Daily Crunch: Slack makes its Wall Street debut

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 9am Pacific, you can subscribe here.

1. Slack prices IPO at $26 per share

Slack is debuting on the New York Stock Exchange today. Trading hasn’t opened yet as I write this, but The Wall Street Journal reports that the company has set a price of $26 per share.

The enterprise communication company is pursuing a direct listing, eschewing the typical IPO process in favor of putting its current stock on to the NYSE without doing an additional raise or bringing on underwriter banking partners.

2. Waymo takes its self-driving car ambitions global in partnership with Renault-Nissan

Waymo has locked in an exclusive partnership with Renault and Nissan to research how commercial autonomous vehicles might work for passengers and packages in France and Japan.

3. UK age checks for online porn delayed after bureaucratic cock-up

Digital minister Jeremy Wright said the government failed to notify the European Commission of age verification standards it expects companies to meet. Without this notification, the government can’t legally implement the policy.

4. iRobot acquires education startup Root Robotics

Root Robotics is the creator of an eponymous coding robot, a two-wheeled device designed to draw on whiteboards and other surfaces, scanning colors, playing music and otherwise playing out coding instructions.

5. SaaS data protection provider Druva nabs $130M, now at a $1B+ valuation, acquiring CloudLanes

Druva has made a name for itself as a provider of cloud-based solutions to protect and manage IT assets.

6. Why all standard black Tesla cars are about to cost $1,000 more

Tesla will start charging $1,000 for its once-standard black paint color next month, according to a tweet by CEO Elon Musk.

7. Tally’s Jason Brown on fintech’s first debt roboadvisor and an automated financial future

We sat down with Tally’s founder and CEO Jason Brown to discuss a new funding round, Tally’s growth strategy and the company’s vision for an automated financial future. (Extra Crunch membership required.)

Powered by WPeMatico

Samsung’s Galaxy S10 5G arrives on Sprint tomorrow

You surely know the whole deal about carts and horses by now. When Samsung’s first 5G handset, the Galaxy S10 5G, arrives on Sprint tomorrow, users will be able to get those blazing fast mobile speeds in all of four markets: Atlanta, Dallas, Houston and Kansas City.

Those all launched last week, after the arrival of the carrier’s first 5G handset, LG’s V50 ThinQ. The good news is that a number of the biggest cities in the country will be getting coverage in “coming weeks,” including Chicago, Los Angeles, New York City, Phoenix and Washington, D.C.

The other good news, I guess, is that you can still use the phone in the rest of the country, albeit with 4G speeds. Of course, with an eye-popping unlocked starting price of $1,300, you’re probably not going to want to spend much of your time on LTE with the rest of us peasants. For those who prefer not to pay all upfront, plans start at $40.28 a month.

Sprint joins Verizon and AT&T, which got the 5G Galaxy back in May and June, respectively.

Powered by WPeMatico

Machine learning for everyone startup Intersect Labs launches platform for data analysis

Machine learning is the holy grail of data analysis, but unfortunately, that holy grail oftentimes requires a PhD in Computer Science just to get started. Despite the incredible attention that machine learning and artificial intelligence get from the press, the reality is that there is a massive gap between the needs of companies to solve business challenges and the availability of talent for building incisive models.

YC-backed Intersect Labs is looking to solve that gap by making machine learning much more widely accessible to the business analyst community. Through its platform, which is being launched fully publicly, business analysts can upload their data, and Intersect will automatically identify the right machine learning models to apply to the dataset and optimize the parameters of those models.

The company was founded by Ankit Gordhandas and Aaron Fried in August of last year. In his previous job, Gordhandas deployed machine learning models to customers and started working on a tool that would speed up his work. “I actually realized I could build a version of the tool that was a little more advanced,” he said, and that work ultimately led to the foundation of Intersect Labs. He linked up with Fried in October, and the two have been working on the platform since.

