Laundry startup FlyCleaners confirms major layoffs

FlyCleaners, a New York startup offering on-demand laundry pickup and delivery, has laid off “a large number” of its employees, co-founder and CEO David Salama told TechCrunch.

This confirms a story earlier this week in Crain’s New York reporting that FlyCleaners filed a notification with the Department of Labor outlining plans to close its Long Island City plant and lay off 116 employees.

As Salama explained when we profiled him several years ago, FlyCleaners customers can use the mobile app whenever they want someone to pick up their laundry — the startup handles pickup and return, while the actual cleaning is handled by local businesses.

In an email about the layoffs, Salama told me that the company (which raised a $2 million round led by Zelkova Ventures back in 2013) created its own team for pickup and delivery because “when we started FlyCleaners six years ago, the last-mile logistics industry was simply not where we needed it to be in order to effectively service our customers.” More recently, however, the company has been testing partnerships with other logistics companies as a way to “supplement” its own team.

“Recently, it became clear to us that the cost of our internal team was just too large to bear and it was starting to hamper our ability to execute strategically and to sustain and grow our business,” Salama continued. “And so, that [led] to the painful decision to lay off a large number of employees and to proceed as a more asset-light organization.”

He added, “We don’t anticipate that this change will materially decrease the service we offer our customers. If anything, by partnering with larger-scale logistics providers, our service should be more efficient and resilient than it currently is.”

But if partners are handling pickups, delivery and the laundry, what does FlyCleaners bring to the table? When I asked what the company will focus on moving forward, Salama said, “I prefer to be discreet about it[,] but I’m comfortable saying that our plan is to leverage our technology to create the best customer experience possible.”

He also said that the startup is working with its logistics partners to find new positions for laid-off employees.

Powered by WPeMatico

Against Gravity is building a VR world that won’t stop growing

The quest to create a social auditorium in virtual reality has eaten many VC dollars over the years. While plenty of contenders have emerged, it’s likely Against Gravity’s href=”https://rec.net/”> Rec Room has been the most creative in its approach to capturing a niche market while plotting how to build a sustainable business based on users in VR headsets talking to one another.

The Seattle startup has told TechCrunch exclusively that it has bagged $24 million over two rounds of funding. The studio’s Series A was led by Sequoia and their Series B, which just recently closed, was led by Index Ventures . Against Gravity has a bevy of top investors that also participated in the rounds, including First Round Capital, Maveron, Anorak Ventures, Acequia Capital, Betaworks and DAG Ventures.

The company didn’t break down the specific details of the rounds. Against Gravity was authorized to raise up to $15.4 in its Series B at up to a $126 million post-money valuation, according to Delaware stock authorization docs we got from PitchBook. The company didn’t comment on the valuation.

Rec Room is hardly a household name compared to some major console titles, but among virtual reality users, the title has been a standby known for the diversity of gameplay available inside its walls and its wide support for hardware. Users are able to create experiences or “rooms” that can be accessed by other users. They don’t need any coding knowledge to build these spaces, as creation all happens within the game and can be done by multiple users simultaneously.

Rec Room is also about to surpass one million rooms created by users on the platform. The company says these environments include “sports games, shooters, adventure quests, nightclubs, club houses, and escape rooms.”

While companies like Linden Labs, the creator of Second Life, have focused their VR efforts on realistic but unvarying user-created environments, Against Gravity has seemingly one-upped their strategy by focusing on dynamic gameplay modes where the emphasis is on user interactions as opposed to graphic fidelity.

The Seattle startup, which was founded in 2016, now has 35 employees building out and maintaining Rec Room. The company is playable on a variety of platforms, and is about to add iOS support to its roster, an expansion that could bring a lot more users onto the VR-centric platform.

Rec Room’s content isn’t monetized too aggressively at the moment. CEO Nick Fajt thinks some of the user-generated experiences are going to offer an interesting opportunity down the road, prompting users to spend in-game tokens on more than just upgrades to the platform’s Playmobil-like avatars.

