Startups net more than capital with NBA players as investors

If you’re a big basketball fan like me, you’ll be glued to the TV watching the Golden State Warriors take on the Toronto Raptors in the NBA finals. (You might be surprised who I’m rooting for.)

In honor of the big games, we took a shot at breaking down investment activities of the players off the court. Last fall, we did a story highlighting some of the sport’s more prolific investors. In this piece, we’ll take a deeper dive into just what having an NBA player as a backer can do for a startup beyond the capital involved. But first, here’s a chart of some startups funded by NBA players, both former and current.

In February, we covered how digital sports media startup Overtime had raised $23 million in a Series B round of funding led by Spark Capital. Former NBA Commissioner David Stern was an early investor and advisor in the company (putting money in the company’s seed round). Golden State Warriors player Kevin Durant invested as part of the company’s Series A in early 2018 via his busy investment vehicle, Thirty Five Ventures. And then, Carmelo Anthony invested (via his Melo7 Tech II fund) earlier this year. Other NBA-related investors include Baron Davis, Andre Iguodala and Victor Oladipo, and other non-NBA backers include Andreessen Horowitz and Greycroft.

I talked to Overtime’s CEO, 27-year-old Zack Weiner, about how the involvement of so many NBA players came about. I also wondered what they brought to the table beyond their cash. But before we get there, let me explain a little more about what Overtime does.

Founded in late 2016 by Dan Porter and Weiner, the Brooklyn company has raised a total of $35.3 million. The pair founded the company after observing “how larger, legacy media companies, such as ESPN, were struggling” with attracting the younger viewer who was tuning into the TV less and less “and consuming sports in a fundamentally different way.”

So they created Overtime, which features about 25 to 30 sports-related shows across several platforms (which include YouTube, Snapchat, Instagram, Facebook, TikTok, Twitter and Twitch) aimed at millennials and the Gen Z generation. Weiner estimates the company’s programs get more than 600 million video views every month.

In terms of attracting NBA investors, Weiner told me each situation was a little different, but with one common theme: “All of them were fans of Overtime before we even met them…They saw what we were doing as the new wave of sports media and wanted to get involved. We didn’t have to have 10 meetings for them to understand what we were doing. This is the world they live and breathe.”

So how is having NBA players as investors helping the company grow? Well, for one, they can open a lot of doors, noted Weiner.

“NBA players are very powerful people and investors,” he said. “They’ve helped us make connections in music, fashion and all things tangential to sports. Some have created content with us.”

In addition, their social clout has helped with exposure. Their posting or commenting on Instagram gives the company credibility, Weiner said.

“Also just, in general, getting their perspectives and opinions,” he added. “A lot of our content is based on working with athletes, so they understand what athletes want and are interested in being a part of.”

It’s not just sports-related startups that are attracting the interest of NBA players. I also talked with Hussein Fazal, the CEO of SnapTravel, which recently closed a $21.2 million Series A that included participation from Telstra Ventures and Golden State Warriors point guard Stephen Curry.

Founded in 2016, Toronto-based SnapTravel offers online hotel booking services over SMS, Facebook Messenger, Alexa, Google Home and Slack. It’s driven more than $100 million in sales, according to Fazal, and is seeing its revenue grow about 35% quarter over quarter.

Like Weiner, Fazal told me that Curry’s being active on social media about SnapTravel helped draw positive attention and “add a lot of legitimacy” to his company.

“If you’re an end-consumer about to spend $1,000 on a hotel booking, you might be a little hesitant about trusting a newer brand like ours,” he said. “But if they go to our home page and see our investors, that holds some weight in the eyes of the public, and helps show we’re not a fly-by-night company.”

Another way Curry’s involvement has helped SnapTravel is in terms of the recruitment and retainment of employees. Curry once spent hours at the office, meeting with employees and doing a Q&A.

“It was really cool,” Fazal said. “And it helps us stand out from other startups when hiring.”

Regardless of who wins the series, it’s clear that startups with NBA investors on their team have a competitive advantage. (Still, Go Raptors!)

