Northzone’s Paul Murphy goes deep on the next era of gaming

As the gaming market continues to boom, billions of dollars are being invested in new games and new streaming platforms vying to own a piece of the action. Most of the value is accruing to the large incumbents in a space, however, and the entrance of Google and other big tech companies makes it difficult to identify where there are compelling opportunities for entrepreneurs to build new empires.

TechCrunch media analyst Eric Peckham recently sat down with Paul Murphy, Partner at European venture firm Northzone, to discuss Paul’s view of the market and where he is focusing his dollars. Below is the transcript of the conversation (edited for length and clarity):

Eric Peckham: You co-founded the hit mobile game Dots before moving to London and joining Northzone last year. Are you still bullish on investment opportunities in mobile gaming or do you think the market has changed?

Paul Murphy: I’m bullish on mobile gaming–the market is bigger than it has ever been. There’s a whole generation of people that have been trained to play games on mobile phones. So those are things that are very positive.

The challenge is you don’t really have a rising tide moment anymore. The winners have won. And so it’s very, very difficult for someone to enter with new content and build a business that’s as big as Supercell or King, regardless of how good their content is. So while the prize for winning in mobile gaming content big, the likelihood is smaller.

Where I’m spending most of my time is not on content, it’s on components within mobile gaming. We’re looking at infrastructure: different platforms that enable mobile gaming, like Bunch which we invested in.

Their product allows you to do live video and audio on top of mobile games. So we don’t have to take any content risk. We’re betting that this great product will fit into a large inventory ecosystem.

Peckham: New mobile game studios that are launching all seem to fall under the sphere of influence of these bigger companies. They get a strategic investment from Supercell or another company. To your point, it’s tough for a small startup to compete entirely on its own.

Murphy: It’s possible in mobile gaming still but it’s really, really hard now. At the same time, what you’ve seen is the odds of winning are lower. It is hard to reach the same scale when it costs you $5.00 to acquire a user today, whereas when Candy Crush launched, it was $0.05 per user. So it’s almost impossible to achieve King-like scale today.

Therefore, you’re looking at similar content risk with reduced upside, which makes that equation less attractive for venture capital. But it might be perfectly fine for an established company because they don’t need to do the marketing, they have the audience already.

The big gaming companies all struggle with the challenge of how to create the next hit IP. They have this machine that can bring any great game to market efficiently, with a large audience they can cross promote from and capital they can invest to build a big brand quickly. For them, the biggest challenge is getting the best content.

So it’s natural to me that the pendulum has swung towards strategic investors in mobile gaming content. Epic has a fund that they set up with Improbable, Supercell is making direct investments, Tencent has been making investments for years. Even from a content perspective, you’re probably going to see Apple, Google, and Amazon making more content investments in mobile gaming.

Image via Getty Images / aurielaki

Peckham: Does this same market dynamic apply to PC games and console games? Do you see a certain area within gaming where there’s still opportunity for independent startups to create the game itself and find success at a venture scale?

Murphy: The reason we made our investment in Klang Games, which is building an MMO called Seed that people will primarily play through PC, is that while there is content risk–you’re never going to get rid of the possibility that the IP doesn’t fly–if it works, it will be massive…an Earth-shattering level of success. If their vision comes to life, it will be very, very big.

So that one has all the risks that you’d have in any other game studio but the upside is exponentially larger, so the bet makes sense to us. And it so happens that it’s going to be on PC first, where there’s certainly a lot of competition but it’s not as saturated and the monetization methods are healthier than in mobile gaming. In PC, you don’t have to do free-to-play tactics that interfere with the gameplay.

Powered by WPeMatico

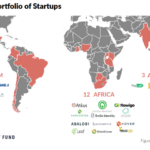

African fintech dominates Catalyst Fund’s 2019 startup cohort

African fintech has taken center stage for the Catalyst Fund, a JP Morgan Chase and Bill & Melinda Gates Foundation-backed accelerator that provides mentorship and non-equity funding to emerging markets startups.

The organization announced its 2019 startup cohort and three out of the four finance ventures — Chipper Cash, Salutat and Turaco — have an Africa focus (Brazil-based venture Diin, was the fourth).

Catalyst Fund, which is managed by global tech consulting firm BFA, also released its latest evaluation report, which showed 60% of the organization’s portfolio startups are located in Africa.

The new additions to the fund’s program will gain $50,000 to $60,000 in non-equity venture building support (as Catalyst Fund dubs it) and six months of technical assistance. The funds and support are aimed at moving the ventures to the next phase of catalyzing business models, generating revenue and connecting to global VCs.

“We really tailor the kind of help we give to companies so they can reach market fit and proof points that investors want to see to enable the next phase of growth,” BFA Deputy Director Maelis Carraro told TechCrunch.

Catalyst Fund’s 2019 startup cohort also gained exposure to the fund’s Circle of Investors — a network of impact and commercial backers who can make decisions on investing in and accelerating particular companies.

Catalyst Fund’s 2019 startup cohort also gained exposure to the fund’s Circle of Investors — a network of impact and commercial backers who can make decisions on investing in and accelerating particular companies.

Next Big Thing and Deciens Capital recently joined the group of 40 investors that includes Techstars and the Mastercard Foundation.

The tenor for support for Catalyst Fund’s newest cohort of startups lasts through 2019. The ventures will also attend the big SOCAP 2019 tech conference in San Francisco, where Catalyst organizes workshops and meetings with its Circle of Investors.

Founded in 2016, the Catalyst Fund’s mandate includes supporting fintech startups that are developing solutions for low-income individuals in emerging markets. The organization has accelerated 20 ventures in Africa, Asia and Latin America that have raised $25.7 million in follow-on capital, according to its latest report.

With the Bill & Melinda Gates Foundation and JP Morgan Chase as the lead backers, Catalyst Fund partners also include Rockefeller Philanthropy Advisors and Accion.

JP Morgan Chase’s interest in supporting Catalyst Fund connects to a firm-wide commitment of the global bank to financial inclusion, according to JP Morgan’s Head of Community Innovation Colleen Briggs — who is also a day-to-day Catalyst Fund manager.