Intersect’s goal is to move analysts from purely retrospective analysis to creating models that can predictively determine business strategy. “People who live in SQL and Excel, they are really good at pulling the data of the past, but we are giving them the superpower of seeing the future,” Gordhandas explained. “All you need is your historical data, upload to our platform, and answer two questions.”

Ankit Gordhandas and Aaron Fried of Intersect Labs. Courtesy of Intersect Labs.

Those questions essentially ask what the model should predict (the outcome variable). From there, Intersect begins by cleaning up the data and ensuring that the various columns are properly scaled for data analysis. Then, the platform begins constructing a range of machine learning models and evaluating their performance against the target output. Once an ideal model is identified, customers can integrate it into their other systems through a REST-style API.

What’s interesting here is that Intersect can get better and better at identifying models over time based on the increasing diversity of datasets that it gets access to. Plus, as researchers identify new models or ways to tune them, the platform can potentially proactively improve the models it had previously identified for its customers, ensuring that they stay at the cutting edge of the field.

Today, the platform can handle one table of standard rows and columns for processing. Gordhandas said that the company intends to expand in the future to “image processing, audio processing, video processing, unstructured data processing” so that the platform can be applied to as diverse a set of data sources as possible

Gordhandas says that Intersect is attempting to sit in the middle of more specialized machine learning platforms that are limited to hyper-focused niches, while also offering more analytical power than comparably simpler solutions.

Certainly the space has seen a proliferation of options. New York City-based Generable (formerly Stan) uses Bayesian modeling and probabilistic programming to improve drug discovery, while Mintigo uses AI modeling to improve customer engagement. A huge number of other startups target different stages of the data analysis pipeline as well.

In the end, Intersect hopes to make these tools more widely accessible. The company has a couple of early customers already, and is going through the Y Combinator accelerator this batch.

Powered by WPeMatico

Slack opens at $38.50, a pop of 48% on its first day of trading on NYSE as WORK

Slack, the workplace messaging platform that has helped define a key category of enterprise IT, made its debut as a public company today with a pop. Trading as “WORK” on the New York Stock Exchange, it opened at $38.50 after setting a reference price last night of $26, valuing it at $15.7 billion, and then setting a bid/asking price of $37 this morning.

The trading climbed up quickly in its opening minutes and went as high as $42 and is now down to $38.95. We’ll continue to update this as the day goes on. These prices are pushing the market cap to around $20 billion.

Note: There was no “money raised” with this IPO ahead of today because Slack’s move into being a publicly traded company is coming by way of a direct listing — meaning the shares went directly on the market with no pre-sale. This is a less-conventional route that doesn’t involve bankers underwriting the listing (nor all the costs that come along with the roadshow and the rest). It also means Slack does not raise a large sum ahead of public trading. But it does let existing shareholders trade shares without dilution and is an efficient way of going public if you’re not in need of an immediate, large cash injection. It’s a route that Spotify also took when it went public last year, and, from the front-page article on NYSE.com, it seems that there might be growing interest in this process — or at least, that the NYSE would like to promote it as an option.

Slack’s decision to go slightly off-script is in keeping with some of the ethos that it has cultivated over the last several years as one of the undisputed juggernauts of the tech world. Its rocket ship has been a product that has touched on not one but three different hot growth areas: enterprise software-as-a-service, messaging apps and platform plays that, by way of APIs, can become the touchstone and nerve center for a seemingly limitless number of other services.

What’s interesting about Slack is that — contrary to how some might think of tech — the journey here didn’t start as rocket science.

Slack was nearly an accidental creation, a byproduct that came out of how a previous business, Tiny Speck, was able to keep its geographically spread-out team communicating while building its product, the game Glitch. Glitch and Tiny Speck failed to gain traction, so after they got shut down, the ever-resourceful co-founder Stewart Butterfield did what many founders who still have some money in the bank and fire in their bellies do: a pivot. He took the basic channel they were using and built it (with some help) into the earliest public version of what came to be known as Slack.

