‘Observation’ is a tense, atmospheric puzzler where you play a modern HAL 9000

When you watch 2001: A Space Odyssey, do you find yourself criticizing HAL 9000’s machinations and thinking, “I could do better than that!” If so, Observation may be right up your alley. In it you play a space station AI called SAM that is called upon by the humans on board to help resolve a deadly mystery — though you may be a part of it yourself.

The game takes place in the near future on board the titular space station, a sort of expanded version of the ISS. You are booted up by astronaut Emma Fisher after an unspecified event that seems to have damaged the station. You, as the Systems Administration and Maintenance AI, are tasked with helping her as she first tries to simply survive the immediate aftermath, then starts to investigate what happened.

To do so you perform various tasks such a digital agent would do, such as unlocking and opening hatches, checking for system errors, collecting information from damaged laptops and so on. It’s mostly done through the many cameras mounted throughout the station, between which you can usually move freely and change the angle so you can get at this hatch or that scrap of paper on the wall.

But from the beginning it’s clear that this is not a simple case of a micrometeorite or some other common space anomaly. I won’t spoil any of the surprises, but suffice it to say that like in 2001, the mystery runs deeper than that, and SAM itself is implicated.

But from the beginning it’s clear that this is not a simple case of a micrometeorite or some other common space anomaly. I won’t spoil any of the surprises, but suffice it to say that like in 2001, the mystery runs deeper than that, and SAM itself is implicated.

Observation is a puzzle game that plays out in real time, though you are rarely presented with a task that needs to be completed in a rush — your commands are rarely an urgent “Open the pod bay doors, SAM!” and more “Something’s wrong with the cooling system, so this hatch won’t open, can you look into it?”

And so you search using your cameras for, say, the server that controls that system, or the scrap of paper that has its schematic so you can reboot it. These solutions are usually just a matter of being, well, observant, but occasionally can be frustrating gadget hunts where you don’t know what you’re looking for among the busy background of a working space station and the detritus of the disaster.

If you’re having trouble with something, chances are you’re overthinking it. I had to look up the solution to one situation, and it turns out I had simply overlooked some interactive objects because they looked so much like background. (For the record, it turns out you can turn stuff on and off at power outlets.)

