Carmen Sandiego returns to Google Earth with a new caper

Google Earth first made use of its rich global 3D visualization as a backdrop for a Carmen Sandiego tie-in back in March, but today there’s a new adventure to explore. After solving The Crown Jewels Caper, amateur home gumshoes are now tasked with finding out the secrets of The Keys to the Kremlin Caper, which kicks off in Russia, as you might’ve guessed from the name.

Google makes use of the Netflix re-imagining of the classic globetrotting Carmen Sandiego character, which debuted in a 1985 computer game released by Broderbund Software. The Google Earth version includes pixelated graphics and gameplay inspired by the original series, with the modern look that’s used in the Netflix show by educational publisher Houghton Mifflin Harcourt.

The game can be played on Android, iOS or desktop (via Chrome) and has a lot of the same charm and appeal of the original series, with similar educational value in terms of highlighting some key cultural and geographic details along the way as you investigate the case.

Powered by WPeMatico

Salesforce Customer Data Platform begins to take shape

Salesforce announced it is making progress toward releasing a Customer Data Platform (CDP) this week at Salesforce Connections in Chicago. While the company is talking in greater detail about the platform, they are calling Customer 360, it won’t be available for pilot customers until this Fall.

The idea behind the CDP isn’t all that different from good old-fashioned CRM, but instead of using a single source of data in a single database, Salesforce’s bread-and-butter product, it draws upon a variety of sources. Martin Khin, SVP for product strategy at Salesforce Marketing Cloud says that the company found that the average customer uses 15 significant sources of data to build a much more comprehensive picture of the customer.

In the 1990s, tracking customer data in a CRM was a fairly straightforward process. You had basic information like company name, address, phone number, main contacts and perhaps a listing of what each customer purchased, but as it has become increasingly crucial to gather enough data to fully understand the customer, it takes a richer set of data.

This whole area of creating a central database like a CDP is something that Salesforce, Adobe and others have begun to discuss in the last year. When you’re dealing with multiple sources of data, it becomes much more than a customer tracking problem. It becomes a serious data integration issue as the data is coming from a variety of disparate sources.

Khin says it comes down to pulling three main areas together. The first is identity management, in the sense that you have to be able to stitch together who this person is as he or she moves across the different data sources. It’s crucial to understand that this is the same individual in each channel and interaction, regardless of the system where the interaction occurs, and even if the customer started out without identifying themselves.

Once you have that identity foundation, which is the key to all of this, you can begin to build that 360 degree picture in the CDP, and with that, you can engage with the customer across multiple channels in a more intelligent way, based on actual detailed data about the person.

If the idea is to provide increasingly customized interactions, it requires as much data as you can gather to offer customized messages across each medium. The danger here is that you’re building a complete picture of each consumer in a central database, which in itself becomes a central point of failure. If a hacker were to breach that database, the prize would be a huge treasure trove of personal customer information.

Khin says Salesforce recognizes this of course, and cites Chairman Marc Benioff’s trust mantra. If that happened, it would be a huge breach of customer trust (and of their customers) and while it’s impossible to full protect any database, Salesforce considers security a huge priority.

The other issue is privacy around this information, especially in light of GDPR customer privacy rules in Europe, and other privacy initiatives coming down the pike in other countries. Khin says Salesforce customers have permission toggles they can turn on or off, depending on the region they are in.

For now, the Salesforce CDP is taking another step towards becoming an actual product. On the plus side, it could mean more meaningful, highly targeted marketing, but on the negative side, it’s a lot of personal information sitting in one place, and that’s something that every vendor building a CDP needs to take into consideration.

Powered by WPeMatico

Palm’s tiny phone is available unlocked at $350

The first time I showed the Palm phone to the TechCrunch staff, they were excited. At the very least, it was a unique take on the category, designed to be a second phone for those moments that didn’t require a larger, bulkier device.

But reality set in pretty quickly. The device’s capabilities were severely limited by a number of factors, including size. The biggest issue, however, was a Verizon exclusive that only let users purchase the device as a second handset tied to an existing account.

Back in April, the company announced that the 3.3-inch phone could be purchased as a standalone device — albeit still through Verizon or US Mobile. Today, it’s expanding that, making the handset available unlocked, so it will work with AT&T, Verizon, T-Mobile and MetroPCS SIMs.

The phone’s available “at only” $350. That’s cheap compared to many full-sized, mid-tier handsets, but cheapness is certainly a relative concept. It still seems like a lot for a second phone, and while it’s certainly adorable, I’d strongly advise against anyone using it as a primary handset. Heck, it’s not even all that great as a standalone MP3 player.

If you’re still interested, you can pre-order it today — and Palm will throw in a $30 leather case with neck and wrist lanyards. It starts shipping in six to eight weeks.

Powered by WPeMatico

Two Sigma leads $12m series A for expert knowledge network NewtonX

Knowledge is the fuel of business. Every decision requires a full understanding of the data underlying it, and that means reaching out not only to an organization’s own staff for insight, but also to experts in the wider world. Management consultants, research agencies, and data providers make hundreds of billions of dollars per year attempting to answer key questions for business executives.

Sometimes they are successful, but many times, finding the right expert can be vexing. For the most important decisions, having multiple experts or even hundreds of experts provide their opinion might be critical to success.

Germain Chastel and Sascha Eder know the problem well. Former McKinsey consultants, they worked with some of the top technology companies in the Valley attempting to answer their questions — but oftentimes struggled to do so given the unique problems that confront those organizations. “We realized it was really hard to find experts who could teach them something and had the insights that were relevant,” Chastel explained.

In early 2017, the two left McKinsey and eventually joined forces with Anuja Ketan, and together the trio formed NewtonX. NewtonX is a “knowledge access platform” which attempts to intelligently answer questions posed to it by business clients. Clients answer a carefully calibrated series of questions to properly vet and scope a query, and then NewtonX farms it out to it network of experts for insight.

