Climate change, AI and ethical leadership in ‘big tech’, with Amazon principal UX design lead Maren Costa

“I just want to be proud of the company that I work for,” Maren Costa told me recently.

Costa is a Principal UX Design Lead at Amazon, for which she has worked since 2002. I was referred to her because of her leadership in the Amazon Employees for Climate Justice group I covered earlier this week for my series on the ethics of technology.

Like many of her peers at Amazon, Costa has been experiencing a tension between work she loves and a company culture and community she in many ways admires deeply, and what she sees as the company’s dangerous failings, or “blind spots,” regarding critical ethical issues such as climate change and AI.

Indeed, her concerns are increasingly typical of employees not only at Amazon, but throughout big tech and beyond, which seems worth noting particularly because hers is not the typical image many call to mind when thinking of giant tech companies.

A Gen-X poet and former Women’s Studies major, Costa drops casual references to neoliberal capitalism running amok into discussions of multiple topics. She has a self-deprecating sense of humor and worries about the impact of her work on women, people of color, and the Earth.

If such sentiments strike you as too idealistic to take seriously, it seems Glass Lewis and ISS, two of the world’s largest and most influential firms advising investors in such companies, would disagree. Both firms recently advised Amazon shareholders to vote in support of a resolution put forward by Amazon Employees for Climate Justice and its supporters, calling on Amazon to dramatically change its approach to climate issues.

Glass Lewis’s statement urged Amazon to “provide reassurance” about its climate policies to employees like Ms. Costa, as “the Company’s apparent inaction on issues of climate change can present human capital risks, which have the potential to lead to the Company having problems attracting and retaining talented employees.” And in its similar report, ISS highlighted research reporting that 64 percent of millennials would be reluctant to work for a company “whose corporate social responsibility record does not align with their values.”

Amazon’s top leadership and shareholders ultimately voted down the measure, but the work of the Climate Justice Employees group continues unabated. And if you read the interview below, you might well join me in believing we’ll see many similar groups crop up at peer companies in the coming years, on a variety of issues. All of those groups will require many leaders — perhaps including you. After all, as Costa said, “leadership comes from everywhere.”

Maren Costa: (Apologizes for coughing as interview was about to start)

Greg Epstein: … Well, you could say the Earth is choking too.

Costa: Segue.

Epstein: Exactly. Thank you so much for taking the time, Maren. You are something of an insider at your company.

Costa: Yeah, I took two years off, so I’ve actually worked here for 15 years but started 17 years ago. I actually came back to Amazon, which is surprising to me.

Epstein: You’ve really seen the company evolve.

Costa: Yes.

Epstein: And, in fact, you’ve helped it to evolve — I wouldn’t call myself a big Amazon customer, but based on your online portfolio, you’ve even worked on projects I personally have used. Though find it hard to believe anyone can find jeans that actually fit them on Amazon, I must say.

Costa: [My work is actually] on every page. You can’t use Amazon without using the global navigation, and that was my main project for years, in addition to a lot of the apparel and sort of the softer side of Amazon. Because when I started, it was very super male-dominated.

I mean, still is, but much more so. Jeff literally thought by putting a search box that you could type in Boolean queries was a great homepage, you know? He didn’t have any need for sort of pictures and colors.

(Photo: Lisa Werner/Moment Mobile/Getty Images)

Epstein: My previous interview [for this TechCrunch series on tech ethics] was with Jessica Powell, who used to be PR director of Google and has written a satirical novel about Google . One of the huge themes in her work is the culture at these companies that are heavily male-dominated and engineer-dominated, where maybe there are blind spots or things that the-

Costa: Totally.

Epstein: … kinds of people who’ve been good at founding these companies don’t tend to see. It sounds like that’s something you’ve been aware of and you’ve worked on over the years.

Costa: Absolutely, yes. It was actually a great opportunity, because it made my job pretty easy.

