Wedding dress customizer Anomalie raises $13M as bridal stores crumble

David’s Bridal once owned 50% of the $36 billion wedding gown market before it filed for bankruptcy last year. Brides were growing sick of the lack of styles and sizes plus high prices at expensive brick & mortar shops. The industry was destined for disruption by software that would replace overhead costs and inflexibility with direct-to-consumer personalization.

That’s why I profiled a new custom wedding dress startup back in 2016 called Anomalie despite little funding or traction. The rise of Instagram meant every bride wanted to look unique on a budget, not pay $5000 for a cookie-cutter $200 dress that happened to be white. Anomalie was willing to embrace software to offer 4 billion design permutations and break the markup cartel by selling gowns starting at $1000.

2.5 years later, Anomalie has begun to prove that cheaper doesn’t have to look cheap and custom doesn’t have to cause a headache. 13% of US brides, 275,000 out of 2.1 million, created an Anomalie account in the last year. With David’s Bridal looking shaky and wedding dresses being a seven-times larger market than bedding and mattresses, investors eagerly proposed to Anomalie. Today the startup announces a $13.6 million Series A led by consumer product VC Goodwater Capital .

“I don’t think I’ll ever get tired of working with brides. Other companies would kill for this costumer. She’s so obsessed with every detail of her wedding dress. it’s just a perfect environment to collect data” says Anomalie co-founder and CEO Leslie Voorhees. “Long lead time, high margin, this industry that’s completely f*cked up — it’s the perfect place to start this mass customization engine beginning with the wedding dress” she tells me, hinting at the startup’s potential to customize other clothing too.

Anomalie is also flexing its tech muscle today with the launch of its new dress sketch visualizer. Choose between a few options on shape, cut, color, pattern, and fabric, and you’ll see an algorithmic sketch of your dream dress appear instantly. Anomalie then pairs you with a squad of its designers to finalize the details, ship swatches, and get you your gown with a 100% refund policy if it’s not right.

The startup’s nest egg will go towards hiring more engineers plus bringing more of production in-house to offer additional features like this. But Voorhees insists that “I don’t think we’ll ever completely automate away the stylists. Customer don’t care about AI or machine learning, but they want to trust us to pull the ideas out of their heads.”

Anomalie co-founder and CEO Leslie Voorhees

Anomalie was woven out of Voorhees’ frustrations picking her own wedding dress. She’d been managing factories and supply chains in Asia for Nike and Apple, and it made no sense why slapping “bridal” on a dress could make it up to ten-times more expensive.

Her investigation uncovered that most brands were outsourcing their manufacturing, so she did an end-run, contacted factories directly, and got her dress made custom for a fraction of the price. So many of her pals demanded help doing the same that the Harvard Business School grad soft-launched Anomalie with her husband Calley Means [Disclosure: who I know from college] in the summer of 2016.

The startup’s gowns now average $1,400. Growth has been swift since weddings are so photographed and shared, with Anomalie reaching an outstanding net promoter score of 91. A friend of mine recently bought her dess through the company and it looked stunning and one-of-a-kind without breaking the bank. And since they’re custom, Anomalie makes inclusivity and advantage by offering larger sizes absent elsewhere

Meanwhile, Anomalie’s incumbent competitors have struggled. Gap and J.Crew abandoned the wedding dress business in the last few years. David’s Bridal emerged from bankruptcy with its 300 retail stores still operating, but it’s slipped to 30 percent US market share. It’s now owned by lenders including Oaktree Capital Group, which is a bad omen given that firm was responsible for driving Toys”R”Us into liquidation instead of keeping it open. No other players have a sizable foot or well-known brand besides super high-end designer Vera Wang.

Anomalie capitalized on David’s troubles by poaching its head of bridal production Angela Ng, who now leads the startup’s Hong Kong team and relieves Voorhees of constant trips to China. It also hired former Sephora VP of digital Marcy Zelmar and former TrueCar VP of engineering Aaron Tavistock. Their goal is to sell more dresses to get Anomalie more data, more factory modularization, and more control over its manufacturing.

