Climate justice and environmental ethics in tech, with Amazon engineer Rajit Iftikhar

Nearly 8,000 Amazon employees, many in prestigious engineering and design roles, have recently signed a petition calling on Jeff Bezos and the Amazon Board of Directors to dramatically shift the giant company’s approach to climate change.

By deploying a kind of corporate social disobedience such as speaking out dramatically at shareholders meetings, and by engaging in a variety of community organizing tactics, the “Amazon Employees for Climate Justice” group has quickly become a leading example of a growing trend in the tech world: tech employees banding together to take strong ethical stances in defiance of their powerful employers.

The public actions taken by these employees and groups have been covered widely by the news media. For my TechCrunch series on the ethics of technology, however, I wanted to better understand what participating actively in this campaign has been like some of the individuals involved.

How are employees in high-pressure jobs balancing their professional roles and responsibilities with being actively, publicly in defiance of their employers on a high-profile issue? How do leaders in these efforts explain the philosophy underlying their ethical stance? And how likely are their ideas to spread throughout Amazon and beyond – perhaps particularly among younger tech workers?

I recently spoke with a handful of the Amazon employees most actively involved in the Employees for Climate Justice campaign, all of whom inspired me– in similar and different ways. Below is the first of two interviews I’ll publish here. This one is with Rajit Iftikhar, a young software engineer from New York who moved to Seattle to work for Amazon after earning his Bachelor’s of Engineering in Computer Science from Cornell in 2016.

Rajit Iftikhar

Rajit struck me as a humble and precociously wise young man who could be a role model — though he seems to have little interest in singling himself out that way — for thousands of other software engineers and technologists at Amazon and beyond.

Greg Epstein: Your personal story has been key to your organizing with Amazon Employees for Climate Justice. Can you start by saying a bit about why?

Rajit Iftikhar: A lot of why I care about climate justice is informed by me having parents from another country that is going to be very adversely affected by [climate change]. Countries like Bangladesh are going to suffer some of the worst consequences from climate change, because of where the country’s located, and the fact that it doesn’t have the resources to adapt.

Bangladesh is already feeling the effects of climate crisis; it is much harder for people to live in the rural areas, [people are] being forced into the cities. Then you have the cyclones that the climate crisis is going to bring, and rising sea levels and flooding.

So, my background [emphasizes, for me] how unjust our emissions are in causing all these problems for people in other countries. And even for communities of color within our country who are going to be disproportionately impacted by the emissions that largely richer people [cause].

Powered by WPeMatico

Annie Kadavy, Russ Heddleston and Charles Hudson will tell us how to raise seed money at Disrupt SF

Just about anyone can come up with a good idea. Fewer people can execute on that idea and turn it into a prototype or MVP. But there is still one final challenge for most entrepreneurs that can prove challenging.

How do you secure that initial seed capital and take your idea to the next level?

At Disrupt SF in October, Redpoint’s Annie Kadavy, DocSend’s Russ Heddleston and Precursor’s Charles Hudson will sit down together and chat it out on the Extra Crunch stage.

Kadavy, Heddleston and Hudson can offer a unique perspective on the process of early-stage fundraising.

Kadavy joined Redpoint in 2018 after a four-year stint at Charles River Ventures, where she sourced or led deals with ClassPass, Cratejoy, DoorDash, Lauren & Wolf and Patreon. She’s also spent time within firms like Bain & Company, Warby Parker and Uber Freight. She understands the importance of operational experience, and knows better than most how to take a company from point A to point B.

Heddleston, co-founder and CEO of DocSend, has a completely different perspective. DocSend is used to securely send and track documents, and one of the most prevalent documents on the platform happens to be pitch decks. Heddleston can tell us about what characteristics get (and keep) the attention of investors, as well as what turns them off.

Hudson, managing partner at Precursor Ventures, has been on both sides of the conference room table. He founded Bionic Panda Games, which was acquired by Zynga in 2010. He moved on to SoftTech VC (now Uncork Capital), where he spent eight years working on seed-stage investments in the consumer internet space. At Precursor Ventures, he’s continuing to invest in early-stage companies that are tackling problems in new markets.