Powered by WPeMatico

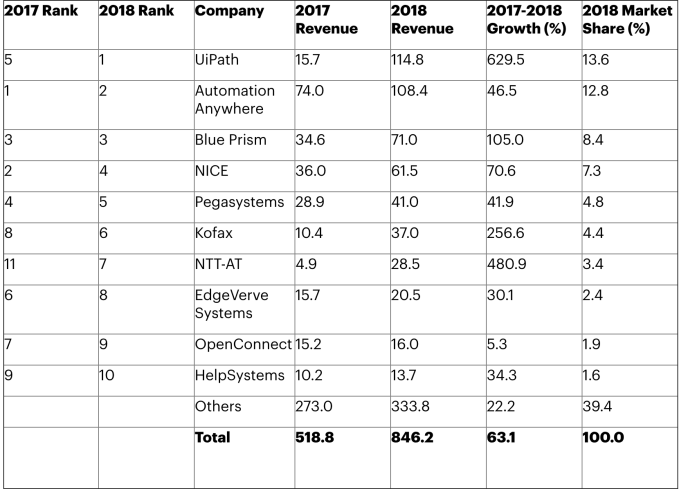

Gartner finds RPA is fastest growing market in enterprise software

If you asked the average person on the street what Robotic Process Automation is, most probably wouldn’t have a clue. Yet new data from Gartner finds the RPA market grew over 63% last year, making it the fastest growing enterprise software category. It is worth noting, however, that the overall market value of $846.2 million remains rather modest compared to other multi-billion dollar enterprise software categories.

RPA helps companies automate a set of highly manual processes.The beauty of RPA, and why companies like it so much, is that it enables customers to bring a level of automation to legacy processes without having to rip and replace the legacy systems.

As Gartner points out, this plays well in companies with large amounts of legacy infrastructure like banks, insurance companies, telcos and utilities.”The ability to integrate legacy systems is the key driver for RPA projects. By using this technology, organizations can quickly accelerate their digital transformation initiatives, while unlocking the value associated with past technology investments,” Fabrizio Biscotti, research vice president at Gartner said in a statement.

The biggest winner in this rapidly growing market is UIPath, the startup that raised $568 million on a fat $7 billion valuation last year. One reason it’s attracted so much attention is its incredible growth trajectory. Consider that UIPath brought in $15.7 million in revenue in 2017 and increased that by a whopping 629.5% to $114.8 million last year. That kind of growth tends to get you noticed. It was good for 13.6% marketshare and first place, all the way up from fifth place in 2017, according to Gartner.

Another startup nearly as hot as UIPath is Automation Anywhere, which grabbed $300M from SoftBank at a $2.6B valuation last year. The two companies have raised a gaudy $1.5 billion between them with UIPath bringing in an even $1 billion and Automation Anywhere getting $550 million, according to Crunchbase.

Automation Anywhere revenue grew from $74 million to $108.4 million, a growth clip of 46.5%, good for second place and 12.8 percent marketshare. Automation Anywhere was supplanted in first place by UIPath last year.

Blue Prism, which went public in 2016, issued $130 million in stock last year to raise some more funds, probably to help keep up with UIPath and Automation Anywhere. Whatever the reason, it more than doubled its revenue from $34.6 million to $71 million, a healthy growth rate of 105 percent, good for third place with 8.4 percent marketshare.

For now, everyone it seems is winning as the market grows in leaps and bounds. In fact, the growth numbers down the line are impressive with NTT-ATT growing 456% and Kofax growing 256% year over year as two prime examples, but even with those growth numbers, the marketshare begins to fragment into much smaller bites.

While the market is still very much in a development phase, which could account for this level of growth and jockeying for market position, at some point that fragmentation at the bottom of the market might lead to consolidation as companies try to buy additional marketshare.

Powered by WPeMatico

Xiaomi’s new Mi CC brand will develop ‘trendy’ smartphones for young people

Huawei may be on the ropes as it battles sanctions from the U.S. government, but fellow Chinese smartphone rival Xiaomi is in expansion mode with the launch of a new brand that’s aimed at winning friends (and sales) among the young and fashionable.

“Mi CC” is the newest brand from Xiaomi. Unveiled on Friday, the phone-maker said it stands for “camera+camera” in reference to its dual-camera feature, but that apparently also segues into “a variety of meanings including chic, cool, colorful and creative.”

The end goal of that marketing bumf is a target customer that Xiaomi describes as “the global young generation.”