Anomalie’s dress visualizer turns a few style selections into a sketch of your potential gown

The new funding round that builds on its $4.5 million seed round was joined by Signia, SoGal Ventures, Lerer Hippeau’s BN Capital Fund, and Fin’s Sam Lessin also includes strategic angels like former Stitch Fix CTO Jeff Barrett and ThirdLove underwear CEO Heidi Zak. At Anomalie’s San Francisco headquarters, mannequins sporting design prototypes stand beside software teams optimizing the new dress visualizer. And when I say the dresses are custom, I mean they can get about as weird as you want. Anomalie is finishing up a dress with lyrics from the couple’s favorite song embroidered in a secret language from their favorite TV show…and it still looks beautiful.

“One of the coolest things about Anomalie is that they’re not just using digital as a distribution strategy, but to also deliver a differentiated product experience” says Goodwater partner Eric Kim. “Anomalie’s sketch-builder is a great expression of this emphasis on product and customer centricity.” Wedding dresses have been largely ignored by startups despite the market being bigger than luggage ($34 billion), or shaving ($21 billion), oral care ($10 billion) and hair loss ($4 billion) combined.

The challenge is that unlike those products, bridal gowns are “a zero failure game. This is like airplane engines and heart rate monitors” Voorhees stresses. Anomalie must maintain perfect quality, times, and customer experience to avoid ruining someone’s big day. “Never messing up a dress or losing a dress — we take this really, really seriously.” She knows a few viral disasters could sink the ship. It also has to stay ahead of fresh entrants like COUTURME, a new Y Combinator startup making custom evening gowns as well as wedding dresses.

Anomalie’s SF headquarters. Photo by Summer Wilson

Anomalie sees global demand for a better experience, and thinks it can apply its data set to wedding dresses for more cultures as well as additional types of clothing. “We are building up a large repository of female measurements and creating tech plus operational processes around ‘mass customization’ that can be applied to other garments” Voorhees reveals. “Our aspirations are around bringing more body inclusivity + customization to women’s fashion, not just bridal.”

And while Anomalie could always find a retail partner to get more exposure, it’s tough for brick & mortar brands to operate online without cannibalizing their sales. “We think the women’s closet of the future contains staples from Stitch Fix, rotating dresses from Rent the Runway, and signature custom garments from Anomalie.”

The Anomalie just needs to educate brides that they can actually have the dress of their dreams, and now it wants to inspire that dream on-site too. Full of ambition and verve, Voorhees concludes, “What’s Pinterest valued at when it’s basically a wedding dress search engine?”

Powered by WPeMatico

‘This is Your Life in Silicon Valley’: Former Pinterest President, Moment CEO Tim Kendall on Smartphone Addiction

Welcome to this week’s transcribed edition of This is Your Life in Silicon Valley. We’re running an experiment for Extra Crunch members that puts This is Your Life in Silicon Valley in words – so you can read from wherever you are.

This is Your Life in Silicon Valley was originally started by Sunil Rajaraman and Jascha Kaykas-Wolff in 2018. Rajaraman is a serial entrepreneur and writer (Co-Founded Scripted.com, and is currently an EIR at Foundation Capital), Kaykas-Wolff is the current CMO at Mozilla and ran marketing at BitTorrent. Rajaraman and Kaykas-Wolff started the podcast after a series of blog posts that Sunil wrote for The Bold Italic went viral.

The goal of the podcast is to cover issues at the intersection of technology and culture – sharing a different perspective of life in the Bay Area. Their guests include entrepreneurs like Sam Lessin, journalists like Kara Swisher and politicians like Mayor Libby Schaaf and local business owners like David White of Flour + Water.

This week’s edition of This is Your Life in Silicon Valley features Tim Kendall, the former President of Pinterest and current CEO of Moment. Tim ran monetization at Facebook, and has very strong opinions on smartphone addiction and what it is doing to all of us. Tim is an architect of much of the modern social media monetization machinery, so you definitely do not want to miss his perspective on this important subject.