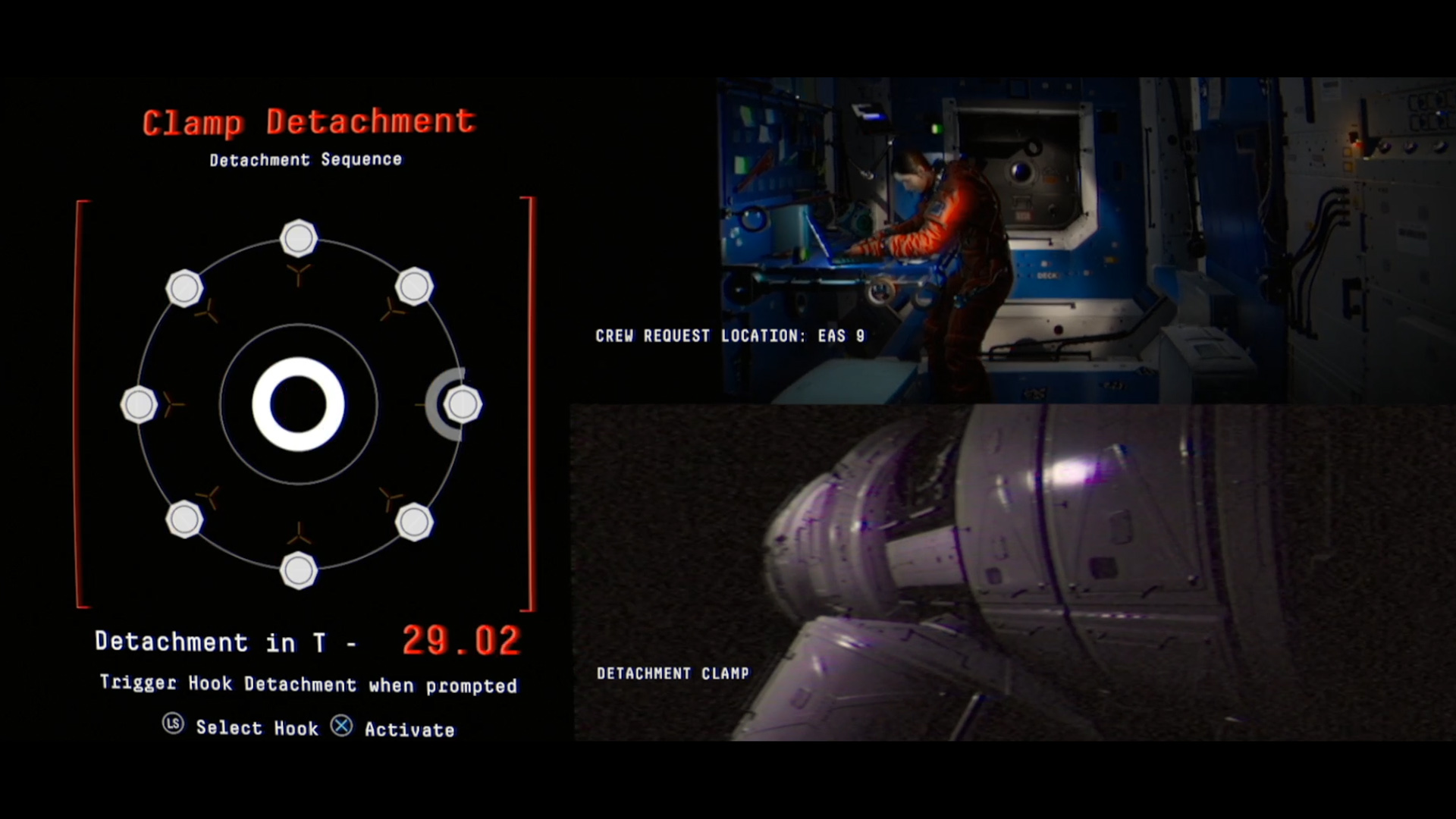

When you have to operate something, like an airlock, there is usually a little minigame to complete in which you must figure out which series of buttons to hit or hold — nothing too taxing, just a way to make it so you aren’t just pressing the Action Button all the time. The controls can be a bit clunky, such as one that had me hold down s to do one thing, then press and hold w at the same time. Do they not understand the same finger does both those things? Fortunately you can remap controls and although mouse movement is a bit stiff, there’s no need for twitchy response time.

When you have to operate something, like an airlock, there is usually a little minigame to complete in which you must figure out which series of buttons to hit or hold — nothing too taxing, just a way to make it so you aren’t just pressing the Action Button all the time. The controls can be a bit clunky, such as one that had me hold down s to do one thing, then press and hold w at the same time. Do they not understand the same finger does both those things? Fortunately you can remap controls and although mouse movement is a bit stiff, there’s no need for twitchy response time.

Although the puzzles are a bit simplistic, it’s a pleasure navigating the station because it is so beautifully realized. The creators clearly did a ton of research and Observation, that is to say the station, is a convincing 21st century operation — cameras and laptops are stashed everywhere, and there are sticky notes from the Russian and Chinese denizens, luggage and experiments tucked away or half finished.

It’s also all viewed through a combination of post-processing effects that make it all feel like you really are viewing it through a security camera system. These effects are a bit inconsistent — at one time you’ll hear what sounds like the whine of an 80s drive or system spinning up; others reflect a sort of Windows 98SE aesthetic; your own interface looks like something out of Terminator. It isn’t cohesive, exactly, but the truth is neither are the systems on board the ISS and other space hardware. And it’s a nice touch that lets the developer differentiate each part of the station and the different devices you connect to.

It’s also all viewed through a combination of post-processing effects that make it all feel like you really are viewing it through a security camera system. These effects are a bit inconsistent — at one time you’ll hear what sounds like the whine of an 80s drive or system spinning up; others reflect a sort of Windows 98SE aesthetic; your own interface looks like something out of Terminator. It isn’t cohesive, exactly, but the truth is neither are the systems on board the ISS and other space hardware. And it’s a nice touch that lets the developer differentiate each part of the station and the different devices you connect to.