Essentially, what Xiaomi is doing here is breaking out a dedicated set of phones for those who care more about aesthetics than performance. To date, the company has built its brand on developing phones that are as good — well, nearly as good — as top smartphone rivals but at a fraction of the cost. The result of that is that a lot of marketing focus is on the technical details, even though Xiaomi has been lauded for some attractive designs, and CC adjusts that balance to target a different kind of audience.

Since Xiaomi has a history of bringing innovation into affordable devices, CC is one to watch out for.

Xiaomi’s CC teaser image doesn’t give much away, apart from the logo

The new division is the result of Xiaomi’s acquisition of the smartphone business belonging to Meitu, a selfie app maker.

Xiaomi bought the business last November to go after new demographics and build on the work of Meitu, which had sold just over 3.5 million after getting into the smartphone business in 2013. Those numbers weren’t enough to justify the continuation of Meitu’s phone business but, evidently, Xiaomi saw promise in that segment. Meitu retains a similarly positive outlook on the fashionable audience and it has a lot to gain financially from the success of CC, too.

Terms of the acquisition deal mean that Meitu will take 10 percent of all profits, with a minimum guaranteed fee of $10 million per year. Big sales could be significant for Meitu, which reported revenue of $406 million in 2018. Notably, two-thirds of that income was from phone sales but Meitu’s smartphone revenue dropped by 51 percent year-on-year. Hence, Xiaomi has come to the rescue with its know-how.

There’s no word on exactly what Mi CC devices will look like or where they will be sold, but Xiaomi is already trumpeting its differentiation.

“Mi CC is created by one of the youngest product teams in Xiaomi, among which half are art majors and are dedicated to creating a trendy design for young consumers,” it wrote in an announcement.

Gavin Thomas plays with a Mi CC phone in a teaser that the brand posted to its Weibo account

The first look is a teaser that features Gavin Thomas — an eight-year-old who went viral in China for his ability to speak Mandarin — but the phone itself is kept hidden in the video thanks to well-placed stickers.

As you’d expect from Meitu, there’s a lot of emphasis on selfies, stickers and other graphics.

Xiaomi has had success with brands, some of which include Redmi — its big-selling budget division — Poco, its ‘performance’-focused division, its gaming brand Shark, which looks much like Razer’s phones.

Outside of mobile, the company develops and sells a range of smart home products, many of which are licensed from third-party partners.

Powered by WPeMatico

Razer goes big on payments with Visa prepaid card

The latest pairing between a tech upstart and a financial titan is a digital prepaid card targeted at Southeast Asia’s 430 million-plus unbanked and underserved population.

On Monday, Razer, the Singapore-based company best known for its gaming laptops and peripherals, announced a partnership with Visa to develop a Visa prepaid solution. The service, which allows unbanked users to top up and cash out easily, will be available as a mini program embedded in Razer Pay, the gaming company’s mobile payments app. That means Razer’s 60 million registered users will be able to pay at any of the 54 million merchant locations around the world that take Visa.

Going virtual is the natural step given the region’s fast-growing digital population, but the pair does not rule out the possibility to introduce a physical prepaid card down the road, Razer’s chief strategy officer Li Meng Lee told TechCrunch over a phone interview.

Both parties have something to gain from this marriage. Hong Kong-listed Razer has in recent years been doubling down on fintech to prove it’s more than a hardware company. Payment services seem like an inevitable development for Razer whose users in the region are accustomed to buying in-game credits at convenience stores.

“For many years, the people who have been making digital payments before it became a sexy word in the last couple of years… [many of them] are the gamers who go to a 7-Eleven, pay in cash, and get a pin code to buy virtual skins for the games,” noted Lee. “Because of that, we’ve been able to build up more than a million service points across Southeast Asia.”

The key differentiator of Razer’s prepaid service, Lee said, is that customers paying at Visa merchants don’t have to already own a bank account, whereas that prerequisite is common for many other e-wallet services.

Razer’s fintech arm Pay is handling transactions for a slew of internet services like Lazada and Grab and has made a big offline push, boasting a network of more than one million touchpoints through retailers including 7-Eleven and Starbucks where it’s accepted.

All in all, Razer claimed it processed over $1.4 billion in payment value last year — but that includes its “merchant services” business, covering on and offline payments, as well as Razer Pay.