These three each have their own perspective on how to get the attention of investors and how to turn a conversation into a cap table.

“How to Raise Your First Dollars” is but one of many panels that will take place on the Extra Crunch stage at Disrupt SF. The Extra Crunch stage, much like Extra Crunch on the web, is meant to serve as a resource for aspiring entrepreneurs and VCs, offering practical, step-by-step advice on how to get to where you’re going.

We’re thrilled to have Kadavy, Heddleston and Hudson join us at the show.

Disrupt SF runs October 2 – October 4 at the Moscone Center in SF. Tickets to Disrupt SF are available here.

Powered by WPeMatico

India’s payments firm MobiKwik kick-starts its international ambitions with cross-border mobile top-ups

MobiKwik, a mobile wallet app in India that has expanded to add several financial services in recent years, said today it plans to enter international markets as it approaches profitability with the local operation. The company is kick-starting its overseas ambitions with cross-border mobile top-ups support.

The 10-year-old firm said it has partnered with DT One, a Singapore-headquartered payments network, to enable international mobile recharge (topping up credit to a mobile account), rewards and airtime credit services in more than 150 nations across some 550 mobile operators. The feature is now live on the app.

The feature is aimed at Indians living overseas and immigrants in India, Upasana Taku, co-founder of MobiKwik told TechCrunch in an interview. Millions of Indians go overseas to pursue education or look for a job. Currently, there is no convenient way for them to either help — or receive help from — their families and friends in India when they need to top up their phones.

Similarly, millions of people come to India in search of a job. The new functionality from MobiKwik will allow their families and friends to top up their mobile credit as well. Taku said there is no processing fee for customers, as MobiKwik is absorbing all the overhead expenses.

For MobiKwik, mobile recharge is just the entry point to assess interest from users, Taku added. “This is the first service we are launching. We will eventually add other essential services as well. Mobile recharge will offer us good data points and will help us understand different markets,” she added.

MobiKwik is also studying different regulatory frameworks in overseas markets and holding conversations with stakeholders, she added.

The announcement comes at a time when MobiKwik is inching closer to profitability, a feat unheard of for a mobile wallet app provider in India. The firm, which claims to have grown its revenue by 100% in the last two years, expects to be profitable by this year and go public by 2022. (Interestingly, MobiKwik was looking to raise a big round at $1 billion valuation two years ago — which never happened.)

In the last year, the firm has expanded to offer financial services such as loans, insurance and investment advice. MobiKwik competes with a handful of payment services in India, including Paytm, PhonePe and Google Pay that either support, or fully work on top of a government-backed payment infrastructure called UPI. In April, UPI apps were used to carry out 782 million transactions, according to official figures.

The big numbers have attracted major investors, too. With $285.6 million in funding, India emerged as Asia’s top fintech market in the quarter that ended in March this year.

Powered by WPeMatico

A diversity and inclusion playbook

You’d be hard-pressed to find a tech company that said it wished it had waited longer to implement on diversity and inclusion efforts. The examples of tech companies “doing it right” in this industry are few and far between, but that doesn’t mean it’s not worth trying. And for those that want to try, there’s a clear playbook to follow.

Where tech companies seem to go wrong is around implementing one-off initiatives such as unconscious bias training, employee resource groups or hiring a head of diversity and inclusion. Alone, these initiatives are not effective. But implementing those together, along with other initiatives, can create lasting change inside tech companies.

More than 10 years ago, Freada Kapor Klein, co-founder of Kapor Capital and the Kapor Center for Social Impact, published her groundbreaking book, “Giving Notice,” about the hidden biases people face in the workplace. In it, Kapor Klein laid out five key strategies as part of a comprehensive approach to addressing inclusion within tech companies. In order for it to be effective, companies must implement every single initiative.

This approach, which is applicable to this day, entails instituting policies practices and principles; implementing formal and informal problem-solving procedures; devising customized training based on organizational needs; ask more specific questions on employee surveys and break down data demographically; and ensure accountability from the top.

Policies, practices and principles

Powered by WPeMatico

Cleo, the London-based fintech, has quietly taken debt financing from US-based TriplePoint Capital

Cleo, the London-based “digital assistant” that wants to replace your banking apps, has quietly taken venture debt from U.S.-based TriplePoint Capital, according to a regulatory filing.