But from that unlikely start something almost surprising happened: the right mix of ease of use, efficient responsiveness and functionality — in aid of those already important areas of workplace communication, messaging and app integration — made Slack into a huge hit. Quickly, Slack became the fastest-growing piece of enterprise software ever in terms of adding users, with a rapid succession of funding rounds (raising over $1.2 billion in total), valuation hikes and multiple product improvements along the way to help it grow.

Today, like many a software-as-a-service business that is less than 10 years old and investing returns to keep up with its fast-growing business, Slack is not profitable.

In the fiscal year that ended January 31, 2019, it reported revenues in its S-1 of $400.6 million, but with a net loss of $138.9 million. That was a slight improvement on its net loss from the previous fiscal year of $140.1 million, with a big jump on revenue, which was $220.5 million.

But its growth and the buzz it has amassed has given it a big push. As of January 31, it clocked up over 10 million daily active users across 600,000 organizations, with 88,000 of them on paid plans and 550,000 using the free version of the app. It will be interesting to see how and if that goodwill and excitement outweighs some of those financial bum notes.

Or, in some cases, possibly other bum notes. The company has made “Work” not just its ticker but its mantra. Its slogan is “Where work happens” and it focuses on how its platform helps make people more productive. But as you might expect, not everyone feels that way about it, with the endless streams of notifications, the slightly clumsy way of handling threaded conversations and certain other distracting features raising the ire of some people. (Google “Slack is a distraction” and you can see some examples of those dissenting opinions.)

Slack has had its suitors over the years, unsurprisingly, and at least one of them has in the interim made a product to compete with it. Teams, from Microsoft, is one of the many rival platforms on the market looking to capitalise on the surge of interest for chat and collaboration platforms that Slack has helped usher in. Other competitors include Workplace from Facebook, Mattermost and Flock, along with Threads and more.

Powered by WPeMatico

The boring genius of how Atrium kills legal busy work

Law firms have little incentive to build or buy software that will save their lawyers time because they often bill clients by the hour. Tasks like tracking down legal documents, extracting key information and drawing up hiring offers or funding term sheets add up to make lawyers expensive, even if they’re constantly repeating mindless busy work.

That’s why legal startup Atrium is so exciting — even though it’s developing tech that might seem boring on the surface. After raising $75 million from Andreessen Horowitz and General Catalyst while growing to 400 clients, today Atrium is announcing its first customer-facing products.