The payment app first launched in Malaysia in mid-2018 and recently branched into Singapore as its second market. Lee said the service plans to roll out in the rest of Southeast Asia soon, upon which the Visa prepaid mini app will also be available in those markets.

For Visa, the tie-up with an internet firm could be a potential boost to its reach in the mobile-first Southeast Asia where some 213 million millennials and youths live.

“This is a great opportunity for us to be working with Razer in addressing how we work to bring the unbanked and underserved population into the financial system,” Chris Clark, Visa’s regional president for the Asia Pacific, told TechCrunch. “We will be doing some work with Razer on financial literacy and financial planning to bring that education to the population across the region.”

Razer’s fintech ambition has been evident since it announced to gobble up MOL, a company that offers online and offline payments in Southeast Asia, in April 2018. Besides payments, Lee said other microfinance services such as lending and insurance are also on the cards as part of an effort to ramp up user stickiness for Razer’s fintech arm.

Note: The original version of this article has been updated to correct that Razer’s $1.4 billion in GMV includes merchant services as well as Razer Pay.

Powered by WPeMatico

Two days left to apply to Startup Battlefield at Disrupt SF 2019

What do early-stage startups Forethought, Pi and Recordgram have in common with successful tech companies like Dropbox, Mint and TripIt? They all competed in Startup Battlefield, our epic pitch competition.

If you’re ready to step up, go big and launch your startup to the world, you need to get moving. We stop accepting applications in just two days — on June 25th at 11:59 p.m. (PT). Apply to compete in the Startup Battlefield right now.

When we say, “go big” we mean it in every sense of the word. The crowd — more than 10,000 people flock to our flagship event. The stakes — a $100,000 equity-free cash prize. The competition — if you make the cut, you’ll go up against some of the finest early-stage startups on the Disrupt Main stage in front of an audience of thousands.

The room will be packed with founders, investors — and tech journalists from more than 400 media outlets. We’re talking influential people who can take your startup dreams and make them a reality. They’ll expect the best, and you’ll deliver.

You have nothing to lose. Applying and participating in Startup Battlefield is free. The selection process is competitive, and TechCrunch editors will choose approximately 15-30 startups to compete. Participating founders receive free, extensive pitch coaching to ensure peak performance.

On the big day, teams get six-minutes to pitch and present a live demo to the judges, a panel consisting of expert VCs and technologists. And that’s followed by a round of Q&A. Survive the first round and you’ll lather, rinse and repeat in front of a new set of judges.

One outstanding startup will emerge to claim the $100,000, the Disrupt Cup and serious bragging rights to become the toast of Disrupt SF ‘19.

But the benefits of competing extend to all Startup Battlefield participants. You’ll enjoy the VIP treatment at Disrupt — including invitations to private investor receptions, and you get free exhibit space in Startup Alley for all three days of the show. You’ll have access to CrunchMatch — our investor/startup matching program that simplifies networking. Oh, and we live-stream the entire event on TechCrunch.com, YouTube, Facebook and Twitter. Plus, it’s available later on-demand.

Disrupt San Francisco 2019 takes place on Oct. 2-4. Don’t miss your chance to step up, go big and go home with $100,000. Apply to Startup Battlefield before the deadline on June 25th at 11:59 p.m. (PT).

Not quite ready for prime time on the Disrupt Main stage? No worries. Why not apply for our TC Top Picks program? Our TC Top Picks receive a free Startup Alley Exhibitor Package, VIP treatment and plenty of media and investor exposure.

Powered by WPeMatico

Equity transcribed: Slack’s IPO, the VCs behind Facebook Libra, founder salaries and trouble in scooter-land

Welcome back to this week’s transcribed edition of Equity.

This week, TechCrunch’s Danny Crichton filled in for co-host Alex Wilhelm – who was out in preparation for his wedding this weekend – joining Kate to cover the big news of the week.

Kate and Danny dive straight into Slack’s IPO and the implications of its direct listing strategy, before shifting gears to discuss the launch of Facebook’s new ‘Libra’ cryptocurrency and the VCs backing the initiative.

The duo then took a look at Lime’s latest fundraising efforts and the potential headwinds facing scooter companies with an appetite for capital. Lastly, Kate and Danny talk about underappreciated tensions for founders, including getting pushed out of their own companies and handling their own salaries.