That rapid-response network has now gotten the attention of Two Sigma Ventures, the venture wing of the high-flying algorithmic-trading hedge fund, which led a $12 million Series A round into New York City-based NewtonX. That’s a follow up to a $3 million seed round co-led by Third Prime Capital and Xfund last year.

Today, the company offers two main product lines. First is what it calls Expert Calls, which are similar to the traditional expert network offering of companies like GLG. Here, a client answers a series of structured questions to determine a single expert to talk to and get feedback from.

The more interesting product to me, and the one representing 70% of the startup’s revenue right now, is Expert Surveys. With this product, the goal is to ask a business question to a wider number of experts who might provide a variety of responses. So, for instance, NewtonX could potentially answer a query such as how CIOs at large Fortune 500 companies are budgeting for cybersecurity this year.

Where NewtonX gets interesting is that it doesn’t want to just casually facilitate these calls and surveys, but instead, the startup wants to build out a true knowledge graph that can better answer questions faster with each activity on the platform. As the platform gets smarter about knowledge, the idea is that on-boarding a new client or initiating a new survey or question will be faster since the platform will already know many of the nuances of that particular field of business.

Over the two and a half years since the company’s founding, it has found wide support among businesses. It counts Microsoft, 23&Me, and Gartner as public clients, and also has a list of 20 corporates already on the platform. Chastel told me that nine of the top ten management consulting firms have also used NewtonX services, and many top research firms have also used the product.

The NewtonX team. Courtesy of NewtonX

Early revenues has allowed the company to expand early. It has 32 employees at its offices near Grand Central, and Chastel noted to me that a majority of employees and a majority of managers are women. He said that the firm’s technology to identify experts on the web is also the basis for their own recruiting efforts.

With the new funding, the company intends to grow to 100 head count locally, and also expand out is client success and expert success teams.

Powered by WPeMatico

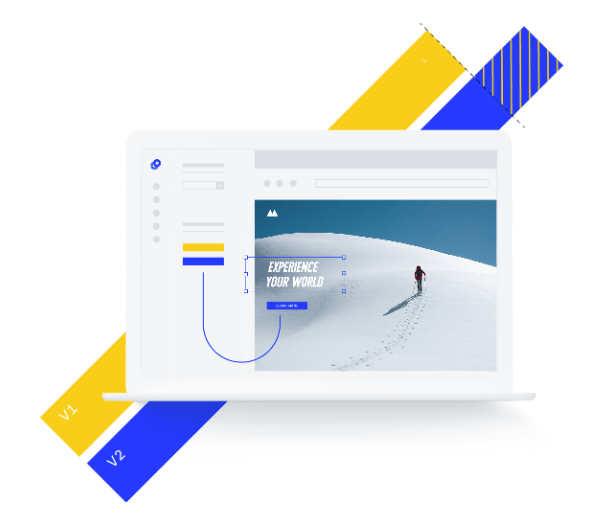

Optimizely raises $50M Series D round for its experimentation platform

Optimizely, a platform that offers tools for A/B testing and personalization on the web and in mobile apps, today announced that it has raised a total of $105 million. This includes a $50 million Series D round led by Goldman Sachs Private Capital, with the participation of Accenture Ventures, as well as a $55 million line of credit from Bridge Bank.

Goldman Sachs’s Michael Kondoleon will join Optimizely’s board of directors as a board member.

“We’re excited to reach this milestone because these investments cement our leadership position in the market,” Optimizely CEO Jay Larson told me. “We can invest more in products to put an even bigger gap between Optimizely and our competition. We can expand geographically. And we will continue to grow our team of world-class digital optimization experts. This is a big day for Optimizely and a big day for the experimentation and personalization industry.”

The company notes that about a quarter of the Fortune 100 currently use its services. The company says it now handles more than 6 billion events a day and that its customers have tripled their investments in digital experience optimization in the last two years. Current customers include the likes of Gap, Visa, IBM, StubHub, Metromile, Lending Club and Sonos.

The company notes that about a quarter of the Fortune 100 currently use its services. The company says it now handles more than 6 billion events a day and that its customers have tripled their investments in digital experience optimization in the last two years. Current customers include the likes of Gap, Visa, IBM, StubHub, Metromile, Lending Club and Sonos.

In total, Optimizely has now raised more than $200 million, excluding the line of credit. The additional $55 million from Bridge Bank is a bit unusual, but not completely out of the ordinary for companies at this stage. “Bridge Bank is proud to continue working with Optimizely, a global leader at the forefront of the digital experience optimization market,” said Mike Lederman, senior vice president and western region director of Bridge Bank’s technology banking group. “Optimizely is on a path of substantial growth and the additional capital will help them continue to build market-leading products that are used by an increasing number of top global brands.”

As is pretty much standard for companies at this stage, Optimizely will use the new funding to drive growth.

Powered by WPeMatico

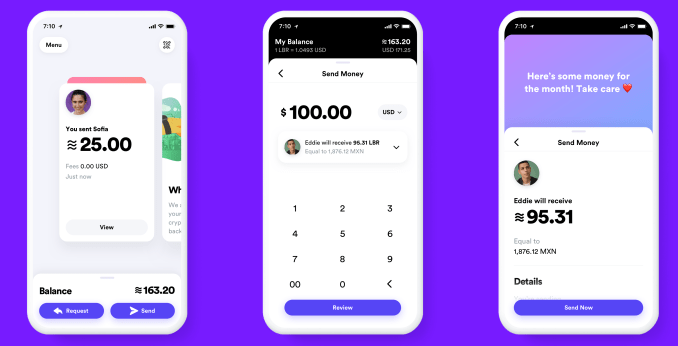

Facebook announces Libra cryptocurrency: All you need to know

Facebook has finally revealed the details of its cryptocurrency, Libra, which will let you buy things or send money to people with nearly zero fees. You’ll pseudonymously buy or cash out your Libra online or at local exchange points like grocery stores, and spend it using interoperable third-party wallet apps or Facebook’s own Calibra wallet that will be built into WhatsApp, Messenger and its own app. Today Facebook released its white paper explaining Libra and its testnet for working out the kinks of its blockchain system before a public launch in the first half of 2020.