Powered by WPeMatico

Startups Weekly: Will the real unicorns please stand up?

Hello and welcome back to Startups Weekly, a newsletter published every Saturday that dives into the week’s noteworthy venture capital deals, funds and trends. Before I dive into this week’s topic, let’s catch up a bit. Last week, I wrote about the sudden uptick in beverage startup rounds. Before that, I noted an alternative to venture capital fundraising called revenue-based financing. Remember, you can send me tips, suggestions and feedback to kate.clark@techcrunch.com or on Twitter @KateClarkTweets.

Here’s what I’ve been thinking about this week: Unicorn scarcity, or lack thereof. I’ve written about this concept before, as has my Equity co-host, Crunchbase News editor-in-chief Alex Wilhelm. I apologize if the two of us are broken records, but I think we’re equally perplexed by the pace at which companies are garnering $1 billion valuations.

Here’s the latest data, according to Crunchbase: “2018 outstripped all previous years in terms of the number of unicorns created and venture dollars invested. Indeed, 151 new unicorns joined the list in 2018 (compared to 96 in 2017), and investors poured more than $135 billion into those companies, a 52% increase year-over-year and the biggest sum invested in unicorns in any one year since unicorns became a thing.”

2019 has already coined 42 new unicorns, like Glossier, Calm and Hims, a number that grows each and every week. For context, a total of 19 companies joined the unicorn club in 2013 when Aileen Lee, an established investor, coined the term. Today, there are some 450 companies around the globe that qualify as unicorns, representing a cumulative valuation of $1.6 trillion.

We’ve clung to this fantastical terminology for so many years because it helps us classify startups, singling out those that boast valuations so high, they’ve gained entry to a special, elite club. In 2019, however, $100 million-plus rounds are the norm and billion-dollar-plus funds are standard. Unicorns aren’t rare anymore; it’s time to rethink the unicorn framework.

Petition to stop using the term “unicorn” unless the company is valued at more than $1 billion *and* profitable.

— Kate Clark (@KateClarkTweets) May 22, 2019

Last week, I suggested we only refer to profitable companies with a valuation larger than $1 billion as unicorns. Understandably, not everyone was too keen on that idea. Why? Because startups in different sectors face barriers of varying proportions. A SaaS company, for example, is likely to achieve profitability a lot quicker than a moonshot bet on autonomous vehicles or virtual reality. Refusing startups that aren’t yet profitable access to the unicorn club would unfairly favor certain industries.

So what can we do? Perhaps we increase the valuation minimum necessary to be called a unicorn to $10 billion? Initialized Capital’s Garry Tan’s idea was to require a startup have 50% annual growth to be considered a unicorn, though that would be near-impossible to get them to disclose…

While I’m here, let me share a few of the other eclectic responses I received following the above tweet. Joseph Flaherty said we should call profitable billion-dollar companies Pegasus “since [they’ve] taken flight.” Reagan Pollack thinks profitable startups oughta be referred to as leprechauns. Hmmmm.

The suggestions didn’t stop there. Though I’m not so sure adopting monikers like Pegasus and leprechaun will really solve the unicorn overpopulation problem. Let me know what you think. Onto other news.

Image by Rafael Henrique/SOPA Images/LightRocket via Getty Images

CrowdStrike has set its IPO terms. The company has inked plans to sell 18 million shares at between $19 and $23 apiece. At a midpoint price, CrowdStrike will raise $378 million at a valuation north of $4 billion.

Slack inches closer to direct listing. The company released updated first-quarter financials on Friday, posting revenues of $134.8 million on losses of $31.8 million. That represents a 67% increase in revenues from the same period last year when the company lost $24.8 million on $80.9 million in revenue.