Crichton: Talking about founders and compensation, our correspondent, Ron Miller, talked to a bunch of VCs to ask how are founders paying themselves today? Obviously, the cost of living in the Bay Area, in New York and other startup hubs has increased dramatically. So VCs have had to become acutely aware of their founders’ financial means.

One of the things that really came out of this survey though, from my perspective, was just how high the numbers are. We surveyed small number. We put it out in the interviews. It came out to post-Series A people are starting to get paid around 200K. But the numbers, even a couple of years ago, I seem to recall was like $120 was the magic number around the Series A, $90K if you had a serious seed fund and like $60 to $80 if you are just getting started.

But the numbers that we saw out of this were significantly higher. I think that shows a lot about how the cost of living has just continued to creep up in San Francisco and in New York.

Clark: Yeah. I think the point is made in the story. If you live in San Francisco and you’re paying a mortgage and you have kids, of course, you need to make six figures really to get by, which is just an unfortunate reality. I can’t say I was surprised by how those salaries looked. Seeing $125K for a founder, if anything, I thought was maybe a little low.

But it reminded me of, nearly a year ago at this point, when I wrote something on how much VCs are paid. I had written it based off data that was provided to me from a consulting firm. People were just up in arms at what I had written because, and I understand looking back, I think it grouped VCs together as VCs who work at really big funds who are getting the 2% carry out of a multi-billion dollar fund and who are paid a lot more.

And there are of course VCs who run seed funds or any kind of fund. There are many different sizes of VC funds. Some VCs actually don’t have a salary at all and are up against the same challenges, if not even more difficult challenges, of a startup founder.

Want more Extra Crunch? Need to read this entire transcript? Then become a member. You can learn more and try it for free.

Kate Clark: Hello, and welcome back to Equity, TechCrunch’s venture capital-focused podcast. My co-host, Alex, is getting married this weekend so he’s not with us today, unfortunately. But we’ve got TechCrunch editor, Danny Crichton on the line. Danny, how are you?

Powered by WPeMatico

Startups Weekly: The scooter cash desert

Hello and welcome back to Startups Weekly, a newsletter published every Saturday that dives into the week’s noteworthy venture capital deals, funds and trends. Before I dive into this week’s topic, let’s catch up a bit. Last week, I noted my key takeaways from Recode + Vox’s Code Conference. Before that, I explored the bull versus bear arguments in regards to Peloton’s upcoming IPO.

Remember, you can send me tips, suggestions and feedback to kate.clark@techcrunch.com or on Twitter @KateClarkTweets. If you don’t subscribe to Startups Weekly yet, you can do that here.  Now, for some quick thoughts on what I’ll call the scooter funding desert. For months, electric scooter businesses were securing large rounds at even larger valuations. So much so that the venture capital funding extravaganza in e-scooters defined Silicon Valley in 2018.

Now, for some quick thoughts on what I’ll call the scooter funding desert. For months, electric scooter businesses were securing large rounds at even larger valuations. So much so that the venture capital funding extravaganza in e-scooters defined Silicon Valley in 2018.

But it’s 2019, and times have changed. In an effort to keep myself from falling into a scooter rabbit hole, I’ll just say this: raising capital is no longer a piece of cake for scooter companies. E-scooter companies have matured some and investors are more aware of the steep costs of building and scaling these hardware-heavy businesses.

Scoot, which recently sold to Bird, was unable to raise additional capital making an exit to Bird its only viable option, sources tell TechCrunch. Bird paid less than $25 million for Scoot, a significant decrease from Scoot’s most recent private valuation of $71 million.

A recent report from The Information suggests both Lime and Bird, the leaders in the U.S., may run out of cash if they don’t raise again soon. “Lime has raised a total of more than $1 billion in the last two years, and over the past eight months it has shuffled its executive team and put a deeper focus on how to squeeze more money out of each scooter ride. The company ran through its cash quickly last year, including a $23 million loss in one month, before raising $310 million mostly from existing investors in February,” The Information’s Cory Weinberg wrote.

Bird, for its part, is running on less than $100 million and is expected to raise again this summer.

