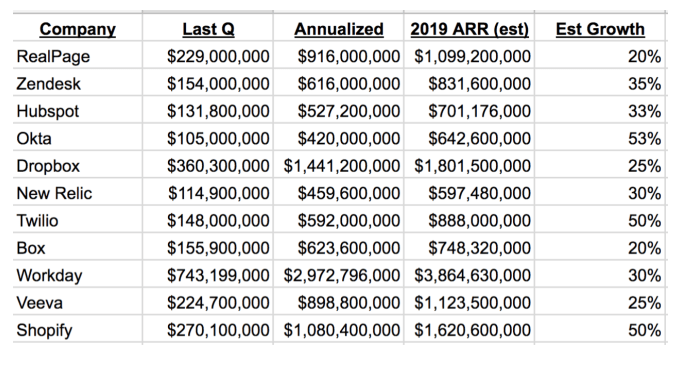

That’s not to say there aren’t SaaS companies making some serious money, just not quite as much as the top players to this point. Jason Lemkin, CEO and founder at SaaStr, a company that invests in and supports enterprise SaaS companies, says a lot of companies are close to that $1 billion goal than you might think, and he’s optimistic that we are going to see more.

“We will have at least 100 companies top $1 billion in ARR, probably many more. It is just math. Almost everyone IPO’ing [SaaS company] has 120-140% revenue retention. That will compound $100 million or $200 million to $1 billion. The only question is when,” he told TechCrunch.

Chart courtesy of SaasStr

He adds that annualized numbers are very close behind ARR numbers and it won’t take long to catch up. Yet as we have seen with some of the companies on this list, it’s still not easy to get there.

It’s hard to develop a billion dollar SaaS company, and it takes time and patience, and perhaps some strategic acquisitions to get there, but the market trajectory continues to move upward. It will likely only grow stronger as more companies move to software in the cloud, and that bodes well for many of the players in this market, even those that didn’t show up on Synergy’s chart.

Powered by WPeMatico