“I think a direction that we’re actually excited about is that we want to let the users creating some of this content charge tokens to play them,” Fajt tells TechCrunch. “I think that’s one that we’re kind of on the cusp of doing and we’re hoping to get that out later this year.”

For Against Gravity, timing has always been a key consideration for expansion, especially inside the slow-growing VR market, which has only recently seemed to hit a stride. I chatted with Fajt back in 2017, and he told me that the key for VR startups surviving was staying lean and biding their time until standalone mobile headsets with positional tracking and motion controllers were released. Facebook’s Oculus Quest headset, which came out less than a month ago, is perhaps the first clear device to fit that vision.

One of Facebook’s head AR/VR executives shared earlier this week that more than $5 million in Quest content had been sold in the company’s store in the first two weeks after the device’s launch. That’s a major development for an industry that hasn’t seen many smash hits, but for free-to-play game makers like Against Gravity, which has now raised $29 million to date, there’s plenty of maturation in the VR market that still needs to happen.

Powered by WPeMatico

What do subscription services and streaming mean for the future of gaming?

The future of gaming is streaming. If that wasn’t painfully obvious to you a week ago, it certainly ought to be now. Google got ahead of E3 late last week by finally shedding light on Stadia, a streaming service that promises a hardware agnostic gaming future.

It’s still very early days, of course. We got a demo of the platform right around the time of its original announcement. But it was a controlled one — about all we can hope for at the moment. There are still plenty of moving parts to contend with here, including, perhaps most consequentially, broadband caps.

But this much is certainly clear: Google’s not the only company committed to the idea of remote game streaming. Microsoft didn’t devote a lot of time to Project xCloud on stage the other day — on fact, the pass with which the company blew threw that announcement was almost news in and of itself.

It did, however, promise an October arrival for the service — beating out Stadia by a full month. The other big piece of the announcement was the ability for Xbox One owners to use their console as a streaming source for their own remote game play. Though how that works and what, precisely, the advantage remains to be seen. What is clear, however, is that Microsoft is hanging its hat on the Xbox as a point of distinction from Google’s offering.

It’s clear too, of course, that Microsoft is still invested in console hardware as a key driver of its gaming future. Just after rushing through all of that Project xCloud noise, it took the wraps off of Project Scarlett, its next-gen console. We know it will feature 8K content, some crazy fast frame rates and a new Halo title. Oh, and there’s an optical drive, too, because Microsoft’s not quite ready to give up on physical media just yet.

Powered by WPeMatico

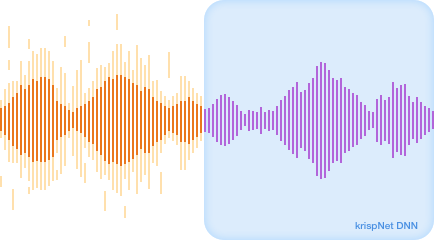

Krisp’s smart noise-cancelling gets official release and pricing

Background noise on calls could be a thing of the past if Krisp has anything to do with it. The app, now available on Windows and Macs after a long beta, uses machine learning to silence the bustle of a home, shared office or coffee shop so your voice and the voices of others comes through clearly.

I first encountered Krisp in prototype form when we were visiting UC Berkeley’s Skydeck accelerator, which ended up plugging $500,000 into the startup alongside a $1.5 million round from Sierra Ventures and Shanda Group.

Like so many apps and services these days, Krisp uses machine learning. But unlike many of them, it uses the technology in a fairly straightforward, easily understandable way.

The machine learning model the company has created is trained to recognize the voice of a person talking into a microphone. By definition pretty much everything else is just noise — so the model just sort of subtracts it from the waveform, leaving your audio clean even if there’s a middle school soccer team invading the cafe where you’re running the call from.

It can also mute sound coming the other direction — that is, the noise on your friend’s side. So if they’re in a noisy street and you’re safe at home, you can apply the smart noise reduction to them as well.

Because it changes the audio signal before it gets to any apps or services, it’s compatible with pretty much everything: Skype, Messenger, Slack, whatever. You could even use it to record podcasts when there’s a leaf blower outside. A mobile version is on the way for release later this year.