JP Morgan recently launched a $125 million, five-year commitment to improve global financial health, she explained. “For us there is a true market opportunity…we genuinely believe that financial inclusion is the foundation for the economy,” Briggs said.

“If we don’t get the social issues right it undermines the resiliency of the communities and the markets where we’re trying to operate.”

That Catalyst Fund’s cohorts have shifted toward Africa focused ventures speaks to the thesis for fintech on the continent.

By a number of estimates, Africa’s 1.2 billion people represent the largest share of the world’s unbanked and underbanked population.

An improving smartphone and mobile-connectivity profile for Africa (see GSMA) turns this scenario into an opportunity for mobile-based financial products.

Hundreds of startups are descending on Africa’s fintech space, looking to offer scalable solutions for the continent’s financial needs. By stats offered by Briter Bridges and a 2018 WeeTracker survey, fintech now receives the bulk of VC capital and deal-flow to African startups.

Ventures such as Catalyst Fund cohort member Chipper Cash — co-founded by Ugandan Ham Serunjogi and Ghanaian Maijid Moujaled — are looking to grow across Africa first before considering any global moves.

The company plans to introduce its no-fee, P2P, cross-border mobile-money payments products beyond current operations in Ghana and Kenya to Rwanda, Tanzania and Uganda within the next 12 months.

Ventures looking to join companies like Chipper Cash as a Catalyst Fund-supported startup can seek a referral from Catalyst’s Circle of Investors — who make a recommendations on new candidates. Catalyst Fund aims to choose 30 startups for its cohort over the next three years, according to program director David del Ser.

Powered by WPeMatico

The VCs behind Libra, Facebook’s new cryptocurrency

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

Sadly, Equity co-host Alex Wilhelm is out this week, but for good reason: He’s getting married this weekend. Fortunately, we had the esteemed TechCrunch editor Danny Crichton step in to discuss Slack’s direct listing, Facebook’s new cryptocurrency, the scooter cash desert, startup founder salaries and more with Equity co-host Kate Clark.

We began this week’s episode with the latest Slack news. The enterprise communications business was said to price its shares at $26 apiece Wednesday afternoon, valuing the company at around $15.7 billion. We taped this episode on Wednesday, the day before Slack’s direct listing. It’s now Friday. We’ll be back next week to unpack Slack’s initial performance on the public markets.

Then, we turned to Facebook’s new cryptocurrency, Libra, which will let you buy things or send money to people with nearly zero fees using interoperable third-party wallet apps or Facebook’s own Calibra wallet that will be built into WhatsApp, Messenger and its own app. As Kate mentioned in the podcast, if you’re curious at all about Libra, read TechCrunch’s Josh Constine’s deep dive here. And, of course, listen to the latest episode to learn more about the role VCs have played in the development of the token and what it means for crypto startups.

Next up on the agenda was scooters, because we can’t seem to tape a single episode of Equity without mentioning VC’s favorite sector. The news wasn’t great this week, however. We’re hearing that Lime, a scooter startup that has raised hundreds of millions in venture capital funding, is having a tough time landing fresh funding. That’s a big problem, because hardware is a tough and expensive business, and if Lime — and Bird for that matter — aren’t able to secure additional capital, well, it’s goodbye scooters.

Finally, Danny and Kate chatted about startup founder salaries. There’s not much written on this topic and comprehensive founder salary data is hard to come by. Fortunately, TechCrunch’s Ron Miller did a little digging to find out just how much VC-backed entrepreneurs are being paid these days. The results are surprising.

As usual, we’ll be back next week. Thanks for listening!

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico

Ethiopia’s bid to become an African startup hub hinges on connectivity

Ethiopia is flexing its ambitions to become Africa’s next startup hub.

The country of 105 million with the continent’s seventh largest economy is revamping government policies, firing up angel networks and rallying digital entrepreneurs.

Ethiopia currently lags the continent’s tech standouts — like Nigeria, Kenya and South Africa — that have become focal points for startup formation, VC and exits.

To join those ranks, the East African nation will need to improve its internet environment, largely controlled by one government-owned telecom. Last week Ethiopia’s government shut down the internet for the entire nation.

Startups, hubs, accelerators

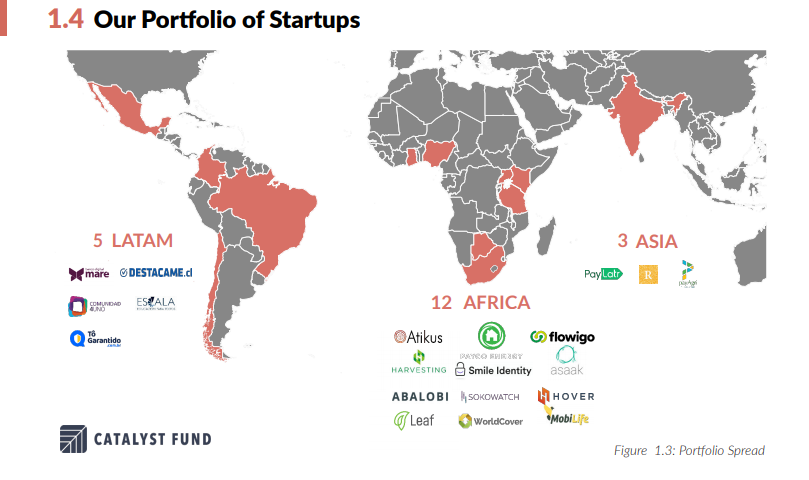

Ethiopia has the workings of a budding tech scene. Much of it was on display recently at the county’s first Startup Ethiopia event held in Addis Ababa.

On the startup front, ride-hail ventures Ride and ZayRide have begun to gain traction (Uber has not yet entered Ethiopia). Their cars are visible buzzing throughout the capital and ZayRide will expand into Liberia in August, CEO Habtamu Tadesse confirmed to TechCrunch.

While in Addis, I downloaded and used Ride — founded by female entrepreneur Samrawit Fikru — which quickly flashed connections to nearby drivers on my phone and allowed for cash payment.

While in Addis, I downloaded and used Ride — founded by female entrepreneur Samrawit Fikru — which quickly flashed connections to nearby drivers on my phone and allowed for cash payment.