Facebook won’t fully control Libra, but instead get just a single vote in its governance like other founding members of the Libra Association, including Visa, Uber and Andreessen Horowitz, which have invested at least $10 million each into the project’s operations. The association will promote the open-sourced Libra Blockchain and developer platform with its own Move programming language, plus sign up businesses to accept Libra for payment and even give customers discounts or rewards.

Facebook is launching a subsidiary company also called Calibra that handles its crypto dealings and protects users’ privacy by never mingling your Libra payments with your Facebook data so it can’t be used for ad targeting. Your real identity won’t be tied to your publicly visible transactions. But Facebook/Calibra and other founding members of the Libra Association will earn interest on the money users cash in that is held in reserve to keep the value of Libra stable.

Facebook’s audacious bid to create a global digital currency that promotes financial inclusion for the unbanked actually has more privacy and decentralization built in than many expected. Instead of trying to dominate Libra’s future or squeeze tons of cash out of it immediately, Facebook is instead playing the long-game by pulling payments into its online domain. Facebook’s VP of blockchain, David Marcus, explained the company’s motive and the tie-in with its core revenue source during a briefing at San Francisco’s historic Mint building. “If more commerce happens, then more small businesses will sell more on and off platform, and they’ll want to buy more ads on the platform so it will be good for our ads business.”

The risk and reward of building the new PayPal

In cryptocurrencies, Facebook saw both a threat and an opportunity. They held the promise of disrupting how things are bought and sold by eliminating transaction fees common with credit cards. That comes dangerously close to Facebook’s ad business that influences what is bought and sold. If a competitor like Google or an upstart built a popular coin and could monitor the transactions, they’d learn what people buy and could muscle in on the billions spent on Facebook marketing. Meanwhile, the 1.7 billion people who lack a bank account might choose whoever offers them a financial services alternative as their online identity provider too. That’s another thing Facebook wants to be.

Yet existing cryptocurrencies like Bitcoin and Ethereum weren’t properly engineered to scale to be a medium of exchange. Their unanchored price was susceptible to huge and unpredictable swings, making it tough for merchants to accept as payment. And cryptocurrencies miss out on much of their potential beyond speculation unless there are enough places that will take them instead of dollars, and the experience of buying and spending them is easy enough for a mainstream audience. But with Facebook’s relationship with 7 million advertisers and 90 million small businesses plus its user experience prowess, it was well-poised to tackle this juggernaut of a problem.

Now Facebook wants to make Libra the evolution of PayPal . It’s hoping Libra will become simpler to set up, more ubiquitous as a payment method, more efficient with fewer fees, more accessible to the unbanked, more flexible thanks to developers and more long-lasting through decentralization.

“Success will mean that a person working abroad has a fast and simple way to send money to family back home, and a college student can pay their rent as easily as they can buy a coffee,” Facebook writes in its Libra documentation. That would be a big improvement on today, when you’re stuck paying rent in insecure checks while exploitative remittance services charge an average of 7% to send money abroad, taking $50 billion from users annually. Libra could also power tiny microtransactions worth just a few cents that are infeasible with credit card fees attached, or replace your pre-paid transit pass.

…Or it could be globally ignored by consumers who see it as too much hassle for too little reward, or too unfamiliar and limited in use to pull them into the modern financial landscape. Facebook has built a reputation for over-engineered, underused products. It will need all the help it can get if wants to replace what’s already in our pockets.

How does Libra work?

By now you know the basics of Libra. Cash in a local currency, get Libra, spend them like dollars without big transaction fees or your real name attached, cash them out whenever you want. Feel free to stop reading and share this article if that’s all you care about. But the underlying technology, the association that governs it, the wallets you’ll use and the way payments work all have a huge amount of fascinating detail to them. Facebook has released more than 100 pages of documentation on Libra and Calibra, and we’ve pulled out the most important facts. Let’s dive in.

The Libra Association — crypto’s new oligarchy

Facebook knew people wouldn’t trust it to wholly steer the cryptocurrency they use, and it also wanted help to spur adoption. So the social network recruited the founding members of the Libra Association, a not-for-profit which oversees the development of the token, the reserve of real-world assets that gives it value and the governance rules of the blockchain. “If we were controlling it, very few people would want to jump on and make it theirs,” says Marcus.

Each founding member paid a minimum of $10 million to join and optionally become a validator node operator (more on that later), gain one vote in the Libra Association council and be entitled to a share (proportionate to their investment) of the dividends from interest earned on the Libra reserve into which users pay fiat currency to receive Libra.

The 28 soon-to-be founding members of the association and their industries, previously reported by The Block’s Frank Chaparro, include:

- Payments: Mastercard, PayPal, PayU (Naspers’ fintech arm), Stripe, Visa

- Technology and marketplaces: Booking Holdings, eBay, Facebook/Calibra, Farfetch, Lyft, Mercado Pago, Spotify AB, Uber Technologies, Inc.

- Telecommunications: Iliad, Vodafone Group

- Blockchain: Anchorage, Bison Trails, Coinbase, Inc., Xapo Holdings Limited

- Venture Capital: Andreessen Horowitz, Breakthrough Initiatives, Ribbit Capital, Thrive Capital, Union Square Ventures

- Nonprofit and multilateral organizations, and academic institutions: Creative Destruction Lab, Kiva, Mercy Corps, Women’s World Banking

Facebook says it hopes to reach 100 founding members before the official Libra launch and it’s open to anyone that meets the requirements, including direct competitors like Google or Twitter. The Libra Association is based in Geneva, Switzerland and will meet biannually. The country was chosen for its neutral status and strong support for financial innovation including blockchain technology.