The amount remains undisclosed, though I understand from sources that the figure is somewhere in the region of mid-“single-digit” millions and will bridge the gap before a larger Series B round later this year. Cleo declined to comment on the fundraising.

However, sources tell me the need to raise debt financing is partly related to Cleo Plus, the startup’s stealthy premium offering that is currently being tested and set to launch more widely soon. The new product offers Cleo users a range of perks, including rewards and an optional £100 cash advance as an alternative to using your bank’s overdraft facility. The credit facility is, for the time bring at least, being financed from the startup’s own balance sheet, hence the need for additional capital.

The new funding also relates to Cleo’s U.S. launch, which began tentatively around a year ago. This has been more successful than was expected, seeing Cleo add 650,000 active U.S. users to date. The U.S. currently makes up more than 90% of new users now, too. Overall, the fintech claims 1.3 million users have signed up to the Cleo chatbot and app, with 350,000 active in the U.K.

Accessible via Facebook Messenger and the company’s iOS app, Cleo is an AI-powered chatbot that gives you insights into your spending across multiple accounts and credit cards, broken down by transaction, category or merchant. In addition, Cleo lets you take a number of actions based on the financial data it has gleaned. This includes choosing to put money aside for a rainy day or specific goal, sending money to your Facebook Messenger contacts, donating to charity and setting spending alerts and more.

Meanwhile, alongside TriplePoint, Cleo is backed by some of the biggest VC names in the London tech scene — including Balderton Capital, Entrepreneur First, Moonfruit co-founders Wendy Tan White and Joe White, Skype founder Niklas Zennström, Wonga founder Errol Damelin, TransferWise founder Taavet Hinrikus and LocalGlobe.

Powered by WPeMatico

Only 5 days left for super savings on passes to Disrupt SF 2019

We know you’re hard at work bringing your early-stage startup dreams to fruition, but allow us to offer this hot tip. Super-early-bird-pass pricing for Disrupt San Francisco 2019 pulls a disappearing act on June 21 at 11:59 p.m. (PT).

Buy your pass now and depending on the pass you buy you can save up to $1,800. You can even select the payment plan option during checkout and pay for your pass over time. Viva la budget!

If you’re serious about realizing your startup dreams, and we’ve never met a startupper who wasn’t, Disrupt SF is a giant incubator for opportunity and success. More than 10,000 people from around the world will converge in San Francisco on October 2-4 for three programming-packed days focused on the early-stage startup community.

Some of the tech and investment world’s top names, minds and makers will join us onstage. With a mind-blowing line-up, and more announced every week, make sure to keep an eye on the growing list of speakers.

Here’s a prime example. David Krane, the CEO and managing partner of investing powerhouse GV (Google Ventures), will join us for an in-depth conversation. His fund has invested in hundreds of tech companies, including Uber, Nest and Blue Bottle Coffee. Learn more about GV, its processes and what might be on Krane’s shopping list. You won’t want to miss this rare public appearance.

Be sure to bear witness to Startup Battlefield, TechCrunch’s epic pitch competition. Or better yet, why not apply to Startup Battlefield? It’s one heck of a launching pad, with a grand prize of $100,000. If you’re ready to show your startup to the world, don’t wait — the application deadline expires on June 25th at 11:59 p.m. (PT).

Dive into Startup Alley, the expo floor, where you’ll find hundreds of early-stage startups displaying their talent, products, platforms and services. It’s networking at its best, and connecting with the right people is easier than ever. Yes, there’s an app for that. It’s CrunchMatch, the free business connecting service. Disrupt that pesky needle-in-a-haystack scenario and easily find and connect with the people you want to meet.

Speaking of the people everyone wants to meet… TechCrunch is searching for outstanding startups to apply to the TC Top Picks program at Disrupt SF. If selected, you get a free Startup Alley Exhibition package, a VIP experience and tons of investor and media attention. You’ll also be interviewed by a TechCrunch editor live on the Showcase Stage, and we promote that interview across all TechCrunch’s social media platforms.