For access to the full transcription, become a member of Extra Crunch. Learn more and try it for free.

Sunil Rajaraman: Welcome to season three of This is Your Life in Silicon Valley. A Podcast about the Bay Area, technology, and culture. I’m your host, Sunil Rajaraman and I’m joined by my cohost, Jascha Kaykas-Wolff.

Jascha Kaykas-Wolff: Are you recording?

Rajaraman: I’m recording.

Kaykas-Wolff: I’m almost done. My phone’s been buzzing all afternoon and I just have to finish this text message.

Rajaraman: So you’re one of those people who can’t go five seconds without checking their phone.

Powered by WPeMatico

Snowflake co-founder and president of product Benoit Dageville is coming to TC Sessions: Enterprise

When it comes to a cloud success story, Snowflake checks all the boxes. It’s a SaaS product going after industry giants. It has raised bushels of cash and grown extremely rapidly — and the story is continuing to develop for the cloud data lake company.

In September, Snowflake’s co-founder and president of product Benoit Dageville will join us at our inaugural TechCrunch Sessions: Enterprise event on September 5 in San Francisco.

Dageville founded the company in 2012 with Marcin Zukowski and Thierry Cruanes with a mission to bring the database, a market that had been dominated for decades by Oracle, to the cloud. Later, the company began focusing on data lakes or data warehouses, massive collections of data, which had been previously stored on premises. The idea of moving these elements to the cloud was a pretty radical notion in 2012.

It began by supporting its products on AWS, and more recently expanded to include support for Microsoft Azure and Google Cloud.

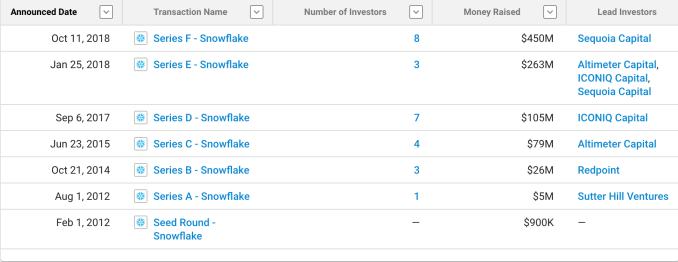

The company started raising money shortly after its founding, modestly at first, then much, much faster in huge chunks. Investors included a Silicon Valley who’s who such as Sutter Hill, Redpoint, Altimeter, Iconiq Capital and Sequoia Capital .

Snowflake fund raising by round. Chart: Crunchbase

The most recent rounds came last year, starting with a massive $263 million investment in January. The company went back for more in October with an even larger $450 million round.

It brought on industry veteran Bob Muglia in 2014 to lead it through its initial growth spurt. Muglia left the company earlier this year and was replaced by former ServiceNow chairman and CEO Frank Slootman.

TC Sessions: Enterprise (September 5 at San Francisco’s Yerba Buena Center) will take on the big challenges and promise facing enterprise companies today. TechCrunch’s editors will bring to the stage founders and leaders from established and emerging companies to address rising questions, like the promised revolution from machine learning and AI, intelligent marketing automation and the inevitability of the cloud, as well as the outer reaches of technology, like quantum computing and blockchain.

Tickets are now available for purchase on our website at the early-bird rate of $395.

Student tickets are just $245 – grab them here.

We have a limited number of Startup Demo Packages available for $2,000, which includes four tickets to attend the event.

For each ticket purchased for TC Sessions: Enterprise, you will also be registered for a complimentary Expo Only pass to TechCrunch Disrupt SF on October 2-4.

Powered by WPeMatico

FTC, Justice Dept. takes coordinated action against robocallers

Federal authorities have announced its latest crackdown on illegal robocallers — taking close to a hundred actions against several companies and individuals blamed for the recent barrage of spam calls.