Online lender SoFi has quietly raised $500M led by Qatar

Groupon co-founder Eric Lefkofsky just-raised another $200M for his new company Tempus

Less than 1 year after launching, Brex eyes $2B valuation

Password manager Dashlane raises $110M Series D

Enterprise cybersecurity startup BlueVoyant raises $82.5M at a $430M valuation

Talkspace picks up $50M Series D

TaniGroup raises $10M to help Indonesia’s farmers grow

Stripe and Precursor lead $4.5M seed into media CRM startup Pico

Maveron, a venture capital fund co-founded by Starbucks mastermind Howard Schultz, has closed on another $180 million to invest in early-stage consumer startups. The capital represents the firm’s seventh fundraise and largest since 2000. To keep the fund from reaching mammoth proportions, the firm’s general partners said they turned away more than $70 million amid high demand for the effort. There’s more where that came from, here’s a quick look at the other VCs to announce funds this week:

- EV Growth closes $200M fund to cover Southeast Asia’s Series B funding gap

- Northwestern Mutual has carved out another $150M for a fintech and insurtech fund

- Future Positive Capital gets $57M to invest in European startups tackling the world’s ‘most pressing problems’

This week, I penned a deep dive on Slack, formerly known as Tiny Speck, for our premium subscription service Extra Crunch. The story kicks off in 2009 when Stewart Butterfield began building a startup called Tiny Speck that would later come out with Glitch, an online game that was neither fun nor successful. The story ends in 2019, weeks before Slack is set to begin trading on the NYSE. Come for the history lesson, stay for the investor drama. Here are the other standout EC pieces of the week.

- Fundraising 101: How to trigger FOMO among VCs by Eric Peckham

- Airbnb’s J Crowley on what makes a great product manager by Jordan Crook

- The savage genius of SoftBank by Josh Constine

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm and I debate whether the tech press is too negative or too positive in its coverage of tech startups. Plus, we dive into Brex’s upcoming round, SoFi’s massive raise and CrowdStrike’s imminent IPO.

Powered by WPeMatico

Groupon co-founder Eric Lefkofsky just raised another $200 million for his newest company, Tempus

When serial entrepreneur Eric Lefkofsky grows a company, he puts the pedal to the metal. When in 2011 his last company, the Chicago-based coupons site Groupon, raised $950 million from investors, it was the largest amount raised by a startup, ever. It was just over three years old at the time, and it went public later that same year.

Lefkofsky seems to be stealing a page from the same playbook for his newest company, Tempus. The Chicago-based genomic testing and data analysis company was founded a little more than three years ago, yet it has already hired nearly 700 employees and raised more than $500 million — including through a new $200 million round that values the company at $3.1 billion.

According to the Chicago Tribune, that new valuation makes it — as Groupon once was — one of Chicago’s most highly valued privately held companies.

So why all the fuss? As the Tribune explains it, Tempus has built a platform to collect, structure and analyze the clinical data that’s often unorganized in electronic medical record systems. The company also generates genomic data by sequencing patient DNA and other information in its lab.

The goal is to help doctors create customized treatments for each individual patient, Lefkofsky tells the paper.

So far, it has partnered with numerous cancer treatment centers that are apparently giving Tempus human data from which to learn. Tempus is also generating data “in vitro,” as is another company we featured recently called Insitro, a drug development startup founded by famed AI researcher Daphne Koller. With Insitro, it is working on a liver disease treatment owing to a tie-up with Gilead, which has amassed related human data over the years from which Insitro can use to learn. As a complementary data source, Insitro, like Tempus, is trying to learn what the disease does in a “dish,” then determine if it can use what it observes using machine learning to predict what it sees in people.

Tempus hasn’t come up with any cancer-related cures yet, but Lefkofsky already says that Tempus wants to expand into diabetes and depression, too.

In the meantime, he tells Crain’s Chicago Business that Tempus is already generating “significant” revenue. “Our oldest partners, have, in most cases, now expanded to different subgroups (of cancer). What we’re doing is working.”

Investors in the latest round include Baillie Gifford; Revolution Growth; New Enterprise Associates; funds and accounts managed by T. Rowe Price; Novo Holdings; and the investment management company Franklin Templeton.

Powered by WPeMatico

Diving deep into Africa’s blossoming tech scene

Jumia may be the first startup you’ve heard of from Africa. But the e-commerce venture that recently listed on the NYSE is definitely not the first or last word in African tech.

The continent has an expansive digital innovation scene, the components of which are intersecting rapidly across Africa’s 54 countries and 1.2 billion people.