Libra governance — who gets a vote

To join the association, members must have a half rack of server space, a 100Mbps or above dedicated internet connection, a full-time site reliability engineer and enterprise-grade security. Businesses must hit two of three thresholds of a $1 billion USD market value or $500 million in customer balances, reach 20 million people a year and/or be recognized as a top 100 industry leader by a group like Interbrand Global or the S&P.

Crypto-focused investors must have more than $1 billion in assets under management, while Blockchain businesses must have been in business for a year, have enterprise-grade security and privacy and custody or staking greater than $100 million in assets. And only up to one-third of founding members can by crypto-related businesses or individually invited exceptions. Facebook also accepts research organizations like universities, and nonprofits fulfilling three of four qualities, including working on financial inclusion for more than five years, multi-national reach to lots of users, a top 100 designation by Charity Navigator or something like it and/or $50 million in budget.

The Libra Association will be responsible for recruiting more founding members to act as validator nodes for the blockchain, fundraising to jump-start the ecosystem, designing incentive programs to reward early adopters and doling out social impact grants. A council with a representative from each member will help choose the association’s managing director, who will appoint an executive team and elect a board of five to 19 top representatives.

Each member, including Facebook/Calibra, will only get up to one vote or 1% of the total vote (whichever is larger) in the Libra Association council. This provides a level of decentralization that protects against Facebook or any other player hijacking Libra for its own gain. By avoiding sole ownership and dominion over Libra, Facebook could avoid extra scrutiny from regulators who are already investigating it for a sea of privacy abuses as well as potentially anti-competitive behavior. In an attempt to preempt criticism from lawmakers, the Libra Association writes, “We welcome public inquiry and accountability. We are committed to a dialogue with regulators and policymakers. We share policymakers’ interest in the ongoing stability of national currencies.”

The Libra currency — a stablecoin

A Libra is a unit of the Libra cryptocurrency that’s represented by a three wavy horizontal line unicode character ≋ like the dollar is represented by $. The value of a Libra is meant to stay largely stable, so it’s a good medium of exchange, as merchants can be confident they won’t be paid a Libra today that’s then worth less tomorrow. The Libra’s value is tied to a basket of bank deposits and short-term government securities for a slew of historically stable international currencies, including the dollar, pound, euro, Swiss franc and yen. The Libra Association maintains this basket of assets and can change the balance of its composition if necessary to offset major price fluctuations in any one foreign currency so that the value of a Libra stays consistent.

A Libra is a unit of the Libra cryptocurrency that’s represented by a three wavy horizontal line unicode character ≋ like the dollar is represented by $. The value of a Libra is meant to stay largely stable, so it’s a good medium of exchange, as merchants can be confident they won’t be paid a Libra today that’s then worth less tomorrow. The Libra’s value is tied to a basket of bank deposits and short-term government securities for a slew of historically stable international currencies, including the dollar, pound, euro, Swiss franc and yen. The Libra Association maintains this basket of assets and can change the balance of its composition if necessary to offset major price fluctuations in any one foreign currency so that the value of a Libra stays consistent.

The name Libra comes from the word for a Roman unit of weight measure. It’s trying to invoke a sense of financial freedom by playing on the French stem “Lib,” meaning free.

The Libra Association is still hammering out the exact start value for the Libra, but it’s meant to be somewhere close to the value of a dollar, euro or pound so it’s easy to conceptualize. That way, a gallon of milk in the U.S. might cost 3 to 4 Libra, similar but not exactly the same as with dollars.

The idea is that you’ll cash in some money and keep a balance of Libra that you can spend at accepting merchants and online services. You’ll be able to trade in your local currency for Libra and vice versa through certain wallet apps, including Facebook’s Calibra, third-party wallet apps and local resellers like convenience or grocery stores where people already go to top-up their mobile data plan.

The Libra Reserve — one for one

Each time someone cashes in a dollar or their respective local currency, that money goes into the Libra Reserve and an equivalent value of Libra is minted and doled out to that person. If someone cashes out from the Libra Association, the Libra they give back are destroyed/burned and they receive the equivalent value in their local currency back. That means there’s always 100% of the value of the Libra in circulation, collateralized with real-world assets in the Libra Reserve. It never runs fractional. And unliked “pegged” stable coins that are tied to a single currency like the USD, Libra maintains its own value — though that should cash out to roughly the same amount of a given currency over time.

When Libra Association members join and pay their $10 million minimum, they receive Libra Investment Tokens. Their share of the total tokens translates into the proportion of the dividend they earn off of interest on assets in the reserve. Those dividends are only paid out after Libra Association uses interest to pay for operating expenses, investments in the ecosystem, engineering research and grants to nonprofits and other organizations. This interest is part of what attracted the Libra Association’s members. If Libra becomes popular and many people carry a large balance of the currency, the reserve will grow huge and earn significant interest.