This month’s Startup Ethiopia also showcased high-potential early-stage ventures, such as payment company YenaPay and online food startup Deamat. YenaPay has worked to build a digital payments imprint in Ethiopia’s largely cash-based economy. The startup has onboarded more than 500 merchants, including ZayRide, according to co-founder Nur Mensur.

Deamat blends e-commerce and agtech. “We connect small-holder farmers with consumers. People can use their phone, pay with their phone, get any kind of agricultural products they want and we deliver,” co-founder Kisanet Haile told me after pitching to judges that included Nigerian angel investor Tomi Davies and Cellulant CEO Ken Njoroge.

Ethiopia has several organizing points for startup, VC and developer activity. Tech talent and startup marketplace Gebeya is located in Addis Ababa (with offices globally), and offers programs and services for ventures and tech professionals to gain developer skills and scale their digital businesses.

Ethiopia has several organizing points for startup, VC and developer activity. Tech talent and startup marketplace Gebeya is located in Addis Ababa (with offices globally), and offers programs and services for ventures and tech professionals to gain developer skills and scale their digital businesses.

BlueMoon is an Ethiopian agtech incubator and seed fund. Its founder Eleni Gabre-Madhin has extensive experience working abroad, and played a central convening role in the debut Startup Ethiopia event.

In terms of developer and co-working type spaces, Ethiopia has iCog Labs — an AI and robotics research company — and IceAddis, one of the country’s first tech hubs. Founded in 2011, IceAddis’s mission is to develop Ethiopia’s IT ecosystem, co-founder and CEO Markos Lemma told me during a tour. The hub runs programs such as Ice180, a six-month startup accelerator bootcamp that has graduated 40 ventures. IceAddis also offers a 24-hour co-working space with internet access for techies and startups that want to burn the midnight oil.

Angels and mentors

Startup Ethiopia featured two angel and support networks for Ethiopia’s startups. Tomi Davies and Ethiopian diaspora returnee Shem Asefaw announced the first Addis Ababa Angel Network, supported by African Business Angels Network, which is expected to accept startups this year.

Startup Ethiopia also showcased Ethiopians in Tech, an entrepreneur support group with Silicon Valley roots. SV-based Bernard Laurendeau, a director at data analytics firm Zenysis and EiT founding member, made the trek from San Francisco to meet with local startups. So did Stackshare founder Yonas Beshawred.

Startup Ethiopia also showcased Ethiopians in Tech, an entrepreneur support group with Silicon Valley roots. SV-based Bernard Laurendeau, a director at data analytics firm Zenysis and EiT founding member, made the trek from San Francisco to meet with local startups. So did Stackshare founder Yonas Beshawred.

Talk of leveraging Ethiopia’s diaspora, which is particularly strong and successful in the United States, for tech was mentioned several times at Startup Ethiopia, including on my panel.

Connectivity

The biggest hurdle for Ethiopia’s startup community (that I could identify) is the situation with local internet.

Mobile and IP connectivity in the country is managed by state-owned Ethio Telecom, though the government — led by newly elected Prime Minister Abiy Ahmed and President Sahle-Work Zewde — has committed to privatize it.

At Startup Ethiopia, I moderated and sat on panels with Ethiopian government representatives to discuss the country’s ‘net situation. This was to the backdrop of the tech event’s Wi-Fi not functioning properly over two days — something that was readily pointed out during Q&A by Ethiopian techies and Liquid Telecom CTO Ben Roberts, who flew in from Nairobi.

Several officials, such as State Minister of Innovation and Technology Jemal Beker, named specific commitments to improve the country’s internet quality, access and choice within the next year, with Ethiopia’s Ministry of Innovation and Technology — Getahun Mekuria — seated in the front row.

Shortly after officials made these public pledges, the government shut down the country’s internet to coincide with national exams.

The government didn’t issue an official reason for the shutdown — and an official in charge of ICT policy did not respond to a TechCrunch inquiry — but press reports and a source speaking on background said the stoppage was done to prevent students from cheating.

Valid reason or not, I received several messages from local techies and startup heads (when the internet was intermittently switched back on) complaining about how the shutdown had totally crippled their businesses.

It appears the situation with internet in Ethiopia may be a bit of a step back before steps forward. After shutting things down, the government announced policy steps last week to break up the national telecom and IP monopoly and issue individual telco licences by the end of 2019.

Prospects

On the upside of Ethiopia’s bid to become a tech and startup hub, the country has a strong demographic and economic thesis — in its large population and economy — to support the scale-up of problem-solving digital businesses. Ethiopia’s large and entrepreneurial diaspora populations, with strong ties to Silicon Valley, could also become a bridge to capital and capacity for its early-stage ventures.

And another edge Ethiopia could have over other African tech hubs is its advances in developing a manufacturing industry (and higher-paid workforce) that’s now pulling some assembly from China. That includes a mobile assembly plant in Addis Ababa for Tenssion’s Tecno, Africa’s leading mobile phone brand.

And another edge Ethiopia could have over other African tech hubs is its advances in developing a manufacturing industry (and higher-paid workforce) that’s now pulling some assembly from China. That includes a mobile assembly plant in Addis Ababa for Tenssion’s Tecno, Africa’s leading mobile phone brand.

Ethiopia’s startup scene will be stuck in the mud, however, without changes to the internet landscape. As we discussed on the Startup Ethiopia stage, the tech and startups of tomorrow — in Africa and globally — won’t just be driven by IoT, or the Internet of Things.

Tech ventures and their end-users are shifting toward an IoEA future: the internet-of-everything-all-the-time. And it’s impossible for Ethiopia’s startups to move in that direction in a market with one state-controlled mobile provider and IP that has the power to arbitrarily nix connectivity.

So on the policy side, the single most effective thing the government of Ethiopia can do to provide an enabling environment for startups is open up its internet market to improve penetration, choice, cost and reliability.

Do that and it’s likely the other tech pieces assembling around the country — ventures, angels, hubs and entrepreneurs — will sort out the rest.