When measured by monetary values, Africa’s tech ecosystem is tiny by Shenzen or Silicon Valley standards.

But when you look at volumes and year over year expansion in VC, startup formation, and tech hubs, it’s one of the fastest growing tech markets in the world. In 2017, the continent also saw the largest global increase in internet users—20 percent.

If you’re a VC or founder in London, Bangalore, or San Francisco, you’ll likely interact with some part of Africa’s tech landscape for the first time—or more—in the near future.

That’s why TechCrunch put together this Extra-Crunch deep-dive on Africa’s technology sector.

Tech Hubs

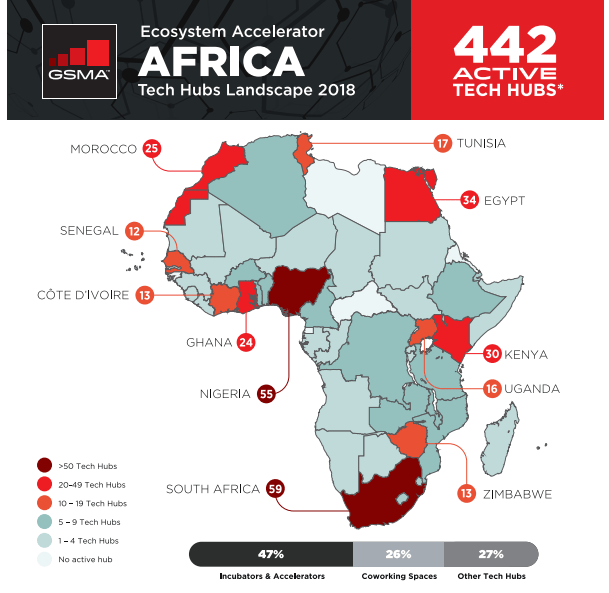

A foundation for African tech is the continent’s 442 active hubs, accelerators, and incubators (as tallied by GSMA). These spaces have become focal points for startup formation, digital skills building, events, and IT activity on the continent.

Prominent tech hubs in Africa include CcHub in Nigeria, Pan-African incubator MEST, and Kenya’s iHub, with over 200 resident members. More of these organizations are receiving funds from DFIs, such as the World Bank, and aid agencies, including France’s $76 million African tech fund.

Prominent tech hubs in Africa include CcHub in Nigeria, Pan-African incubator MEST, and Kenya’s iHub, with over 200 resident members. More of these organizations are receiving funds from DFIs, such as the World Bank, and aid agencies, including France’s $76 million African tech fund.

Blue-chip companies such as Google and Microsoft are also providing money and support. In 2018 Facebook opened its own Hub_NG in Lagos with partner CcHub, to foster startups using AI and machine learning.

Powered by WPeMatico

An insider’s look into venture with Andreessen Horowitz’s Scott Kupor

After a decade in the peculiar world of venture capital, Andreessen Horowitz managing director Scott Kupor has seen it all when it comes to the dos and don’ts for dealing with Valley VCs and company building. In his new book Secrets of Sand Hill Road (available on June 3), Scott offers up an updated guide on what VCs actually do, how they think and how founders should engage with them.

TechCrunch’s Silicon Valley editor Connie Loizos will be sitting down with Scott for an exclusive conversation on Tuesday, June 4 at 11:00 am PT. Scott, Connie and Extra Crunch members will be digging into the key takeaways from Scott’s book, his experience in the Valley and the opportunities that excite him most today.

Tune in to join the conversation and for the opportunity to ask Scott and Connie any and all things venture.

To listen to this and all future conference calls, become a member of Extra Crunch. Learn more and try it for free.

Powered by WPeMatico

Touring Factory Berlin, Europe’s ‘largest club for startups’

According to the startups at Factory Berlin, it’s not just another co-working space. After all, the company took its name from Andy Warhol’s famous factory in New York City, and it describes itself as “Europe’s largest club for startups.”