The Libra Blockchain — built for speed

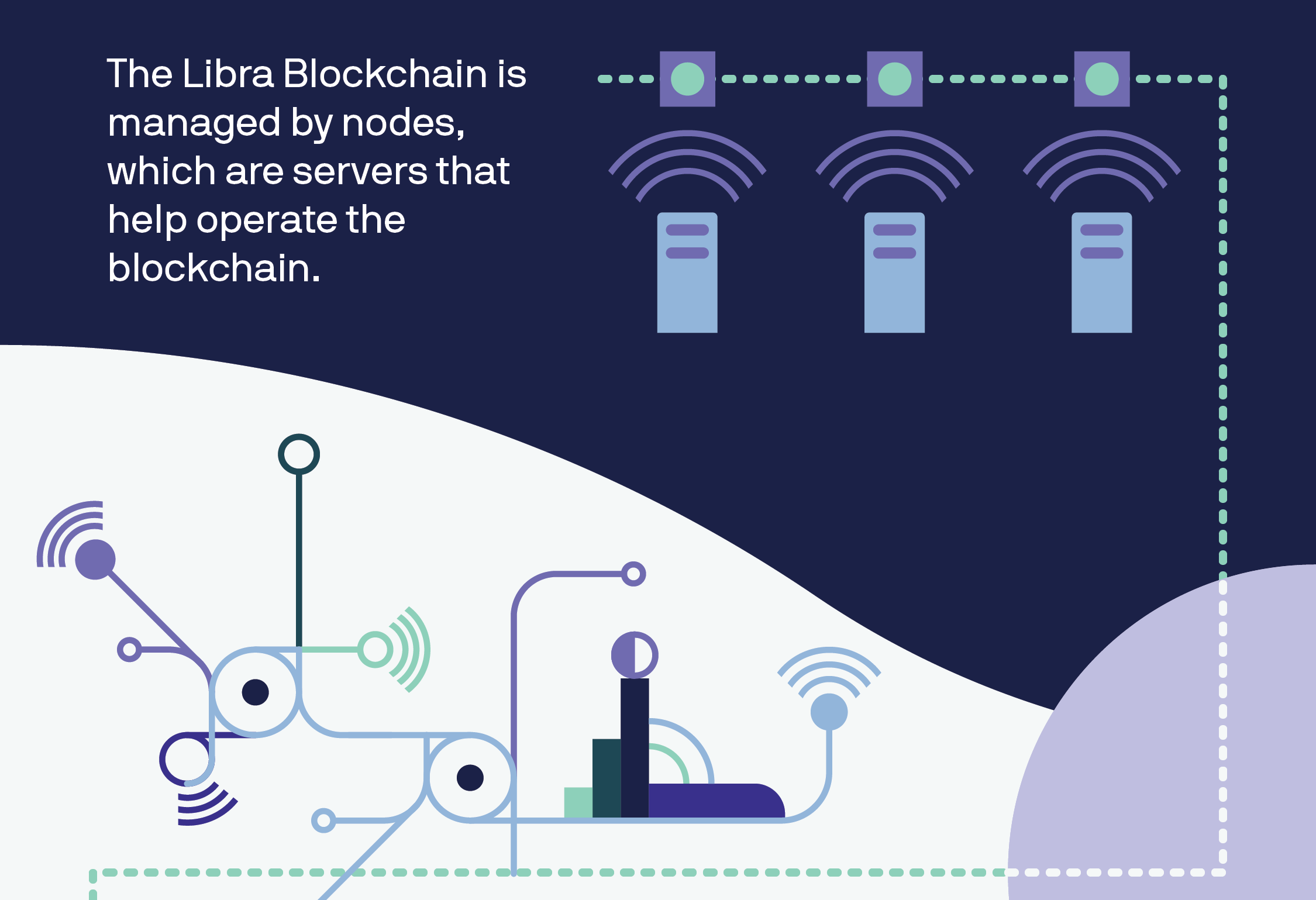

Every Libra payment is permanently written into the Libra Blockchain — a cryptographically authenticated database that acts as a public online ledger designed to handle 1,000 transactions per second. That would be much faster than Bitcoin’s 7 transactions per second or Ethereum’s 15. The blockchain is operated and constantly verified by founding members of the Libra Association, which each invested $10 million or more for a say in the cryptocurrency’s governance and the ability to operate a validator node.

When a transaction is submitted, each of the nodes runs a calculation based on the existing ledger of all transactions. Thanks to a Byzantine Fault Tolerance system, just two-thirds of the nodes must come to consensus that the transaction is legitimate for it to be executed and written to the blockchain. A structure of Merkle Trees in the code makes it simple to recognize changes made to the Libra Blockchain. With 5KB transactions, 1,000 verifications per second on commodity CPUs and up to 4 billion accounts, the Libra Blockchain should be able to operate at 1,000 transactions per second if nodes use at least 40Mbps connections and 16TB SSD hard drives.

Transactions on Libra cannot be reversed. If an attack compromises over one-third of the validator nodes causing a fork in the blockchain, the Libra Association says it will temporarily halt transactions, figure out the extent of the damage and recommend software updates to resolve the fork.

Transactions aren’t entirely free. They incur a tiny fraction of a cent fee to pay for “gas” that covers the cost of processing the transfer of funds similar to with Ethereum. This fee will be negligible to most consumers, but when they add up, the gas charges will deter bad actors from creating millions of transactions to power spam and denial-of-service attacks. “We’ve purposely tried not to innovate massively on the blockchain itself because we want it to be scalable and secure,” says Marcus of piggybacking on the best elements of existing cryptocurrencies.

Currently, the Libra Blockchain is what’s known as “permissioned,” where only entities that fulfill certain requirements are admitted to a special in-group that defines consensus and controls governance of the blockchain. The problem is this structure is more vulnerable to attacks and censorship because it’s not truly decentralized. But during Facebook’s research, it couldn’t find a reliable permissionless structure that could securely scale to the number of transactions Libra will need to handle. Adding more nodes slows things down, and no one has proven a way to avoid that without compromising security.

That’s why the Libra Association’s goal is to move to a permissionless system based on proof-of-stake that will protect against attacks by distributing control, encourage competition and lower the barrier to entry. It wants to have at least 20% of votes in the Libra Association council coming from node operators based on their total Libra holdings instead of their status as a founding member. That plan should help appease blockchain purists who won’t be satisfied until Libra is completely decentralized.

Move coding language — for moving Libra

The Libra Blockchain is open source with an Apache 2.0 license, and any developer can build apps that work with it using the Move coding language. The blockchain’s prototype launches its testnet today, so it’s effectively in developer beta mode until it officially launches in the first half of 2020. The Libra Association is working with HackerOne to launch a bug bounty system later this year that will pay security researchers for safely identifying flaws and glitches. In the meantime, the Libra Association is implementing the Libra Core using the Rust programming language because it’s designed to prevent security vulnerabilities, and the Move language isn’t fully ready yet.