Powered by WPeMatico

Meet your new chief of staff: An AI chatbot

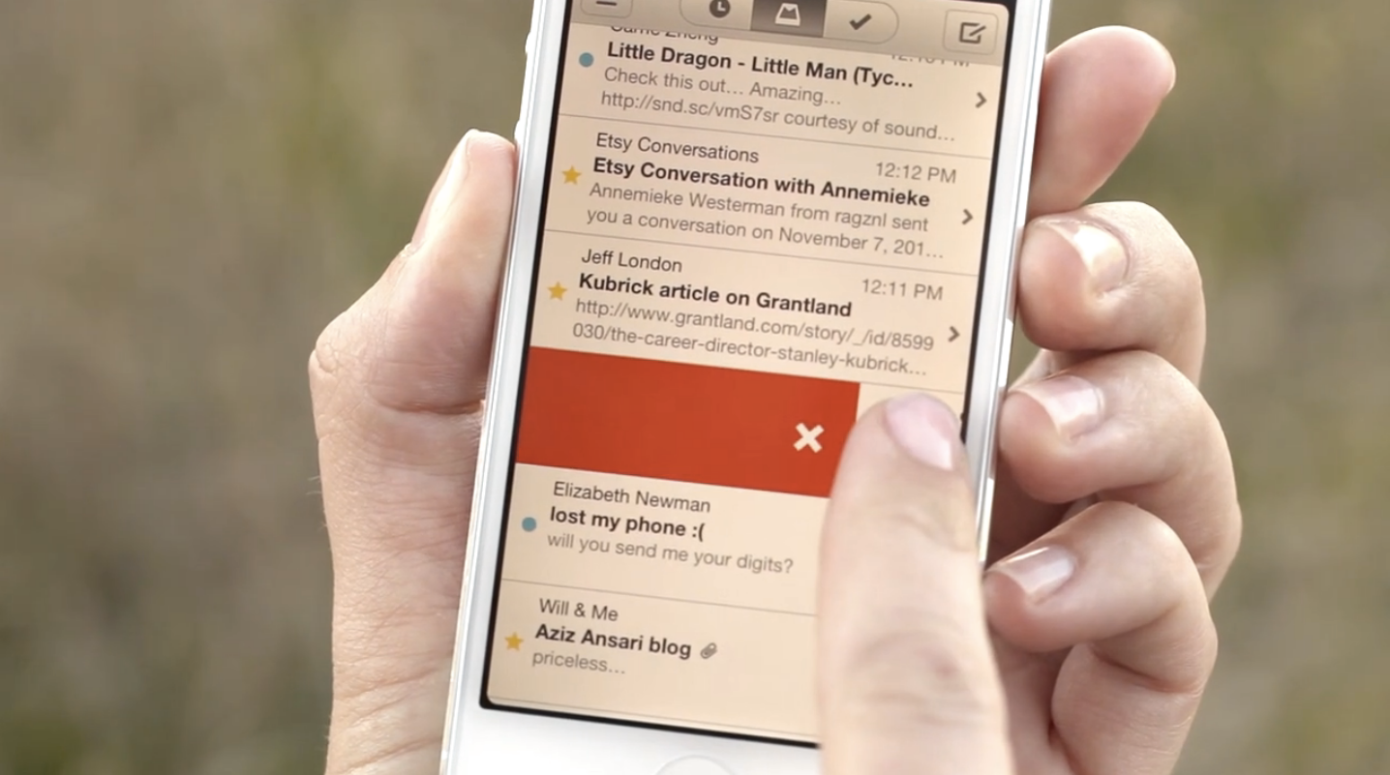

Years ago, a mobile app for email launched to immediate fanfare. Simply called Mailbox, its life was woefully cut short — we’ll get to that. Today, its founders are back with their second act: An AI-enabled assistant called Navigator meant to help teams work and communicate more efficiently.

With the support of $12 million in Series A funding from CRV, #Angels, Designer Fund, SV Angel, Dropbox’s Drew Houston and other angel investors, Aspen, the San Francisco and Seattle-based startup behind Navigator, has quietly been beta testing its tool within 50 organizations across the U.S.

“We’ve had teams and research institutes and churches and academic institutions, places that aren’t businesses at all in addition to smaller startups and large four-figure-person organizations using it,” Mailbox and Navigator co-founder and chief executive officer Gentry Underwood tells TechCrunch. “Pretty much anywhere you have meetings, there is value for Navigator.”

The life and death of Mailbox

Mailbox, a mobile email management system, was responsible for many of the features both Apple Mail and Gmail use today, including swipe to archive or delete.

It launched in 2013, as mentioned, to quick success. At the time, Apple’s App Store was much newer and there were few available options for mobile email, especially ones that prioritized design and efficiency, as Mailbox did.

As a result, Mailbox, created by a venture-capital backed Palo Alto startup by the name of Orchestra, exploded. Mere weeks after its launch, it attracted 1.25 million people to its waitlist. Shortly after that, it hit another milestone: It was acquired.

Dropbox paid $100 million to bring Mailbox and its 13 employees on board, including Underwood and his co-founder Scott Cannon. Dropbox CEO Drew Houston, still years away from leading his company through a successful IPO, told The Wall Street Journal his plan was to “help Mailbox reach a much different audience much faster.”

“That was a very special time,” Underwood said. “There were still a lot of opportunities for improvements for how email was being used on these tiny little devices.”

Two years later, in 2015, the worst happened. Dropbox made the unpopular decision to shut down Mailbox, despite its cult following, in order to focus more on its own core product and the development of other new productivity tools.

“That was a hard time for us and Mailbox users,” Underwood said. “It was a tough decision for Dropbox as well … Ultimately, Mailbox didn’t meet the focus criteria for Dropbox and I understood the decision. It was in every sense their right to do with it what they thought was best.”

Act two

About a year later, in 2016, the Mailbox team had licked their wounds and begun work on an entirely new venture.

About a year later, in 2016, the Mailbox team had licked their wounds and begun work on an entirely new venture.

Much like Slack disrupted the frequency and efficiency of workplace communication, Navigator hopes to reimagine meetings, an essential element of business that’s often dreaded the most.