Bird may be in a better position to secure fresh funds. The company enters VC deal talks hot off the heels of its acquisition of Scoot, which gives it access to San Francisco, a coveted market in the scooter universe. Lime, for its part, is said to be struggling. The company enters deal talks amid a number of personnel shake-ups. Multiple policy leaders at the business, including chief programs officer Scott Kubly, recently stepped down, as did Lime co-founder and CEO Toby Sun.

I’d wager that both Bird and Lime will announce mega rounds in the next few months, but at much smaller valuation step-ups than we’ve seen in the past, perhaps even at a flat valuation. It’s worth noting, however, that e-scooters are still exploding around the world. India’s Bounce, for example, closed on $72 million this week to scale its scooter rental business.

On to other news…

Slack’s big listing: It happened. Slack became a public company this week after completing a direct listing. The workplace communication software juggernaut debuted on the New York Stock Exchange up 48% Thursday, at $38.50 per share, after reports emerged Wednesday night that the business had agreed to a reference price of $26 per share. Slack, founded in 2009 as Tiny Speck, closed up 48.5% Thursday at $38.62 per share. The stock had climbed as high as $42 in intraday trading. Slack’s market cap now sits well above $20 billion, or nearly three times its most recent private valuation of $7 billion.

My inbox is full to the brim with unsolicited commentary on Slack’s direct listing. I’ll share some of the highlights.

— Kate Clark (@KateClarkTweets) June 19, 2019

Facebook’s new cryptocurrency: Explained

I know, I know, Facebook isn’t a startup, but Facebook’s attempts to create a new global financial system are worth learning about. TechCrunch’s Josh Constine wrote 4,000 words to help you understand the ins and outs of the new cryptocurrency, called Libra, which will let you buy things or send money to people with nearly zero fees.

The future of diversity and inclusion in tech

Here’s my must-read of the week. TechCrunch’s Megan Rose Dickey wrote what is perhaps the most comprehensive story on the state of D&I in tech today. She interviewed many leaders in the space, including Arlan Hamilton, Ellen Pao, Freada Kapor Klein and more, to provide a realistic rundown of the progress we’ve made in making the tech industry more inclusive — and what’s left to accomplish.

Is seed investing still a local business?

According to CB Insights, the number of seed-stage funding deals in the U.S. declined for the fourth straight year in 2018, continuing a trend that has seen the number of deals steadily drop, while the average size of deals increased. It’s safe to say this is the new normal. Yet, there continues to be a huge surplus of available capital and there are more funds out there than ever before. Here are three things entrepreneurs must remember when investors come calling from abroad.

Meero raises $230M for its on-demand photo business

Postman raises $50M to grow its API development platform

Navigator, the new project from the creators of Mailbox, launches with $12M

Nigerian motorcycle transit startup MAX.ng raises $7M

Humanising Autonomy pulls in $5M to help self-driving cars keep an eye on pedestrians

Armoire gets $4M to become the everyday Rent the Runway

Probably Genetic lands VC backing to launch D2C genetic testing business

San Francisco is getting closer to banning the sale of e-cigarettes in the city in a bid to prevent minors from accessing them. The city’s Board of Supervisors voted unanimously this week to approve two proposals: legislation that would ban the sale or delivery of e-cigarettes in San Francisco and a separate proposal that would prohibit the sale, manufacturing and distribution of tobacco products, including e-cigarettes, on property owned or managed by the city. It seems designed to take aim at Juul, since the company’s headquarters are in city-owned buildings at San Francisco’s Pier 70. Juul has already started lobbying to stop the ban.

If you’ve been unsure whether to sign up for TechCrunch’s awesome new subscription service, now is the time. Through next Friday, it’s only $2 a month for two months. Seems like a no-brainer. Sign up here. Here are some of my personal favorite EC pieces of the week:

- Startup founders need to decide how much salary is enough by Ron Miller

- You won the H-1B lottery: Don’t lose your ticket when changing jobs by Xiao Wang and Anjana Prasad

- How to negotiate term sheets with strategic investors by Alex Gold

- A chat with Niantic CEO John Hanke about the launch of Harry Potter: Wizards Unite by Greg Kumparak

The VCs behind Libra, Facebook’s new cryptocurrency

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, TechCrunch editor Danny Crichton and I discuss Facebook’s cryptocurrency, the scooter funding desert and more. You can subscribe to Equity here or wherever else you listen to podcasts.