Late last year, we toured Factory Berlin’s five-story, 14,000-square-meter location in Görlitzer Park. Yes, it’s a building where startups can rent workspace, but as part of the tour, we had a chance to talk to several entrepreneurs, and everyone described it as a real community.

“Being part of the community, to us, means not isolating ourselves from the outer world,” said Code University founder Tom Bachem. “Or especially in Berlin, from the great startup ecosystem that we have — but instead, really deeply integrating into it.”

Similarly, Neel Popat of Donut pointed to the Factory’s blockchain events and showcases as a major benefit, while Kip Carter of New School said his team has used the Factory messaging app to find experts who can work with New School’s kids.

And |Pipe| founder and CEO Simon Hossell said it’s been a great base for entrepreneurs who aren’t from Berlin: “It’s the fact that you know although you may be a stranger or a foreigner in a new city, there’s always a group of people — like-minded, smart, intelligent individuals around you that are always there to help and encourage.”

Powered by WPeMatico

Security startup Bugcrowd on crowdsourcing bug bounties: ‘Cybersecurity is a people problem’

For a cybersecurity company, Bugcrowd relies much more on people than it does on technology.

For as long as humans are writing software, developers and programmers are going to make mistakes, said Casey Ellis, the company’s founder and chief technology officer in an interview TechCrunch from his San Francisco headquarters.

“Cybersecurity is fundamentally a people problem,” he said. “Humans are actually the root of the problem,” he said. And when humans made coding mistakes that turn into bugs or vulnerabilities that be exploited, that’s where Bugcrowd comes in — by trying to mitigate the fallout before they can be maliciously exploited.

Founded in 2011, Bugcrowd is one of the largest bug bounty and vulnerability disclosure companies on the internet today. The company relies on bug finders, hackers, and security researchers to find and privately report security flaws that could damage systems or putting user data at risk.

Bugcrowd acts as an intermediary by passing the bug to the companies to get fixed — potentially helping them to dodge a future security headache like a leak or a breach — in return for payout to the finder.

The greater the vulnerability, the higher the payout.

“The space we’re in is brokering conversations between different groups of people that don’t necessarily have a good history of getting along but desperately need to talk to each other,” said Ellis.

Powered by WPeMatico

Spotify is building shared-queue Social Listening

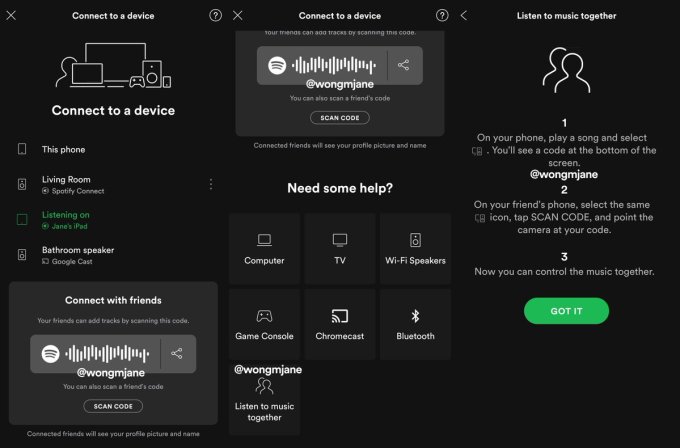

Want to rock out together even when you’re apart? Spotify has prototyped an unreleased feature called “Social Listening” that lets multiple people add songs to a queue they can all listen to. You just all scan one friend’s QR-style Spotify Social Listening code, and then anyone can add songs to the real-time playlist. Spotify could potentially expand the feature to synchronize playback so you’d actually hear the same notes at the same time, but for now it’s a just a shared queue.

Social Listening could give Spotify a new viral growth channel, as users could urge friends to download the app to sync up. The intimate experience of co-listening might lead to longer sessions with Spotify, boosting ad plays or subscription retention. Plus, it could differentiate Spotify from Apple Music, YouTube Music, Tidal and other competing streaming services.

A Spotify spokesperson tells TechCrunch that “We’re always testing new products and experiences, but have no further news to share at this time.” Spotify already offers Collaborative Playlists friends can add to, but Social Listening is designed for real-time sharing. The company refused to provide further details on the prototype or when it might launch.