The modeling of the main character, Emma, is also excellent, though lapsing a bit into uncanny valley territory due to some clunky animations here and there. Maybe it’s just the microgravity. But one thing that can’t be faulted is the voice acting — Emma’s actor is brilliant, and other voices you encounter are also well done. Considering the amount of dialogue in the game, this could have been a dealbreaker, but instead it’s a pleasure to hear. Ambient audio is likewise lovely — wear headphones.

The atmosphere is oppressive and tense, but not exactly scary; don’t expect a xenomorph to bust out of any vents, but also don’t expect Space Station Simulator 2019. This is a serious, adult (though not explicit or violent) sci-fi narrative and, from what I’ve played, a smart and interesting one.

The atmosphere is oppressive and tense, but not exactly scary; don’t expect a xenomorph to bust out of any vents, but also don’t expect Space Station Simulator 2019. This is a serious, adult (though not explicit or violent) sci-fi narrative and, from what I’ve played, a smart and interesting one.

I haven’t finished the game (which was sent to me in advance for review… but I’ve been in an intense love/hate relationship with Mordhau), but based on what I’ve played I can easily recommend Observation to anyone with a mind to take on mildly difficult puzzles and experience a well-presented story in a carefully crafted environment. Space buffs will also enjoy. At less than $25 right now (less with this week’s sale going on), I’d say it’s a no-brainer.

Observation released earlier this week on the Epic Games and PlayStation stores.

Powered by WPeMatico

CoinBits launches as a passive investment app for bitcoin

Erik Finman is a twenty-something bitcoin maximalist as famous for his precocity as he is for his $12 bet on the currency a few years ago.

Now, Finman, who built his first company while still in high school, is launching a new startup called CoinBits, which allows users to passively invest in bitcoin.

The idea, according to Finman, is to democratize access to the currency by letting everyday folks invest nominal sums through well-known mechanisms like roundups on transactions made with a credit or debit card or through regular transactions from a customer’s savings or checking account to bitcoin through CoinBits.

Every transaction also helps Finman’s own bitcoin holdings grow, and makes the young entrepreneur a little wealthier himself through his bitcoin holdings.

Users can make one-time investments of $10, $25, $50 or $100 through the web-based platform and can establish a level of risk for their holdings.

Finman’s app collects no commissions on transactions, and 98% of the bitcoin is stored offline — for safety.

“Overall, investing in bitcoin is complicated and can feel almost impossible,” said Finman. “Coinbits allows you to put that spare change in bitcoin. For example, if you spend $1.75 on French fries, that remaining 25 cents is invested automatically.”

Withdrawals are handled by CoinBits, which will give users same-day processing for a 50 cent-fee, and offers an easily downloadable record for accountants to deal with any gains or losses associated with bitcoin.

Given the fractional nature of these investments, and the volatility of bitcoin, it’s hard to know what real value investors can reap from these small transactions, but it’s a less risky way to experiment with building bitcoin holdings than take a huge flyer on the market.

Powered by WPeMatico

Livekick raises $3M to use live video for one-on-one training

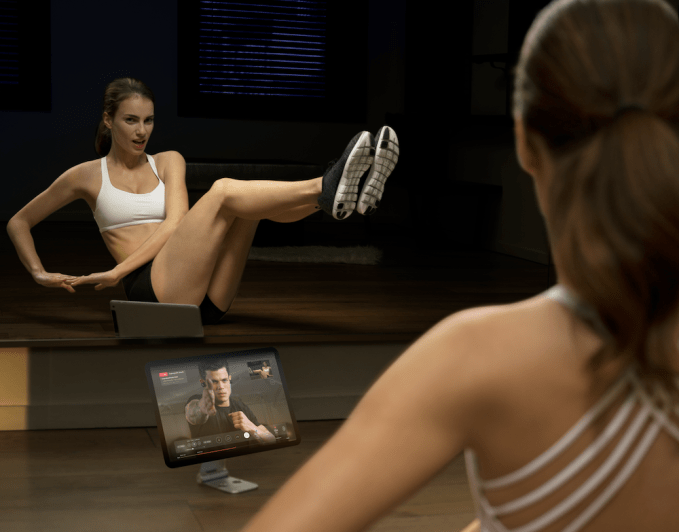

Livekick, a startup that gives customers access to one-on-one personal training and yoga from their home (or hotel room, or elsewhere), is announcing that it has raised $3 million in seed funding.