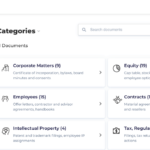

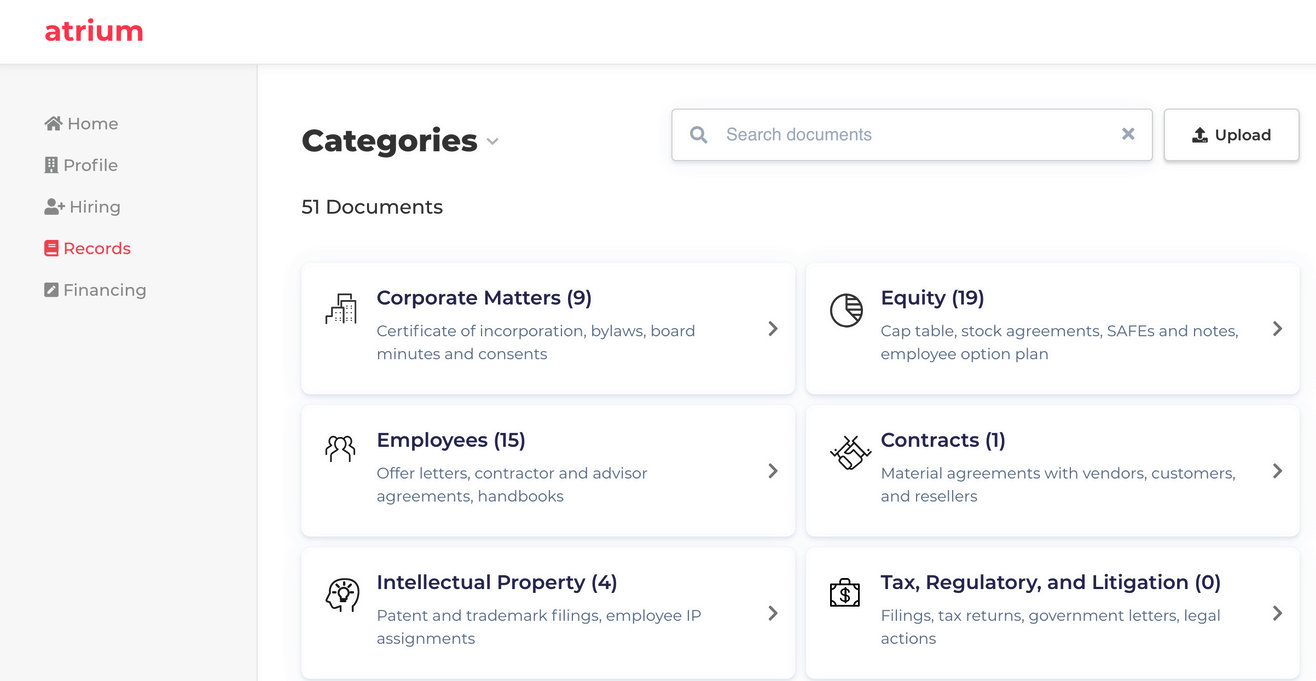

Atrium Records creates a collaborative file locker for you and your lawyer so you always have access to the latest versions of corporate documents. Atrium Hiring automatically generates hiring offers and contracts from details you add to a form, and tracks everyone’s approvals and signatures.

Atrium Records

Rather than having to pay for these tools separately, they come as part of a subscription to a bundle of Atrium’s legal services, with special projects like counsel through an acquisition costing extra. This business model incentivizes Atrium to work as efficiently as possible instead of bilking hourly rates, and build tools to eliminate less-skilled work or assist with common corporate duties. That’s allowed it to speed up legal work on incorporations, financings, M&A and contract negotiations.

“One of the reasons we partnered with Andreessen Horowitz on the last round [a $65 million Series B] was we really align with the way they approach venture capital,” Atrium co-founder and CEO Justin Kan tells me. “Marc’s initial observation was . . . let’s not just provide capital but also other services like a talent network. We have kind of done the same stuff. Not only are we helping people with the legal stuff they want to get done but with the other stuff surrounding it.”

Atrium CEO Justin Kan at TechCrunch Disrupt SF 2017

For example, Atrium’s Fundraising Concierge service provides assistance to startups for defining their narrative, setting up investor meetings and generating fair term sheets. Atrium has to date aided startups with raising more than $1 billion, from seed rounds of $200,000 to huge $50 million rounds

Developing drab but useful software for enterprises is a drastic shift for Kan. He pioneered life vlogging by strapping a camera to his head at his startup Justin.tv that eventually blossomed into Twitch and sold to Amazon for $1 billion. It’s been quite an adjustment for Kan going from making video-game-streaming consumer apps and angel investing to Atrium. “Two years. It has been an interesting and crazy ride. I wanted to get back to starting companies. That was the fastest learning I’d ever had. But I forgot learning means failing a lot,” he says with a wry smile.

Whatever tribulations they required seem worth it now that Atrium’s new products are ready. Atrium Records improves on the clumsy status quo where clients have to dig through emails from their lawyers hoping to find the most up-to-date versions of important corporate documents. If they can’t, they wait around after emailing their lawyer who has to hope they remember where they buried that term sheet or cap table in their firm’s file tree. This messy process can rack up billable hours, lead to data mismatches and let important signatures or approvals fall through the cracks.