The feature is reminiscent of Turntable.fm, a 2011 startup that let people DJ in virtual rooms on their desktop that other people could join where they could chat, vote on the next song and watch everyone’s avatars dance. But the company struggled to properly monetize through ad-free subscriptions and shut down in 2014. Facebook briefly offered its own version called “Listen With…” in 2012 that let Spotify or Rdio users synchronize music playback.

Spotify Social Listening was first spotted by reverse-engineering sorceress and frequent TechCrunch tipster Jane Manchun Wong. She discovered code for the feature buried in Spotify’s Android app, but for now it’s only available to Spotify employees. Social Listening appears in the menu of connected devices you can open while playing a song beside nearby Wi-Fi and Bluetooth devices. “Connect with friends: Your friends can add tracks by scanning this code – You can also scan a friend’s code,” the feature explains.

A help screen describes Social Listening as “Listen to music together. 1. On your phone, play a song and select (Connected Devices). You’ll see a code at the bottom of the screen. 2. On your friend’s phone, select the same (Connected Devices) icon, tap SCAN CODE, and point the camera at your code. 3. Now you can control the music together.” You’ll then see friends who are part of your Social Listening session listed in the Connected Devices menu. Users can also copy and share a link to join their Social Listening session that starts with the URL prefix https://open.spotify.com/socialsession/. Note that Spotify never explicitly says that playback will be synchronized.

With streaming apps largely having the same music catalog and similar $9.99 per month premium pricing, they have to compete on discovery and user experience. Spotify has long been in the lead here with its algorithmically personalized Discover Weekly playlists, which were promptly copied by Apple and SoundCloud.

Oddly, Spotify has stripped out some of its own social features over the years, eliminating the in-app messaging inbox and instead pushing users to share songs over third-party messaging apps. The deemphasis in discovery through friends conveniently puts the focus on Spotify’s owned playlists. That gives it leverage over the record labels during their rate negotiations as it’s who influences which songs will become hits, so if labels don’t play nice their artists might not get promoted via playlists.

That’s why it’s good to see Spotify remembering that music is an inherently social experience. Music physically touches us through its vibrations, and when people listen to the same songs and are literally moved by it at the same time, it creates a sense of togetherness we’re too often deprived of on the internet.

Powered by WPeMatico

Foursquare buys Placed from Snap Inc. on the heels of $150M in new funding

Foursquare just made its first acquisition. The location tech company has acquired Placed from Snap Inc. on the heels of a fresh $150 million investment led by The Raine Group. The terms of the deal were not disclosed. Placed founder and CEO David Shim will become president of Foursquare.

Placed is the biggest competitor to Foursquare’s Attribution product, which allows brands to track the physical impact (foot traffic to store) of a digital campaign or ad. Up until now, Placed and Attribution by Foursquare combined have measured more than $3 billion in ad-to-store visits.

Placed launched in 2011 and raised $13.4 million (according to Crunchbase) before being acquired by Snap Inc. in 2017.

As part of the deal with Foursquare, the company’s Attribution product will henceforth be known as Placed powered by Foursquare. The acquisition also means that Placed powered by Foursquare will have more than 450 measureable media partners, including Twitter, Snap, Pandora and Waze. Moreover, more than 50% of the Fortune 100 are partnered with Placed or Foursquare.

It’s also worth noting that this latest investment of $150 million is the biggest financing round for Foursquare ever, and comes following a $33 million Series F last year.

Here’s what Foursquare CEO Jeff Glueck had to say about the financing in a prepared statement:

This is one of the largest investments ever in the location tech space. The investment will fund our acquisition and also capitalize us for our increased R&D and expansion plans, allowing us to focus on our mission to build the world’s most trusted, independent location technology platform.

That last bit, about an independent location technology platform, is important here. Foursquare is 10 years old and has transformed from a consumer-facing location check-in app — a game, really — into a location analytics and development platform.