It works — I’ve tested it, as have thousands of other users during the beta. But now comes the moment of truth: will anyone pay for it?

The new, official release of the app will let you mute the noise you hear on the line — that is, the noise coming from the microphones of people you talk to — for free, forever. But clearing the noise on your own line, like the baby crying next to you, after a two-week trial period, will cost you $20 per month, or $120 per year, or as low as $5 per month for group licenses. You can collect free time by referring people to the app, but eventually you’ll probably have to shell out.

Not that there’s anything wrong with that: A straightforward pay-as-you-go business model is refreshing in an age of intrusive data collection, pushy “freemium” platforms and services that lack any way to make money whatsoever.

Powered by WPeMatico

ARM shows SoftBank does tech PE the right way

Private equity firms get a bad rap — and not without reason. In the prototypical example, a bunch of men in suits (and these folks always seem to be men for some reason) swoop in from Manhattan with Excel spreadsheets and pink slips, slashing and burning through an organization while ladening the balance sheet with debt in an algebraic alchemy of monetary extraction.

Vultures, parasites, octopuses — these are folks who almost certainly won popularity contests in high school and now seem to be shooting for most unpopular person to be compared to a crustacean in the Finance section of the WSJ (and there is some damn strong competition in those pages).

Sometimes that restructuring can save an org, and yes, many companies need a Marie Kondo armed with a business plan. But it’s a model that works best for, say, retail chains, and traditionally has been wholly incompatible with the tech industry.

Tech is a tough place for private equity buyouts, as the biggest expense for most companies is talent (i.e. R&D), and cutting R&D is usually the quickest path to cutting the valuation of the asset you just acquired. Unlike retail or manufacturing, there are just fewer cost levers to manipulate to make the numbers look better, and so PE firms have generally shied away from big tech acquisitions.

So it was interesting talking to Simon Segars this week in New York. Segars is the CEO and longtime executive at ARM Holdings, the U.K.-headquartered chip designer that powers billions of devices worldwide. Over the past two decades, ARM has had an incredible run: Last year, its designs were imprinted on 22.9 billion chips, thanks largely to the now ubiquitous adoption of smartphones across the world.

That success has been under stress though. As Brian Heater analyzed in his State of the Smartphone, smartphone growth has slowed in most markets as consumers extend their upgrade cycles and the pace of innovation has slowed. Add in the ongoing trade kerfuffle between the U.S. and China, and suddenly being the worldwide leading designer of smartphone chips isn’t as enviable as it was even just a few years ago.

As a public company facing this landscape, ARM would have faced incredible pressure from investors to meet short-term revenue targets while cutting back on R&D — the very source of future growth the company has relied on its entire history. But ARM isn’t a public company — instead, SoftBank founder and CEO Masayoshi Son bought out the company entirely in 2016 for $32 billion.

Rather than being pegged to its stock price or a quick return to a PE shop, ARM is now seemingly evaluated on growth in its intellectual property and strategy for capturing new markets. “I’m in a very fortunate position where, despite the slowing of the smartphone market … I’ve got an owner that says, invest, you know, invest like crazy to make sure you capture these ways of growth in the future, which is what we’re doing,” Segars explained to TechCrunch.

The company could have just doubled down on its existing product lines, but SoftBank’s ownership has opened the floodgates to explore other areas that could use ARM expertise. The company is now focused (if one can focus on many things) on everything from 5G and networking to IoT and autonomous driving. “We look to be in the right place at the right time with the right technology to catch the upswing into the future,“ Segars said.

That strategy requires some serious audacity though. ARM’s EBITDA was $225 million last year (21% lower than the year before) on $1.8 billion in net sales, which year-over-year grew a paltry 0.2% according to SoftBank’s latest financials. Meanwhile, operating expenses are up from the addition of hundreds of new employees and a new headquarters campus in Cambridge, outside London. R&D isn’t cheap, nor does it payoff quickly.