Atrium Hiring

Kan says he’s seen some grisly situations. “You never signed your equity documents so you actually have no equity in this company. And now that there’s financing, there could be a taxable event. There’s often surprisingly serious problems that happen.” Atrium’s senior product manager Sahil Bhagat walks me through how Atrium can help clients avoid an issue like, “Maybe you hired 10 employees but didn’t update your cap table and then you’re hiring the 11th employee but you don’t have any equity to grant so you have to go through the hassle of increasing your options pool.”

Atrium Records acts like your searchable legal Dropbox. The startup works with your last law firm to ingest your documents around equity, taxes, employees and IP, and make sure they’re all up to date. Machine learning extracts critical data about financings and cap tables so that’s instantly available in the Atrium dashboard and you don’t have to dig into the original docs. Plus, you don’t have to pay for lawyers or paralegals to do that manually. And your lawyer can build a task list of documents for you to edit or sign so you always know what to do next, which is a relief when you’re wrangling approvals from all your existing investors.

Atrium Hiring operationalizes one of the biggest founder time-sucks. Instead of writing hiring contracts from scratch each time, you fill out a form and use menu selections to set the salary, share count, vesting schedule and offer expiration. Looking across its anonymized data set of contracts, Atrium can recommend the best clauses and most common set ups, like four-year vesting with one-year cliffs. You can see the status of the contracts every step of the way, from drafting and finalizing to getting employees to accept.

Kan tells me Atrium’s goal is to continue building on its archive of more than 100,000 legal documents to develop aggregated pools of data clients could opt into. If they’re willing to share their salary data, vendor contract pricing and more, they’ll get access to that of Atrium’s other clients. “You’ll be able to see if you’re on the high end of being paid by Salesforce for a contract,” Kan explains. That’s a much more data-driven approach than when most lawyers just think of the last few salaries they saw for that position and give you a rough average.

“Being able to tell what the market norms are is a powerful negotiating tool.” The startup has even been offering its tips for free as part of fundraising workshops it uses to attract clients. The challenge for the company will be ensuring efficiency doesn’t mean cutting corners.

Atrium has grown to 150 staffers split between legal practitioners and its product team in its two years since launch. Kan is trying to build a culture where everyone cooperates, unlike infamously cutthroat law firms where partners can compete for cases. He hopes that talent will stick with Atrium because it’s deleting the most tedious parts of their jobs. “No one wanted go to law school to review 1,000 hiring docs.”

Powered by WPeMatico

Nissan’s zero-emission ice cream van uses old EV batteries to keep things cool

File ice cream vans under “things I never thought posed a significant risk to the environment but might actually.” Nissan has developed a new concept vehicle that addresses the problem of all the emissions generated by conventional ice cream vans, and older models in particular, which pump out a lot of greenhouse gases while idling in order to just make sure the ice cream on board stays iced.

For the project, Nissan’s working with ice cream company Mackie’s of Scotland, a purveyor of fine frozen treats that has already taken steps to reduce its footprint using dairy from its own, family-run farm that’s powered by energy from renewable sources, including wind and solar. From the sustainably-made product, to the new zero-emission delivery van conceived and built by Nissan, the companies are calling the approach a “sky to scoop” way to reduce their carbon footprint.

To start, Nissan took their e-NV200 light-duty commercial van, which itself is fully electric and provides up to 124 miles of range on a charge. For this ice cream concept, the van was modified with Nissan’s new “Energy Roam,” a lithium-ion power pack that uses battery cells recovered from older Nissan EVs built from 2010 on. These repurposed power packs can each store about 0.7kWh with output of 1kW, and two are used on board to run a built-in soft-serve machine, fridges and freezers. The power packs can be recharged either from a 230v main power outlet (this is designed for U.K. use), or from solar tiles installed on the van’s roof, which can fill up the batteries in two to four hours on their own.