In the so-called “Operation Call It Quits,” the Federal Trade Commission brought four cases — two filed on its behalf by the Justice Department — and three settlements in cases said to be responsible for making more than a billion illegal robocalls.

Several state and local authorities also brought actions as part of the operation, officials said.

Each year, billions of automatically dialed or spoofed phone calls trick millions into picking up the phone. An annoyance at least, at worse it tricks unsuspecting victims into turning over cash or buying fake or misleading products. So far, the FTC has fined companies more than $200 million but only collected less than 0.01% of the fines because of the agency’s limited enforcement powers.

In this new wave of action, the FTC said it will send a strong signal to the robocalling industry.

Andrew Smith, director of the FTC’s Bureau of Consumer Protection, said Americans are “fed up” with the billions of robocalls received every year. “Today’s joint effort shows that combatting this scourge remains a top priority for law enforcement agencies around the nation,” he said.

It’s the second time the FTC has acted in as many months. In May, the agency also took action against four companies accused of making “billions” of robocalls.

The FTC said its latest action brings the number of robocall violators up to 145.

Several of the cases involved shuttering operations that offer consumers “bogus” credit card interest rate reduction services, which the FTC said specifically targeted seniors. Other cases involved the use of illegal robocalls to promote money-making schemes.

Another cases included actions against Lifewatch, a company pitching medical alert systems, which the FTC contended uses spoofed caller ID information to trick victims into picking up the phone. The company settled for $25.3 million. Meanwhile, Redwood Scientific settled for $18.2 million, suspended due to the inability for defendant Danielle Cadiz to pay, for “deceptively” marketing dentistry products, according to the FTC’s complaint.

The robocalling epidemic has caught the attention of the Federal Communications Commission, which regulates the telecoms and internet industries. Last month, its commissioners proposed a new rule that would make it easier for carriers to block robocalls.

Powered by WPeMatico

Lightyear One debuts as the first long-range solar-powered electric car

Electric cars are better for the environment than fossil fuel-burning vehicles, but they still rely on the grid, which can be variously dirty or clean depending on what sources it uses for its energy. The new Lightyear One is a prototype vehicle that would improve that by collecting the power it needs to run from the sun.

Lightyear, a startup from the Netherlands born as Stella, has come a long way since it won a Crunchie award in 2015, with a vehicle that now looks ready for the road. The Lightyear One prototype vehicle unveiled today has a sleek, driver-friendly design and also boasts a range of 450 miles on a single charge – definitely a first for a car powered by solar and intended for the actual consumer market.

© Twycer / www.twycer.nl

The startup says that it has already sold “over a hundred vehicles” even though this isn’t yet ready to hit the road, but Lightyear is aiming to begin production by 2021, with reservations available for 500 additional units for the initial release. You do have to pay €119,000 up front (around $136,000 USD) to secure a reservation, however.

Lightyear One isn’t just a plug-in electric with some solar sells on the roof: Instead it’s designed from the ground up to maximize performance from a smaller-than-typical battery that can directly grab sun from a roof and hood covered with 16 square feet of solar cells, embedded in safety glass designed with passenger wellbeing in mind. The car can also take power directly from regular outlets and existing charging stations for a quick top-up, and again because it’s optimized to be lightweight and power efficient, you can actually get around 250 miles on just one night of charging from a standard (European) 230V outlet.

The car should supplement existing electric cars for buyers who are more conscious of range anxiety and nervous about having enough charge, the company says. It still have to actually enter production, however, and even when it does it’ll be a fairly expensive and small batch product, at least at first. But it’s an impressive feat nonetheless, and a potential new direction for EVs of the future.

Powered by WPeMatico

Orderful nabs $10M from A16Z to modernise the B2B supply chain network

The march of globalization continues unabated, and with it comes a growing demand for companies of all sizes to communicate with and sell to each other, regardless of the distance or any other barrier. Now, a startup that has built a platform to help them do that better and more cheaply is announcing a round of funding to capitalize on the opportunity. Orderful, which aims to modernize supply chain management through an API-based cloud service, has raised $10 million in a Series A from Andreessen Horowitz.