The company was founded by entrepreneur Yarden Tadmor and fitness expert Shayna Schmidt. Tadmor said that with all his travel for work, his fitness routine “really eroded,” so he contacted Schmidt and asked her to train him remotely — they’d connect via FaceTime, he’d mount his phone at the gym and she’d supervise his workout.

“We trained this way for a while, and then we realized: Hey, this is something that other people can really benefit from,” Tadmor said.

So with Livekick, users can sign up for one, two or three live, 30-minute sessions with a remote trainer, who they’ll connect with via the Livekick iOS app or website. (After a two-week trial, pricing starts at $32 per week.) The workouts will be tailored to the space and equipment that you have access to, and the trainers will also assign other workouts for the rest of the week.

Tadmor and Schmidt contrasted this approach with companies like Peloton and Mirror, which are bringing new exercise equipment and classes into the home, but which don’t offer one-on-one interaction with a trainer. Tadmor said this individualized approach is not just better-tailored to each user’s needs, but also more effective at keeping them motivated. And Schmidt said the live interaction also ensures that people are doing their workouts correctly and safely.

As for the trainers, Schmidt said this gives them a new way to find clients, particularly during their off-hours.

“For trainers, the hours that users are never booked are usually noon to 4pm — they never get a client because people are at work, obviously,” she said. “So we can give trainers in London those hours because for a user in New York, that’s morning. We can really fill their schedules [and] help them make some more income.”

Beyond consumer subscriptions, Livekick also offers a corporate program called Livekick for Work. And just to be clear, the service isn’t just for frequent travelers, as Tadmor noted: “If you live in New York, you have access to a lot of fitness options, but most people don’t. You’ve got to do a lot of commuting to get to a studio with great trainers, and so part of what we’re trying to bring is really let you do that from the comfort of your home.”

And while we recently covered the launch of a similar service called Future, Livekick actually launched in September, and Tadmor said the average retention rate has been over six months.

The round was led by Firstime VC, with participation from Rhodium and Draper Frontier.

“With its leading technology and ethos to make exercise accessible and affordable, we believe Livekick has the capacity to improve the lives and health of millions,” said Firstime’s Nir Tarlovsky in a statement.

Powered by WPeMatico

CFIUS Cometh: What this obscure agency does and why it matters to your fund or startup

Contributor

On January 12, 2016, Grindr announced it had sold a 60% controlling stake in the company to Beijing Kunlun Tech, a Chinese gaming firm, valuing the company at $155 million. Champagne bottles were surely popped at the small-ish firm.

Though not at a unicorn-level valuation, the 9-figure exit was still respectable and signaled a bright future for the gay hookup app. Indeed, two years later, Kunlun bought the rest of the firm at more than double the valuation and was planning a public offering for Grindr.

On March 27, 2019, it all fell apart. Kunlun was putting Grindr up for sale instead.

What went wrong? It wasn’t that Grindr’s business ground to a halt. By all accounts, its business seems to actually be growing. The problem was that Kunlun owning Grindr was viewed as a threat to national security. Consequently, CFIUS, or the Committee for Foreign Investment in the United States, stepped in to block the transaction.

So what changed? CFIUS was expanded by FIRRMA, or the Foreign Risk Review Modernization Act, in late 2018, which gave it massive new power and scale. Unlike before, FIRRMA gave CFIUS a technology focus. So now CFIUS isn’t just an American problem—it’s an American tech problem. And in the coming years, it will transform venture capital, Chinese involvement in US tech, and maybe even startups as we know it.

Here’s a closer look at how it all fits together.

What is CFIUS?

Image via Getty Images / Busà Photography

CFIUS is the most important agency you’ve never heard of, and until recently it wasn’t even more than a committee. In essence, CFIUS has the ability to stop foreign entities, called “covered entities,” from acquiring companies when it could adversely affect national security—a “covered transaction.”

Once a filing is made, CFIUS investigates the transaction and both parties, which can take over a month in its first pass. From there, the company and CFIUS enter a negotiation to see if they can resolve any issues.

Powered by WPeMatico

Luckin leaves bitter aftertaste, now trading below IPO price

In the first few days following Luckin Coffee’s initial public offering, the stock chart for LK looked like a roller coaster. Now it’s looking more like a free fall.