“What we saw with Mailbox was that really great processes were an effective way to help teams be creative; yet, lots of teams don’t make use of great processes,” Underwood explained. “After Mailbox, we really wanted to find a way to help teams be more effective and Navigator is a teamwork assistant whose job is really to help teams basically make the most of working together.”

According to Doodle’s 2019 state of the meeting report, 71% of working professionals lose time every week because of unnecessary meetings, most often because those meetings are ineffective or poorly organized. This is a cause of frustration and a loss of time and money; in fact, Doodle estimates nearly $400 billion is lost annually as a consequence of botched meetings.

Still, meetings aren’t going away. Workers in corporate America spend roughly five hours per week in meetings and another four hours per week preparing for meetings. Managers spend double that. There’s a big opportunity here to leverage technology to improve, even eliminate, this pain point.

The video conferencing business Zoom, for example, is hyperfocused on refining the video meeting, specifically for the remote worker. Its recent initial public offering and subsequent performance on the public markets has proven its value and the demand for technology that makes doing business easier. Slack’s direct listing today, which saw the business tripling in value at its debut, is further proof of the market opportunity for productivity tech.

Similar to Slack, which began as an artful online game, Aspen has prioritized design in building Navigator, the first of many products it plans to launch.

“We approached the problem of helping teams work together as a design problem,” Underwood said. “We tried over 200 different prototypes of different ways to encode and distribute best practices within a team. The concept of a virtual teammate was the one that finally began to show signs of working.”

Underwood says nothing was directly imported from Mailbox, aside from a dedication to human-centered design.

“We are solving a different problem but the way we are going about solving it, in trying to build something that resonates with people, is certainly consistent,” he said. “As a team, we seem to gravitate toward these ubiquitous, uncomfortable, painful problems, like email and meetings, and try to build solutions that transform people’s experiences of them.”

Making meetings suck less

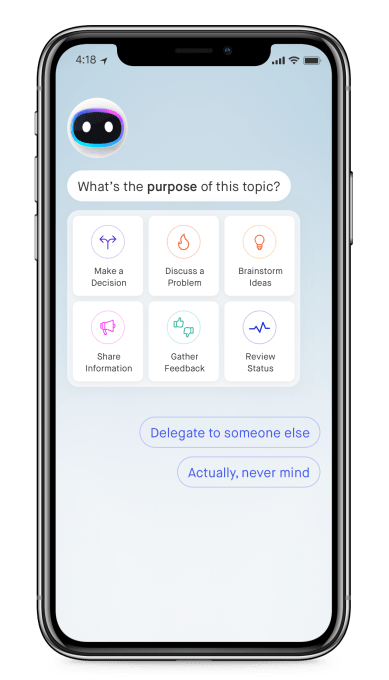

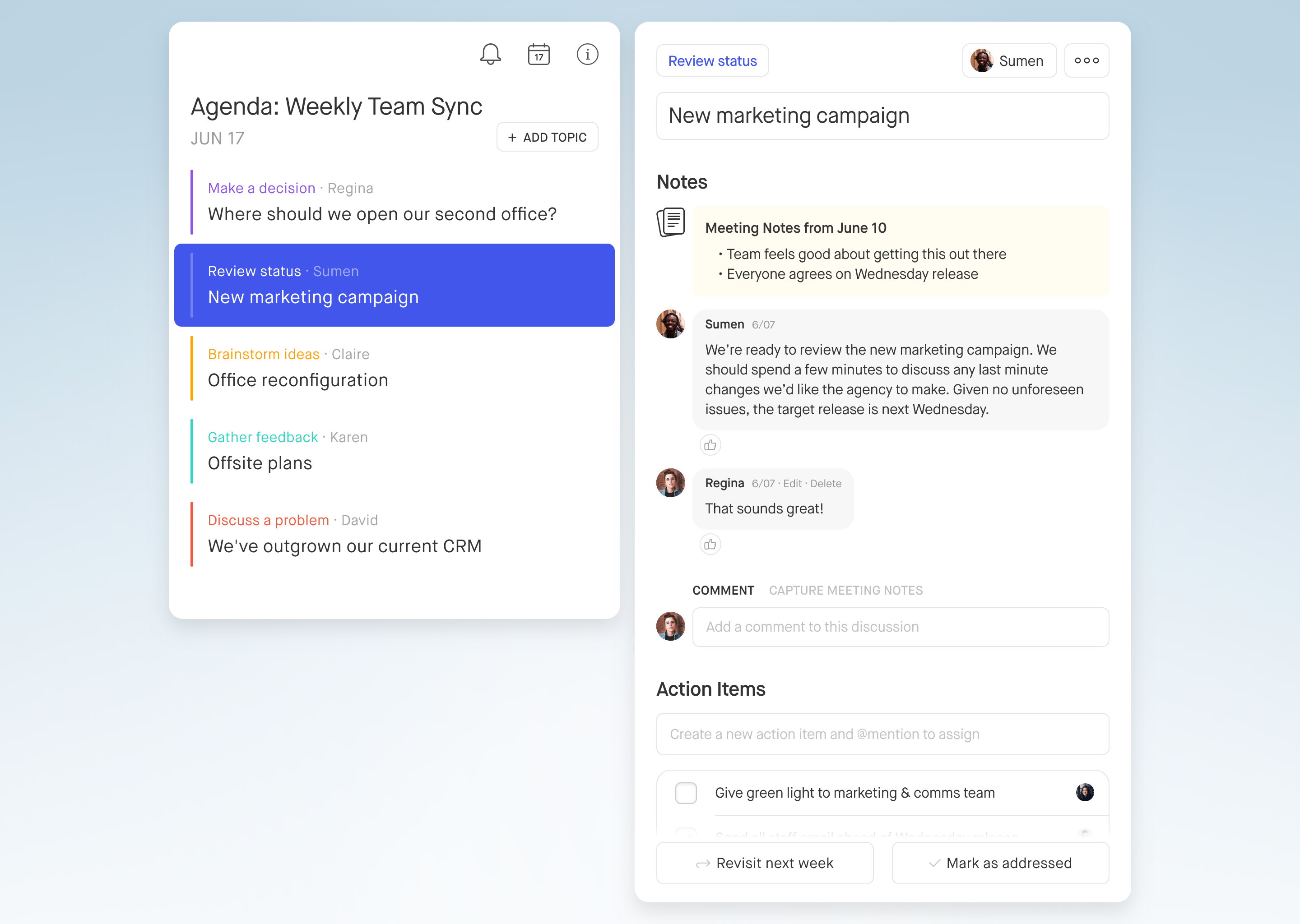

Navigator focuses on team meetings and one-on-ones, requesting information from meeting attendees before and after the meeting takes place.