Besides its all-electric power sources, the Nissan concept van includes a number of revisions of the traditional model of mobile ice cream selling, including situating the vendor outside the van with a hatch that opens to expose the ice cream dispensing goodness. It’s also equipped with contactless payment support so you can just pay with Apple Pay or Google Pay on the go, and through an integration with What3Words, the van broadcasts its location via Twitter instead of with a jaunty jingle.

Bonus for ice cream sellers: Nissan notes that van owners could collect and store power using the on-board batteries and sell it back to the grid even when it’s not ideal weather for selling cold confections — though it’s definitely still a concept, so this is all theoretical.

Powered by WPeMatico

GirlGaze Network looks to connect brands with female creatives

It started with a hashtag. Amanda de Cadenet, photographer, author and TV host, was spending time with her sister, a director and photographer in her own right, when an ACLU study on the lack of diversity among directors was published in the NYT Magazine, with de Cadenet’s sister an interviewee in the cover story.

“It’s about damn time,” she said to her sister, launching a conversation that would re-route de Cadenet’s path forward. Her experience as a photographer, able to book editorial jobs but rarely getting paid gigs, cemented what she had just read in the magazine article.

“The glass ceiling was so low that I couldn’t get off my knees,” she explained of that time.

Over the next 48 hours she would design a logo and a font and contact everyone in her creative network, brands and artists alike, to answer the call when she tweeted a call to action. She simply asked for female photographers and videographers to share their photos alongside the hashtag #girlgaze.

“The majority of pictures taken of females are taken by men,” said de Cadenet. “If the goal is for us to be accepted and embrace who we are, our flaws and all, we’re never going to see those pieces of ourselves depicted in media when taken from the perspective that doesn’t have an experience of those things.”

Thousands of photos flooded in over the first 72 hours and were re-shared on the GirlGaze Instagram. It was de Cadenet’s way of highlighting the amazing work being done by creative women, and showing the different story that is told in content created from the perspective of a female. But more importantly, it’s how she built an army of 200,000+ female-identifying photographers and directors to eventually launch the GirlGaze Network.

Today, at Cannes Lion festival, nearly three years later, de Cadenet did just that.

The GirlGaze Network allows brands to sign up and find diverse, female-identifying and non-binary creatives to generate amazing content. The network has been in beta for the past few months, and was integral in a global campaign from Dove, which employed 400 photographers and directors across 62 countries.

In essence, the GirlGaze Network acts as representation for a group of people who have not gotten equal pay or equal respect within their field. It also gives brands the opportunity to right the ship and hire diverse creative talent to generate their troves of content, whether it’s for social media, a campaign or otherwise.

Here’s how it works:

Creatives pay nothing to be on the platform and share their portfolio.

Brands join the platform through a paid subscription, where they can see the portfolios of thousands of photographers, directors and creatives. These brands have access to an à la carte menu to establish what kind of jobs they’d like to post, putting the compensation quote up at the very beginning so that whomever receives the job is paid a fair amount for the gig.

Big brands looking to hire a large amount of people, as Dove did with the #showus campaign, join the Enterprise tier to customize their exact offer, including per-project talent as well as full-time positions.

Brands can search for talent by title, skills, location and availability. But perhaps even more interesting, the GirlGaze Network has an “Unbiased Browsing” feature, allowing brands who genuinely want to rid themselves of unconscious bias to browse portfolios only, without access to any details about the creative herself.

GirlGaze also handles all of the back-end nitty gritty, including casting and NDAs and all the other paperwork involved.

“The biggest challenge for GirlGaze is to let brands and companies know that they’re not doing this underserved community a favor by hiring them,” said de Cadenet. “This community creates work that is incredibly impactful, really powerful, smart, beautiful. Ultimately, it’s going to add to the bottom line of their business because we’re in a time where the world is very attuned to what is BS and what isn’t. This community tells stories. They have a perspective.”

Thus far, GirlGaze has worked with brands such as Levi’s, Nike, Google and Warby Parker, and has brought in more than $1 million in pay to their network of female-identifying and non-binary creatives.