On top of all of the above, there’ll be a slew of workshops, Q&A Sessions, demos and the Disrupt Hackathon. There’s so much opportunity to grow, connect and create. Join us at Disrupt SF 2019. Save your hard-earned money and buy a super early-bird pass before June 21 at 11:59 p.m. (PT).

Is your company interested in sponsoring or exhibiting at Disrupt San Francisco 2019? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

Enterprise healthcare platform Collective Health raises $205M led by SoftBank

SoftBank’s Vision Fund may be facing some challenges when it comes to restocking its massive reserves, but the firm famous for cutting big checks is leading a sizeable round for Collective Health. This startup focused on enterprise employee healthcare management announced a $205 million Series E raise today, bringing its total funding to $434 million since its founding in 2013. Its last raise was a $110 million round in February, 2018.

Collective Healths’ client list includes Red Bull, Pinterest, Zendesk and more, and it counts GV, NEA, DFJ Growth and Sun Life among its financial backers. Its platform is an integrator for the various insurance and benefit providers that large employers offer to their employees, and provides access to info, as well as claims filing, eligibility checks and data sharing across vendors. The funding will also help with additional engineering hires to continue to build out the platform.

The funding will help the company add more partner providers, a process that’s key to continued growth as it seeks to expand its footprint and ensure that it can serve customers and their employees across the U.S. In addition to the Vision Fund, this round included new investors PSP Investments, DFJ Growth and G Squared, as well as new participation from existing investors.

Powered by WPeMatico

Early-bird pricing extended one week for TC Sessions: Mobility 2019

Procrastinate much? Then give thanks to Saint Expeditus, the patron saint of speedy causes, because now you have an extra week to save $100 on your pass to TC Sessions: Mobility 2019 on July 10, in San Jose, Calif.

Do not shillyshally, dillydally or otherwise drag your feet on this last-chance opportunity. Buy your ticket right now before the early-bird clock runs out at 11:59 p.m. (PT) on Friday, June 21.

TC Sessions: Mobility, a day-long intensive experience, explores the current and future states of mobility and transportation. More than 1,000 attendees — founders, technologists, thinkers, makers and investors — will explore the potential gains and the growing pains inherent with revolutionary technology and rapidly evolving industries.

Check out just some of the presentations and demos we have waiting for you. Don’t forget to check out the day’s jam-packed agenda:

- Demo with Jay Giraud: Damon Motorcycles CEO and founder Jay Giraud will bring a motorcycle onstage to demonstrate the company’s rider protection system that combines radar, camera and other sensors to track the speed, direction and velocity of up to 64 objects at a time.

- Will Venture Capital Drive the Future of Mobility? Leading early-stage investors, Michael Granoff, Ted Serbinski and Sarah Smith will debate the uncertain future of mobility tech and whether VC dollars are enough to push the industry forward.

- Building Mobility-First Cities: What does moving around the city of the future look like? We’ll talk with Avery Ash, head of autonomous mobility at INRIX and Seleta Reynolds, GM of the Los Angeles Department of Transportation to figure it out.

Things get even more interesting when you demo your early-stage startup at TC Sessions: Mobility 2019. Display your genius in front of the most targeted, influential audience you could possibly hope to find — mobility-minded founders, investors, technologists and media.

TC Sessions: Mobility 2019 takes place on July 10 in San Jose, Calif. Don’t disappoint Saint Expeditus. Act now and buy your ticket. Your chance to save $100 ends on Friday, June 21 at 11:59 p.m. (PT).

Is your company interested in sponsoring or exhibiting at TC Sessions: Mobility? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

Decentralized video infrastructure platform Livepeer raises $8M Series A

Video is the core entertainment medium of the web. Platforms like YouTube, Twitch, Netflix and more deliver millions of hours of videos to hungry consumers every day, and those deliveries will only intensify as video games move increasingly to streaming models.

Yet, delivering all of that content remains an expensive and challenging endeavor. The largest platforms employ hundreds of video-encoding specialist engineers to optimize the transcoding and delivery costs of their product, while also paying millions either for their own cloud infrastructure or to AWS or Google Cloud. Yet, few affordable options exist for startups — such as live-streaming apps like Houseparty (which was bought last week by Epic Games) — or even for large enterprises with streaming needs but without access to specialized hardware.