The new funding comes on the back of a previous seed round from Initialized Capital and a period of time mostly bootstrapping the business. It will be used to continue building out more functionality on the platform and to continue to expand the network of partners using it. Today there are 1,000 retailers, 10,000 vendors and 5,000 carriers on Orderful’s platform, but even that still only represents a small part of the wider industry of businesses that buy, sell and transport components and full products from A to B.

To understand the problem that Orderful is trying to fix, a little rundown on how supply chain management works today is helpful. In the old, pre-computer days, all information exchange happened by way of phone, fax, post, and documents that often were delivered along with goods, which all required manual assessment and recording.

The rise of computers and the internet did push that system into the digital world, but only just: electronic data interchange (EDI), as this general area is known, is a loosely organised set of technical standards to use computers to communicate this data between businesses to enable purchases, make accounting reconciliations, and transfer shipping details.

It’s a business that has boomed with the growth of globalization and companies trading with each other at an increasing pace. Supply chain management software is a market that ballooned to $14 billion in value in 2018, according to Gartner. Incumbent leaders include the likes of SAP, Oracle and JDA.

The problem is that EDI is actually not as easy as it ought to be. It’s a hodge-podge of standards, you usually need a team of specialists to integrate the services at each end point, and it doesn’t allow for a wider network effect that you might get from being “online” with one supplier already. All of that translates to it being actually quite slow and expensive.

Erik Kiser, the founder and CEO of Orderful, found and identified this inefficiency while he was working as one of those specialists, realizing that with the rise of APIs, large database technology and cloud-based software-as-a-service, there was an opportunity to build a new kind of platform that could do everything that EDI did, but on a supercharged basis.

Marc Andreessen (co-founder of A16Z) coined the phrase ‘software will eat the world,’ Kiser noted to me, “But actually software eats software sometimes, too.”

The idea behind Orderful is that it has created a series of APIs that can adapt to whatever systems a business is already using, in turn “translating” that business’s product and other data into information that can be imported into the Orderful platform to in turn be picked up by buyers, sellers, and shippers.

(In other words, there is no expectation of ripping out legacy systems, but simply creating bridges to migrate what is already there to newer and better platforms.) This also brings down the operational costs of hiring teams to build and potentially run EDI integrations.

“EDI predates the internet, and there are not many digital protocols that we use today that are pre-internet,” David Ulevitch, the partner at Andreessen Horowitz who led the investment and joined the board, said in an interview.

“Orderful, and Erik, recognised that as more commerce was becoming digital, there needed to be a better way to do all this. There is currently no SaaS company out there addressing this and removing the friction. It provides velocity between distributors and producers because when you connect once you can then trade with a number of partners. Time is up for EDI.”

While there may be no direct competitor to Orderful at the moment, there are a lot of potential players that I can see posing a challenge down the line (or potentially working with or even buying Orderful if not). They include the incumbents in supply-chain management like Oracle, SAP and the rest.

But also companies like Amazon, which has built its own EDI alternative (or version, you might say) that is used for its own management of suppliers. The company is very well known for building for itself, and then productizing, but for now Kiser says that it’s a partner, and customers can interface and sell to Amazon on Orderful using its APIs.

One thing that Amazon is instructive about, though, is when considering how Orderful’s data trove could be used for more analytics and business intelligence down the line.

“I don’t think companies not doing business with Amazon will be inclined to use its platform for trading,” Kiser said. “But they do have a lot of information about their network.”

Indeed, he pointed out that it’s been said there are some 30 economists at the company looking at its B2B supply chain data, and considering how it can be parsed for example to predict inflation.

“They are already using the data. With Orderful we have the opportunity to be the most influential software company if we can be the plumbing that connects companies,” Kiser said. “There are a ton of services that we can add on the platform and that’s where we are going even if right now we are focused on the plumbing and simply making it easy to trade data.”