One such creative is photographer Nolwen Cifuentes, who has been following GirlGaze from the start and also worked on the Dove campaign.

“This is for really cool brands that want female photographers so they can focus on a story they didn’t have before,” said Cifuentes. “I’ve heard criticism against brands from people who believe they might be queer baiting or using inclusion as a trend. But the thing about GirlGaze is that they are genuinely passionate about female photographers and the stories being told by female photographers, so the brands that come to them are going to be genuine, as well.”

Powered by WPeMatico

SaaS data protection provider Druva nabs $130M, now at a $1B+ valuation, acquiring CloudLanes

As businesses continue to move more of their computing and data to the cloud, one of the startups that has made a name for itself as a provider of cloud-based solutions to protect and manage those IT assets has raised a big round of funding to build its business.

Druva, which provides software-as-a-service-based data protection, backup and management solutions, has raised $130 million in a round of funding that CEO and founder Jaspreet Singh says takes the company “well past the $1 billion mark” in terms of its valuation.

Alongside this news, it’s making an acquisition to continue building out the storage part of its business (one of several product areas that it’s developing): it’s acquiring CloudLanes, a startup that was backed by Microsoft and others, for an undisclosed sum, in a deal that will likely be formally announced in early July.

The funding is being led by Viking Global Investors, the hedge fund and investment firm, with participation from two other new investors, Neuberger Berman and Atreides Capital, and existing investors Riverwood Capital, Tenaya Capital and Nexus Venture Partners (which were part of Druva’s last round of $80 million in 2017). The company, Singh said, is now nearly at a $100 million annual run rate. And although he would not disclose revenues, he said it’s now in a strong position to consider going public as its next step (or finally entertaining one of the many acquisition offers Singh admitted Druva gets).

“As we look at growth and the potential of what we are doing, the next obvious step is to look at public markets in the next 12 to 18 months,” he said in an interview.

The strong numbers (in terms of funding raised, valuation and performance) are a sign not just of Druva’s own business health, but of the opportunity it is tackling.

Spurred by a number of factors — the unfortunate rise of malicious hacking and data breaches, a massive wave of computing services that are creating mountains of data that can now be parsed for insights and a big move to cloud computing — the data protection industry is booming, with IDC predicting that it will collectively cost some $55 billion by 2020 to store and manage “copy data” (backups of the data), and that the data protection market will likely see revenues of $8 billion by 2020. Druva itself works with some 4,000 organizations today, with many in the mid-market in terms of size, with customers ranging across a number of verticals and including the likes of Build Group, American Cancer Society and Port of New Orleans — but as a measure of the opportunity, IDC notes that as of 2017 it had only about a 1% share (it doesn’t have more updated figures yet).

With a huge opportunity like this, it’s also an unsurprisingly crowded area in terms of competition. Singh points out that others looking to provide services in the same area include huge incumbents like CommVault and IBM, as well as newer entrants like Rubrik (itself on something of a fundraising tear in the last few years to capitalise on the same opportunity).

Singh notes that Druva stands out from these because it is the only one in the pack that started that remains an exclusively cloud-based, SaaS offering, meaning a company requires no hardware changes or appliance purchases in order to use it. While that’s an area that everyone is now moving into, his argument is that having started out here gives Druva a level of expertise and experience that cannot be matched by others — an important point when data protection is at stake.

The reality of today’s enterprise world is that there are a number of companies that are very far from being “in the cloud.” Despite the song and dance that we hear all the time about how cloud is the future, they are more often than not either relying entirely still on on-premises computing, or a hybrid solution. As Singh talks about it, this is almost irrelevant to what Druva is offering, and is in fact a segue to helping those companies come to trust and move more off premises, by giving them a strong example of how a cloud-based solution not only works, but can be less expensive and better than on-premise alternatives.