Powered by WPeMatico

Ray Dalio is coming to Disrupt SF

When it comes to the gods of finance, few people reach the stratosphere of Ray Dalio . The founder of Bridgewater, the investment firm that has grown to manage $150 billion in assets, Dalio is one of the most successful financial entrepreneurs of his generation, and indeed, of all time.

While Dalio and Bridgewater are known for their pathbreaking analysis of the world economic machine that has reaped them billions in returns, they aren’t just known for their financial results. Rather, Bridgewater is also widely known for its unique culture shaped over decades of trial and error.

Dalio has made sharing that culture his mission in life, publishing Principles, a book and companion mobile app, to train the next generation of founders, executives and business leaders about how to build a culture that seeks truth and excellence in all of its activities.

Dalio will be joining us for a fireside chat on the Extra Crunch stage this October at TechCrunch Disrupt SF, where he will discuss how to build a culture at a startup.

For startup founders, building the culture of their companies is one of the most important yet enigmatic activities they will undertake as leaders. Culture isn’t just a list of values pasted in the corner of a WeWork cubicle; rather, it is the accumulated actions and interactions that founders, employees and investors undertake every single day.

But what exactly should those actions be? How can a founder guide their companies to embody the right values? Dalio has strong views on what a culture should look like at a company. His Principles are based on constantly seeking access to the best information, assessing that information objectively and always striving to improve decision-making processes through thoughtful disagreement and learning.

On the Extra Crunch stage, Dalio will talk about how to instill the right behaviors into the core DNA of a company’s founders — even before they have hired employee number one. He will also discuss how to maintain and augment his Principles as a company scales, particularly in those high-growth phases where culture either intensifies or withers away amidst the deluge of new hires.

Dalio made his mark building out one of the most successful investment firms of all time. Now he will share his secrets to the founders building the next generation of unicorns.

Dalio joins a variety of amazing speakers who will be on our stage come October, with many still to be announced! Disrupt SF runs October 2 – October 4 at the Moscone Center right in SF. Tickets to the show are available here, but move quickly, because the Early-Bird pricing ends today!

Powered by WPeMatico

Daily Crunch: Google’s not making any more tablets

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 9am Pacific, you can subscribe here.

1. Google says it’s not making any more tablets

“For Google’s first-party hardware efforts, we’ll be focusing on Chrome OS laptops and will continue to support Pixel Slate,” the company said in statement.

Google SVP Rick Osterloh took to Twitter to emphasize that while Google’s hardware team will be “solely focused on building laptops moving forward,” the company will still be working with partners on Android and Chrome OS tablets.

2. Slack’s value rockets as stock closes up 48.5% in public debut

At the close of trading yesterday, Slack’s market cap sat well above $20 billion, or nearly 3 times its most recent private valuation of $7 billion.

3. One of NASA’s robotic astronaut helpers just flew on its own in space for the first time

The robot — called “Bumble” and one of a series of Astrobee robots that NASA developed to work along with astronauts on the ISS — is the first ever to fly on its own in space.

4. Samsung exec says the Galaxy Fold is ‘ready to hit the market’

Just last week, Huawei noted that it was holding off on its own Mate X release. But Samsung, at least, may finally be ready to unleash its foldable on the world, two months after the planned release.

5. Meet your new chief of staff: An AI chatbot

Mailbox’s founders are back with their second act: An AI-enabled assistant called Navigator meant to help teams work and communicate more efficiently.

6. Terry Gou resigns as Foxconn’s chairman to run for president of Taiwan

Gou, who founded Foxconn 45 years ago and is also its biggest shareholder, will remain on the company’s board.

7. A chat with Niantic CEO John Hanke on the launch of Harry Potter: Wizards Unite

Built in collaboration with WB Games, Wizards Unite is a reimagining of Pokémon GO’s real-world, location-based gaming concept through the lens of JK Rowling’s Harry Potter universe. (Extra Crunch membership required.)

Powered by WPeMatico

Slack and Zoom are flying high; they’re also being chased already by upstarts

Two of the highest-flying now-public enterprise companies of the year — Slack and Zoom — are different in many ways, besides the fact that one is focused on workplace messaging while the other is centered around video conferencing.