The Chinese Coffee chain successfully completed its highly anticipated offering roughly a week ago, raising more than $550 million after pricing at $17 per share, the high end of its $15-$17 per share range.

Luckin was met with a warm reception from the markets, with the stock skyrocketing roughly 20% to a greater than $5 billion market cap in its first day of trading. However, concerns over the company’s lofty valuation, major cash burn and uncertain path to profitability have caused the stock to nosedive since.

Luckin has dropped around 25% since closing its debut trading day at $20.38 per share, and 40% from its intraday peak of $25.96. As of Friday’s open, Luckin stock sat at $15.44, now well below its IPO price.

Leading into the IPO, Luckin had already been the topic of much debate. Luckin had filed for its public offering just a year and a half after its founding. And prior to its filing, Luckin had raised more than $500 million in venture capital through four fundraising rounds that all occurred just within roughly one year’s time, per PitchBook and Crunchbase data.

As Luckin’s valuation continued to level up, many questioned the sustainability of its business model and heavily discounted pricing strategy, with Luckin’s limited operating history already pointing to substantial losses and heavy cash outflows.

The concerns have followed Luckin into the public markets, and it’s unclear whether the stock’s early struggles are just growing pains or a broader indication that public investors have limits to the levels of nascency and unprofitability they are willing to accept and bet capital on.

As one of the few publicly traded early-stage growth companies, and likely the only one in the “coffee” vertical, Luckin lacks similar companies for investors to compare the stock to and also seems to lack a natural investor base — with the story a bit too foreign for typical tech sector investors and a bit too hectic for your typical food and beverage investor.

What is clear is that much is still misunderstood regarding the company’s unique history, its growth strategy, local market dynamics or otherwise. We’ll continue to keep an eye on Luckin stock to see whether the picture gets a bit brighter once investors get more comfortable with the story and as management proves its ability to execute.

For now, check out articles on Extra Crunch written by TechCrunch’s Danny Crichton and Rita Liao for deep dive primers into Luckin and all its moving parts.

Powered by WPeMatico

Why Luckin’s ultimate target may not be Starbucks

Starbucks plans to double its store count in China to 5,000 in 2021 and Luckin, a one-year-old coffee startup, is matching up by aiming to reach 4,500 by the end of this year. Luckin’s upsized $651 million flotation has brought American investors’ attention to this potential Starbucks rival in China, where the Seattle giant controlled over half of the coffee market as late as 2017. But as soon as you make your first purchase with Luckin, you realize its ultimate goal may not be to topple Starbucks.

To get your caffeine intake from Luckin, the ordering process happens entirely on its app. First, you will decide how you want to fetch the drink: have it delivered within 30 minutes, pick it up at a nearby Luckin kiosk, or sit back and sip at one of its full-on cafes, or what it calls ‘relax stores.’

Say you’re tied up at the desk, you can input your location to check if you’re within Luckin’s delivery radius. Luckin has essentially built a vast coffee delivery network through its partnership with one of China’s biggest courier services SF Express, which dispatch staff to ferry the drinks on scoot fleets. You then place the order, choosing from a range of drinks and customizing it — hot or cold, the amount of sugar and portions of creamer, the type of syrup flavor and the likes. When you get to the end, Luckin will ask you to pay via its app. If you’re a first-time user, you get a ‘first order free’ voucher, a common strategy for many Chinese consumer-facing apps to lure new users.

You then place the order, choosing from a range of drinks and customizing it — hot or cold, the amount of sugar and portions of creamer, the type of syrup flavor and the likes. When you get to the end, Luckin will ask you to pay via its app. If you’re a first-time user, you get a ‘first order free’ voucher, a common strategy for many Chinese consumer-facing apps to lure new users.

Powered by WPeMatico

Best Buy cancels Samsung Galaxy Fold pre-orders

Samsung is taking its time bringing the Galaxy Fold back to market. And frankly, that’s probably for the best. The Note debacle from a few years back was an important lesson about what happens when you rush a product back to market. That one resulted in a second recall — PR nightmare upon PR nightmare.

With a release date still very much in limbo, Best Buy has sent notes to those who pre-ordered the Fold. Spotted by The Verge, the letter has since been posted to Best Buy’s support forum. It cites “a plethora of unforeseen hiccups,” (fair enough) adding, “Because we put our customers first and want to ensure they are taken care of in the best possible manner, Best Buy has decided to cancel all current pre-orders for the Samsung Galaxy Fold.