Indeed, when Glueck paints his vision for the company, he lists five key areas of focus:

- Developer Tools to build smarter apps and customer engagement, using geo-context;

- Analytics, including consumer insights for planning;

- Audiences, so businesses can reach the right consumer segments for their message;

- Attribution, to test and learn which messages, segments and channels work best;

- Consumer, where through our own apps and Foursquare Labs’ R&D efforts we showcase what’s possible and inspire developers via our innovations around contextual location.

You’ll notice that its consumer apps, Foursquare and Swarm, are at the bottom of the list. But that’s because Foursquare’s real technological and strategic advantage isn’t in building the best social platform. In fact, Glueck said that more than 90% of the company’s revenue came from the enterprise side of the business. Foursquare’s advantage is in the accuracy of its technology, as afforded by the decade of data that has come from Foursquare, Swarm and the users who have expressly verified their location.

The Pilgrim SDK fits into that top item on the list: developer tools. The Pilgrim SDK allows developers to embed location-smart experiences and notifications into their apps and services. But it also expands Foursquare’s access to data from beyond its own apps to the greater ecosystem, yielding the data it needs to power analytics tools for brands and publishers.

With this acquisition, Placed will be able to leverage Foursquare’s existing map of 105 million places of interest across 190 countries, as well as tap into the measured U.S. audience of more than 100 million monthly devices:

Foursquare and Placed share a similar philosophy of building against a truth set of real consumer responses. Getting real people to confirm the name of their location is the only way to know if your technology is accurate or not. Placed has leveraged over 135 million survey responses in its first-party Placed survey apps, all from consumers opted-in to its rewards app. Foursquare expands the truth set for machine learning exponentially by adding in our over 13 billion consumer confirmations.

The hope is that Foursquare is accurate enough to become the de facto location analytics and services company for measuring ad spend. With enough scale, that may allow the company to break into the walled gardens where most of that ad spend is going: Facebook and Google.

Of course, to win as the “world’s most trusted, independent location technology platform,” consumers have to trust the platform. After all, one’s location may be the most sensitive piece of data about them. Foursquare has taken steps to be clear about what its technology is capable of. In fact, at SXSW this year, Foursquare offered a limited run of a product called Hypertrending, which was essentially an anonymized view of real-time location data showing activity in the Austin area.

Here’s what executive chairman and co-founder Dennis Crowley had to say at the time:

We feel the general trend with internet and technology companies these days has been to keep giving users a more and more personalized (albeit opaquely personalized) view of the world, while the companies that create these feeds keep the broad “God View” to themselves. Hypertrending is one example of how we can take Foursquare’s aggregate view of the world and make it available to the users who make it what it is. This is what we mean when we talk about “transparency” – we want to be honest, in public, about what our technology can do, how it works, and the specific design decisions we made in creating it.

With regards to today’s acquisition of Placed, Jeff Glueck had this to say:

Both companies also share a commitment to privacy and consumers being in control. Our Foursquare credo of “data as a privilege” only deepens as our company expands. We believe location should only be shared when consumers can see real value and visible benefits driven by location. We remain dedicated to elevating the industry through respect for transparency, user control, and instituting layers of privacy safeguards.

This new financing brings Foursquare’s total funding to $390.4 million.

Powered by WPeMatico

‘Gato Roboto’ and ‘Dig Dog’ put pixelated pets to work in gleeful gaming homages

Drawing inspiration from games of yore but with dog and cat protagonists that signal light adventures rather than grim, dark ones, Gato Roboto and Dig Dog are easy to recommend to anyone looking to waste a couple hours this weekend. Not only that, but the latter was developed in a fascinating and inspiring way.

Both games share a 1-bit aesthetic that goes back many years but most recently was popularized by the inimitable Downwell and recently used to wonderful effect in both Return of the Obra Dinn and Minit. This is a limitation that frees the developer from certain concerns while also challenging them to present the player with all the information they need with only two colors, or in Dig Dog’s case a couple more (but not a lot).

In the latter game, you play as a dog, digging for bones among a series of procedurally generated landscapes populated by enemies and hazards. Dig Dug is the obvious callback in the name, but gameplay is more bouncy and spontaneous rather than the slower, strategic digging of the arcade classic.