First, it learns the topic of the meeting from participants and organizes them into a clear agenda complete with discussion topics. During the meeting, workers can use Navigator to quickly capture key takeaways that are later shared with every member of the meeting afterward. Later, the assistant checks in with attendees to learn whether they’ve completed their tasks.

“It’s sort of like a chief of staff focused on helping meetings run effectively,” Underwood said. “It helps people show up. They feel invited and welcome and like their voice is valued, which changes how it feels for them to enter that room.”

Currently, Navigator works with Google’s G suite, Microsoft’s Office 365 and Slack. Soon, it will offer task integration with Asana, Jira, Trello and others.

For now, it comes without a cost as the team continues to work out bugs with its first cohort of customers. Underwood says later this year they will begin to incorporate subscription-based feeds for the product.

“Navigator is another teammate, not another tool,” Underwood said. “It’s about turning meetings from painful, expensive wastes of time, to effective, meaningful moments of deep collaboration. They have that potential. When done well, they can be exceedingly powerful.”

Powered by WPeMatico

A chat with Niantic CEO John Hanke on the launch of Harry Potter: Wizards Unite

Just shy of three years ago, Pokémon GO took over the world. Players filled the sidewalks, and crowds of trainers flooded parks and landmarks. Anywhere you looked, people were throwing Pokéballs and chasing Snorlax.

As the game grew, so did the company behind it. Niantic had started its life as an experimental “lab” within Google — an effort on Google’s part to keep the team’s founder, John Hanke, from parting ways to start his own thing. In the months surrounding GO’s launch, Niantic’s team shrank dramatically, spun out of Google, and then rapidly expanded… all while trying to keep GO’s servers from buckling under demand and to keep this massive influx of players happy. Want to know more about the company’s story so far? Check out the Niantic EC-1 on ExtraCrunch here.

Now Niantic is back with its next title, Harry Potter: Wizards Unite. Built in collaboration with WB Games, it’s a reimagining of Pokémon GO’s real-world, location-based gaming concept through the lens of JK Rowling’s Harry Potter universe.

I got a chance to catch up with John Hanke for a few minutes earlier this week — just ahead of the game’s US/UK launch this morning. We talked about how they prepared for this game’s launch, how it’s built upon a platform they’ve been developing across their other titles for years, and how Niantic’s partnership with WB Games works creatively and financially.

Greg Kumparak: Can you tell me a bit about how all this came to be?

John Hanke: Yeah, you know.. we did Ingress first, and we were thinking about other projects we could build. Pokémon was one that came up early, so we jumped on that — but the other one that was always there from the beginning, of the projects we wanted to do, was Harry Potter. I mean, it’s universally beloved. My kids love the books and movies, so it’s something I always wanted to do.

Like Pokémon, it was an IP we felt was a great fit for [augmented reality]. That line between the “muggle” world and the “magic” world was paper thin in the fiction, so imagining breaking through that fourth wall and experiencing that magic through AR seemed like a great way to use the technology to fulfill an awesome fan fantasy.

Powered by WPeMatico

Get your early-bird tickets to TC Sessions: Enterprise 2019

In a world where the enterprise market hovers around $500 billion in annual sales, is it any wonder that hundreds of enterprise startups launch into that fiercely competitive arena every year? It’s a thrilling, roller-coaster ride that’s seen it all: serious success, wild wealth and rapid failure.

That’s why we’re excited to host our inaugural TC Sessions Enterprise 2019 event on September 5 at the Yerba Buena Center for the Arts in San Francisco. Like TechCrunch’s other TC Sessions, this day-long intensive goes deep on one specific topic. Early-bird tickets are on sale now for $395 — and we have special pricing for MBA students and groups, too. Buy your tickets now and save.

Bonus ROI: For every ticket you buy to TC Sessions: Enterprise, we’ll register you for a free Expo Only pass to TechCrunch Disrupt SF on October 2-4. Sweet!

Expect a full day of programming featuring the people making it happen in enterprise today. We’re talking founders and leaders from established and emerging companies, plus proven enterprise-focused VCs. Discussions led by TechCrunch’s editors, including Connie Loizos, Frederic Lardinois and Ron Miller, will explore machine learning and AI, intelligent marketing automation and the inevitability of the cloud. We’ll even touch on topics like quantum computing and blockchain.

Tired of the hype and curious about what it really takes to build a successful enterprise company? We’ve got you. You’ll hear from proven serial entrepreneurs who’ve been there, done that and what they might like to build next.

We’re building the agenda of speakers, panelists and demos, and we have a limited number of speaking opportunities available. If you have someone in mind, submit your recommendation here.

This event is perfect for enterprise-minded founders, investors, MBA students, engineers, CTOs and CIOs. If you need four or more tickets, take advantage of our group rate and save 15% over the early-bird price when you buy in bulk. Are you an MBA student? Save your dough — buy a student ticket for $245.

TC Sessions: Enterprise 2019 takes place September 5 in San Francisco. Join us for actionable insights and world-class networking. Buy your early-bird tickets today.

Is your company interested in sponsoring or exhibiting at TC Sessions: Enterprise 2019? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

A Netflix hack lets you feel the action in a scene by vibrating your phone

Netflix Hack Day, the company’s internal hackathon, has a habit of producing some amazing gems — like a brain-controlled interface, a Fitbit hack that shuts off Netflix when you fall asleep, a Netflix app for the original NES and a way to navigate the Netflix app with Face ID and ARKit, to name a few. At this year’s Netflix Hack Day, employees ventured into areas like voice technology and haptics — the latter, so your phone could vibrate right along with the on-screen action, among other things.