The letter goes on to assure customers that the big-box retailer is “working closely with Samsung” to help deliver the product to customers. At the moment, however, their guess on the time frame is as good as ours.

Recent reports have suggested that an announcement was imminent, with the company having solved design flaws that had reviewers peeling off screens and getting debris jammed in the holes of the folding mechanism. More recent reports gave the product a June 13 release date, but that, too, appears to have been scrubbed for the time being.

Powered by WPeMatico

Nigeria’s Gokada raises $5.3M round for its motorcycle ride-hail biz

In many large cities across Africa, motorcycle taxis are as common as yellow cabs in New York.

That includes Lagos, Nigeria, where ride-hail startup Gokada has raised a $5.3 million Series A round to grow its two-wheel transit business.

Gokada has trained and on-boarded more than 1,000 motorcycles and their pilots on its app that connects commuters to moto-taxis and the company’s signature green, DOT– approved helmets.

The startup has completed nearly 1 million rides since it was co-founded in 2018 by Fahim Saleh — a Bangladeshi entrepreneur who previously founded and exited Pathao, a motorcycle, bicycle and car transportation company.

For Gokada’s Series A, Rise Capital led the investment, joined by Adventure Capital, IC Global Partners and Illinois-based First MidWest Group. Coinciding with the round, Nigerian investor and Jobberman founder Ayodeji Adewunmi will join Gokada as co-CEO.

Gokada will use the financing to increase its fleet and ride volume, while developing a network to offer goods and services to its drivers. “We’re going to start a Gokada club in each of the cities with a restaurant where drivers can relax, and we’ll experiment with a Gokada Shop, where drivers can get things they need on a regular basis, such as plantains, yams and rice,” Saleh told TechCrunch.

The startup differs from other ride-hail ventures in that it doesn’t split fare revenue with drivers. Gokada charges drivers a flat-fee of 3,000 Nigerian Naira a day (around $8) to work on their platform. The company is looking to generate a larger share of its revenue from building a commercial network around its rider community.

“We don’t do anything with the fares. We want to create an Amazon Prime-type membership…and ecosystem around the driver where we’re going to provide them more and more services, such as motorcycle insurance, maintenance, personal life-insurance and micro-finance loans,” Saleh said.

“We’re trying to provide a network of great services for our drivers that makes them stick with us, and not necessarily see a reason to switch to other platforms,” said Saleh.

“We’re trying to provide a network of great services for our drivers that makes them stick with us, and not necessarily see a reason to switch to other platforms,” said Saleh.

Competition among those platforms is heating up, as global players enter Africa’s motorcycle taxi market and local startups raise VC and expand to new countries.

Uber began offering a two-wheel transit option in East Africa in 2018, around the same time Bolt (previously Taxify) started motorcycle taxi service in Kenya.

Rwanda has motorbike taxi startups SafeMotos and Yegomoto. Uganda-based motorcycle ride-hail company SafeBoda expanded into Kenya in 2018 and this month raised a Series B round of an undisclosed amount, co-led by the venture arms of Germany’s Allianz and Indonesia’s Go-Jek.

SafeBoda will use the round to further expand in East Africa and Nigeria in the near future, the startup’s co-CEO Maxime Dieudonne confirmed to TechCrunch.

In Nigeria, Gokada faces a competitor in local startup MAX.ng, which offers mobile-based passenger and logistics delivery services.

Overall, Africa’s motorcycle taxi market is becoming a significant sub-sector in the continent’s e-transport startup landscape. Two-wheel transit startups are vying to digitize a share of Africa’s boda boda and okada markets (the name for motorcycle taxis in East and West Africa) — representing a collective revenue pool of $4 billion and expected to double to $9 billion by 2021, according to a TechSci study.

“There is a formalization of an informal sector play here…to make it safer and higher quality,” Gokada investor Nazar Yasin of Rise Capital told TechCrunch.

The appeal to passengers is the lower cost of motorbike transit compared to buses or cabs ($1.85 is Gokada’s average fare) and the ability of two-wheelers to cut through the heavy congestion in cities such as Lagos and Nairobi.