That’s where Livepeer comes in. The brainchild of multi-time founder duo Doug Petkanics and Eric Tang, Livepeer offers a decentralized platform for video encoding centered on the Ethereum network. Its early success has attracted the attention of media VCs, and the company announced today that it has raised an $8 million Series A venture capital round led by Northzone. Houseparty founder Ben Rubin joined the round as well, and video infrastructure behemoth Brightcove’s former CEO David Mendels also joined as an advisor to the company.

Livepeer is essentially a marketplace between encoding providers (the supply side) and app developers who need video-streaming services (the demand side). Today, developers can integrate Livepeer inside their apps by downloading the node, running the Livepeer media server and funding their account with Ethereum. So far, more than 100 events have streamed their videos using the platform, although Petkanics admits that they have been an “early-adopter, philosophically-aligned crowd.”

At this point in the life cycle of crypto and blockchain, it can be easy to be skeptical of next-generation technologies built on these platforms. But Petkanics believes there is a unique opportunity in video that connects well with this market.

In addition to the absolutely stupendous increase in video streaming across the web, there is a unique compute market for encoding: the millions of GPUs bought by crypto miners over the past few years. Those GPUs calculate the hashes required to make money in crypto, but in many cases according to Petkanics, leave idle the other processing units on those chips that actually handle video encoding. Livepeer sees an opportunity — at least early in the company’s growth cycle — to essentially bootstrap on top of that excess capacity for processing power.

Right now, Petkanics told me the company has more than 30 providers of compute power on the platform, and that the “supply side of the network is running, and it is the last thing that keeps me up at night.”

That excess compute power is driving significantly lower prices for encoding. Petkanics said that Livepeer is 10 times cheaper than incumbent streaming providers, and with additional development work in the coming years, he believes he can further improve that cost advantage. Today, he said that the platform can handle two streams for roughly 70 cents per day, compared to $3 per stream per hour of incumbents (a number that surely varies across companies with different levels of negotiation leverage).

Having compute power is one thing — getting customers to use it is another. The goal of the Series A funding, along with the company’s new Pilot Partner Program, is to begin implementing applications outside of the crypto-fans and enter the enterprise. The company is offering six months free for new participants as an inducement to try the platform.

Ultimately, Petkanics sees Livepeer creating a “token coordinating network” that incentivizes more compute power to join and match the needs of customers. Even more interestingly, the increasing need of particular video-encoding algorithms means there is an incentive for developers to add new functionality to the company’s open-source media server, creating a novel way to improve open-source sustainability.

Petkanics and Tang have previously worked together with Jordan Cooper on Wildcard, a redesign of the mobile browser that had previously raised $10 million, led by General Catalyst. Before that, they worked together at Hyperpublic, which developed databases of local information with an API for developers that sold to Groupon in 2012. Livepeer has 12 employees, with half based in New York City, and half distributed.

In addition to Northzone, Digital Currency Group, Libertus, Collaborative Fund, Notation Capital, Compound, North Island and StakeZero joined the round.

Powered by WPeMatico

Huawei says US ban will cost it $30B in lost revenue

Following a string of trade restrictions from the U.S., China’s telecoms equipment and smartphone maker Huawei expects its revenues to drop $30 billion below forecast over the next two years, founder and chief executive Ren Zhengfei said Monday during a panel discussion at the company’s Shenzhen headquarters.

Huawei’s production will slow down in the next two years while revenues will hover around $100 billion this and next year, according to the executive. The firm’s overseas smartphone shipment is tipped to drop 40%, he said, confirming an earlier report from Bloomberg.

That said, Ren assured that Huawei’s output will be “rejuvenated” by the year 2021 after a period of adjustment.

Huawei’s challenges are multifaceted as the U.S. “entity list” bars it from procuring from American chip makers and using certain Android services, among a list of other restrictions. In response, the Chinese behemoth recently announced it has been preparing for years its own backup chips and an alternative smartphone operating system.