Yet, that is exactly how Son and SoftBank approach this take-private transaction. “During the acquisition process, Masa said to me, ‘You run the business, I only care about long-term strategy, not going to interfere, you know, you know what you’re doing.’ … [and] Masa has been absolutely true to his word on that,” Segars said. “From a day-to-day basis, SoftBank leaves us completely alone.”

And unlike the bean counters that plague most PE shops, Son isn’t interested in detailed operational data from the firm. “When I give tactical updates… he’s asleep, [but] try stopping him when he’s talking about long-term strategy,” Segars said.

And unlike the PE model of dumping a bunch of high-interest corporate debt on the balance sheet to eke out returns, SoftBank has — at least, so far — avoided that particular tactic. While there were ruminations that SoftBank was considering cashing out some dollars from ARM using loans early last year, such rumors have apparently not panned out. Segars confirmed that “we have none” when we asked about leverage, which has otherwise plagued much of the rest of SoftBank Group and its various entities.

While ARM clearly has a bullish owner who somehow uses financial wizardry to give the company the resources it needs to grow, Son doesn’t have an infinite timeline for the company. Much like classic PE firms with five to seven-year time horizons to harvest returns, Son has already spoken out loud about pushing ARM back into the public markets in roughly five years’ time.

“I’m pretty sure, the night before we go public again, I’m going to be thinking ‘Man, I wish we’d had more time, you know, five years sounds like a lot,” Segars said. But “the way I talk about it within ARM is we’re in an investment phase now … and the goal is that by the time we re-list … the revenues from these new markets are taking off and that’s flowing to the bottom line and we get back to a world of growing top line and expanding margins.”

In other words, ARM is a classic PE deal, but with the focus on actually getting the fundamentals in the business right without that financial alchemy and employee firing sadness. Maybe the plan will work, or maybe it won’t, but it is the right approach to handling the growth of a tech company.

How many other tech companies could use such an approach? How many other companies are currently languishing if only they had more focused owners with a true growth mindset to invest in the future? Silicon Valley has created trillions of dollars in market value over the past two decades, but there is even more waiting to be unlocked. And the best part is, it doesn’t even require an Excel macro to make it happen.

Powered by WPeMatico

RealityEngines.AI raises $5.25M seed round to make ML easier for enterprises

RealityEngines.AI, a research startup that wants to help enterprises make better use of AI, even when they only have incomplete data, today announced that it has raised a $5.25 million seed funding round. The round was led by former Google CEO and Chairman Eric Schmidt and Google founding board member Ram Shriram. Khosla Ventures, Paul Buchheit, Deepchand Nishar, Elad Gil, Keval Desai, Don Burnette and others also participated in this round.

The fact that the service was able to raise from this rather prominent group of investors clearly shows that its overall thesis resonates. The company, which doesn’t have a product yet, tells me that it specifically wants to help enterprises make better use of the smaller and noisier data sets they have and provide them with state-of-the-art machine learning and AI systems that they can quickly take into production. It also aims to provide its customers with systems that can explain their predictions and are free of various forms of bias, something that’s hard to do when the system is essentially a black box.

As RealityEngines CEO Bindu Reddy, who was previously the head of products for Google Apps, told me, the company plans to use the funding to build out its research and development team. The company, after all, is tackling some of the most fundamental and hardest problems in machine learning right now — and that costs money. Some, like working with smaller data sets, already have some available solutions like generative adversarial networks that can augment existing data sets and that RealityEngines expects to innovate on.

Reddy is also betting on reinforcement learning as one of the core machine learning techniques for the platform.

Once it has its product in place, the plan is to make it available as a pay-as-you-go managed service that will make machine learning more accessible to large enterprise, but also to small and medium businesses, which also increasingly need access to these tools to remain competitive.