A notable facet of motorcycle ride-hail companies in Africa is better organizing a space with a reputation for being somewhat chaotic and downright dangerous (see Nigeria’s past bans on the sector entirely due to safety).

For Gokada that includes training courses and certification of riders, the ability to track trips and safety stats from the app, and quality control for motorcycles — something that’s been lacking in East and West Africa’s non-digital moto-taxi space.

The company’s rider program offers a way for drivers to buy, own and maintain their motorcycles as they earn. Gokada has entered into partnership with Indian motorcycle maker TVS Motors to create a custom version of the company’s TVS Apache motorcycles for Gokada drivers.

Gokada is also experimenting with adding sensors to its fleet to better track safety standards. “We’re looking at seat sensors and another GPS sensor to track things like ‘did this driver add more than one passenger on the bike’ and all that data will feed back into our servers,” Saleh said.

The company won’t enter any new countries in Africa in the near future. “We plan to expand all over Nigeria. We think it’s a large enough market for now,” said Saleh. Nigeria is Africa’s most populous nation (190 million) and largest economy.

Powered by WPeMatico

Lime’s founding CEO steps down as his co-founder takes control

In an all-hands meeting this afternoon, the scooter and bike-sharing phenom Lime announced co-founder and chief executive officer Toby Sun would transition out of the C-suite to focus on company culture and R&D. Brad Bao, a Lime co-founder and long-time Tencent executive, will assume chief responsibilities, Lime confirmed to TechCrunch.

“Lime has experienced unprecedented growth in the global marketplace under the joint leadership of our co-founders Brad Bao and Toby Sun,” the company said in a statement provided to TechCrunch. “Fortunately, Lime’s structure allows for our executive leadership to be multipurpose and we are making a few changes to our team today to seize the opportunity ahead of us.”

Sun and Bao launched Lime together in late 2016. The San Mateo-based company had near-immediate success, attracting hundreds of millions in venture capital funding and reaching a valuation of more than $1 billion in only a year and a half’s time. Today, the company is valued at $2.4 billion and is expected to hit the fundraising circuit soon.

In addition to today’s CEO shake-up, Lime’s chief operating officer and former GV partner Joe Kraus has been promoted to the role of president. Kraus joined Lime full-time late last year after more than a decade at the venture capital arm of Alphabet.

Meet @tobysun and @Bradbao, our founders.#UnlockLife

Full Film: https://t.co/FyLLe86Ywt pic.twitter.com/0ndiBCTOIT— Lime (@limebike) May 23, 2019

Bao, given his Tencent tenure, seems like a natural choice to lead Lime into a more mature phase of business. Sun, a former investment director at Fosun Kinzon, has less operational experience than his counterpart, who was most recently the vice president of the Chinese conglomerate’s gaming decision.

News of Sun’s demotion comes hot off the heels of a fresh new marketing campaign, featured above, in which the Lime co-founders describe the scooter-sharing startup’s origin story and grand ambitions. The company, backed by Bain Capital Ventures, Andreessen Horowitz, Fidelity Ventures, GV, IVP and a slew of other top-notch investors, is active in more than 100 cities in the U.S. and 27 cities internationally. As of June, riders had taken more than 50 million trips on one of Lime’s vehicles.

Powered by WPeMatico

Streem buys Selerio in effort to boost its AR teleconferencing tech

Streem, an AR startup that is meshing teleconferencing software with computer vision tech, has acquired a small U.K. startup called Selerio that’s also building out augmented reality technologies.

The startups were both members of betaworks’ VisionCamp accelerator program last year where they met and collaborated while tackling separate computer vision problems in the AR space.

Streem’s play is that they can create a kind of souped-up Skype call that enables home service providers to get more visual data in the course of chatting with home-owners. This can be something simple like character recognition that enables users to point their phone rather than reciting a 30-character serial number; the company can also take measurements or save localized notes.

The Portland startup has disclosed more than $10 million in funding, though they have also just closed a new bout of funding (they’re not sharing the amount yet).

Selerio’s focus is all about gaining a contextual understanding of a space. The startup was spun out of research from Cambridge University. The company has not disclosed its amount of seed funding, but betaworks, Greycroft Partners and GGV Capital are among its backers. All three of Selerio’s employees have joined Streem as part of the acquisition.

Powered by WPeMatico