“We didn’t expect the U.S. to attack Huawei with such intense and determined effort. We are not only banned from providing targeted components but also from joining a lot of international organizations, collaborating with many universities, using anything with American components or even connecting to networks that use American parts,” said Ren at the panel.

The founder said these adverse circumstances, though greater than what he expected, would not prevent the company from making strides. “We are like a damaged plane that protected only its heart and fuel tank but not its appendages. Huawei will get tested by the adjustment period and through time. We will grow stronger as we make this step.”

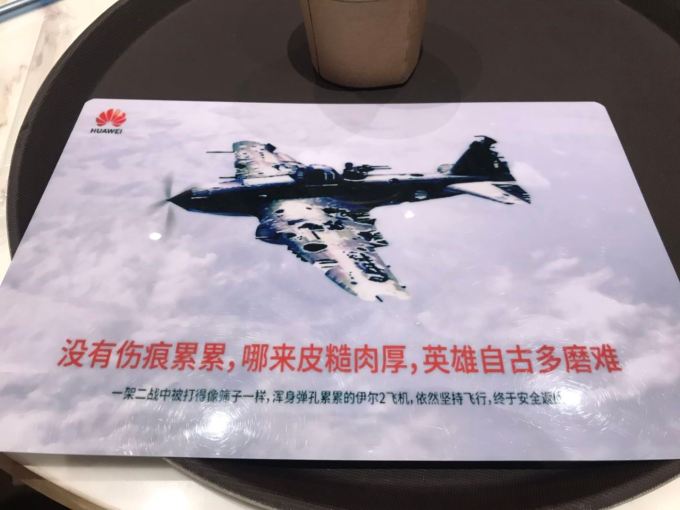

“Heroes in any times go through great challenges,” reads a placard left on a table at a Huawei campus cafe, featuring the image of a damaged World War II aircraft (Photo: TechCrunch)

That image of the beaten aircraft holding out during hard times is sticking to employees’ minds through little motivational placards distributed across the Huawei campus. TechCrunch was among a small group of journalists who spoke to Huawei staff about the current U.S.-China situation, and many of them shared Ren’s upbeat, resilient attitude.

“I’m very confident about the current situation,” said an employee who has been working at Huawei for five years and who couldn’t reveal his name as he wasn’t authorized to speak to the press. “And my confidence stems from the way our boss understands and anticipates the future.”

More collaboration

Although 74-year-old Ren had kept a quiet profile ever since founding Huawei, he has recently appeared more in front of media as his company is thrown under growing scrutiny from the west. That includes efforts like the Monday panel, which was dubbed “A Coffee With Ren” and known to be Ren’s first such fireside chat.

Speaking alongside George Gilder, an American writer and speaker on technology, and Nicholas Negroponte, co-founder of the MIT Media Lab, Ren said he believed in a more collaborative and open economy, which can result in greater mutual gains between countries.

“The west was the first to bring up the concept of economic globalization. It’s the right move. But there will be big waves rising from the process, and we must handle them with correct rather than radical measures,” said Ren.

“It’s the U.S. that will suffer from any effort to decouple,” argued Gilder. “I believe that we have a wonderful entrepreneurial energy, wonderful creativity and wonderful technology, but it’s always thrived with collaboration with other countries.”

“The U.S. is making a terrible mistake, first of all, picking on a company,” snapped Negroponte. “I come from a world where the interest isn’t so much about the trade, commerce or stock. We value knowledge and we want to build on the people before us. The only way this works is that people are open at the beginning… It’s not a competitive world in the early stages of science. [The world] benefits from collaboration.”

“This is an age for win-win games,” said one of the anonymous employees TechCrunch spoke to. He drew the example of network operator China Mobile, which recently announced to buy not just from Huawei but also from non-Chinese suppliers Nokia and Ericsson after it secured one of the first commercial licenses to deploy 5G networks in the country.

“I think the most important thing is that we focus on our work,” said Ocean Sun, who is tasked with integrating network services for Huawei clients. He argued that as employees, their job is to “be professional and provide the best solutions” to customers.

“I think the commercial war between China and the U.S. damages both,” suggested Zheng Xining, an engineer working on Huawei’s network services for Switzerland. “Donald Trump should think twice [about his decisions].”

Powered by WPeMatico