On every stage you’re tasked with collecting a bone that’s somewhere near the bottom, while avoiding various types of enemies and traps or, if you so choose, destroying them and occasionally yielding coins. These coins can be traded with a merchant who appears on some stages, offering various gameplay perks like a longer dash or higher jump.

The simple controls let you jump, dig, and do a midair dash that kills enemies — that’s pretty much it. The rest is down to moment-to-moment choices: dig around that enemy or go through them? If I go this way will I trap myself in this hole? Is it worth attacking that bat nest for a coin or will it be too hard to get out alive?

Collected bones contribute towards unlocking new stages with different, more dangerous enemies and devious traps. It gives a sense of progression even when you only get a bone or two, as does your dog rocketing back upwards in a brief but satisfying zoomies celebration every time. So even when you die, and you will die a lot, you feel like you’re working towards something.

It’s a great time-waster and you won’t exhaust its challenges for hours of gameplay; it’s also very easy to pick up and play a few stages of, since a whole life might last less than a minute. At $4 it’s an easy one to recommend.

Interestingly, Dig Dog was developed by its creator with only minimal use of his hands. A repetitive stress condition made it painful and inadvisable for him to code using the keyboard, so he uses a voice-based coding system instead. If I had been told I couldn’t type any more, I’d probably just take up a new career, so I admire Rusty Moyher for his tenacity. He made a video about the process here, if you’re curious:

Gato Roboto, for Switch and PC, is a much more complicated game, though not nearly so much as its inspirations, the NES classics Metroid and Blaster Master. In Gato Roboto, as in those games, you explore a large world filled with monsters and tunnels, fighting bosses and outfitting yourself with new abilities, which in turn let you explore the world further.

This one isn’t as big and open as recent popular “metroidvanias” like Hollow Knight or Ori and the Blind Forest — it’s really much more like a linear action-adventure game in the style of metroidvanias.

The idea is that you’ve crash-landed on a planet after tracking a mysterious signal, but the spaceman aboard the ship is trapped — you play his cat, Kiki, who must explore the planet in his stead.

At first (or shall I say fur-st) you really are just a cat, but you’re soon equipped with a power suit that lets you jump and shoot like any other action game. However, you frequently have to jump out of it to get into a smaller tunnel or enter water, in which the suit can’t operate (and the cat only barely). In this respect it’s a bit like Blaster Master, in which your pilot could dismount and explore caves in top-down fashion — an innovation that made the game one of my favorites for the system. (If you haven’t played the Switch remake, Blaster Master Zero, I implore you to.)

Gato Roboto isn’t as taxing or complex as its predecessors, but it’s not really meant to be. It’s a non-stop romp where you always have a goal or an obstacle to overcome. The 1-bit graphics are so well executed that I stopped noticing them after a minute or two — the pixel art is very clear and only rarely does the lack of color cause any confusion whatever.

Gato Roboto isn’t as taxing or complex as its predecessors, but it’s not really meant to be. It’s a non-stop romp where you always have a goal or an obstacle to overcome. The 1-bit graphics are so well executed that I stopped noticing them after a minute or two — the pixel art is very clear and only rarely does the lack of color cause any confusion whatever.

Like Dig Dog and Downwell before it, you can pick up color schemes to change the palette, a purely aesthetic choice but a fun collectible (some are quite horrid). The occasional secret and branching path keeps your brain working a little bit, but not too much.

The game is friendly and forgiving, but I will say that the bosses present rather serious difficulty spikes, and you may, as I did, find yourself dying over and over to them because they’re a hundred times more dangerous than ordinary enemies or environmental hazards. Fortunately the game is (kitty) littered with save points and, for the most part, the bosses are not overlong encounters. I still raged pretty hard on a couple of them.

It’s twice the price of Dig Dog, a whopping $8. I can safely say it’s worth the price of two coffees. Don’t hesitate.

These pleasant distractions should while away a few hours, and to me they represent a healthy gaming culture that can look back on its past and find inspiration, then choose to make something new and old at the same time.

Powered by WPeMatico