Powered by WPeMatico

Tundra, the zero-fee wholesale marketplace, picks up $12 million

Tundra, a new zero-commission wholesale marketplace, has today announced the close of $12 million in Series A funding. The round was led by Redpoint’s Annie Kadavy, with participation from investors such as Initialized Capital, Peterson Ventures, FJ Labs, Switch Ventures and Background Capital.

Tundra was founded by married couple Arnold and Katie Engel who previously ran a global supply chain company called Vox Supply Chain. In that world, they quickly realized just how much inefficiency is built into the wholesale market, from disorganized trade shows to transaction fees from the incumbents to a business that’s largely done on phone with pen and paper.

That’s where Tundra comes in.

Tundra allows suppliers to list their products on the platform, which is built to look and feel like a B2C marketplace. Buyers can come on the platform and shop for products, complete with ratings and reviews, supplier performance metrics, and free shipping with easy tracking.

“The wholesale market is set up to benefit big businesses, with other platforms and distributors charging anywhere from 5 percent to 30 percent commission,” said Engel. “That can be particularly pronounced for small businesses.”

“The wholesale market is set up to benefit big businesses, with other platforms and distributors charging anywhere from 5 percent to 30 percent commission,” said Engel. “That can be particularly pronounced for small businesses.”

Plus, it can be perilous for small players to depend on big platforms like Amazon. Just a few weeks ago, there were rumors that Amazon would focus its attention on big brands like P&G and purge smaller suppliers from the platforms. Amazon denied the rumors, saying it evaluates suppliers on an individual basis.

For Tundra, the hope is to eliminate both the time-consuming and tedious process of negotiating deals at trade shows as well as the cost of simply buying and selling wholesale products online. And, importantly, Tundra has a zero-fee model, which means that buyers and suppliers can operate on the platform without spending a penny if they so choose.

Of course, the company has to generate revenue in some way, which is why Tundra offers premium options at checkout, such as faster shipping, order insurance, and additional custom clearance and logistics services for international orders.

Having spent a year serving as Head of Strategic Operations growing Uber Freight, Redpoint Managing Director Annie Kadavy saw first-hand just how gargantuan the wholesale market is. During a phone interview, she reminded me that almost every item within view at any given moment was shipped on a truck and purchased at a wholesale price before it was purchased by a consumer in a store.

“Tundra’s greatest challenge ahead is execution, because the market opportunity here is very obvious,” said Kadavy. “It’s a huge business that is currently transacted by fax, phone call and pen and paper, so the opportunity is very clear.”

There is clearly movement in the space. Just last month, Shopify acquired Handshake to handle B2B e-commerce directly for customers. That followed its acquisition of dropshipping platform Oberlo in 2017, signaling the fact that existing platforms realize the opportunity of wholesale e-commerce, as well.

And a recent report stated that B2B e-commerce passed the $1 trillion mark for the first time in 2018.

The opportunity is there, as is the competition, but Tundra comes to the table armed with fresh capital.

Powered by WPeMatico

Showpad, a sales enablement platform for presentations and other collateral, raises $70M

Sales teams have long turned to tech solutions to help improve how they source leads, develop relationships and close deals. Now, one of the startups that helps out at a key point in that trajectory is announcing a round of growth funding to help fuel its own rapid growth. Showpad, a sales enablement platform that lets salespeople source and organise relevant content and other collateral that they use in their deals, has raised a Series D of $70 million.

The funding, which brings the total raised by Showpad to $160 million, is coming in the form of debt and equity. The equity part is co-led by Dawn Capital and Insight Partners, with existing investors Hummingbird Ventures, and Korelya Capital also participating. Silicon Valley Bank is providing debt financing. This is one of the first big investments out of Dawn’s Opportunities Fund that we wrote about last week.

The company is not disclosing its valuation but Pieterjan Bouten, the CEO who co-founded the company with Louis Jonckheere (currently CPO) and Peter Minne (CTO), confirmed that it has doubled since last year, and is seven times the valuation it had when it raised a $50 million Series C in 2016. The company is growing 90% year-on-year at the moment in terms of revenues.