Powered by WPeMatico

Helium launches $51M-funded ‘LongFi’ IoT alternative to cellular

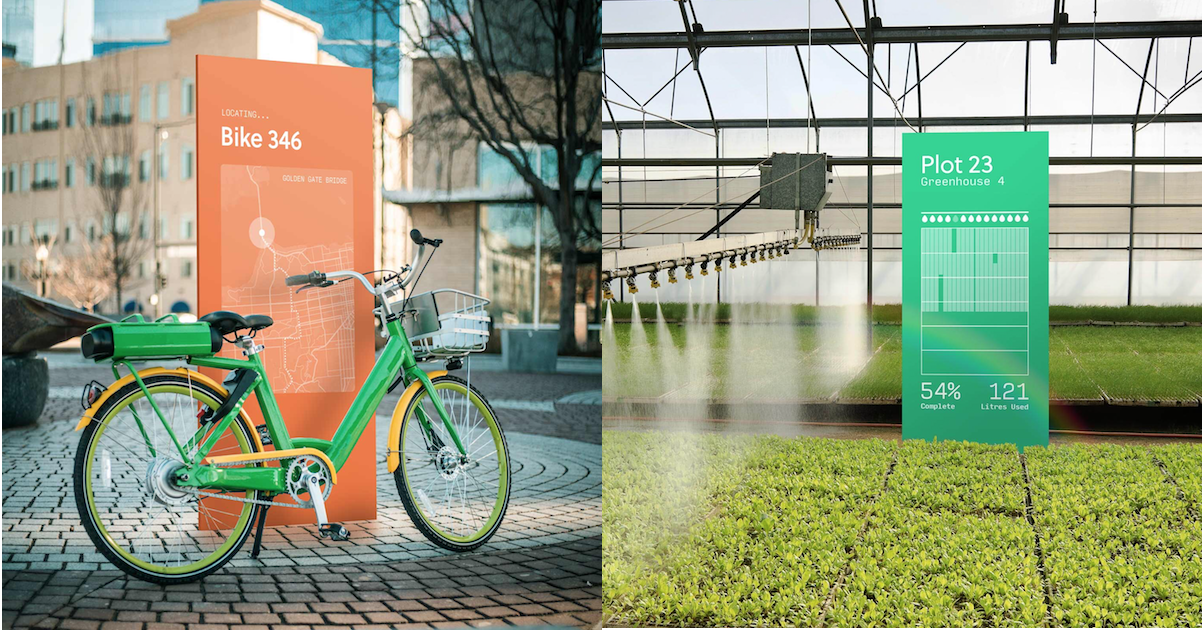

With 200X the range of Wi-Fi at 1/1000th of the cost of a cellular modem, Helium’s “LongFi” wireless network debuts today. Its transmitters can help track stolen scooters, find missing dogs via IoT collars and collect data from infrastructure sensors. The catch is that Helium’s tiny, extremely low-power, low-data transmission chips rely on connecting to P2P Helium Hotspots people can now buy for $495. Operating those hotspots earns owners a cryptocurrency token Helium promises will be valuable in the future…

The potential of a new wireless standard has allowed Helium to raise $51 million over the past few years from GV, Khosla Ventures and Marc Benioff, including a new $15 million Series C round co-led by Union Square Ventures and Multicoin Capital. That’s in part because one of Helium’s co-founders is Napster inventor Shawn Fanning. Investors are betting that he can change the tech world again, this time with a wireless protocol that like Wi-Fi and Bluetooth before it could unlock unique business opportunities.

Helium already has some big partners lined up, including Lime, which will test it for tracking its lost and stolen scooters and bikes when they’re brought indoors, obscuring other connectivity, or their battery is pulled, out deactivating GPS. “It’s an ultra low-cost version of a LoJack” Helium CEO Amir Haleem says.

InvisiLeash will partner with it to build more trackable pet collars. Agulus will pull data from irrigation valves and pumps for its agriculture tech business. Nestle will track when it’s time to refill water in its ReadyRefresh coolers at offices, and Stay Alfred will use it to track occupancy status and air quality in buildings. Haleem also imagines the tech being useful for tracking wildfires or radiation.

Haleem met Fanning playing video games in the 2000s. They teamed up with Fanning and Sproutling baby monitor (sold to Mattel) founder Chris Bruce in 2013 to start work on Helium. They foresaw a version of Tile’s trackers that could function anywhere while replacing expensive cell connections for devices that don’t need high bandwith. Helium’s 5 kilobit per second connections will compete with SigFox, another lower-power IoT protocol, though Haleem claims its more centralized infrastructure costs are prohibitive. It’s also facing off against Nodle, which piggybacks on devices’ Bluetooth hardware. Lucky for Helium, on-demand rental bikes and scooters that are perfect for its network have reached mainstream popularity just as Helium launches six years after its start.

Helium says it already pre-sold 80% of its Helium Hotspots for its first market in Austin, Texas. People connect them to their Wi-Fi and put it in their window so the devices can pull in data from Helium’s IoT sensors over its open-source LongFi protocol. The hotspots then encrypt and send the data to the company’s cloud that clients can plug into to track and collect info from their devices. The Helium Hotspots only require as much energy as a 12-watt LED light bulb to run, but that $495 price tag is steep. The lack of a concrete return on investment could deter later adopters from buying the expensive device.

Only 150-200 hotspots are necessary to blanket a city in connectivity, Haleem tells me. But because they need to be distributed across the landscape, so a client can’t just fill their warehouse with the hotspots, and the upfront price is expensive for individuals, Helium might need to sign up some retail chains as partners for deployment. As Haleem admits, “The hard part is the education.” Making hotspot buyers understand the potential (and risks) while demonstrating the opportunities for clients will require a ton of outreach and slick marketing.

Without enough Helium Hotspots, the Helium network won’t function. That means this startup will have to simultaneously win at telecom technology, enterprise sales and cryptocurrency for the network to pan out. As if one of those wasn’t hard enough.

Powered by WPeMatico

Fortnite maker Epic acquires social video app Houseparty

What does a gaming company do after raising $1.25 billion? Acquisitions seem like a pretty good place to start. Epic Games — of Unreal Engine and the ridiculously successful Fortnite phenomenon — has just picked up Houseparty.

The social video app announced the news via blog post this morning. The deal seems like a natural fit for Epic. Social has been an integral piece of Fortnite’s success as a multiplayer battle royale title.

Founded in 2015, Houseparty is a social network that delivers video chat across a number of different platforms, including iOS, Android and macOS. Like Fortnite, the offering tends to skew younger. Specifically, the app caters toward teen users, providing a more private and safer space than other, broader platforms.

“Houseparty brings people together, creating positive social interactions in real time,” Epic CEO Tim Sweeney said in a post announcing the news. “By teaming up, we can build even more fun, shared experiences than what could be achieved alone.”

For Houseparty, the acquisition appears to mean the app will continue to operate relatively unchanged for the time being. In an FAQ, the company noted that the app is largely staying the same as of today. Things like friendships and streaks will remain untouched by the company, and Epic and Houseparty accounts will stay separate. How such integration looks going forward remains to be seen, of course.

“Joining Epic is a great step forward in achieving our mission of bringing empathy to online communication,” Houseparty co-founder and CEO Sima Sistani said of the news. “We have a common vision to make human interaction easier and more enjoyable, and always with respect for user privacy.”

With some massive investments on its side, it seems more acquisitions are likely in the cards for the gaming company. In January it purchased Serbia-based computer design startup 3Lateral.

Powered by WPeMatico

Adjust raises $227M to measure mobile ads and prevent fraud

Adjust is announcing that it has raised $227 million in new funding.

The company, founded in Berlin back in 2012, has created a variety of ad measurement and anti-fraud tools — CEO Christian Henschel said the goal is to “make marketing simpler, smarter and safer.” Adjust says it’s now being used in more than 25,000 mobile apps for customers like NBCUniversal, Zynga, Robinhood, Pinterest and Procter & Gamble.

It’s been nearly four years since the company raised its previous round of $15 million. Henschel (pictured above with his co-founder and CTO Paul Müller) told me the company was already profitable back then, and it’s continued to be profitable while growing revenue by an average of 80 percent every year. So it raised more money (a lot more), he said, “because we saw the opportunity … to grow our business even further.”

Henschel pointed to three broad areas where Adjust is planning to invest and grow. First, there’s combating fraud, where he said the company was “very early,” first launching its mobile fraud prevention suite in 2016. It expanded its offerings earlier this year with the acquisition of Unbotify.

Second, he said Adjust will continue to invest in automation and aggregation — an area where it made another recent acquisition, namely the data aggregation company Acquired.io.

“We’re giving our customers the ability to get rid of the repetitive and boring tasks and really focus them back on thigns that human beings are very good at — that is creativity,” Henschel said.

Lastly, the company (which already has 350 employees in 15 offices worldwide) will continue to invest in customer service and geographic expansion, particularly in Asia.

Speaking of acquisitions, Adjust says it’s also partnered with Japanese marketing agency Adways and acquired Adways’ attribution tool PartyTrack. So naturally, you might assume that this new capital means even more deals are in the works, but Henschel said, “Acquisitions are always tough — it’s hard to find the right companies, and even harder to integrate them.”

In other words, he’s open to acquiring more companies, but he said, “We don’t have any plans right now.”

This new round brings Adjust’s total funding to $250 million. It was led by Eurazeo Growth, Highland Europe, Morgan Stanley Alternative Investment Partners and Sofina.

“Adjust reached profitability just three years after its creation, and has seen extraordinary growth since then,” said Eurazeo Growth’s Yann du Rusquec in a statement. “The company is ideally positioned to further expand its product and footprint throughout 2019 and beyond, cementing its position as one of the most successful global tech champions to come out of Europe.”

Powered by WPeMatico

Nintendo reimagines a Zelda classic with Link’s Awakening for the Switch

It’s going to be a while before players can get their hands on the Breath of the Wild sequel teased at the end of Nintendo’s E3 Direct earlier today. The good news, however, is that Nintendo’s got a few other Zelda-related adventures in the pipeline before that. There’s the compelling beat-based Cadence of Hyrule, due out this Thursday, and later this year, the company is releasing a remastered version of the Game Boy classic, The Legend of Zelda: Link’s Awakening.

That one’s due out in September. As is the case with a number of recent titles (see: most of Square’s presser from earlier this week), Link’s Awakening isn’t so much a new game as a revamp of an older one designed to get the most out of the latest technology.

Here that means more than most, however. Released in 1993, the original version of the game was subject to the Game Boy’s 8-bit, monochrome limitations. The title began life as a portable port of the third Zelda game, SNES’s A Link to the Past, but ultimately became a real boy under the direction of long-time Nintendo producer Shigeru Miyamoto.

The Link to the Past connection is very much present. Link’s Awakening feels cut from the same Hyrulian cloth as A Link to the Past. As someone who’s old enough to have played the original title during its first go-round, things came trickling back to me during a gameplay demo at E3. But the graphical advances are pretty substantial. The game is a far cry from the 1998 Game Boy Color reissue, The Legend of Zelda: Link’s Awakening DX.

Link’s Awakening is very much a Zelda title through and through, but the visuals are more than enough to make it feel like a fresh title. A direct line for the character design can be drawn to the GameCube’s The Wind Waker, when Link became decidedly more adorable. That’s coupled with the familiar 3/4 RPG perspective that was a staple of the franchise’s early days.

The backgrounds have been refreshed nicely, with a kind of tilt-shift style art that selectively blurs out set pieces. As someone who plays Switch almost exclusively as a handheld, it was refreshing to see it played out on the big screen.

Gameplay came back in a flash. Though a rep had to walk me through a few pieces of the first mission: finding a magic mushroom for a witch’s potion. It’s all very Macbeth. Or the Scottish video game. Nintendo did a much longer walkthrough on Treehouse this morning, all of which should prove familiar if you’ve played the original.

Nothing quite scratches the itch of a new Zelda title, but a full revamp of a Game Boy game more than a quarter century after the original comes close.

Powered by WPeMatico