The CloudLanes acquisition fits in with this strategy, too: the company’s solution stack includes cloud storage that leverages on-premise data as a cache; ransomware protection; audit logs and more. “It will help us cover the gap between the data center and cloud more effectively,” Singh said.

This is also the belief that is propelling Druva to expanding into newer areas of business. Singh noted that business intelligence is going to be a big focus for the company, which makes sense: now that there is a lot of data being stored and managed by Druva, the next obvious move is to help parse it for insights. Security and making a wider move to secure endpoints are also areas that the company is considering, he said.

“We invest in companies based on a thorough assessment of their business models and fundamentals, the quality of their management teams, and cyclical and secular industry trends,” said Harish Belur, managing director, Riverwood Capital, in a statement. “Druva is doing something unique and special and, as a result, has grown at a phenomenal rate over recent years, all while keeping the trust and loyalty of its enterprise customers around the globe. We know this market is taking off and we continue to invest in Druva because we are sure it has the right product, executive team, and market execution to maintain leadership in the industry.”

I asked if companies like Amazon or Microsoft are friends, or frenemies, considering that they have a big part to play in cloud services. Singh said that so far, so good, since they are all more focused on infrastructure — or at least that’s where most of their strength has been up to now. Amazon, in particular, is a strong partner to the company he said, where Druva is often an early adopter of new tools of Amazon’s, and the AWS sales team regularly suggests Druva to customers for data protection and management services. Druva even happened to include a quote from the company in its news release:

“Druva is a leading Advanced Technology Partner in the AWS Partner Network,” said Mike Clayville, vice president Worldwide Commercial Sales and Business Development, Amazon Web Services, Inc., in a statement. “Druva’s solutions powered by AWS are changing the way data is managed and protected at thousands of companies globally. We’d like to congratulate Druva on its latest fund raise, and look forward to innovating with Druva to create new solutions that benefit our customers.”

Seems like that could be one to watch, as well, as both companies continue their cloud expansion, both independently and in competition with others.

Powered by WPeMatico

Harry Potter: Wizards Unite will launch on June 21st

After a year of teasing out Harry Potter: Wizards Unite, Niantic (the company behind Pokémon GO) and WB Games have at long last announced an official release date for the game: June 21st.

The news came this evening at a press event held just outside of Universal Studios’ Wizarding World (where else?). Though details were light, Niantic also confirmed plans to hold events similar to its Pokémon GO Fests for this new Potter title.

The game first rolled out in a limited “beta” phase in early May, available only in Australia and New Zealand. I asked if the June 21st date was for a worldwide release, and was told that June 21st marks the beginning of a wider country-by-country rollout, with the U.S. and U.K. getting access first.

Curious as to what Niantic’s Potter-themed follow-up to Pokémon GO is like? We went hands-on with an early build about three months ago, and you can find our impressions here.

Update: The launch trailer just dropped (embedded below) and sure enough, the video description confirms that it’ll arrive in the U.S. and U.K. first.

Powered by WPeMatico

Slack prices IPO at $26 per share

Slack’s public debut is happening Thursday on the NYSE and the company has set a reference price of $26 per share for its direct listing, according to WSJ, which would value the company at around $15.7 billion.

The company’s stock is expected to pop at open, according to the WSJ’s sources. Slack is pursuing a direct listing, eschewing the typical IPO process in favor of putting its current stock on to the NYSE without doing an additional raise or bringing on underwriter banking partners.

This isn’t a first for the technology industry, as Spotify did the same thing about this time last year, but it is still an outlier in terms of common practice for startups looking to the public markets for their liquidity event.

Slack, launched in 2013 by Flickr co-founder Stewart Butterfield, was initially built as a side project to support team communication for Butterfield’s game company Tiny Speck. In the intervening years, it has risen to become one of the most recognized enterprise communication tools currently available.

Update: Slack’s pricing and symbol, ‘WORK’ are now officially confirmed.

Powered by WPeMatico