And as a point of reference, another sales enablement player, Seismic, last December raised a Series E of $100 million at a $1 billion valuation.

Founded in Ghent, Belgium, Showpad today operates across two main headquarters, its original European base and Chicago. The latter was the homebase of LearnCore, a company that Showpad acquired last year that focuses on sales coaching and training. This became a strategic acquisition to expand Showpad’s primary product, a platform that acts as a kind of content management system for sales collateral. (Today, while Chicago is where Showpad builds its go-to market efforts and professional services, Ghent focuses on engineering and product, he said.) As it happens, Chicago is also the headquarters of Seismic.

As Bouten described in an interview, Showpad is part of what he considers to be the fourth pillar of the technology marketing stack: storage (the cloud services where you keep all your data), CRM, marketing automation and sales enablement, where Showpad sits.

While the first three are key to helping to manage a salesperson’s activities and work, the fourth is a crucial one for helping to make sure a salesperson can do his or her job more effectively.

Traditionally a lot of the content that salespeople used — presentations, white papers, other materials — to help make their cases and close their deals would be managed offline and directly by individual salespeople. Showpad has taken some of that process and made it digital, which means that now teams of salespeople can more effectively share materials amongst each other; and interestingly the material and its link to successful sales becomes part of how Showpad “learns” what works and what doesn’t.

That, in turn, helps build Showpad’s own artificial intelligence algorithms, to help suggest the best materials for a particular sales effort either to someone else in that team, or to other salespeople using the platform.

“To date there has been enormous innovation in automating the marketing and sales workflow. However, in the end, sales comes down to one person selling to another,” said Norman Fiore, General Partner at Dawn Capital and member of the Showpad Board, in a statement. “Historically, this has been an offline process that has been wildly inconsistent and opaque. Showpad’s suite of products succeeds in bringing this process online for the first time with data-rich feedback loops on the effectiveness of teams, managers, salespeople and even individual pieces of sales content.”

This is a crowded area of the market with a number of standalone companies building sales enablement solutions, but also other companies within the sales stack also adding on enablement as a value-added service.

For now, though, Bouten notes that these are more strategic partners than competitors. For example, Salesforce and Microsoft are partners, and, he adds, “We integrate with Salesloft to make sure sure emails that are sent out are using the right content. We become the single source of truth but also are being used for outreach.”

Today, the company has around 1,200 enterprise customers, including Johnson & Johnson, GE Healthcare, Bridgestone, Honeywell, and Merck. The plan going forward will be to continue building out the services that it offers around its sales enablement software, alongside the core product itself.

“You can equip sales people with the best content, but if they are not trained and coached in the right way, it goes nowhere,” Bouten said.

Powered by WPeMatico

Monzo, the UK challenger bank, raises £113M Series F led by YC’s Continuity fund at a £2B post-money valuation

Monzo, the fast-growing U.K.-based challenger bank with more than two million account holders, has raised £113 million (~$144m) in additional funding.

Confirming TechCrunch’s scoop in April, the Series F round is led by Y Combinator’s “Continuity” growth fund, and gives the company a new £2 billion (~$2.5b) post-money valuation. That’s double the £1 billion valuation it garnered in October last year.

A number of other new and existing investors have also participated in the Series F. They include Latitude, General Catalyst, Stripe, Passion Capital, Thrive, Goodwater, Accel, and Orange Digital Ventures.

The investment by London-based Latitude, the growth fund from prolific seed investor LocalGlobe, is particularly noteworthy given that LocalGlobe itself didn’t previously back Monzo. The same might be said of YC’s Continuity, considering that Monzo isn’t a YC alumni (although GoCardless, Monzo co-founder Tom Blomfield’s previous startup, did take part in the Silicon Valley accelerator).

The take-away: a growth fund attached to an early-stage fund can be a great antidote to the anti-portfolio (the list of successful companies a VC firm either missed, were unable or chose not to invest in).