Project Rumble Pack, as the hack that used haptics was called, takes inspiration from mobile gaming. Some games vibrate, which allows players to feel the action — like a bouncing ball, a car on a race track, an object getting hit or destroyed and so on.

Similarly, Project Rumble lets you feel the action in a scene from a show or movie — like a fight, battle or big explosion. (Imagine a Michael Bay movie with Rumble Pack turned on!) The team behind the hack, Hans van de Bruggen and Ed Barker, demoed haptics in an episode of Voltron where a huge explosion makes the phone shake in your hands.

The hack was created by syncing Netflix content with haptic effects using Immersion Corporation technology.

Another hack, called The Voice of Netflix, taught Netflix to speak using the voice of Netflix’s favorite characters. The team trained a neural net to find words in Netflix’s content, which could then be used to create new sentences on demand.

A third favorite was TerraVision — a practical hack that sounds like a business opportunity.

The hack lets filmmakers drop into an interface a photo of a look they like for a film location, then get back the closest results from a library of location photos. The hack used a computer vision model trained to recognize places for its reverse-image search functionality.

The final highlight was a silly hack that plays “walk-out music” — like the music that kicks in when Oscar speeches go too long — when someone overstays their allotted time in a booked conference room.

Sadly, many of Netflix’s hacks don’t tend to escape the confines of the hackathon itself. But they can inspire real-world projects in other ways, and help to keep the creativity flowing.

An overview of this year’s Netflix Hack Day, which focused on Netflix’s studio efforts, is below.

Powered by WPeMatico

Watch: Facebook’s Libra coin explained simply

They’re not called Zuckerbucks, but Facebook just reinvented digital money. Facebook’s Libra cryptocurrency that will launch early next year is more like PayPal than Bitcoin — it’s designed to be easy enough for everyone to use. But it’s still complicated to understand, so I’m going to break it down for you nice and simple.

Watch our handy video above or read the transcript below.

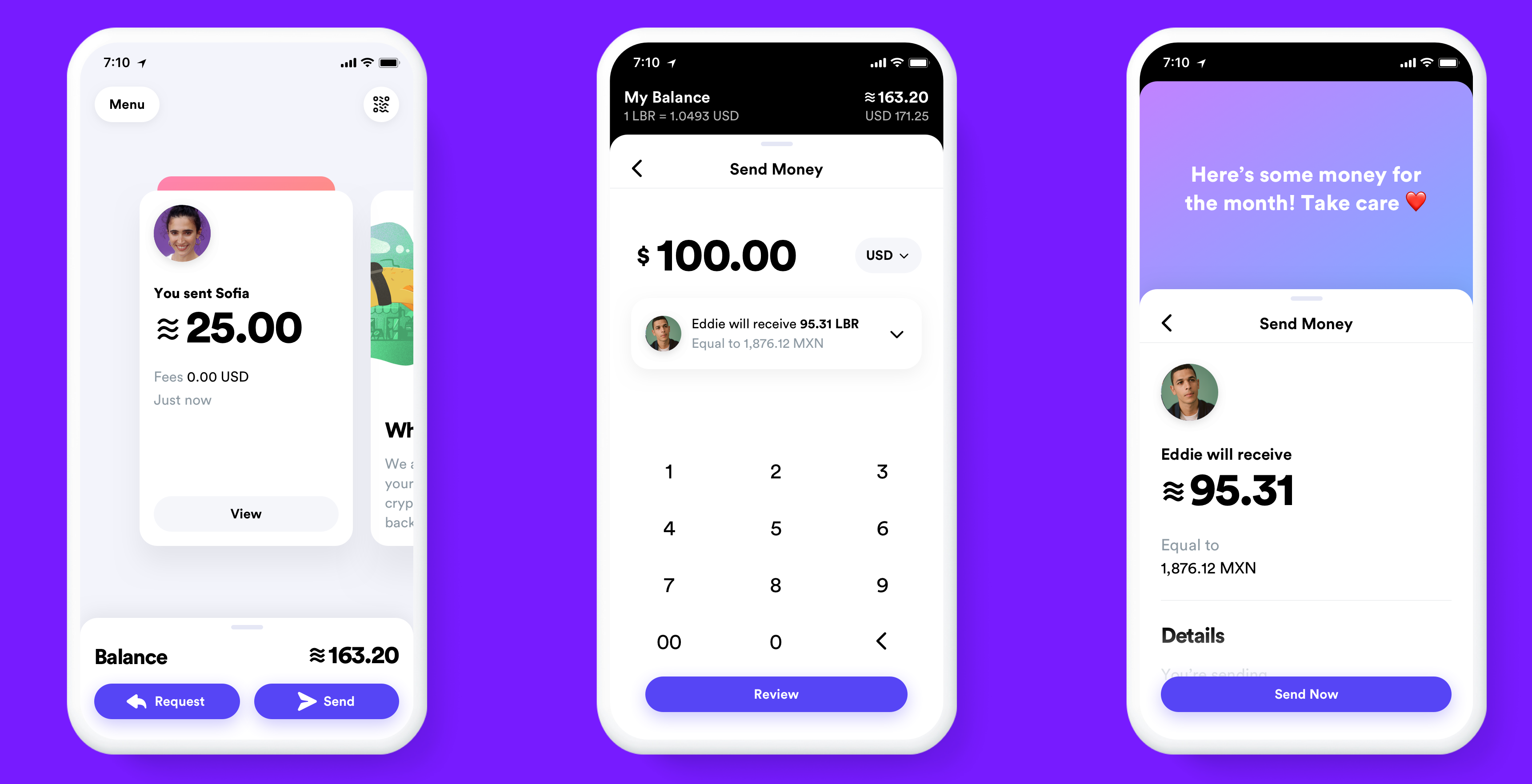

Libra is like cash that lives inside your phone. How do you buy Facebook’s cryptocurrency? Starting in 2020, you’ll be able to purchase Libra through Libra wallet apps on your phone or from some local grocery and convenience stores. You cash in your local currency like dollars and get nearly the same number of Libra coins, which are represented by this wavy three-line emoji instead of the $ symbol. But first you’ll have to verify your identity with a photo.