Move was created to make it easier to write blockchain code that follows an author’s intent without introducing bugs. It’s called Move because its primary function is to move Libra coins from one account to another, and never let those assets be accidentally duplicated. The core transaction code looks like: LibraAccount.pay_from_sender(recipient_address, amount) procedure.

Eventually, Move developers will be able to create smart contracts for programmatic interactions with the Libra Blockchain. Until Move is ready, developers can create modules and transaction scripts for Libra using Move IR, which is high-level enough to be human-readable but low-level enough to be translatable into real Move bytecode that’s written to the blockchain.

The Libra ecosystem and the Move language will be completely open to use and build, which presents a sizable risk. Crooked developers could prey on crypto novices, claiming their app works just the same as legitimate ones, and that it’s safe because it uses Libra. But if consumers get ripped off by these scammers, the anger will surely bubble up to Facebook. Yet still, Calibra’s head of product tells me, “There are no plans for the Libra Association to take a role in actively vetting [developers],” Calibra’s head of product Kevin Weil tells me.

Even though it’s tried to distance itself sufficiently via its subsidiary Libra and the association, many people will probably always think of Libra as Facebook’s cryptocurrency and blame it for their woes.

Read our full story on the dangers of Libra’s unvetted developer platform

Libra incentives — rewarding early businesses

The Libra Association wants to encourage more developers and merchants to work with its cryptocurrency. That’s why it plans to issue incentives, possibly Libra coins, to validator node operators who can get people signed up for and using Libra. Wallets that pull users through the Know Your Customer anti-fraud and money laundering process or that keep users sufficiently active for over a year will be rewarded. For each transaction they process, merchants will also receive a percentage of the transaction back.

Businesses that earn these incentives can keep them, or pass some or all of them along to users in the form of free Libra tokens or discounts on their purchases. This could create competition between wallets to see which can pass on the most rewards to their customers, and thereby attract the most users. You could imagine eBay or Spotify giving you a discount for paying in Libra, while wallet developers might offer you free tokens if you complete 100 transactions within a year.

“One challenge for Spotify and its users around the world has been the lack of easily accessible payment systems – especially for those in financially underserved markets,” Spotify’s Chief Premium Business Officer Alex Norström writes. “In joining the Libra Association, there is an opportunity to better reach Spotify’s total addressable market, eliminate friction and enable payments in mass scale.”

This savvy incentive system should massively help ratchet up Libra’s user count without dictating how businesses balance their margins versus growth. Facebook also has another plan to grow its developer ecosystem. By offering venture capital firms like Andreessen Horowitz and Union Square Ventures a portion of the reserve interest, they’re motivating to fund startups building Libra infrastructure.

Using Libra

So how do you actually own and spend Libra? Through Libra wallets like Facebook’s own Calibra and others that will be built by third-parties, potentially including Libra Association members like PayPal. The idea is to make sending money to a friend or paying for something as easy as sending a Facebook Message. You won’t be able to make or receive any real payments until the official launch next year, though, but you can sign up for early access when it’s ready here.

None of the Libra Association members agreed to provide details on what exactly they’ll build on the blockchain, but we can take Facebook’s Calibra wallet as an example of the basic experience. Calibra will launch alongside the Libra currency on iOS and Android within Facebook Messenger, WhatsApp and a standalone app. When users first sign up, they’ll be taken through a Know Your Customer anti-fraud process where they’ll have to provide a government-issued photo ID and other verification info. They’ll need to conduct due diligence on customers and report suspicious activity to the authorities.

From there you’ll be able to cash in to Libra, pick a friend or merchant, set an amount to send them and add a description and send them Libra. You’ll also be able to request Libra, and Calibra will offer an expedited way of paying merchants by scanning your or their QR code. Eventually it wants to offer in-store payments and integrations with point-of-sale systems like Square.

The Libra Association’s e-commerce members seem particularly excited about how the token could eliminate transaction fees and speed up checkout. “We believe blockchain will benefit the luxury industry by improving IP protection, transparency in the product life cycle and — as in the case of Libra — enable global frictionless e-commerce,” says FarFetch CEO Jose Neves.

Privacy — at least from Facebook

Facebook CEO Mark Zuckerberg explained some of the philosophy behind Libra and Calibra in a post today. “It’s decentralized — meaning it’s run by many different organizations instead of just one, making the system fairer overall. It’s available to anyone with an internet connection and has low fees and costs. And it’s secured by cryptography which helps keep your money safe. This is an important part of our vision for a privacy-focused social platform — where you can interact in all the ways you’d want privately, from messaging to secure payments.”

By default, Facebook won’t import your contacts or any of your profile information, but may ask if you wish to do so. It also won’t share any of your transaction data back to Facebook, so it won’t be used to target you with ads, rank your News Feed, or otherwise earn Facebook money directly. Data will only be shared in specific instances in anonymized ways for research or adoption measurement, for hunting down fraudsters or due to a request from law enforcement. And you don’t even need a Facebook or WhatsApp account to sign up for Calibra or to use Libra.

“We realize people don’t want their social data and financial data commingled,” says Marcus, who’s now head of Calibra. “The reality is we’ll have plenty of wallets that will compete with us and many of them will not be in social, and if we want to successfully win people’s trust, we have to make sure the data will be separated.”

In case you are hacked, scammed or lose access to your account, Calibra will refund you for lost coins when possible through 24/7 chat support because it’s a custodial wallet. You also won’t have to remember any long, complex crypto passwords you could forget and get locked out from your money, as Calibra manages all your keys for you. Given Calibra will likely become the default wallet for many Libra users, this extra protection and smoother user experience is essential.