Meanwhile, Monzo’s new funding round and YC’s backing should be viewed within the context of not only fast growth and increasingly convincing product-market fit in the U.K. — the challenger bank is currently adding 200,000 new sign-ups for its current account each month — but also recently unveiled plans to tentatively launch across the pond.

We first reported that Monzo was busy assembling a U.S.-based team over five months ago, and the U.K. company made its U.S. plans official last week. This will see a U.S. Monzo app and connected Mastercard debit card available via in-person signups at events to be held soon. The rollout will initially consist of a few thousand cards, supported by a waitlist in preparation for a wider launch.

The U.S. launch is being done in partnership with a local bank, but in the longer term Monzo plans to apply for its own U.S. bank license, similar to the strategy it employed in the U.K. so as to own and operate as much of its technical, product and regulatory infrastructure as possible.

In the U.K., this has helped Monzo achieve an NPS score of 80, which Blomfield previously told me is unusually high for a bank. This is seeing 60% of U.K. signups remain long-term active, transacting at once per week. As a counterpoint, however, the percentage of Monzo users that pay a salary into their Monzo account sits at between about 27% and 30% of active users, suggesting that a significant number of Monzo customers aren’t yet using it as their main account (Monzo’s definition of salaried is anyone who deposits at least £1,000 per month by bank transfer).

Success in the U.S., therefore, isn’t a given, conceded Blomfield when I had a call with him earlier this month. Instead, he argued that the key to cracking North America will be creating a fully localised version of Monzo based on carefully listening to U.S. users and once again finding product-market fit. He says there are obvious and less obvious cultural and technical differences in the way Brits and Americans save, spend and manage their finances, and this will require significant product divergence from the U.K. version of Monzo. Today’s new £113 million injection of capital is clearly designed to provide some of the breathing space required to achieve that.

As a side note, there are encouraging signs from other London-based fintechs that have ventured across the pond. One recent example is the financial “digital assistant” chatbot Cleo, which entered the U.S. around a year ago and has been more successful than the company anticipated, seeing Cleo add 650,000 active U.S. users to date. In fact, the U.S. currently makes up more than 90% of new Cleo users, prompting one source to describe the U.K. startup as effectively a U.S. company now.

Powered by WPeMatico

At last, a camera app that automatically removes all people from your photos

As a misanthrope living in a vibrant city, I’m never short of things to complain about. And in particular the problem of people crowding into my photos, whatever I happen to shoot, is a persistent one. That won’t be an issue any more with Bye Bye Camera, an app that simply removes any humans from photos you take. Finally!

It’s an art project, though a practical one (art can be practical!), by Do Something Good. The collective, in particular the artist damjanski, has worked on a variety of playful takes on the digital era, such as a CAPTCHA that excludes humans, and setting up a dialogue between two Google conversational agents.

The new app, damjanski told Artnome, is “an app for the post-human era… The app takes out the vanity of any selfie and also the person.” Fortunately, it leaves dogs intact.

The new app, damjanski told Artnome, is “an app for the post-human era… The app takes out the vanity of any selfie and also the person.” Fortunately, it leaves dogs intact.

Of course it’s all done in a self-conscious, arty way — are humans necessary? What defines one? What will the world be like without us? You can ponder those questions or not; fortunately, the app doesn’t require it of you.

Bye Bye Camera works using some of the AI tools that are already out there for the taking in the world of research. It uses YOLO (You Only Look Once), a very efficient object classifier that can quickly denote the outline of a person, and then a separate tool that performs what Adobe has called “context-aware fill.” Between the two of them a person is reliably — if a bit crudely — deleted from any picture you take and credibly filled in by background.

It’s a fun project (though the results are a mixed bag) and it speaks not only to the issues it supposedly raises about the nature of humanity, but also the accessibility of tools under the broad category of “AI” and what they can and should be used for.

You can download Bye Bye Camera for $3 on the iOS App Store.

Powered by WPeMatico