You’ll then be able to spend your Libra while online shopping, or potentially pay for things like Ubers or your subscription for Spotify, since those companies have partnered with Facebook to make Libra popular. Since it’s almost free to digitally move Libra from one account to the other, you won’t have to pay high credit card processing fees that can add almost 4% to your total. And some Libra wallet apps and shops will give bonus discounts or free coins for signing up and paying with Libra.

You’ll also be able to send and request money from friends like you would with Venmo or PayPal. It’s as easy to send Libra as it is a message. In fact, Facebook is building its own Libra wallet app called Calibra that will live inside of WhatsApp, Facebook Messenger and its own standalone app.

You won’t have to attach your real name and identity to any of your payments, but they will be public. Facebook knows it’s a little bit creepy and you probably don’t want it spying on what you buy. So Facebook set up a new company also called Calibra that will keep all your financial data separate from your Facebook profile. That means it can’t use your transaction data to target you with ads, re-order your News Feed or sell your info to marketers.

Eventually, Facebook hopes you’ll use Libra to pay your bills, scan your wallet’s QR code to purchase coffee or tap your phone to buy your public transit ticket. At any time, you can cash out of Libra and get your local currency back in your bank account, or handed to you at a local grocery store.

But how does the Libra cryptocurrency technically work…without a bunch of blockchain buzzwords? Libra is coded to have a stable price, be secure and be controlled not just by Facebook.

Instead, Libra is run by the 28-member Libra Association that it hopes will grow to 100 members by the time it launches in the first half of 2020. Financial companies like Visa and Mastercard, merchants and apps like eBay and Lyft, venture capital funds like Andreessen Horowitz and Union Square Ventures and nonprofits like Kiva are all members. They each paid at least $10 million to get one vote on the Libra council that controls what happens to the currency. They’ll be responsible for checking to make sure Libra transactions are real and creating the Libra Reserve.

Each time you cash in a dollar, that money goes into a big bank account called the Libra Reserve that creates and sends you roughly one Libra token. The Libra Reserve is made up of a collection of the most stable international currencies, like the U.S. dollar, British pound, the euro and the Japanese yen. The idea is that even if one of those currencies goes up or down in price, the value of the Libra will stay stable. That way, shops will accept the Libra as payment without worrying the value of the coin will drop tomorrow. Big swings in price are why older cryptocurrencies like Bitcoin or Ethereal haven’t grown popular as payment methods. Libra can also handle 1,000 transactions per second, while Bitcoin can only handle 7.

So how do Facebook and the other Libra Association members earn money? Off of interest on all the assets held in the Libra Reserve. After the Libra Association pays for its operations and investments in technology, members earns a cut of the remaining interest in proportion to how much they invested when they joined. If Libra gets popular, tons of people cash in and the reserve grows huge, the interest could add up to serious revenue for Facebook.

But there’s also a subtle second way Facebook could get rich from Libra. If the currency makes it easier for small businesses to accept payments online, they’ll sell more stuff. They’ll then have extra money to spend on Facebook ads, which will make it extra quick to buy things with Libra. Ninety million small businesses already have Facebook Pages, but Facebook only has 7 million advertisers. If it can turn more of those local merchants into ad buyers, Facebook’s revenues could skyrocket.

The big risk of Libra is that anyone will be able to develop apps for it. That could lead to another Cambridge Analytica situation. But instead of some shady app maker snatching your personal info, they could steal your digital currency. Facebook and the Libra Association say they won’t vet Libra developers, which leaves the door wide open to abuse. And if people get scammed, they’ll blame Facebook.

But if Facebook succeeds, the real win could be for the 1.7 billion people left in poverty with no bank account around the world. They’re exploited by international money sending services like Western Union or Monogram that charge steep 7% fees that take $50 billion away from families per year. And if they’re mugged, they could lose all their money since they have nothing stored online. All they’ll need is a photo ID and Libra could give them an alternative to a bank account that’s tougher to steal and could make it easy to pay for what they need.

There are plenty of reasons to worry that Libra could give Facebook and other tech giants more power or lead to people getting scammed. But it could also give disadvantaged people everywhere a way to join the modern economy. And at least it’s not called FaceCoin.

And if you want to know how Libra could spawn Facebook’s next scandal, read this:

Video by Gregory Manalo, b-roll via Libra Association

Powered by WPeMatico

Transitioning from engineering to product with Adobe’s Anjul Bhambhri

Many roles inside of startups and tech companies are clear: marketers market, salespeople sell, engineers engineer. Then there are the roles like “product manager” that seem obvious on the surface (product managers “product,” right?) but in reality are very fuzzy roles that can be highly variable across different companies.

A few weeks ago, TechCrunch editor Jordan Crook interviewed J Crowley, who is head of product for Airbnb Lux and was formerly at Foursquare. Crowley came up in the consumer product world without a technical background, and he spoke to overcoming some of his own insecurities to become a leading product thinker in the Valley.

This week, I wanted to offer another perspective on product from Anjul Bhambhri, who is Vice President, Platform Engineering at Adobe, where she and her team conceived Adobe’s new Experience Platform for real-time customer experience management.

Across Bhambhri’s more than two decade career straddling the line between software engineering and product, she has worked on deeply technical, enterprise projects at Sybase and Informix as startups, big data infrastructure at IBM, and now at Adobe.

We discuss the challenges and opportunities of moving from an engineering career into product (and management more generally) as well as the ways she thinks about building compelling products that are sold B2B.

This conversation has been condensed and edited for clarity

Scaling out product after product

Danny Crichton: Anjul, thanks for joining us. One of the major initiatives that we’ve been doing as part of Extra Crunch is to interview experts in their fields, talking about how they go about doing their job, and how you think about the decisions that come up on a day-to-day basis in the work that you do. So to start, I would love to talk a little about your background.

Anjul Bhambhri: Very nice to meet you, and happy to share my journey, Danny. I have been in the software industry now for really almost 30 years. I’m an electrical engineer, and basically, my entire career has been in data, databases, and big data analytics.

Powered by WPeMatico