For now, Calibra won’t make money. But Calibra’s head of product Kevin Weil tells me that if it reaches scale, Facebook could launch other financial tools through Calibra that it could monetize, such as investing or lending. “In time, we hope to offer additional services for people and businesses, such as paying bills with the push of a button, buying a cup of coffee with the scan of a code or riding your local public transit without needing to carry cash or a metro pass,” the Calibra team writes. That makes it start to sound a lot like China’s everything app WeChat.

A global coin

Facebook got one thing right for sure: Today’s money doesn’t work for everyone. Those of us living comfortably in developed nations likely don’t see the hardships that befall migrant workers or the unbanked abroad. Preyed on by greedy payday lenders and high-fee remittance services, targeted by muggers and left out of traditional financial services, the poor get poorer. Libra has the potential to get more money from working parents back to their families and help people retain credit even if they’re robbed of their physical possessions. That would do more to accomplish Facebook’s mission of making the world feel smaller than all the News Feed Likes combined.

If Facebook succeeds and legions of people cash in money for Libra, it and the other founding members of the Libra Association could earn big dividends on the interest. And if suddenly it becomes super quick to buy things through Facebook using Libra, businesses will boost their ad spend there. But if Libra gets hacked or proves unreliable, it could cost lots of people around the world money while souring them on cryptocurrencies. And by offering an open Libra platform, shady developers could build apps that snatch not just people’s personal info like Cambridge Analytica, but their hard-earned digital cash.

Facebook just tried to reinvent money. Next year, we’ll see if the Libra Association can pull it off. It took me 4,000 words to explain Libra, but at least now you can make up your own mind about whether to be scared of Facebook crypto.

Powered by WPeMatico

The rise of the gig economy helps London-based insurtech Zego to raise $42M

A couple of years ago, London-based startup Zego realised gig-economy workers would need insurance, and went on to raise a very healthy £6 million in Series A funding, led by Balderton Capital. Its first products were pay-as-you-go scooter and car insurance for food delivery workers.

It’s now announced a $42 million raise in one of the largest funding rounds for a European insurtech startup, in a Series B investment led by pan-European investment firm Target Global, specialists in the fintech and mobility space, with other backers including TransferWise founder Taavet Hinrikus. The proceeds will be used to for Zego’s expansion across Europe and to increase the workforce from 75 to 150.

The raise takes the firm to a total of $51 million in funding, with new investors Latitude joining existing backers Balderton Capital and Tom Stafford of DST Global. The investment comes as the company claims a whopping 900% growth over the past 12 months.

Zego caters to the new mobility services, such as ride-hailing, ridesharing, car rental and scooter sharing, and offers a range of policies from minute-by-minute insurance to annual cover, providing more flexibility than traditional insurers, with pricing based on usage data from vehicles.

This means it’s become popular with scooter and car delivery drivers, plus van and taxi fleets. The firm currently insures one-third of the U.K.’s food delivery market, largely through partnerships with Deliveroo, Just Eat and Uber Eats.

Sten Saar, CEO and co-founder of Zego, said: “When we built Zego from scratch three years ago, our mission was to transform the insurance sector by creating products which truly reflected the rapidly changing world of transport… The world is becoming more urbanized and because of this, we are moving from traditional ownership of vehicles to shared ‘usership’. This means that the rigid model of insurance that has existed for hundreds of years is no longer fit for purpose.”

Ben Kaminski, partner of lead investors Target Global, said: “With the growth of new mobility services, Zego identified a major gap in the insurance market and created a unique business model to fill it, which the incumbents will find very difficult to replicate. The potential of this company is almost limitless, and I fully expect to see its U.K. success mirrored across Europe and beyond in the coming years.”

