FCC passes measure urging carriers to block robocalls by default

The FCC voted at its open meeting this week to adopt an anti-robocall measure, but it may or may not lead to any abatement of this maddening practice — and it might not be free, either. That said, it’s a start toward addressing a problem that’s far from simple and enormously irritating to consumers.

The last two years have seen the robocall problem grow and grow, and although there are steps you can take right now to improve things, they may not totally eliminate the issue or perhaps won’t be available on your plan or carrier.

Under fire for not acting quickly enough in the face of a nationwide epidemic of scam calls, the FCC has taken action about as fast as a federal regulator can be expected to, and there are two main parts to its plan to fight robocalls, one of which was approved today at the Commission’s open meeting.

The first item was proposed formally last month by Chairman Ajit Pai, and although it amounts to little more than nudging carriers, it could be helpful.

Carriers have the ability to apply whatever tools they have to detect and block robocalls before they even reach users’ phones. But it’s possible, if unlikely, that a user may prefer not to have that service active. And carriers have complained that they are afraid blocking calls by default may in fact be prohibited by existing FCC regulations.

The FCC has said before that this is not the case and that carriers should go ahead and opt everyone into these blocking services (one can always opt out), but carriers have balked. The rulemaking approved basically just makes it crystal clear that carriers are permitted, and indeed encouraged, to opt consumers into call-blocking schemes.

That’s good, but to be clear, Wednesday’s resolution does not require carriers to do anything, nor does it prohibit carriers from charging for such a service — as indeed Sprint, AT&T, and Verizon already do in some form or another. (TechCrunch is owned by Verizon Media, but this does not affect our coverage.)

BREAKING: The @FCC votes to authorize call blocking to help stop #robocalls. That’s good news. Now the bad news: it refuses to prevent new consumer charges and fees to block these awful calls. That’s not right. We should stop robocalls and do it for FREE.https://t.co/6bay6cnujN

— Jessica Rosenworcel (@JRosenworcel) June 6, 2019

Commissioner Starks noted in his approving statement that the FCC will be watching the implementation of this policy carefully for the possibility of abuse by carriers.

At my request, the item [i.e. his addition to the proposal] will give us critical feedback on how our tools are performing. It will now study the availability of call blocking solutions; the fees charged, if any, for these services; the effectiveness of various categories of call blocking tools; and an assessment of the number of subscribers availing themselves of available call blocking tools.

A second rule is still gestating, existing right now more or less only as a threat from the FCC should carriers fail to step up their game. The industry has put together a sort of universal caller ID system called STIR/SHAKEN (Secure Telephony Identity Revisited / Secure Handling of Asserted information using toKENs), but has been slow to roll it out. Pai said late last year that if carriers didn’t put it in place by the end of 2019, the FCC would be forced to take regulatory action.

Why the Commission didn’t simply take regulatory action in the first place is a valid question, and one some Commissioners and others have asked. Be that as it may, the threat is there and seems to have spurred carriers to action. There have been tests, but as yet no carrier has rolled out a working anti-robocall system based on STIR/SHAKEN.

Pai has said regarding these systems that “we [i.e. the FCC] do not anticipate that there would be costs passed on to the consumer,” and it does seem unlikely that your carrier will opt you into a call-blocking scheme that costs you money. But never underestimate the underhandedness and avarice of a telecommunications company. I would not be surprised if new subscribers get this added as a line item or something; watch your bills carefully.

Powered by WPeMatico

Economic development organizations: good or bad for entrepreneurial activity?

Contributor

In developing VC markets such as the Midwest, some may think that funding from the government or economic development organizations are a godsend for local entrepreneurs. Startups are often looking for all the help they can get, and a boost in funds or an attractive set of economic incentives can be perceived as the fuel they need to take the next step in their growth journey.

While this type of funding can be helpful, a startup should ensure that funding from these sources is not a double-edged sword. The biggest positive, of course, is the money, which can help startups with product development, hiring, marketing, sales and more. But there can also be certain restrictions or limitations that are not fully understood initially—these restrictions could hinder growth at an inopportune time later on.

The inevitable question, then, is should startups consider partnering with the government or various economic development groups as they look to get off the ground? Let’s take a closer look.

What Local Economic Development Organizations Have to Offer

Today, particularly in the Midwest, it’s common for state and local governments to offer startups incentives such as tax exemptions or grants in an effort to keep local businesses around and also attract companies from other regions.

So how do these incentives work? When it comes to tax credits or exemptions, local governments are sometimes willing to provide these incentives if a startup can demonstrate how paying lower taxes will benefit the wider community.

Powered by WPeMatico

Google continues to preach multi-cloud approach with Looker acquisition

When Google announced it was buying Looker yesterday morning for $2.6 billion, you couldn’t blame some of the company’s 1,600 customers if they worried a bit if Looker would continue its multi-cloud approach. But Google Cloud chief Thomas Kurian made clear the company will continue to support an open approach to its latest purchase when it joins the fold later this year.

It’s consistent with the messaging from Google Next, the company’s cloud conference in April. It was looking to portray itself as the more open cloud. It was going to be friendlier to open-source projects, running them directly on Google Cloud. It was going to provide a way to manage your workloads wherever they live, with Anthos.

Ray Wang, founder and principal analyst at Constellation Research, says that in a multi-cloud world, Looker represented one of the best choices, and that could be why Google went after it. “Looker’s strengths include its centralized data-modeling and governance, which promotes consistency and reuse. It runs on top of modern cloud databases including Google BigQuery, AWS Redshift and Snowflake,” Wang told TechCrunch. He added, “They wanted to acquire a tool that is as easy to use as Microsoft Power BI and as deep as Tableau.”

Patrick Moorhead, founder and principal analyst at Moor Insights & Strategy, also sees this deal as part of a consistent multi-cloud message from Google. “I do think it is in alignment with its latest strategy outlined at Google Next. It has talked about rich analytics tools that could pull data from disparate sources,” he said.

Kurian pushing the multi-cloud message

Google Cloud CEO Thomas Kurian, who took over from Diane Greene at the end of last year, was careful to emphasize the company’s commitment to multi-cloud and multi-database support in comments to media and analysts yesterday. “We first want to reiterate, we’re very committed to maintaining local support for other clouds, as well as to serve data from multiple databases because customers want a single analytics foundation for their organization, and they want to be able to in the analytics foundation, look at data from multiple data sources. So we’re very committed to that,” Kurian said yesterday.

From a broader customer perspective, Kurian sees Looker providing customers with a single way to access and visualize data. “One of the things that is challenging for organizations in operationalizing business intelligence, that we feel that Looker has done really well, is it gives you a single place to model your data, define your data definitions — like what’s revenue, who’s a gold customer or how many servers tickets are open — and allows you then to blend data across individual data silos, so that as an organization, you’re working off a consistent set of metrics,” Kurian explained.

In a blog post announcing the deal, Looker CEO Frank Bien sought to ease concerns that the company might move away from the multi-cloud, multi-database support. “For customers and partners, it’s important to know that today’s announcement solidifies ours as well as Google Cloud’s commitment to multi-cloud. Looker customers can expect continuing support of all cloud databases like Amazon Redshift, Azure SQL, Snowflake, Oracle, Microsoft SQL Server, Teradata and more,” Bien wrote in the post.

No antitrust concerns

Kurian also emphasized that this deal shouldn’t attract the attention of antitrust regulators, who have been sniffing around the big tech companies like Google/Alphabet, Apple and Amazon as of late. “We’re not buying any data along with this transaction. So it does not introduce any concentration risk in terms of concentrating data. Secondly, there are a large number of analytic tools in the market. So by just acquiring Looker, we’re not further concentrating the market in any sense. And lastly, all the other cloud players also have their own analytic tools. So it represents a further strengthening of our competitive position relative to the other players in the market,” he explained. Not to mention its pledge to uphold the multi-cloud and multi-database support, which should show it is not doing this strictly to benefit Google or to draw customers specifically to GCP.

Just this week, the company announced a partnership with Snowflake, the cloud data warehouse startup that has raised almost a billion dollars, to run on Google Cloud Platform. It already runs AWS and Microsoft Azure. In fact, Wang suggested that Snowflake could be next on Google’s radar as it tries to build a multi-cloud soup-to-nuts analytics offering.

Regardless, with Looker the company has a data analytics tool to complement its data processing tools, and together the two companies should provide a fairly comprehensive data solution. If they truly keep it multi-cloud, that should keep current customers happy, especially those who work with tools outside of the Google Cloud ecosystem or simply want to maintain their flexibility.

Powered by WPeMatico

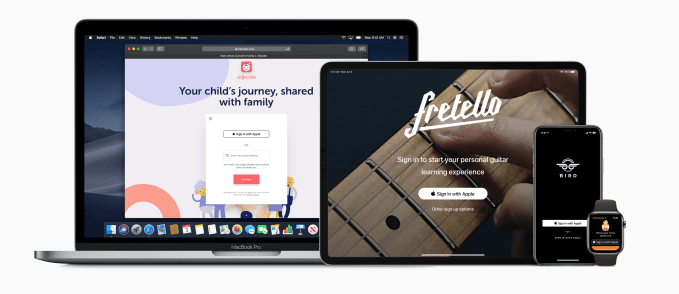

Answers to your burning questions about how ‘Sign In with Apple’ works

One of the bigger security announcements from Apple’s Worldwide Developer Conference this week is Apple’s new requirement that app developers must implement the company’s new single sign-on solution, Sign In with Apple, wherever they already offer another third-party sign-on system.

Apple’s decision to require its button in those scenarios is considered risky — especially at a time when the company is in the crosshairs of the U.S. Department of Justice over antitrust concerns. Apple’s position on the matter is that it wants to give its customers a more private choice.

From a security perspective, Apple offers a better option for both users and developers alike compared with other social login systems which, in the past, have been afflicted by massive security and privacy breaches.

Apple’s system also ships with features that benefit iOS app developers — like built-in two-factor authentication support, anti-fraud detection and the ability to offer a one-touch, frictionless means of entry into their app, among other things.

For consumers, they get the same fast sign-up and login as with other services, but with the knowledge that the apps aren’t sharing their information with an entity they don’t trust.

Consumers can also choose whether or not to share their email with the app developer.

If customers decide not to share their real email, Apple will generate a random — but real and verified — email address for the app in question to use, then will route the emails the app wants to send to that address. The user can choose to disable this app email address at any time like — like if they begin to get spam, for example.

The ability to create disposable emails is not new — you can add pluses (+) or dots (.) in your Gmail address, for example, to set up filters to delete emails from addresses that become compromised. Other email providers offer similar features.

However, this is the first time a major technology company has allowed customers to not only create these private email addresses for sign-ins to apps, but to also disable those addresses at any time if they want to stop receiving emails at them.

Despite the advantages to the system, the news left many wondering how the new Sign In with Apple button would work, in practice, at a more detailed level. We’ve tried to answer some of the more burning and common questions. There are likely many more questions that won’t be answered until the system goes live for developers and Apple updates its App Review Guidelines, which are its hard-and-fast rules for apps that decide entry into the App Store.

1) What information does the app developer receive when a user chooses Sign In with Apple?

The developer only receives the user’s name associated with their Apple ID, the user’s verified email address — or the random email address that routes email to their inbox, while protecting their privacy — and a unique stable identifier that allows them to set up the user’s account in their system.

Unlike Facebook, which has a treasure trove of personal information to share with apps, there are no other permissions settings or dialog boxes with Apple’s sign in that will confront the user with having to choose what information the app can access. (Apple would have nothing more to share, anyway, as it doesn’t collect user data like birthday, hometown, Facebook Likes or a friend list, among other things.)

2) Do I have to sign up again with the app when I get a new iPhone or switch over to use the app on my iPad?

No. For the end user, the Sign In with Apple option is as fast as using the Facebook or Google alternative. It’s just a tap to get into the app, even when moving between Apple devices.

3) Does Sign In with Apple work on my Apple Watch? Apple TV? Mac?

Sign In with Apple works across all Apple devices — iOS/iPadOS devices (iPhone, iPad and iPod touch), Mac, Apple TV and Apple Watch.

4) But what about Android? What about web apps? I use my apps everywhere!

There’s a solution, but it’s not quite as seamless.

If a user signs up for an app on their Apple device — like, say, their iPad — then wants to use the app on a non-Apple device, like their Android phone, they’re sent over to a web view.

Here, they’ll see a Sign In with Apple login screen where they’ll enter their Apple ID and password to complete the sign in. This would also be the case for web apps that need to offer the Sign In with Apple login option.

This option is called Sign In with Apple JS as it’s JavaScript-based.

(Apple does not offer a native SDK for Android developers, and honestly, it’s not likely to do so any time soon.)

5) What happens if you tap Sign In with Apple, but you forgot you already signed up for that app with your email address?

Sign In with Apple integrates with iCloud Keychain so if you already have an account with the app, the app will alert you to this and ask if you want to log in with your existing email instead. The app will check for this by domain (e.g. Uber), not by trying to match the email address associated with your Apple ID — which could be different from the email used to sign up for the account.

6) If I let Apple make up a random email address for me, does Apple now have the ability to read my email?

No. For those who want a randomized email address, Apple offers a private email relay service. That means it’s only routing emails to your personal inbox. It’s not hosting them.

Developers must register with Apple which email domains they’ll use to contact their customers and can only register up to 10 domains and communication emails.

7) How does Sign In with Apple offer two-factor authentication?

On Apple devices, users authenticate with either Touch ID or Face ID for a second layer of protection beyond the username/password combination.

On non-Apple devices, Apple sends a six-digit code to a trusted device or phone number.

8) How does Sign In with Apple prove I’m not a bot?

App developers get access to Apple’s robust anti-fraud technology to identify which users are real and which may not be real. This is tech it has built up over the years for its own services, like iTunes.

The system uses on-device machine learning and other information to generate a signal for developers when a user is verified as being “real.” This is a simple bit that’s either set to yes or no, so to speak.

But a “no” doesn’t mean the user is a definitely a bot — they could just be a new user on a new device. However, the developer can take this signal into consideration when providing access to features in their apps or when running their own additional anti-fraud detection measures, for example.

9) When does an app have to offer Sign In with Apple?

Apple is requiring that its button is offered whenever another third-party sign-in option is offered, like Facebook’s login or Google. Note that Apple is not saying “social” login though. It’s saying “third-party,” which is more encompassing.

This requirement is what’s shocking people as it seems heavy-handed.

But Apple believes customers deserve a private choice, which is why it’s making its sign-in required when other third-party options are provided.

But developers don’t have to use Sign In with Apple. They can opt to just use their own direct login instead. (Or they can offer a direct login and Sign In with Apple, if they want.)

10) Do the apps only have to offer Sign In with Apple if they offer Google and/or Facebook login options, or does a Twitter, Instagram or Snapchat sign-in button count, too?

Apple hasn’t specified this is only for apps with Facebook or Google logins, or even “social” logins. Just any third-party sign-in system. Although Facebook and Google are obviously the biggest providers of third-party sign-in services to apps, other companies, including Twitter, Instagram and Snapchat, have been developing their own sign-in options, as well.

As third-party providers, they too would fall under this new developer requirement.

11) Does the app have to put the Sign In with Apple button on top of the other options or else get rejected from the App Store?

Apple is suggesting its button be prominent.

The company so far has only provided design guidelines to app developers. The App Store guidelines, which dictate the rules around App Store rejections, won’t be updated until this fall.

And it’s the design guidelines that say the Apple button should be on the top of a stack of other third-party sign-in buttons, as recently reported.

The design guidelines also say that the button must be the same size or larger than competitors’ buttons, and users shouldn’t have to scroll to see the Apple button.

But to be clear, these are Apple’s suggested design patterns, not requirements. The company doesn’t make its design suggestions law because it knows that developers do need a degree of flexibility when it comes to their own apps and how to provide their own users with the best experience.

12) If the app only has users signing up with their phone number or just their email, does it also have to offer the Apple button?

Not at this time, but developers can add the option if they want.

13) After you sign in using Apple, will the app still make you confirm your email address by clicking a link they send you?

Nope. Apple is verifying you, so you don’t have to do that anymore.

14) What if the app developer needs you to sign in with Google, because they’re providing some sort of app that works with Google’s services, like Google Drive or Docs, for example?

This user experience would not be great. If you signed in with Apple’s login, you’d then have to do a second authentication with Google once in the app.

It’s unclear at this time how Apple will handle these situations, as the company hasn’t offered any sort of exception list to its requirement, nor any way for app developers to request exceptions. The company didn’t give us an answer when we asked directly.

It may be one of those cases where this is handled privately with specific developers, without announcing anything publicly. Or it may not make any exceptions at all, ever. And if regulators took issue with Apple’s requirement, things could change as well. Time will tell.

15) What if I currently sign in with Facebook, but want to switch to Sign In with Apple?

Apple isn’t providing a direct way for customers to switch for themselves from Facebook or another sign-in option to Apple ID. It instead leaves migration up to developers. The company’s stance is that developers can and should always offer a way for users to stop using their social login, if they choose.

In the past, developers could offer users a way to sign in only with their email instead of the third-party login. This is helpful particularly in those cases where users are deleting their Facebook accounts, for example, or removing apps’ ability to access their Facebook information.

Once Apple ID launches, developers will be able to offer customers a way to switch from a third-party login to Sign In with Apple ID in a similar way.

Do you have more questions you wish Apple would answer? Email me at sarahp@techcrunch.com

Powered by WPeMatico

Weighing Peloton’s opportunity and risks ahead of IPO

Exercise tech company Peloton filed confidentially for IPO this week, and already the big question is whether their last private valuation at $4 billion might be too rich for the appetites of public market investors. Here’s a breakdown of the pros and cons leading up to the as-yet revealed market debut date.

Risk factors

The biggest thing to pay attention to when it comes time for Peloton to actually pull back the curtains and provide some more detailed info about its customers in its S-1. To date, all we really know is that Peloton has “more than 1 million users,” and that’s including both users of its hardware and subscribers to its software.

The mix is important – how many of these are actually generating recurring revenue (vs. one-time hardware sales) will be a key gauge. MRR is probably going to be more important to prospective investors when compared with single-purchases of Peloton’s hardware, even with its premium pricing of around $2,000 for the bike and about $4,000 for the treadmill. Peloton CEO John Foley even said last year that bike sales went up when the startup increased prices.

Hardware numbers are not entirely distinct from subscriber revenue, however: Per month pricing is actually higher with Peloton’s hardware than without, at $39 per month with either the treadmill or the bike, and $19.49 per month for just the digital subscription for iOS, Android and web on its own.

That makes sense when you consider that its classes are mostly tailored to this, and that it can create new content from its live classes which occur in person in New York, and then are recast on-demand to its users (which is a low-cost production and distribution model for content that always feels fresh to users).

Powered by WPeMatico

Why identity startup Auth0’s founder still codes: It makes him a better boss

If you ask Eugenio Pace to describe himself, “engineer” would be fairly high on the list.

“Being a CEO is pretty busy,” he told TechCrunch in a call last week. “But I’m an engineer in my heart — I am a problem solver,” he said.

Pace, an Argentinan immigrant to the U.S., founded identity management company Auth0 in 2013 after more than a decade at Microsoft. Auth0, pronounced “auth-zero,” has been described as like Stripe for payments or Twilio for messaging. App developers can add a few lines of code and it immediately gives their users access to the company’s identity management service.

That means the user can securely log in to the app without building a homebrew username and password system that’s invariably going to break. Any enterprise paying for Auth0 can also use its service to securely logon to the company’s internal network.

“Nobody cares about authentication, but everybody needs it,” he said.

Pace said Auth0 works to answer two simple questions. “Who are you, and what can you do?” he said.

“Those two questions are the same regardless of the device, the app, or whether if I’m an employee of somebody or if I am an individual using an app, or if I am using a device where there’s no human attached to it,” he said.

Whoever the users are, the app needs to know if the person using the app or service is allowed to, and what level of access or functionality they can get. “Can you transfer these funds?,” he said. “Can you approve these expense reports? Can you open the door of my house?” he explained.

Pace left Microsoft in 2012 and founded Auth0 during the emergence of Azure, which transformed Microsoft from a software giant into a cloud company. It was at Microsoft where he found identity management was one of the biggest headaches for developers moving their apps to the cloud. He wrote book after book, and edition after edition. “I felt like I could keep writing books about the problem — or I can just solve the problem,” he said.

So he did.

Instead of teaching developers how to become experts in identity management, he wanted to give them the tools to employ a sign-on solution without ever having to read a book.

Powered by WPeMatico

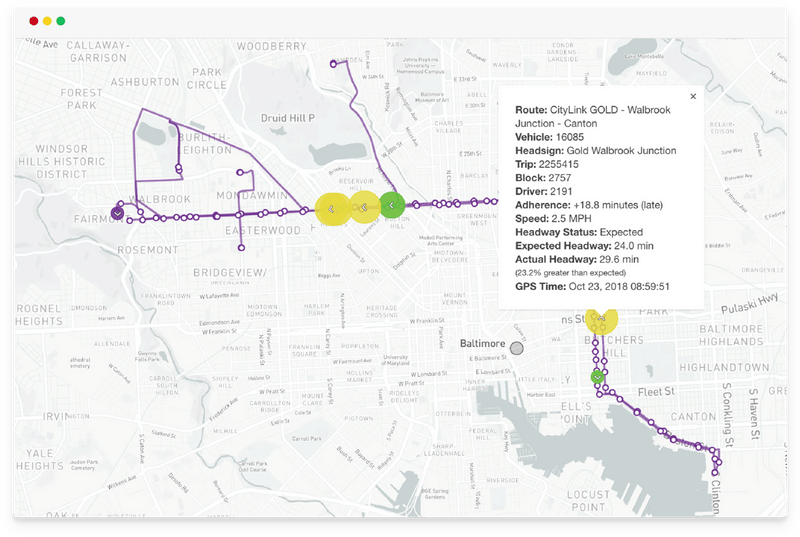

Swiftly raises $10 million Series A to power real-time transit data in your city

Swiftly just raised a $10 million Series A round led by VIA ID, Aster Capital, Renewal Funds and Wind Capital to grow its software-as-a-service business for cities’ transportation agencies. lt works by helping cities manage their transit systems and identify points in the schedule or route that negatively impact service efficiency and reliability.

Swiftly also offers real-time passenger info that will “predict when the bus will arrive in a way that is much more accurate than the current system,” Swiftly co-founder and CEO Jonny Simkin told TechCrunch. In fact, Simkin says Swiftly is up to 30% more accurate than current systems.

“It’s one thing to tell someone their bus is 10 minutes delayed, but if we can get to the root of the problem, it’s better for the city and stimulates the economy,” he said.

That’s where Swifty’s data platform comes in to gather insights and analyze historical data to rethink route planning and where to place stops. In one city, these insights led the customer to implement processes to change lights to green when a bus is running behind schedule.

Swiftly currently works with more than 50 cities and 2,500 transit professionals throughout the country. That comes out to powering more than 1.2 billion passenger trips per year. If you’ve never heard of Swiftly, you’re not alone. And that’s by design.

Swiftly is meant to be behind-the-scenes software that enables local transportation agencies to better manage their fleets and offerings to their respective riders. Swiftly’s customer is generally either a transit agency, a city or department of transportation.

“They buy our platform because they want to improve the passenger experience, and improve service reliability and efficiency,” Simkin said.

For the passenger, they experience Swiftly when they open Google Maps and look for transit routes or when they open a city’s specific transit service. One of Swiftly’s customers is the Santa Clara Valley Transportation Authority in San Jose, Calif. Its CIO, Gary Miskell, says Swiftly is one of the authority’s early innovation partners.

“With Swiftly’s innovative product development, VTA has been able to improve our real time information accuracy and provide cutting edge data to our planning and operations staff thus improving our transit system performance,” Miskell said in a statement.

With the funding, the plan is to expand to several hundred cities in the U.S. and worldwide.

“Public transit is very important to our communities and cities and it’s something that needs to be more efficient,” Simkin said. “Public transit is this extensive piece of the community and there to serve everyone, but often times those tools fall short.”

Powered by WPeMatico

Unmortgage, the ‘part own, part rental’ housing startup, loses founder and CEO

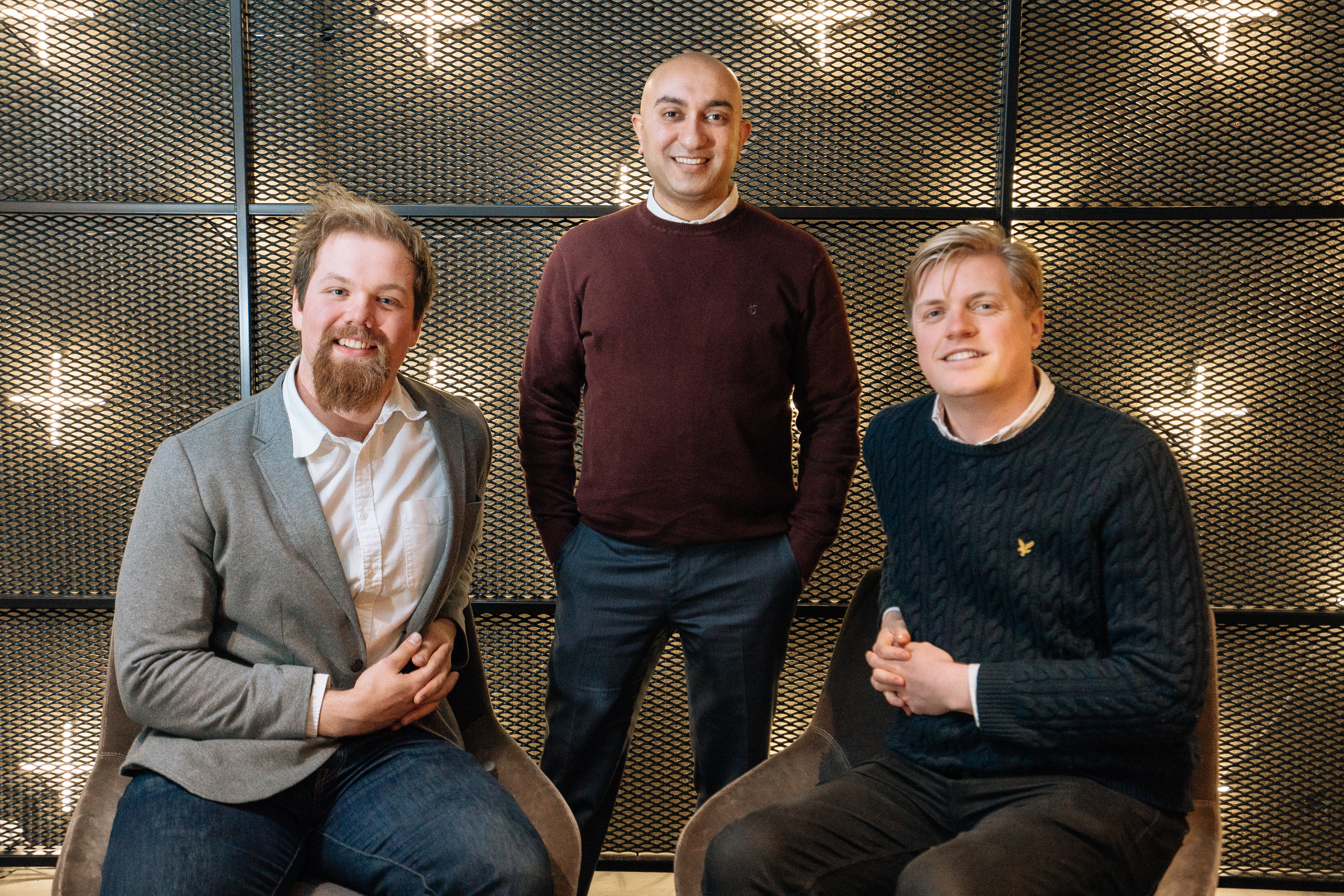

Unmortgage founder and CEO Rayhan Rafiq-Omar (centre) has departed the company

Unmortgage, the London-based startup that wants to let people buy as little as 5% of a home and rent the rest, has lost its founder and CEO, TechCrunch has learned.

According to a regulatory filing on Companies House, Unmortgage’s Rayhan Rafiq-Omar was terminated as a director on 4 May, and has been replaced on the board by Unmortgage co-founder and product lead Josef Wasinski.

However, sources tell me the board room reshuffle is the result of Rafiq-Omar leaving the startup entirely, which is bound to come as a shock to London’s fintech and property tech community. It’s not clear why he has departed, although one source tells me it wasn’t of his own volition.

Rafiq-Omar is named on Companies House as a person of “significant control” of Unmortgage, with a share ownership of more than 25% but not more than 50%, and voting rights of more than 25% but not more than 50%. He was also the driving force behind Unmortgage, and in conversations I’ve had with the departing CEO over the last few years, I always got the impression he was not only determined to help fix the housing market but also wanted to build a business for the long term.

The company appeared to be off to a decent start, too, having raised a hefty £10 million seed round to fund its operations. Backing the round was fintech venture capital firms Anthemis Exponential Ventures (which lost its own CEO last year amid accusations of inappropriate behaviour), and Augmentum Fintech plc. Separately, Unmortgage had managed to court institutional investment to fund the acquisition of property, which was at the heart of its mortgage alternative model. In other words, there is a lot of money at stake.

Declining to discuss the specific reasons for his departure, Rafiq-Omar gave TechCrunch the following statement:

Unmortgage is a genuine zero to one story – an innovation that inspired many to join me on a journey to restore hope in homeownership. I’m immensely proud to have created something from nothing over the last four years. But it’s the tough times that truly define us. And those around us.

So if there’s one thing I’d like you to quote me on, if you do write this story, it’s my deepest thanks to my family and friends during this personal and professional set-back. My parents and my wife Sofi have really stepped up to support me emotionally. And a special thanks should also go to [Rentify’s] George Spencer, James Micklethwait and my partners at Allianz Global Investors: Adrian Jones and Irshaad Ahmed. Their friendship at this time has been important to me.

I’ve reached out to both Anthemis and Augmentum Fintech and will update this post if and when I hear back.

Meanwhile, an Unmortgage spokesperson provided the following statement:

As Unmortgage enters the next stage of its growth strategy, it has strengthened and restructured its senior team to reflect the needs of the business.

Hugh Boyle has been appointed as CEO and will be leading Unmortgage day-to-day as it provides a new route to homeownership for the millions of people who are currently locked out of the market. Hugh is the Former International Division CFO and CEO of MBIA UK Insurance, subsidiary of MBIA Inc. He will be supported by Nigel Purves, COO, Conrad Holmboe, CIO and Co-founder Josef Wasinski.

Having founded the business alongside Josef and Nigel, we look forward to Ray playing a pivotal advisory role as Unmortgage continues its journey to help aspiring homeowners via our innovative gradual homeownership product.

Powered by WPeMatico

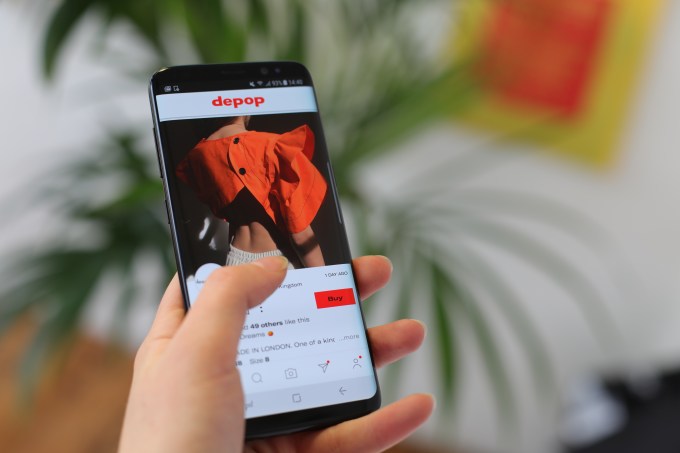

Depop, a social app targeting millennial and Gen Z shoppers, bags $62M, passes 13M users

The rising popularity of omni-channel commerce — selling to customers wherever they happen to be spending time online — has spawned an army of shopping tools and platforms that are giving legacy retail websites and marketplaces a run for their money. Now, one of the faster growing of these is announcing an impressive round of funding to stay on trend and continue building its business.

Depop, a London startup that has built an app for individuals to post and sell (and mainly resell) items to groups of followers by way of its own and third-party social feeds, has closed a Series C round of $62 million led by General Atlantic. Previous investors HV Holtzbrinck Ventures, Balderton Capital, Creandum, Octopus Ventures, TempoCap and Sebastian Siemiatkowski, founder and CEO of Swedish payments company Klarna, all also participated.

The funding will be used in a couple of areas. First, to continue building out the startup’s technology — building in more recommendation and image detection algorithms is one focus.

And second, to expand in the U.S., which CEO Maria Raga said is on its way to being Depop’s biggest market, with 5 million users currently and projections of that going to 15 million in the next three years.

That’s despite strong competition from other peer-to-peer selling platforms like Vinted and Poshmark, and social platforms that have been doubling down on commerce, like Instagram and Pinterest. On the other hand, the opportunity is big: A recent report from ThredUp, another second-hand clothes sales platform, estimated that the total resale market is expected to more than double in value to $51 billion from $24 billion in the next five years, accounting for 10% of the retail market.

Prior to this, Depop had raised just under $40 million. It’s not disclosing its valuation except to say it’s a definite up round. “I’m extremely happy,” Raga said when I asked her about it this week.

The rise of the bedroom entrepreneur

The funding comes on the heels of strong growth and strong focus for the startup.

If “social shopping,” “selling to groups of followers,” and the “use of social feeds” (or my headline…) didn’t already give it away, Depop is primarily aimed at millennial and Gen Z consumers. The company said that about 90% of its active users are under the age of 26, and in its home market of the U.K. it’s seen huge traction, with one-third of all 16 to 24-year-olds registered on Depop.

Its rise has dovetailed with some big changes that the fashion industry has undergone, said Raga. “Our mission is to redefine the fashion industry in the same way that Spotify did with music, or Airbnb did with travel accommodation,” she said.

“The fashion world hasn’t really taken notice” of how things have evolved at the consumer end, she continued, citing concerns with sustainability (and specifically the waste in the fashion industry), how trends are set today (no longer dictated by brands but by individuals) and how anything can be sold by anyone, from anywhere, not just from a store in the mall, or by way of a well-known brand name website. “You can now start a fashion business from your bedroom,” she added.

For this generation of bedroom entrepreneurs, social apps are not a choice, but simply the basis and source of all their online engagement. Depop notes that the average daily user opens the app “several times per day” both to browse things, check up on those that they follow, to message contacts and comment on items and, of course, to buy and sell. On average, Depop users collectively follow and message each other 85 million times each month.

This rapid uptake and strong usage of the service has driven it to 13 million users, revenue growth of 100% year-on-year for the past few years and gross merchandise value of more than $500 million since launch. (Depop takes a 10% cut, which would work out to total revenues of about $50 million for the period.)

When we first wrote about Depop back in 2015 (and even prior to that), the startup and app were primarily aiming to provide a way for users to quickly snap pictures of their own clothes and other used items to post them for sale, one of a wave of flea-market-inspired apps that were emerging at that time. (It also had an older age group of users, extending into the mid-thirties.)

Fast-forward a few years and Depop’s growth has been boosted by an altogether different trend: the emergence of people who go to great efforts to buy limited editions of collectable, or just currently very hot, items, and then resell them to other enthusiasts. The products might be lightly used, but more commonly never used, and might include limited-edition sneakers, expensive t-shirts released in “drops” by brands themselves or items from one-off capsule collections.

It may have started as a way of decluttering by shifting unused items of your own, but it’s become a more serious endeavor for some. Raga notes that Depop’s top sellers are known to clear $100,000 annually. “It’s a real business for them,” she said.

And Depop still sells other kinds of goods, too. These pressed-flower phone cases, for example, have seen a huge amount of traction on Twitter, as well as in the app itself in the last week:

Ordered a new phone case off this woman from depop who makes them with pressed flowers n she sent me this :’) pic.twitter.com/oBtRtQ1MJc

— megan (@__meganbenson) June 1, 2019

Alongside its own app and content shared from there to other social platforms, Depop extends the omnichannel approach with a selection of physical stores, too, to showcase selected items.

The startup has up to now taken a very light-touch approach to the many complexities that can come with running an e-commerce business — a luxury that’s come to it partly because its sellers and buyers are all individuals, mostly younger individuals and, leaning on the social aspect, the expectation that people will generally self-police and do right by each other, or risk getting publicly called out and lose business as a result.

I think that as it continues to grow, some of that informality might need to shift, or at least be complemented with more structure.

In the area of shipping, buyers generally do not seem to expect the same kind of shipping tracking or delivery professionals appearing at their doors. Sellers handle all the shipping themselves, which sometimes means that if the buyer and seller are in the same city, an in-person delivery of an item is not completely unheard of. Raga notes that in the U.S. the company has now at least introduced pre-paid envelopes to help with returns (not so in the U.K.).

Payments come by way of PayPal, with no other alternatives at the moment. Depop’s 10% cut on transactions is in addition to PayPal’s fees. But having the Klarna founder as a backer could pave the way for other payment methods coming soon.

One area where Depop is trying to get more focused is in how its activities line up with state laws and regulations.

For example, it currently already proactively looks for and takes down posts offering counterfeit or other illicit goods on the platform, but also relies on people or brands reporting these. (Part of the tech investment into image detection will be to help improve the more automated algorithms, to speed up the rate at which illicit items are removed.)

Then there is the issue of tax. If top sellers are clearing $100,000 annually, there are taxes that will need to be paid. Raga said that right now this is handed off to sellers to manage themselves. Depop does send alerts to sellers, but it’s still up to the sellers themselves to organise sales tax and other fees of that kind.

“We are very close to our top sellers,” Raga said. “We’re in contact on a daily basis and we inform of what they have to do. But if they don’t, it’s their responsibility.”

While there is a lot more development to come, the core of the product, the approach Depop is taking and its success so far have been the winning combination to bring on this investment.

“Technology continues to transform the retail landscape around the world and we are incredibly excited to be investing in Depop as it looks to capture the huge opportunity ahead of it,” said Melis Kahya, General Atlantic head of Consumer for EMEA, in a statement. “In a short space of time the team has developed a truly differentiated platform and globally relevant offering for the next generation of fashion entrepreneurs and consumers. The organic growth generated in recent years is a testament to the impact they are having and we look forward to working with the team to further accelerate the business.”

Powered by WPeMatico

Sennheiser debuts its first wireless gaming headset, the GSP 670

During Computex last week, Sennheiser gave media a sneak peek at its first wireless gaming headset, the GSP 670, slated to ship starting at the beginning of next month.

The GSP 670 retails for €349 (about $393), significantly pricier than other popular wireless gaming headsets (as well as its wired predecessor, the Sennheiser GSP 600, priced at $249.95). Sennheiser is hoping its features, as well as the company’s reputation for excellent sound quality and comfortable headsets, will convince gamers to take the plunge. (When I tried on a pair at Computex, it delivered on wearability, connection speeds and audio quality, but of course it is hard to tell how headsets will feel and sound after hours of gaming, versus a few minutes of testing.)

Despite the freedom afforded by wireless, many gamers stick with wired headsets to avoid reductions in sound quality and connection speeds or having to worry about battery levels, issues that Sennheiser addresses with the GSP 670’s features. Like other wireless headsets, the GSP 670 needs to be connected to a wireless dongle. Each one comes with a GSA 70 compact USB dongle with proprietary technology that Sennheiser developed to ensure a low-latency connection it promises transmits sounds with “near-zero delay.” The USB is compatible with PCs and the Sony PlayStation 4. The GSP 670 also has Bluetooth, so users can pair it with their smartphones and tablets, as well.

The GSP 670’s microphone is noise-cancelling and can be muted by raising the boom arm. The headset has two volume wheels to allow users to control chat audio and game audio separately. Gamers can also adjust the audio on the GSP 670 with Sennheiser’s Gaming Suite for Windows, a software tool that lets users switch between audio presets or customize sound levels, and also includes surround sound modes and an equalizer.

In terms of battery, Sennheiser claims the GSP 670’s quick-charging battery can run for two hours after a seven-minute charge. When fully charged, it says the battery can last for up to 20 hours on Bluetooth and 16 hours when connected via the GSA 70 dongle. The headset has automatic shutdown to save power.

The GSP 670 is currently available for pre-order on Sennheiser’s website and will ship beginning on July 1.

Powered by WPeMatico