Slack began life as a very different startup, while Zoom founder Eric Yuan knew from the outset that he wanted to take on his former employer, WebEx. Slack raised a lot of money from many sources before hitting the public market — roughly $1.4 billion over 10 rounds. Zoom raised just $160 million across five rounds, including a $100 million Series D round funded entirely by Sequoia. The two also approached their public offerings differently. Slack chose a direct listing that didn’t raise new money for the company; Zoom chose a traditional IPO, raising half a billion dollars in funding for its coffers just ahead of its first day of trading.

Still, the two companies also have much in common. Both took on incumbents (WebEx and email, respectively). Both are rooted in workplace collaboration and, as such, have some of the same competitors, including Microsoft Teams. Another shared quality, notes Zoom investor Gordon Ritter of Emergence Capital Partners: both are “powered by viral end-user adoption, which is not the case for every SaaS company.” (Slack largely grows within a company, starting with one team; Zoom grows internally and externally, given the nature of video conferencing across companies.)

What the two may also have in common: potentially fewer days at the top of the heap than some of their predecessors. The reason, as says longtime VC Greg Gretsch, who co-founded Jackson Square Ventures in 2011, is the “intensity of new competition is on a completely different level today from what it was 15 or 20 years ago.”

Ritter, who co-founded Emergence in 2002 and has backed Box, Yammer and Veeva Systems, where he remains board chair, echoes the sentiment. The “cycle time of incumbents having their day in the sun is getting shorter and shorter,” he notes.

It’s happening broadly to Fortune 500 companies, whose average lifespan is now less than 20 years, compared with 60 years in the 1950s. But now, even still fast-growing companies like Zoom and Slack, which “have amazing futures,” says Ritter, will likely have startups nipping at their heels very soon.

Craig Hanson, a general partner and co-founder of NextWorld Capital in San Francisco, explains it this way: “In the current environment, with all the entrepreneurs and capital looking for the next great idea, each startup success story immediately blooms an entire field of new startups chasing after them.”

It’s almost possible to time it, says Hanson. “Once a startup raises a big growth round or has an impressive exit, in two to three quarters, you’ll see rounds of funding for similar new companies. This happens in both consumer and enterprise tech. VCs may regret missing out on the first company that just raised big and hope that there’s room for another one, or some great IPO or acquisition may spark a newfound passion for a space they overlooked before or that they thought was too hard until someone proved them wrong.”

Consider the many failed video conferencing startups to precede Zoom, including long-forgotten outfits like TeamSlide, LiveMeeting and Vyew. Indeed, Eric Yuan’s startup was anything but a sure thing, But once a space has been validated by the kind of success that Zoom enjoys, it makes it easier for other founders to raise money. This might partly explain why, in April, a nearly five-year-old, Boston-based startup named Owl Labs landed $15 million in Series B funding for its video conference camera with 360-degree capabilities. Another web conferencing startup, Highfive, based in Redwood City, Calif., drummed up $32 million last year, including from Lightspeed Venture Partners and Andreessen Horowitz.

“It’s easier to explain what they want to do [if they can say] ‘We’re like Twilio for ____,’” says Hanson, adding that as recently as 2016, “you’d have maybe two to three startups going after a space and chasing the incumbents. Now there will be 10 startups, and the incumbents were themselves startups just a handful of years earlier.”

The trend isn’t limited to recently public companies, says Gretsch. In his view, “success for many companies and sectors is declared long before the first IPO, and with that perceived success comes a wave of me-too competitors.”

It goes “hand in hand with the explosion of seed rounds over the last 10 years, which itself has been largely driven by how little it really costs for a company to get a finished product into customers hands,” he says.

In fact, Gretsch isn’t so sure the trend is a new one. Nevertheless, because the sheer number of startups that receive funding is now “off the charts,” it’s changing the game for consumer and enterprise companies alike.

“Any company that’s enjoying success has to remain paranoid and not ever settle for resting on their laurels,” says Gretsch. Today, it just happens to be “more true than it was 23 years ago, when [famed Intel CEO] Andy Grove used it for the title of his book.”

That famous best-seller? “Only the Paranoid Survive.”

Powered by WPeMatico