Powered by WPeMatico

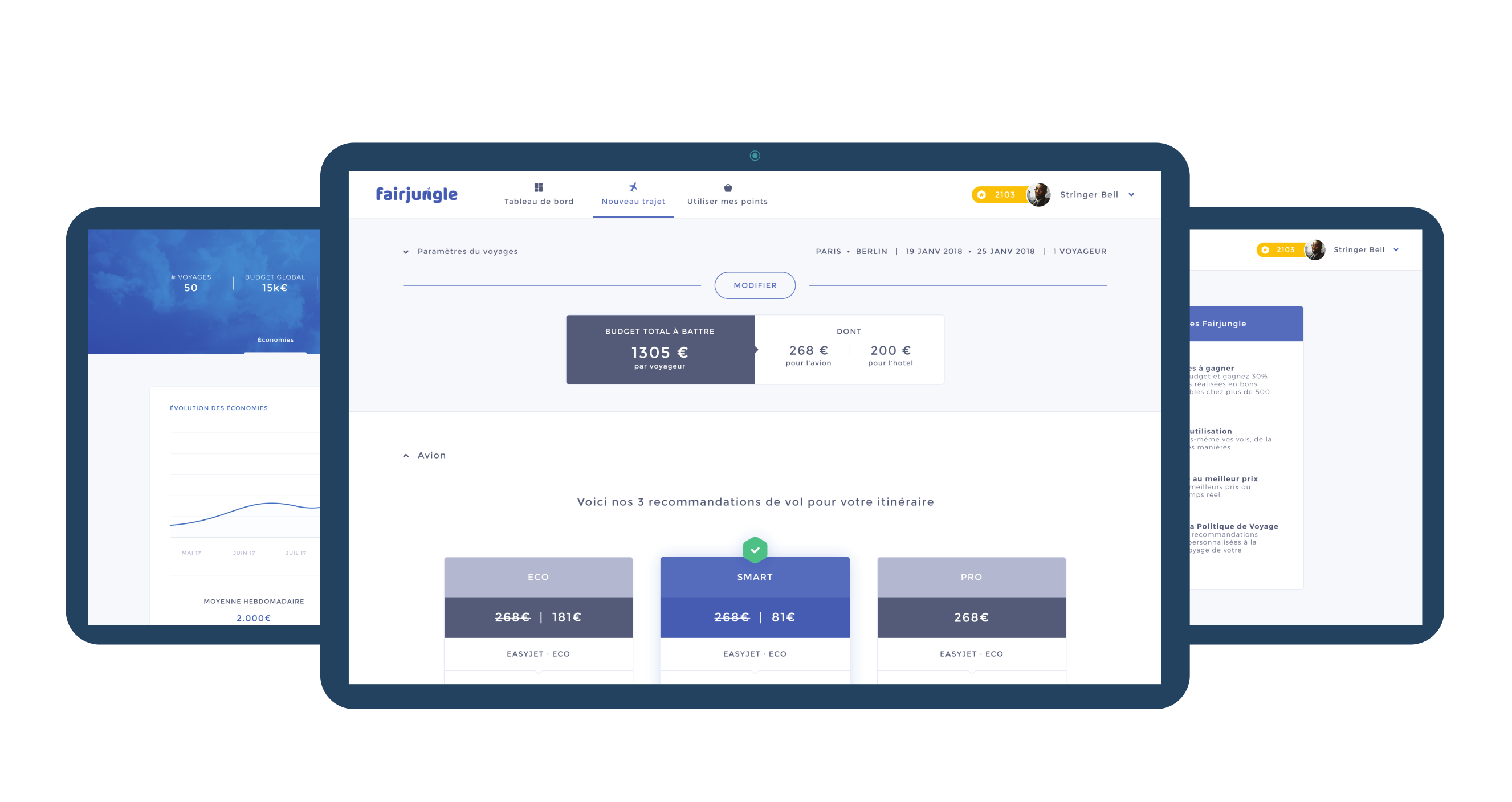

Fairjungle is a modern take on corporate travel management

French startup Fairjungle wants to make it easier to book a flight or a hotel room for corporate purposes. The company just raised a $2 million funding round (€1.8 million) from Thibaud Elzière, Eduardo Ronzano, Bertrand Mabille and Whitestones Ventures.

If you work for a big company, chances are you book corporate flights through GBT, CWT or BCD Travel. And let’s be honest, the web interface usually sucks. It’s often hard to compare flights, change dates or even get a fair price.

Fairjungle is betting on a modern user experience and a software-as-a-service business model to change this industry. The idea is to make it feel more like you’re using a flight comparison service instead of a travel agency with a website.

“The value proposition [of legacy competitors] was historically around finding the best travel options for the business traveler, which has become obsolete today when you have tools like Skyscanner and Google Flights,” co-founder and CEO Saad Berrada told me.

In order to modernize that industry, the startup is leveraging the inventory of Skyscanner, Booking.com, Amadeus, Travelfusion and Hotelbeds. This way, you can book flights on 400 airlines and reserve hotel rooms in one million hotels.

After searching for a flight or a hotel room, you can book directly from Fairjungle. This way, employees don’t have to download invoices and file expense reports on a separate platform every time they travel. Companies can set up different rules to keep costs down. For instance, a flight that is unusually expensive requires approval from a manager.

Instead of charging per transaction, Fairjungle has opted for a SaaS model with a subscription of €5 per monthly active user.

Fairjungle currently focuses on small and mid-sized companies. The company has attracted 20 clients so far, including OVH. And it expects to generate $3.4 million (€3 million) in gross bookings by the end of the year.

Powered by WPeMatico

Sprint is the latest telecom to offer a tracking device that uses LTE

Following in the footsteps of AT&T and Verizon*, Sprint is now offering an LTE tracker. The matchbook-sized device, simply called Tracker, provides real-time location tracking on Safe + Found app.

Sprint’s new Tracker

The Tracker competes with Tile, but instead of Bluetooth, Sprint’s device uses 4G LTE, GPS and Wi-Fi location services, so it can be used to track things, people or pets that might travel a significant distance away, compared to a range of 100 ft to 300 ft for Tile (depending on the version). The Tracker is manufactured by Coolpad and users need to pay $2.50 per month for 24 months to cover the cost of the device, plus an additional $5 per month to connect it.

AT&T and Verizon both launched LTE trackers over the past year and Apple is also rumored to be working on a tracking device that connects to iPhones, based on an asset package for pairing devices by proximity spotted in the first beta of iOS 13 by 9to5Mac.

*Disclosure: TechCrunch is part of Verizon Media, a subsidiary of Verizon Communications.

Powered by WPeMatico

More tickets available to the 14th Annual TechCrunch Summer Party

Get ready for summer in the city, TechCrunch -style. We just released a fresh batch of tickets to the 14th Annual TechCrunch Summer Party. Available on a first-come, first-served basis, tickets to our popular event sell out quickly, and they’ll be gone before you know it. Don’t wait — buy your ticket today.

Join us for TechCrunch’s fabulous summer fete at Park Chalet — San Francisco’s coastal beer garden — where you can enjoy ocean views, refreshing drinks and delicious appetizers. It’s a wonderful way to relax and celebrate the entrepreneurial spirit with more than 1,000 members of the startup community.

It’s also a wonderful way to meet your next investor, co-founder or — who knows? You’ll find startup magic in between the drinks, the games, the food and the fun. Opportunity happens at TechCrunch parties.

Check out the party particulars:

- When: July 25 from 5:30 p.m. – 9:00 p.m.

- Where: Park Chalet in San Francisco

- How much: $95

Come and join the summer fun. Connect with community and opportunity. As always, you’ll have a chance to win great door prizes — like TechCrunch swag, Amazon Echos and tickets to Disrupt San Francisco 2019.

Tickets sell out quickly, so don’t wait. Buy your 14th Annual Summer Party ticket today.

Did you try to buy a ticket and come up empty? We release tickets to the Summer Party on a rolling basis. Sign up here, and we’ll let you know when the next batch goes on sale.

Is your company interested in sponsoring or exhibiting at the TechCrunch 14th Annual Summer Party? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico